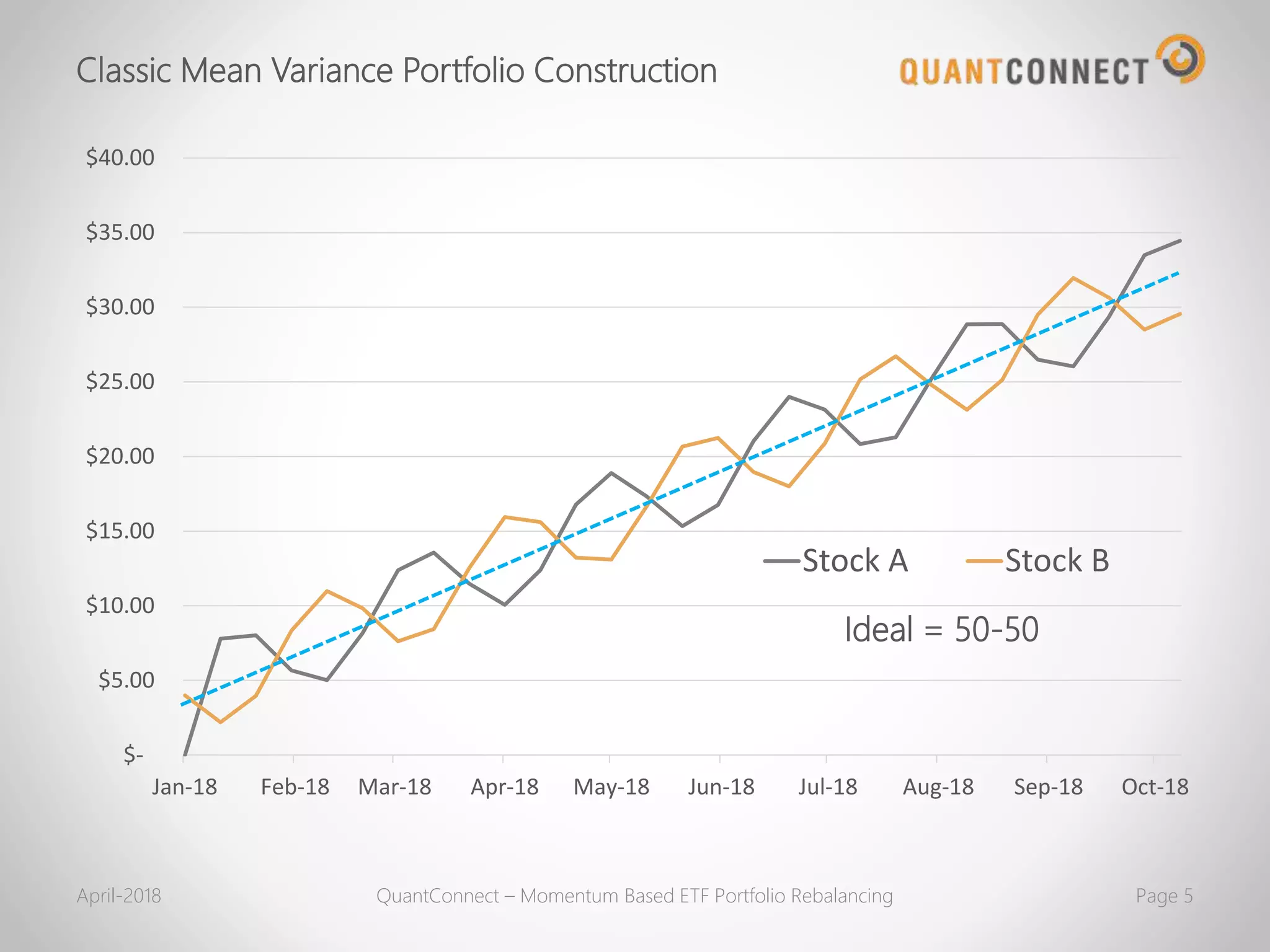

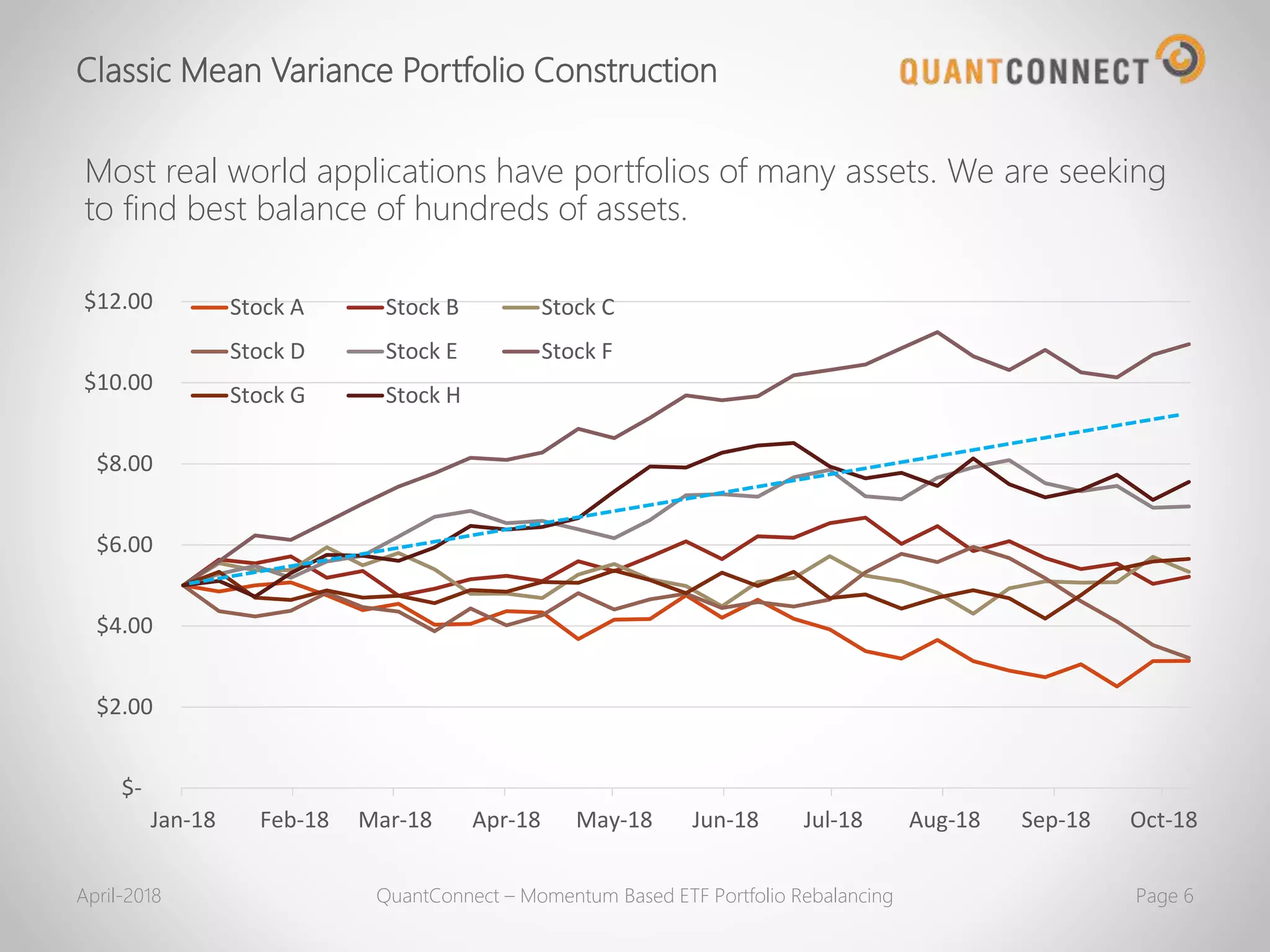

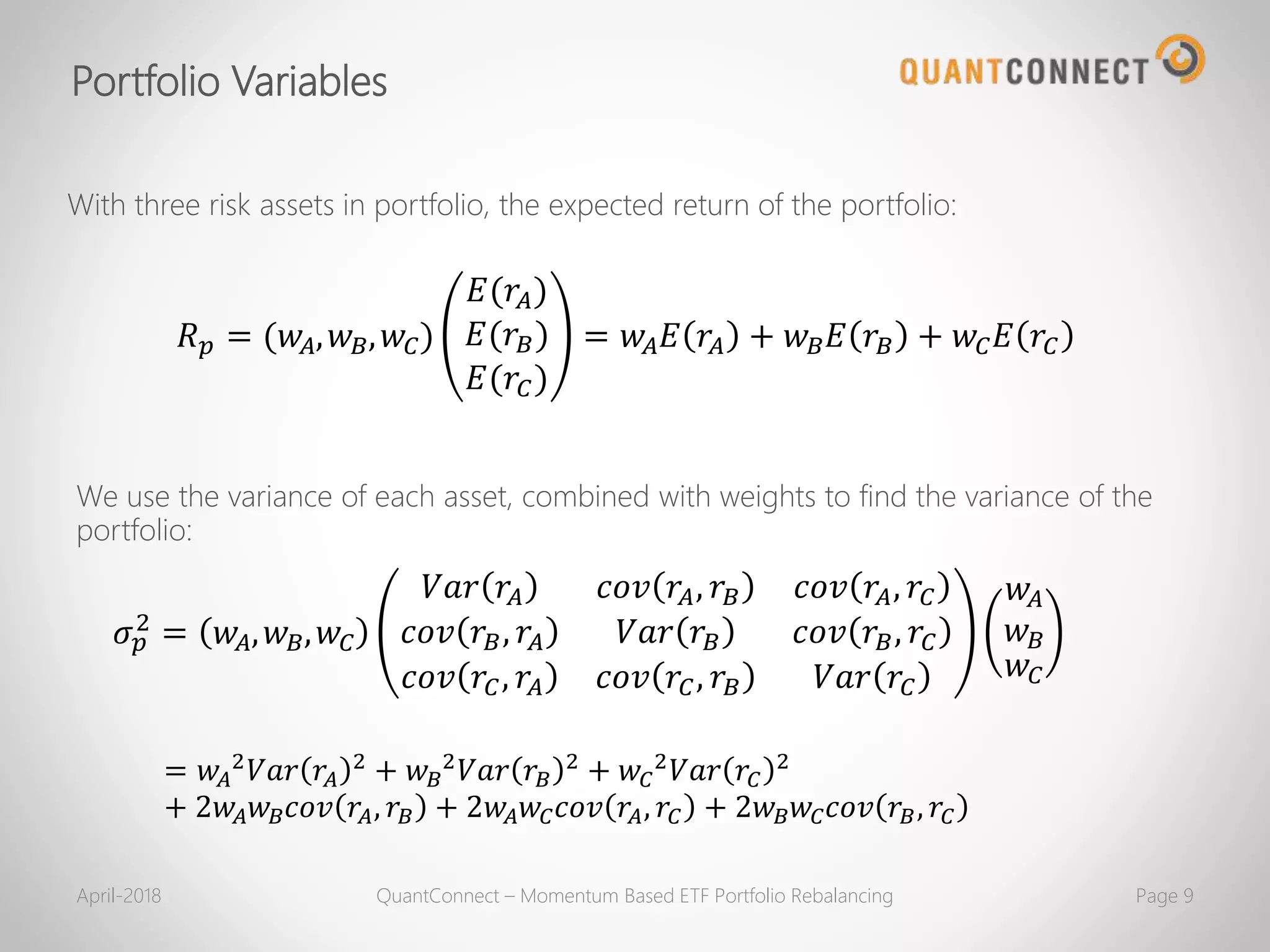

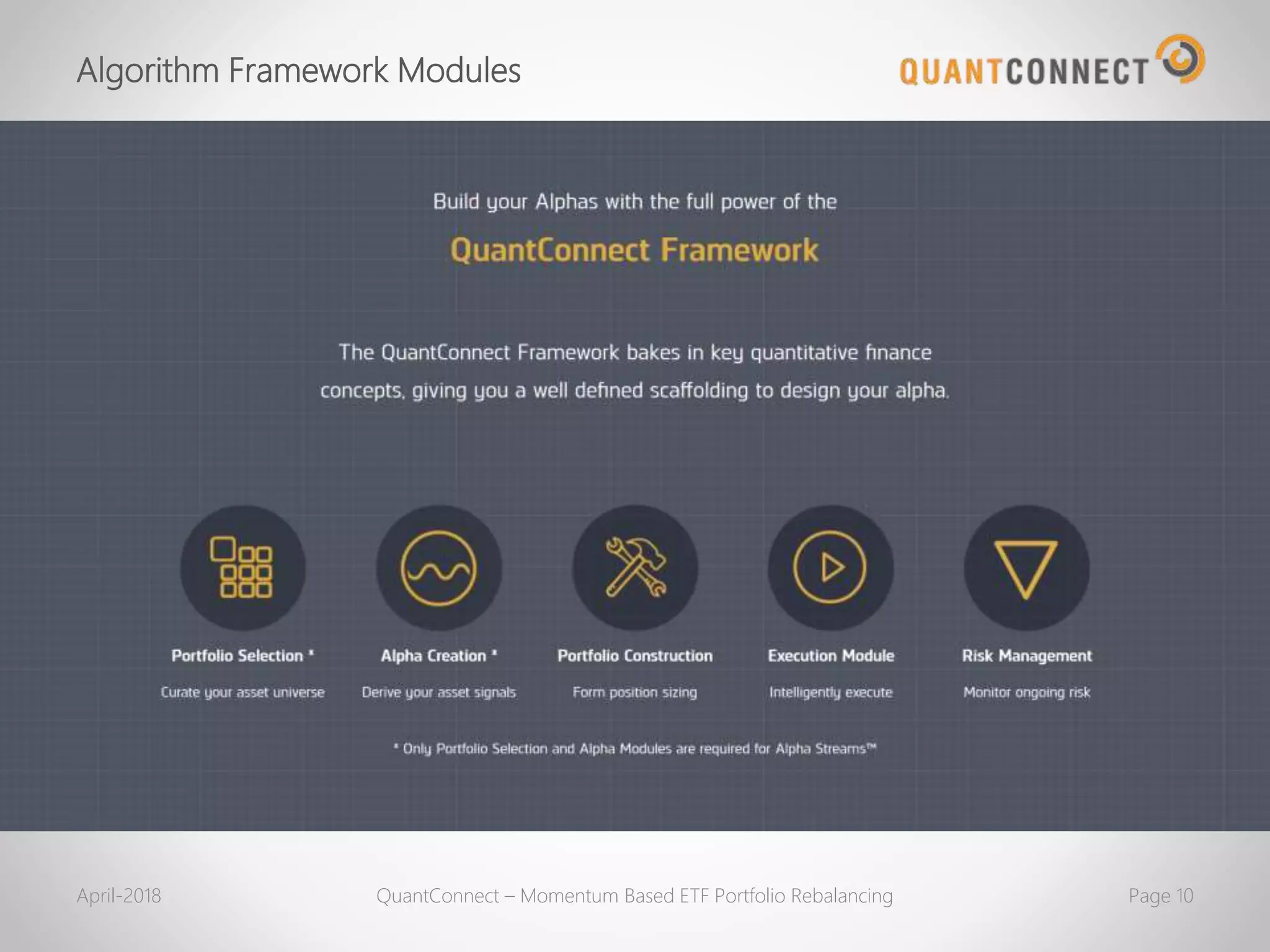

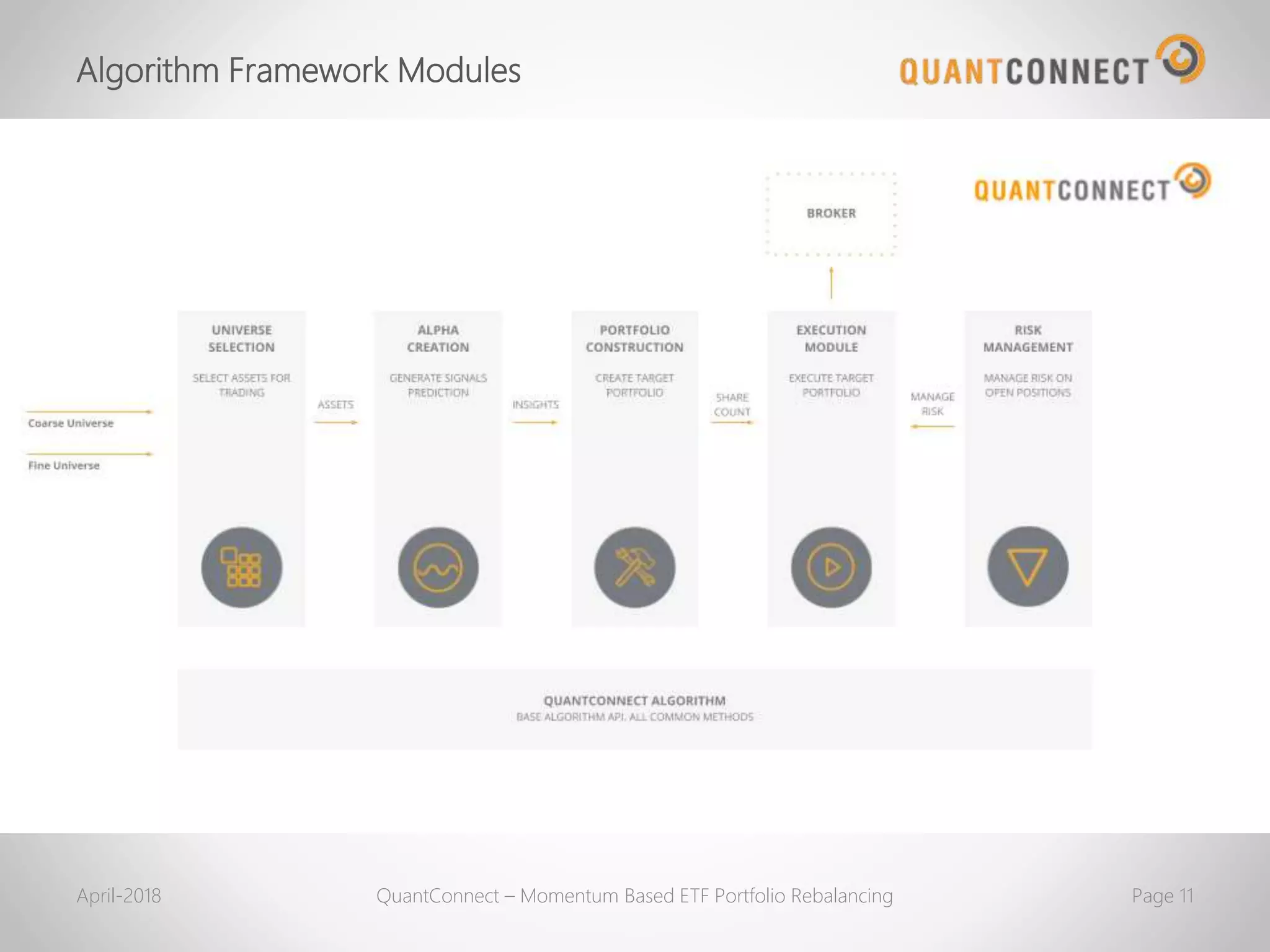

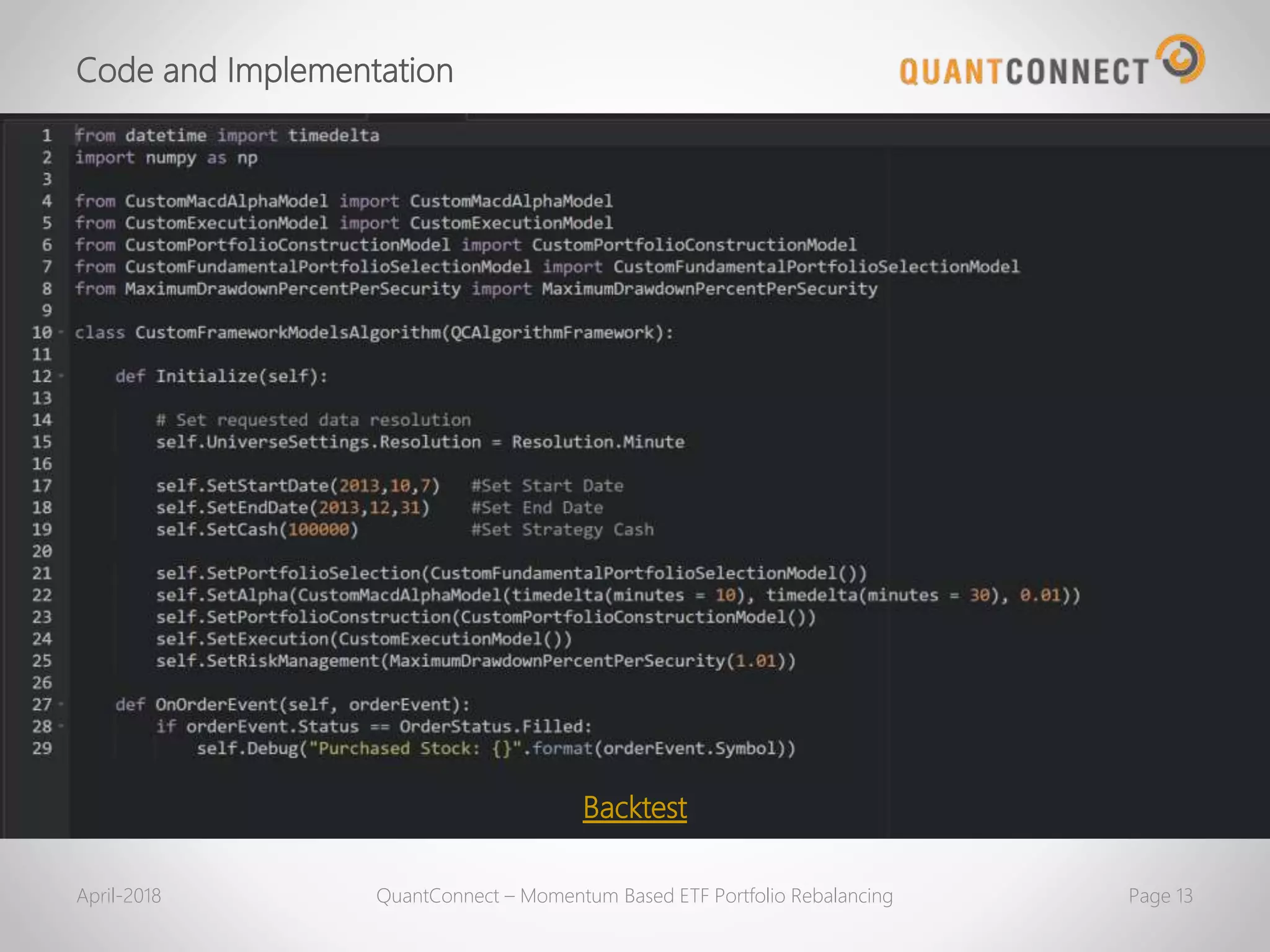

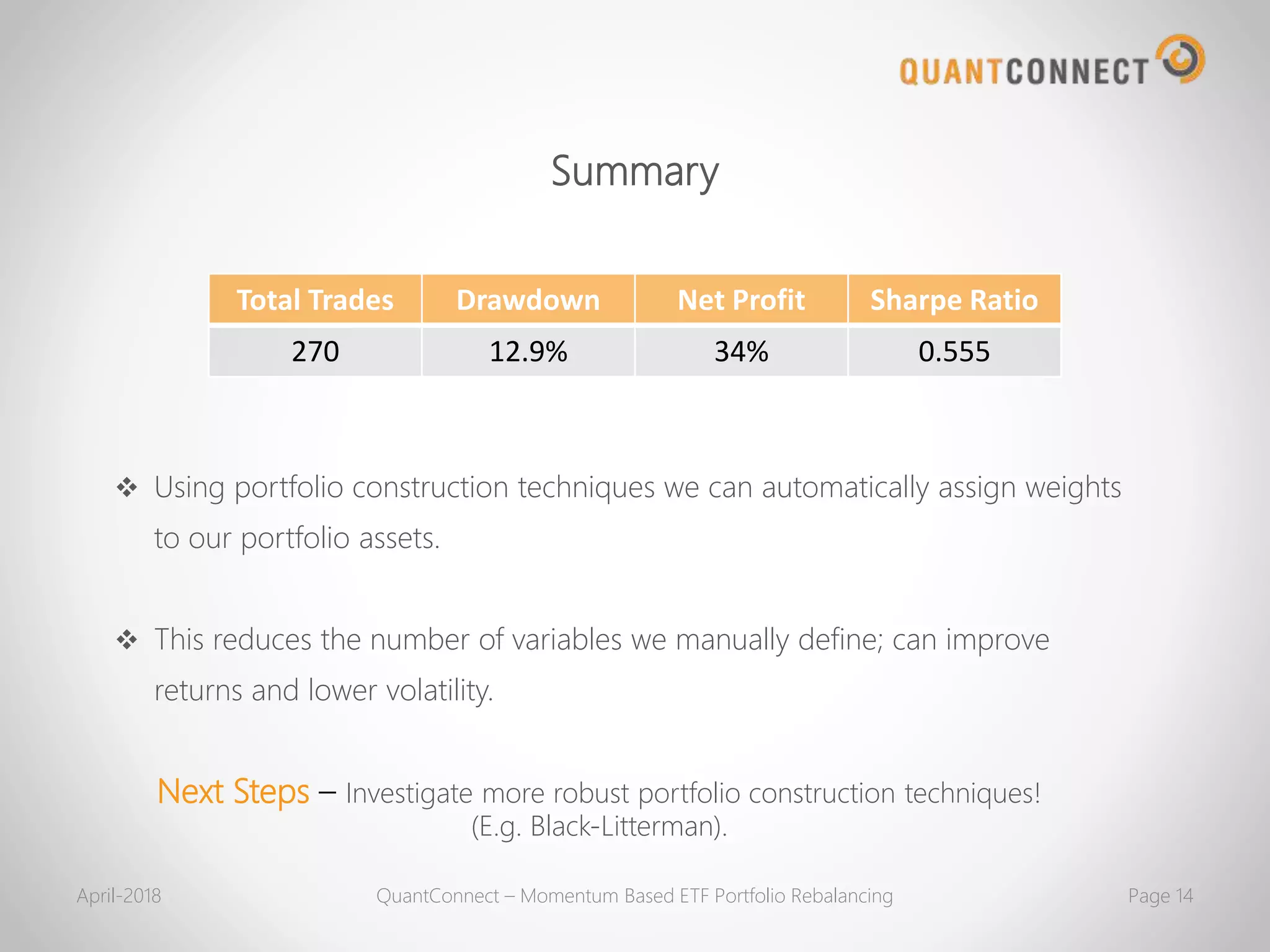

The document discusses momentum-based ETF portfolio rebalancing aimed at optimizing portfolio construction for an optimal Sharpe ratio. It outlines the traditional mean-variance optimization method, including how to calculate expected returns and minimize volatility, while proposing a shift to maximize the Sharpe ratio instead. The backtest summary indicates successful automatic weight assignments in portfolio assets, highlighting improvements in returns and reduced volatility.