QNBFS Daily Market Report June 14, 2021

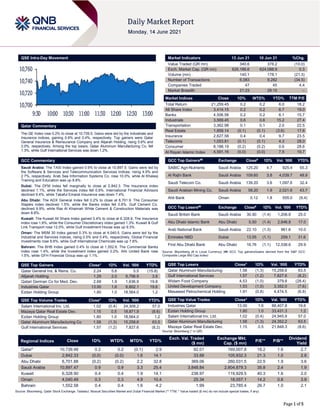

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.2% to close at 10,739.5. Gains were led by the Industrials and Insurance indices, gaining 0.6% and 0.4%, respectively. Top gainers were Qatar General Insurance & Reinsurance Company and Alijarah Holding, rising 5.6% and 2.0%, respectively. Among the top losers, Qatar Aluminum Manufacturing Co. fell 1.3%, while Gulf International Services was down 1.2%. GCC Commentary Saudi Arabia: The TASI Index gained 0.9% to close at 10,897.5. Gains were led by the Software & Services and Telecommunication Services indices, rising 4.9% and 2.7%, respectively. Arab Sea Information Systems Co. rose 10.0%, while Al Khaleej Training and Education was up 8.8%. Dubai: The DFM Index fell marginally to close at 2,842.3. The Insurance index declined 1.1%, while the Services index fell 0.8%. International Financial Advisors declined 9.4%, while Takaful Emarat Insurance was down 7.4%. Abu Dhabi: The ADX General Index fell 0.2% to close at 6,701.9. The Consumer Staples index declined 1.5%, while the Banks index fell 0.8%. Gulf Cement Co. declined 9.9%, while Ras Al Khaimah White Cement & Construction Materials was down 8.6%. Kuwait: The Kuwait All Share Index gained 0.4% to close at 6,328.9. The Insurance index rose 1.6%, while the Consumer Discretionary index gained 1.3%. Kuwait & Gulf Link Transport rose 12.0%, while Gulf Investment House was up 9.3%. Oman: The MSM 30 Index gained 0.3% to close at 4,040.5. Gains were led by the Industrial and Services indices, rising 0.5% and 0.4%, respectively. Global Financial Investments rose 9.6%, while Gulf International Chemicals was up 7.6%. Bahrain: The BHB Index gained 0.4% to close at 1,552.6. The Commercial Banks index rose 1.4%, while the Investment index gained 0.2%. Ahli United Bank rose 1.5%, while GFH Financial Group was up 1.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 2.24 5.6 5.5 (15.8) Alijarah Holding 1.29 2.0 6,798.9 3.8 Qatari German Co for Med. Dev. 2.68 1.9 1,636.9 19.8 Industries Qatar 13.00 1.6 6,802.1 19.6 Ezdan Holding Group 1.80 1.0 18,564.0 1.2 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 1.02 (0.4) 24,308.2 57.0 Mazaya Qatar Real Estate Dev. 1.15 0.5 18,871.9 (8.6) Ezdan Holding Group 1.80 1.0 18,564.0 1.2 Qatar Aluminum Manufacturing Co 1.58 (1.3) 15,258.6 63.5 Gulf International Services 1.57 (1.2) 7,827.6 (8.2) Market Indicators 13 Jun 21 10 Jun 21 %Chg. Value Traded (QR mn) 340.6 378.2 (10.0) Exch. Market Cap. (QR mn) 626,186.6 624,088.9 0.3 Volume (mn) 140.1 178.1 (21.3) Number of Transactions 6,083 9,282 (34.5) Companies Traded 47 45 4.4 Market Breadth 21:23 28:15 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 21,259.45 0.2 0.2 6.0 18.2 All Share Index 3,414.15 0.2 0.2 6.7 19.0 Banks 4,506.58 0.2 0.2 6.1 15.7 Industrials 3,569.45 0.6 0.6 15.2 27.4 Transportation 3,362.98 0.1 0.1 2.0 22.5 Real Estate 1,859.14 (0.1) (0.1) (3.6) 17.6 Insurance 2,627.58 0.4 0.4 9.7 23.5 Telecoms 1,053.81 (0.1) (0.1) 4.3 28.0 Consumer 8,188.19 (0.2) (0.2) 0.6 28.6 Al Rayan Islamic Index 4,591.16 (0.0) (0.0) 7.5 19.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% SABIC Agri-Nutrients Saudi Arabia 125.20 4.7 925.4 55.3 Al Rajhi Bank Saudi Arabia 109.60 3.8 4,039.7 48.9 Saudi Telecom Co. Saudi Arabia 139.20 3.6 1,097.6 32.4 Saudi Arabian Mining Co. Saudi Arabia 58.20 1.9 2,021.6 43.7 Ahli Bank Oman 0.12 1.8 555.0 (9.4) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi British Bank Saudi Arabia 30.90 (1.4) 1,206.8 25.0 Abu Dhabi Islamic Bank Abu Dhabi 5.50 (1.4) 2,646.8 17.0 Arab National Bank Saudi Arabia 22.10 (1.3) 961.6 10.0 Emirates NBD Dubai 13.55 (1.1) 259.1 31.6 First Abu Dhabi Bank Abu Dhabi 16.76 (1.1) 12,536.6 29.9 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Aluminum Manufacturing 1.58 (1.3) 15,258.6 63.5 Gulf International Services 1.57 (1.2) 7,827.6 (8.2) Widam Food Company 4.53 (1.0) 379.8 (28.4) United Development Company 1.53 (1.0) 3,352.0 (7.6) Mesaieed Petrochemical Holding 1.91 (0.8) 4,474.5 (6.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 13.00 1.6 88,407.8 19.6 Ezdan Holding Group 1.80 1.0 33,431.3 1.2 Salam International Inv. Ltd. 1.02 (0.4) 24,945.9 57.0 Qatar Aluminum Manufacturing 1.58 (1.3) 24,352.2 63.5 Mazaya Qatar Real Estate Dev. 1.15 0.5 21,848.3 (8.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,739.48 0.2 0.2 (0.1) 2.9 92.01 169,007.8 18.2 1.6 2.7 Dubai 2,842.33 (0.0) (0.0) 1.6 14.1 33.88 105,932.3 21.3 1.0 2.8 Abu Dhabi 6,701.88 (0.2) (0.2) 2.2 32.8 369.06 260,031.5 22.5 1.9 3.6 Saudi Arabia 10,897.47 0.9 0.9 3.3 25.4 3,848.84 2,604,879.3 35.8 2.4 1.9 Kuwait 6,328.90 0.4 0.4 1.9 14.1 238.97 119,929.5 40.3 1.6 2.0 Oman 4,040.49 0.3 0.3 4.9 10.4 25.34 18,057.1 14.2 0.8 3.9 Bahrain 1,552.58 0.4 0.4 1.6 4.2 1.99 23,785.4 26.7 1.0 2.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,700 10,720 10,740 10,760 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE Index rose 0.2% to close at 10,739.5. The Industrials and Insurance indices led the gains. The index rose on the back of buying support from GCC and foreign shareholders despite selling pressure from Qatari and Arab shareholders. Qatar General Insurance & Reinsurance Company and Alijarah Holding were the top gainers, rising 5.6% and 2.0%, respectively. Among the top losers, Qatar Aluminum Manufacturing Co. fell 1.3%, while Gulf International Services was down 1.2%. Volume of shares traded on Sunday fell by 21.3% to 140.1mn from 178.1mn on Thursday. Further, as compared to the 30-day moving average of 214.3mn, volume for the day was 34.6% lower. Salam International Inv. Ltd. and Mazaya Qatar Real Estate Dev. were the most active stocks, contributing 17.4% and 13.5% to the total volume, respectively. Source: Qatar Stock Exchange (*as a % of traded value) News Qatar QIGD announces appointment of new Chief Executive Officer – Qatari Investors Group (QIGD) announced the appointment of Joseph Abdo as Chief Executive Officer with effect from June 13, 2021. (QSE) Energy majors bid for Qatar LNG project – Six top western energy firms are vying to partner in the vast expansion of Qatar's liquefied natural gas output, industry sources said, helping the Gulf state cement its position as the leading LNG producer while several large projects around the world recently stalled. Exxon Mobil, Royal Dutch Shell, TotalEnergies and ConocoPhillips, which are part of Qatar's existing LNG production were joined by new entrants Chevron and Italy's Eni in submitting bids on May 24 for the expansion project, industry sources told Reuters. The bids show energy giants continue to have appetite for investing in competitive oil and gas projects despite growing government, investor and activist pressure on the sector to tackle greenhouse gas emissions. Unlike Qatar's early LNG projects in the 1990s and 2000s when the country relied heavily on international oil companies' technical expertise and deep pockets, the country's national oil company Qatar Petroleum (QP) has gone ahead alone with the development of the nearly $30bn North Field expansion project. It is, however, seeking to partner with the oil majors in order to share the financial risk of the development and help sell the additional volumes of LNG it will produce. (Bloomberg, Reuters) FocusEconomics: Qatar GDP on track to exceed $200bn by 2025 – Qatar’s GDP is set to exceed $200bn in four years and reach $204bn by 2025, according to researcher FocusEconomics. The country’s GDP this year has been forecast at $169bn, $178bn in 2022, $186bn (2023) and $195bn (2024). GDP per capita, FocusEconomics said, is set to reach $72,105 in 2025 from $60,235 this year. Next year, it has been projected at $63,139 and $65,866 (2023) and $68,993 (2024). The country’s current account balance (as a percentage of GDP) will reach 7.5 in 2025 from 4.2 this year. Next year it will be 7.7, 8.6 in 2023 and 11.8 in 2024. Fiscal balance (as a percentage of GDP) will reach 2.7 in 2025 from 1.8 this year. Next year, it will be 2.3 and 2.5 (in 2023) and 2.6 (2024). The country’s merchandise trade balance will reach $52.4bn in 2025 from $39.4bn this year, the report said. Unemployment as a percentage of active population will be 0.3 this year and 0.1 in 2025. FocusEconomics said Qatar’s economy appeared to be “resilient” in the first quarter of the year. The non- energy private sector purchasing managers' index (PMI) was “well in expansionary territory” in the period, while industrial production data suggests the performance of the energy sector “improved” relative to 4Q2020. Heading into second quarter (2Q), the YoY comparisons will be “flattered by the highly favorable base effect, but underlying momentum seems to have softened.” The non-energy private sector PMI slumped in April and May, amid the progressive tightening of restrictions to ward off a second wave of Covid-19. (Gulf-Times.com) International Georgieva: IMF eyes new trust to provide aid to broader group of countries – The International Monetary Fund is exploring creation of a new trust that could allow its members to lend their IMF reserves to more countries, including middle- income countries vulnerable to climate change, IMF Chief Kristalina Georgieva said on Sunday. Georgieva said leaders of the Group of Seven rich economies had given the IMF a ‘green light’ to keep working on the plan, and China - the world’s second largest economy - had also expressed interest, along with middle- income countries that stand to benefit from such a fund. She said the IMF would continue working on the “Resilience and Sustainability Trust” - which could help countries combat climate change or improve their health care systems - ahead of the July meeting of finance officials from the Group of 20 major economies, which includes China. “Now we have the indication that we have a green light to go ahead, and we will reach out to others,” Georgieva told Reuters in an interview after the end of the G7 leaders summit in Cornwall, England. “China has expressed interest to participate, and I would expect there could be other emerging market economies with sound fundamentals and strong reserve positions that may also do the same,” she Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 40.16% 41.87% (5,823,427.1) Qatari Institutions 18.35% 32.86% (49,430,135.1) Qatari 58.51% 74.73% (55,253,562.2) GCC Individuals 0.54% 0.43% 363,501.4 GCC Institutions 3.85% 2.49% 4,652,760.3 GCC 4.39% 2.92% 5,016,261.7 Arab Individuals 12.29% 13.70% (4,786,980.0) Arab Institutions 0.00% 0.00% – Arab 12.29% 13.70% (4,786,980.0) Foreigners Individuals 3.45% 3.27% 636,665.7 Foreigners Institutions 21.36% 5.39% 54,387,614.8 Foreigners 24.81% 8.65% 55,024,280.5

- 3. Page 3 of 5 said. G7 leaders on Sunday said they welcomed an expansion of the global lender’s emergency reserves, or Special Drawing Rights (SDRs), by $650bn, and backed a global target of providing $100bn to the most vulnerable countries, but said other countries should participate. The IMF’s Poverty Reduction and Growth Trust already allows members to share their IMF reserves, but small island states and other middle-income countries that have been hit hard by the coronavirus pandemic and significant economic downturns, are not eligible for funding through that IMF vehicle. Georgieva welcomed the G7’s commitment to donate one billion COVID-19 vaccine doses as a key step toward ending the pandemic, and said discussions would continue within the G20. The IMF has been urging rich countries to act, warning that a big divergence in the recoveries of advanced and developing economies could undercut demand and disrupt supply chains, which would also affect countries that are recovering faster. “This is a moral imperative and an economic necessity,” Georgieva said, adding that allowing the gap between rich and poor countries to continue to widen could also trigger unrest. “We have seen in the past that divergence that leads to more inequality, it creates a breeding ground for more instability in the world,” she said. Georgieva said she would work with IMF members in the coming months on how they could re- allocate some of their SDRs or use budget loans to reach - or even exceed - the $100bn goal. Countries could also use budget loans and other means to raise the money, she said, noting this was done successfully in the first year of the pandemic when the IMF sought donations for its Poverty Reduction and Growth Trust. The IMF expects its board to formally approve the $650bn SDR allocation in August, paving the way for member countries to donate their unneeded reserves to others in need. The previously unreported new trust could help broaden the effort and make funds available to more countries, and for broader initiatives, in line with global goals for combating climate change. Eric LeCompte, an adviser to the United Nations and executive director of Jubilee USA Network, said the IMF’s work on the new trust marked “significant progress” for many middle income countries also hit hard by the pandemic. “It means that more countries with needs can get aid and resources to get through the pandemic,” he said. (Reuters) Raab: Britain raps EU for treating N.Ireland as separate country – British foreign minister Dominic Raab criticised the European Union on Sunday for treating Northern Ireland as if it was a separate country rather than part of the United Kingdom, and that approach was causing damage to the British province. “Various EU figures here in Carbis Bay, but frankly for months now and years, have characterized Northern Ireland as somehow a separate country and that is wrong. It is a failure to understand the facts,” he told the BBC’s Andrew Marr program. Macron says Brexit deal must be honored – President Emmanuel Macron on Sunday said that France respects Britain’s sovereignty but it is time to end rows over sausages and focus on more serious issues. Macron said he wants Britain to respect its post-Brexit trade agreement with the European Union. “My wish is that we succeed collectively in putting into action what we signed several months ago,” Macron told a news conference at the G7 leaders’ summit. France's Macron says G7 is not hostile towards China – The G7 group of nations may have its differences with China over issues such as forced labor and human rights, but it is not a club that is hostile to the Asian economic powerhouse, French President Emmanuel Macron said on Sunday. “China is an economic rival from whom we expect the full respect of (international trade) rules,” Macron told a news conference at the end of a summit of G7 leaders in Britain. (Reuters) Italy's Draghi says G7 had to be frank about China – Italian Prime Minister Mario Draghi said the Group of Seven countries had to be frank about differences between the West and China in its post-summit communique that called out Beijing on issues ranging from rights to the origins of the coronavirus. “It’s an autocracy that does not adhere to multilateral rules and does not share the same vision of the world that the democracies have,” Draghi told reporters on Sunday after a Group of Seven leaders summit in Britain. “We need to cooperate but we also need to be frank about things that we do not share and do not accept. The US president said that silence is complicity.” Asked by a reporter if Italy’s participation in China’s Belt and Road infrastructure network was raised at the G7 summit, Draghi said it had not been mentioned but he added: “regarding that specific agreement, we will assess it carefully.” The G7 leaders at their summit sought to counter China’s influence by offering developing nations an infrastructure plan that could rival China’s Belt and Road initiative. Italy was the first major Western power to endorse the Chinese plan in 2019, before Draghi became prime minister, in a bit to revive its economy. (Reuters) Germany's Laschet vows to raise military spending if elected – Germany must increase military spending and take on a greater share of military burdens within NATO, the conservative candidate to succeed Angela Merkel as chancellor said in a newspaper interview on Sunday. Heads of state within the 30- nation North Atlantic Treaty Organization (NATO) will meet in Brussels on Monday and discuss the path to follow against challenges such as China, Russia and cyber threats. Laschet, backed by Merkel's conservatives to run for chancellor at the Sept. 26 election, said he would ensure that Germany, Europe's largest economy, meets the alliance's spending target of 2% of gross domestic product. "When we have agreed something internationally, we should stick to it", he told Welt am Sonntag (WamS). He said the Bundeswehr, the federal armed forces, should take on more responsibility in Africa, around the Mediterranean and in Mali. "We can always talk about us taking a higher share of the burdens," he said referring to Mali, where the Bundeswehr participates in a European Union training mission and in a United Nations peacekeeping mission. French president Emmanuel Macron on Thursday said that France's operation battling Islamist militants in the Sahel region, of which Mali is a part, would come to an end with troops now operating as part of broader international efforts in the region. A German poll on Sunday showed the conservative party block of Christian Democrats and their Bavarian sister party CSU, at 27%, well ahead of the Greens at 20%. Separately, the Green Party at a party conference that ended on Sunday softened up a previously categoric stance against the use of armed drones by the Bundeswehr after a tight vote of 347 versus 343 on the motion. But the Greens reject the two percent NATO target as they deem it costly and arbitrary. (Reuters) China cautions G7: 'small' groups don't rule the world – China on Sunday pointedly cautioned Group of Seven leaders that the days when “small” groups of countries decided the fate of the world was long gone, hitting back at the world’s richest democracies which sought a unified position to counter China. “The days when global decisions were dictated by a small group of countries are long gone,” a spokesman for the Chinese embassy in London said. “We always believe that countries, big or small, strong or weak, poor or rich, are equals, and that world affairs should be handled through consultation by all countries.” (Reuters) Regional Saudi Public Investment Fund bolsters MENA investments division – The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, on Sunday said it has appointed Eyas al-

- 4. Page 4 of 5 Dossari and Omar al-Madhi as senior directors to its MENA investments division. PIF, which manages $430bn, has also appointed Abdullah Shaker as senior director to its global capital finance division. PIF earlier this month expanded its local holdings investments division to become the MENA investments division, and its corporate finance division to become the global capital finance division. The fund also established two deputy governor roles to support the fund's continued growth and expansion. The PIF is at the center of Saudi Arabia's plans to transform the economy by creating new sectors and diversifying revenues away from oil. The fund is expected to inject at least $40bn annually into the local economy until 2025, and increase its assets to $1tn by that date. (Zawya) Saudi Arabia's Dur and Taiba in merger talks – Saudi Arabia's Dur Hospitality Co and Taiba Investments Co are in merger talks that could create a company with combined assets worth $2.4bn across the Kingdom's hotel, tourism and real estate sectors. Dur and Taiba announced the merger talks in similar bourse statements on Sunday, adding that an agreement may not be reached between to the two companies in which Aseelah Investment Co is a significant shareholder. Taiba, which has interests in hotels, tourism facilities and real estate, has a market capitalization of $1.5bn, Refinitiv data shows. Dur's market capitalization is $923mn, with investments in hotels, travel agencies and entertainment centers, Refinitiv data shows. Saudi Arabia's sovereign wealth fund, the Public Investment Fund, owns nearly 17% of Dur, according to Refinitiv. (Reuters) DEWA to add additional 600MW of clean energy capacity to Dubai’s energy mix in 2021 – Saeed Mohammed Al Tayer, MD & CEO of Dubai Electricity and Water Authority (DEWA), has announced that the authority will add 600 megawatts (MW) of clean energy capacity using photovoltaic solar panels and Concentrated Solar Power (CSP) during 2021. The move will increase DEWA’s total power capacity from clean energy to 1,613 MW compared to 1,013 MW currently. Al Tayer said that next July, DEWA will commission the 300MW first stage of the 5th phase of the Mohammed bin Rashid Al Maktoum Solar Park. DEWA will commission the world's tallest CSP tower at 262.44 metres with a capacity of 100MW in September and 200MW from the parabolic trough as part of the 4th phase of the solar park by the end of 2021. (Zawya) Dubai's Meraas now holds all shares of DXB Entertainments – State-backed Meraas Leisure and Entertainment now holds all the shares of Dubai theme parks operator DXB Entertainments (DXBE), according to a bourse filing. The minority shareholders of the company, which operates Dubai Parks and Resorts, had accepted in March the offer to take over the company, whose losses were reported to be at $1.7bn, or 78% of its capital, as of the end of September 2020. “Following completion of the mandatory acquisition, all of the shares of (DXBE) are now held by Meraas,” DXBE said in a statement to the Dubai Financial Market (DFM). (Zawya) Abu Dhabi’s ADQ said in talks to invest $500mn in Flipkart – Abu Dhabi sovereign fund ADQ is in talks to invest about $500mn in India’s Flipkart, according to sources, as the Walmart Inc.- backed e-commerce firm raises funds ahead of a potential initial public offering next year. The oil-rich Emirate’s newest state investment company is discussing an injection of funds that would value Flipkart between $35bn and $40bn, the sources said. The fundraising would come ahead of a planned IPO that could take place as soon as 2022, they said. Flipkart is seeking to raise at least $3bn and could decide to increase the amount to as much as $3.75bn, as investors have shown significant interest, sources said. Considerations are ongoing and the talks could fall apart, the people said. Flipkart is seeking to raise at least $3bn from a group of investors including SoftBank Group Corp., Singapore’s GIC Pte and Canada Pension Plan Investment Board, Bloomberg News reported June 7 citing sources. The group also includes the Abu Dhabi Investment Authority (ADIA), one of the Emirate’s largest sovereign wealth funds, the sources said at the time. (Bloomberg) Abu Dhabi's ADQ invests in India's edtech giant Byju's – Abu Dhabi’s state state-owned ADQ is one of the investors participating in the latest funding round by India’s education technology firm Byju’s. The edtech giant raised about $350mn from investors that also include UBS Group, Zoom founder Eric Yuan and Blackstone, the Economic Times reported. The latest funding valued Byju at around $16.5bn post investment, making it the most-valued start-up in India. ADQ, which owns Abu Dhabi Ports, Abu Dhabi Airport and bourse operator Abu Dhabi Securities Exchange (ADX), is on an investment spree. It has taken strategic stakes in a variety of ventures within the UAE and globally. (Zawya) Kuwait's economy contracted by 9.9% in 2020 – Kuwait’s GDP contracted 9.9% in 2020, compared with growth of 0.4% in 2019, mainly because of last year’s sharp drop in oil prices, state news agency KUNA reported on Sunday. Kuwait, which makes half its revenues from oil, had its finances squeezed by an oil price crash and by the COVID-19 pandemic, while a draft law that would allow it to tap international debt has stalled amid disagreement between successive parliaments and cabinets. The International Monetary Fund estimated in April that Kuwait’s GDP contracted 8% in 2020. KUNA based its report on Central Bank of Kuwait’s Governor, Mohammad Al-Hashel, who cited preliminary estimates and statistics and said the institution used all the tools available to it to blunt the pandemic’s impact. He said preliminary estimates and statistics also showed the headline inflation rate increased to about 2.1% in 2020 from about 1.1% in 2019. Kuwait’s population, which mostly comprises expatriate workers and their families, declined by 2.2% in 2020 after growing 3.3% in 2019. (Reuters)

- 5. Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Shahan Keushgerian Mehmet Aksoy, PhD Head of Research Senior Research Analyst Senior Research Analyst saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa mehmet.aksoy@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 May-17 May-18 May-19 May-20 May-21 QSE Index S&PPan Arab S&PGCC 0.9% 0.2% 0.4% 0.4% 0.3% (0.2%) (0.0%) (0.5%) 0.0% 0.5% 1.0% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,877.53 (1.1) (0.7) (1.1) MSCI World Index 3,012.67 0.2 0.5 12.0 Silver/Ounce 27.92 (0.3) 0.4 5.7 DJ Industrial 34,479.60 0.0 (0.8) 12.7 Crude Oil (Brent)/Barrel (FM Future) 72.69 0.2 1.1 40.3 S&P 500 4,247.44 0.2 0.4 13.1 Crude Oil (WTI)/Barrel (FM Future) 70.91 0.9 1.9 46.1 NASDAQ 100 14,069.42 0.4 1.8 9.2 Natural Gas (Henry Hub)/MMBtu 3.23 4.2 8.8 35.1 STOXX 600 457.51 (0.0) 0.6 13.5 LPG Propane (Arab Gulf)/Ton 95.00 (0.3) 3.5 26.2 DAX 15,693.27 0.1 (0.5) 12.6 LPG Butane (Arab Gulf)/Ton 100.50 (1.7) 1.5 44.6 FTSE 100 7,134.06 0.2 0.5 14.1 Euro 1.21 (0.5) (0.5) (0.9) CAC 40 6,600.66 0.2 0.8 17.7 Yen 109.66 0.3 0.1 6.2 Nikkei 28,948.73 (0.3) (0.1) (0.7) GBP 1.41 (0.5) (0.4) 3.2 MSCI EM 1,381.99 0.2 0.0 7.0 CHF 1.11 (0.4) 0.1 (1.5) SHANGHAI SE Composite 3,589.75 (0.7) (0.1) 5.4 AUD 0.77 (0.6) (0.4) 0.2 HANG SENG 28,842.13 0.4 (0.3) 5.8 USD Index 90.56 0.5 0.5 0.7 BSE SENSEX 52,474.76 0.1 0.2 9.6 RUB 72.08 0.4 (1.0) (3.1) Bovespa 129,441.00 (1.4) (1.5) 9.9 BRL 0.20 (1.2) (1.4) 1.5 RTS 1,678.57 0.1 1.9 21.0 143.0 137.6 106.2