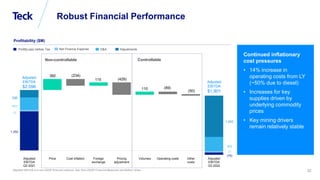

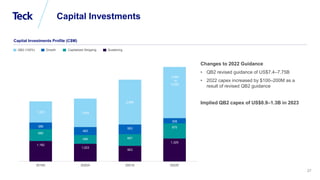

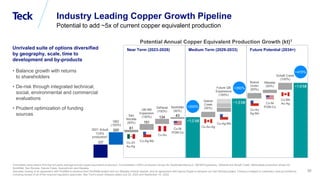

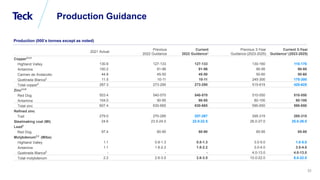

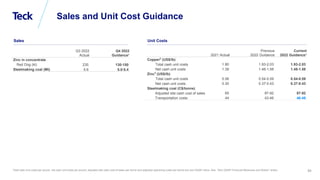

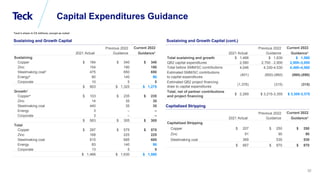

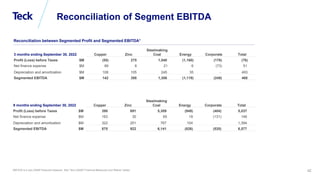

The document summarizes key points from a Global Metals and Mining Conference presentation by Teck Resources. It discusses Teck's priorities of rebalancing its portfolio to focus on low-carbon metals like copper, operational excellence, long-term copper growth through projects like QB2, and industry-leading sustainability. It also announces the sale of Teck's 21.3% interest in the Fort Hills oil sands project for $1 billion in cash to advance its strategic rebalancing. Key Q3 2022 results highlighted include $2.4 billion in gross profit before depreciation and amortization and $1.9 billion in adjusted EBITDA.