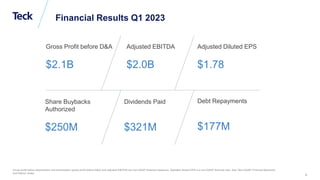

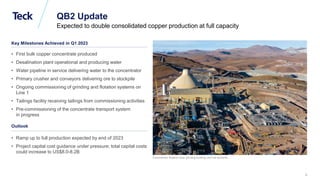

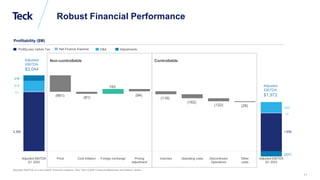

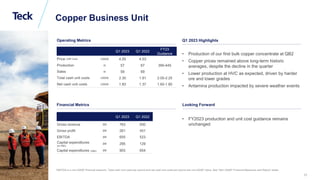

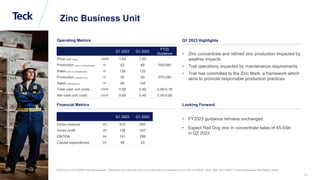

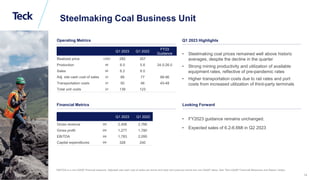

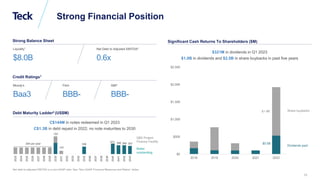

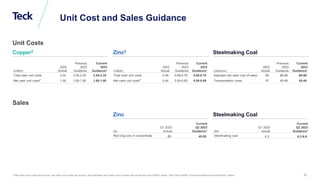

The document outlines the key points from Teck's First Quarter 2023 Conference Call held during the global metals and mining conference, highlighting various forward-looking statements and financial metrics. It emphasizes the company's strategy to unlock shareholder value through a more direct separation, growth in copper production, and significant cash returns via dividends and share buybacks. Risks and uncertainties related to market conditions, operational issues, and sustainability goals are also discussed.