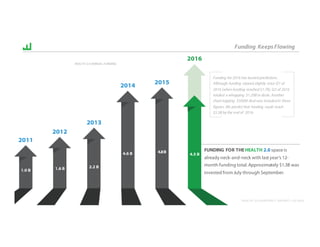

The Q3 2016 Health 2.0 quarterly report highlights significant funding trends and developments in the digital health sector, including a focus on female-led initiatives and solutions for underserved communities. Notable investments included a $500 million venture in diabetes management by Verily and Sanofi, alongside other substantial raises for health tech companies. The report indicates a strong growth trajectory for digital health funding, predicting a total of $5.5 billion by the end of the year.