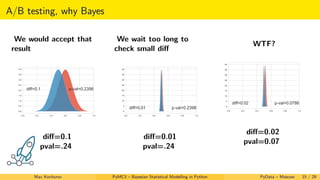

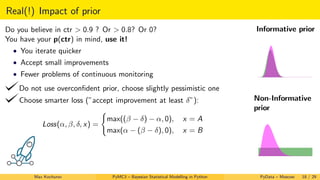

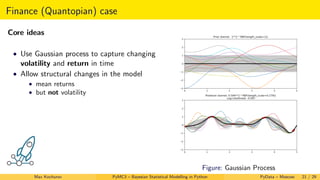

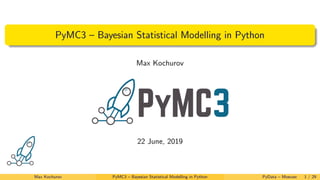

The document introduces PyMC3 for Bayesian statistical modeling in Python, explaining the basics of Bayesian statistics including prior, likelihood, and posterior concepts. It discusses the application of Bayesian inference in various fields such as finance, music streaming, e-commerce, astronomy, life sciences, and medicine. Furthermore, it covers Markov Chain Monte Carlo (MCMC) methods, hierarchical models, and case studies including A/B testing, highlighting the advantages of Bayesian approaches over traditional frequentist methods.

![Hierarchical Models

What if we have more diverse data? We can estimate an amount of devils + uncertainty!

Data: [8, 2, 2, 10, 0,

0, 2, 5, 6, 10] out of 20 flips

λDevil ∼ Exponential(1)

λAngel ∼ Exponential(1)

pi ∼ Beta(λAngel , λAngel + λDevil )

flipsi ∼ Binomial(pi , Ni )

Max Kochurov PyMC3 – Bayesian Statistical Modelling in Python PyData – Moscow 8 / 29](https://image.slidesharecdn.com/6-190715100351/85/PyMC3-Bayesian-Statistical-Modelling-in-Python-22-2019-22-320.jpg)

![Hierarchical Models

What if we have more diverse data? We can estimate an amount of devils + uncertainty!

Data: [8, 2, 2, 10, 0,

0, 2, 5, 6, 10] out of 20 flips

λDevil ∼ Exponential(1)

λAngel ∼ Exponential(1)

pi ∼ Beta(λAngel , λAngel + λDevil )

flipsi ∼ Binomial(pi , Ni )

Max Kochurov PyMC3 – Bayesian Statistical Modelling in Python PyData – Moscow 8 / 29](https://image.slidesharecdn.com/6-190715100351/85/PyMC3-Bayesian-Statistical-Modelling-in-Python-22-2019-23-320.jpg)

![Inspecting Your Model

plt.hist(trace["angels"],

alpha=.8, label='Alpha')

plt.hist(trace["angels"]+trace["devils"],

alpha=.8, label='Beta')

plt.legend(fontsize=20)

0 1 2 3 4 5 6 7 8

0

50

100

150

200

250

300

Alpha

Beta

Max Kochurov PyMC3 – Bayesian Statistical Modelling in Python PyData – Moscow 11 / 29](https://image.slidesharecdn.com/6-190715100351/85/PyMC3-Bayesian-Statistical-Modelling-in-Python-22-2019-28-320.jpg)

![Inspecting Your Model

0.0 0.2 0.4 0.6 0.8 1.0

0

1

2

3

4

5

6

7

Prob Distribution

for a, b in zip(

trace["angels"],

trace["angels"]+trace["devils"]

):

plt.plot(

np.linspace(0, 1),

st.beta(a, b).pdf(np.linspace(0, 1)),

color="b", alpha=.025

)

a_mean = trace["angels"].mean()

b_mean = (trace["angels"]+trace["devils"]).mean()

plt.plot(

np.linspace(0, 1),

st.beta(a_mean, b_mean).pdf(np.linspace(0, 1)),

color="black", linewidth=4.0

)

plt.axvline(0.5)

plt.title("Prob Distribution", fontsize=20)

Max Kochurov PyMC3 – Bayesian Statistical Modelling in Python PyData – Moscow 12 / 29](https://image.slidesharecdn.com/6-190715100351/85/PyMC3-Bayesian-Statistical-Modelling-in-Python-22-2019-29-320.jpg)