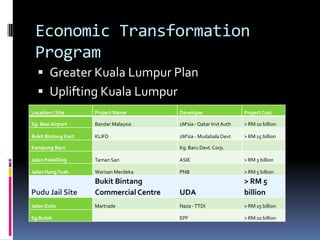

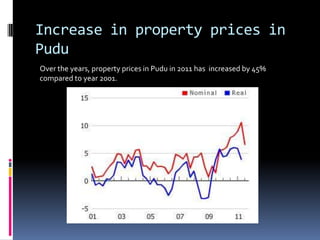

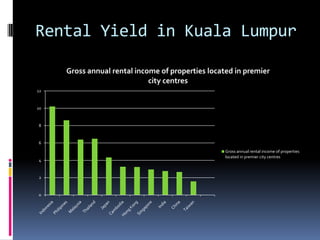

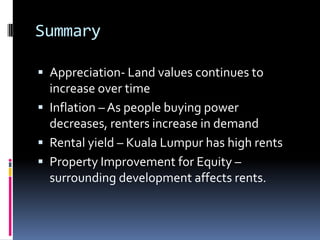

This document discusses reasons for investing in property and highlights opportunities in Pudu, Kuala Lumpur. It notes that property is a good investment due to appreciation over time, inflation increasing rental demand, and potential for rental yield. Pudu is highlighted as a strategic upcoming area with infrastructure improvements planned and proximity to attractions making it well located. Recent property price increases and upcoming development projects suggest continued growth in the Pudu property market.