The Path to Purchase Institute's 2015 Design of the Times competition has a deadline for entries on June 5, with finalists showcased at the Shopper Marketing Conference & Expo in October. Additionally, the institute is seeking judges for the competition, with commitments required for two judging phases in August and October. Albertsons and Safeway's VP of Shopper Marketing emphasizes collaborative shopper marketing programs post-merger, outlining strategies for engaging with national and division-specific marketing efforts.

![avid sports enthusiasts as well as more ca-

sual fans such as moms who want to in-

clude Reese’s products into creative experi-

ences with their families through recipes,

crafts, party planning and snack options.

“‘Reese’s Playoff Pandemonium’ has

something to offer both of these consum-

ers by communicating to them in the places

where we know they’re already engaged –

in-store, online and social channels,” says

Eric Snyder, consumer promotions man-

ager for Hershey. “We’re able to provide

them with useful, entertaining information

and also reward them for their engagement

with the coupon and bonus snacking and

recipe ideas.”

Out-of-store drivers for the campaign in-

cluded digital media, videos on social and

mobile, e-newsletters, the GoReeses.com

promotional site, and the mobile texting

campaign that prompted the coupons. In-

store POS, which ran across all materials

and featured “Ref” Foxworthy in an inte-

gratedthemewiththeonlineandsocialma-

terials, prompted shoppers to grab Reese’s

products for their game-day gatherings.

Specific in-store components included

a “Ref” Foxworthy standee provided by

Strine Printing Co., York, Pennsylvania,

as well as lug-ons that looked like penalty

flags, floor mats, shelf danglers, recipe tear-

pads and merchandising units with cus-

tomized headers, all provided by Hershey

PrintShop, Hershey, Pennsylvania.

“Playoff Pandemonium” complemented

Reese’s existing college football partner-

ships and seemed like a natural fit for the

brand, Snyder says. “The message was con-

sistent to grow association of Reese’s with

the football playoff occasion, increasing

purchases and frequency.” SM

PROGRAMS10 SHOPPER MARKETING MAY 2015

By Ed Finkel

Hershey, Pa. — The Hershey

Co. complemented Reese’s

status as an official sponsor of

the first-ever College Football

Playoff by executing a “Playoff

Pandemonium” campaign last

winter that coincided with the

four-team playoff to determine

a champion. Reese’s dispatched

comedian Jeff “Ref” Foxworthy

to explain “Reese’s Rules” to fans

through videos that were part of

a broader path-to-purchase cam-

paign.

For example, Reese’s Rules say

tackling is permitted when some-

one grabs the last Reese’s Minia-

ture; pass interference may be called

if you don’t share your Reese’s Minis;

and, when noshing on Reese’s Pea-

nut Butter Cups, always go for two.

“Jeff Foxworthy has entertained

millions with his comedy for more than

25 years,” says Reese’s senior brand

manager John Maitrejean, “and he’s the

largest-selling comedic recording artist

in history. So we believed he was the per-

fect choice to bring some entertainment to a

heated and intense playoff season.”

Consumers were encouraged to share

their own witty rules – or Reese’s-related

images – using a #ReesesGameday hashtag,

while an in-store SMS text campaign en-

abled them to ask for both additional “Re-

ese’s Rules” and a coupon for future Reese’s

purchases. The campaign aimed to reach

Reese’s Sweetens ‘Playoff Pandemonium’

Comedic referee explains how to make the brand part of game day during college playoffs

By Wayne Niemi

Irvine, Calif. — When consumer electron-

ics manufacturer Vizio was preparing to

introduce its new 21-inch 2.1 sound stand

last summer, the company’s marketers

knew there would be a unique challenge

in producing an in-store piece around the

audio system’s subwoofer. Vibrations from

the speaker could weaken the display, or

worse, the display housing could muffle or

distort sound quality.

Both scenarios were major concerns as

Vizio sought to roll out semi-permanent

units to 685 Sam’s Club stores and select

Costco locations, fulfilling an in-store vision

forthebrandthatseniordirectorofmerchan-

dising Victor Shu and his team work hard

every year to create. “We use a broad range

of consumer studies, market insights and

mystery shop data, along with retailer in-

sights and requirements to shape our P-O-P

and merchandising strategy,” says Shu. “The

display is an integral part of Vizio’s in-store

marketing efforts year after year, especially

for products such as the sound stand that

encourage customer interaction.”

Vizio entrusted the design project to Bur-

bank, California-based Origin, but sound

quality wasn’t going to be the only chal-

lenge for the P-O-P firm. The manufac-

turer’s in-store budget for the sound stand

required senior account manager Matt

Weston and the Origin team to get creative.

“We were given a budget that

was certainly challenging,”

Weston says, “so we had to

design into that cost. What

we were able to accomplish

was a premium display, and

certainly an upgrade to what

they’ve done before. We were

able to use new, upgraded

materials while maintaining

Vizio’s budget constraints.”

The necessity to use differ-

entmaterialsforthe2.1launch

relates back to the issue of in-

store customer interaction

with the product and the pos-

sibility that very high volumes

could potentially compromise

the stability of the display.

“The key requirement was that whatever we

created had to ensure there was no vibration

from the speaker, even when turned up to

11,” says Weston. “We couldn’t use metal

hardware because it could come loose.”

Origin tested other options until it came

up with a one-piece, urethane foam base

with a medium-density fiberboard back

panel. “After we were happy with the foam

and we did our testing,” Weston says, “I

took it to the client. Their sound engineers

are literally the ears of the company. They

listened to the sound quality and gave it

Vizio Makes Sound Decisions

P-O-P firm’s design solution props up manufacturer’s merchandising strategy at Sam’s, Costco

BRAND: Reese’s

KEY INSIGHTS: Sports enthusiasts as

well as casual fans such as moms want

creative experiences with their families

through recipes, crafts, party planning

and snack options. These individuals are

engaged in-store, online and in social

channels.

ACTIVATION: Comedian Jeff Foxworthy

appeared in videos on social media while

an in-store SMS text campaign gave

shoppers access to additional “Reese’s

Rules” and coupons for future purchases.

In-store POS featured Foxworthy in an

integrated theme.

MANUFACTURER: Vizio

SOLUTION PROVIDER: Origin

MERCHANDISING CHALLENGE: To cre-

ate an interactive in-store display for the

2.1 sound stand audio system that allows

shoppers to test the full range of volume

without distorting the sound or compro-

mising the display.

ACTIVATION: The manufacturer rolled

out semi-permanent units to 685 Sam’s

Club stores and select Costco locations,

achieving the highest compliance rate for

a Vizio display.

to the base with three screws and plug it in.”

On top of that, Weston says Origin hasn’t

received a single report of units damaged

during shipping or failure on the store

floor. “That’s especially pleasing,” he says.

“Even the push buttons we used looked

great and have proved to be resilient to

everyday wear and tear.”

The displays began shipping to stores in

August and were slated to remain for six to

nine months. Shu said the full success of

the display would be evaluated based on

five criteria: design and implementation;

durability; cost and timing; compliance

rates; and sales impact.

Weston says that the development of

the display could have a lasting impact

on Vizio’s future in-store efforts. “The ure-

thane foam was a resounding success,” he

says. “We were able to use it to make some-

thing that looked great, sounded great and

was really easy to set up.” SMThe Vizio display that recently appeared in Sam’s Club and Costco

proved to be a key component to the launch of the 2.1 sound stand.

their approval.”

The collaboration of Vizio’s research and

Origin’s innovative design paid off. Accord-

ing to Weston, the display had the highest

compliance rate of any in Vizio’s history –

as high as 65% to 75%, compared to Vizio’s

average of 25% to 40%.

Weston attributed the success in place-

ment to the fact that the 25-inch-wide by

18-inch-high display shipped nearly fully as-

sembled. “We shipped it with the product

alreadymountedtothedisplaybase,”hesays.

“All[retailers]hadtodowasattachtheheader

The “Playoff Pandemonium” campaign targeted

serious and casual sports fans by engaging with

both groups in-store, online and through social

media channels.](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-10-2048.jpg)

![MAY 2015 SHOPPER MARKETING PROGRAMS 11

APPLIED LEARNING

TO EMPOWER

YOUR SUCCESS

Structured professional

development courses designed

to help individuals become

peak performers in shopper

marketing-related roles

For more information contact Stacey Bobby

at sbobby@p2pi.org or (773) 992-4423

An exclusive benefit

for Institute Members

TO LEARN MORE & REGISTER TODAY:

www.p2pi.org/leadershipu

Who Should Attend:

All professionals whose jobs impact

path to purchase success including:

> Brand Marketers

> Shopper Marketers

> Customer Marketers

> Sales/Category/Management Leaders

> Buyers/Merchants

> Insights Professionals

> Agency/Solution Providers

Coming to a City Near You:

Minneapolis, MN.....May 13-14

Chicago, IL ...............Jun. 24-26

Atlanta, GA...............Jul. TBD

New York, NY...........Sep. TBD

Shopper marketing is not a

department, it’s a discipline.

Courses Include:

SM 100: Fundamentals of Shopper Marketing

SM 101: Principles of Shopper Behavior & Engagement

SM 102: Effective Strategies for Developing Shopper Insights

SM 103: Understanding Retailers

SM 104: The Digital Landscape for Shopper Marketing

Do you know all you need to know to keep

up with this rapidly changing industry?

older adult, Sales said. Quality, fresh and

specialty selections are important to these

customers along with a good store experi-

ence. Sales explained that while the com-

pany doesn’t plan to abandon this core cus-

tomer, it now sees an opportunity to work

toward targeting growing segments. “We

are building shopper-targeted activation

around reaching our best opportunity for

the future,” she said. “This group is highly

grocery involved and skews heavily to-

ward Millennials and Hispanics. We want

to provide relevant and engaging solutions

for these shoppers.”

The company will still plan and execute

campaigns that are unique to a banner

because they want to “stay true” to their

brands, Sales said. “As you can see, we are

in constant contact with our shopper base.

Theseprogramsareeffectiveandimpactful.”

Now the second largest supermarket op-

erator in the United States, the Albertsons

and Safeway Family of Stores maintains

2,230 stores spread across 34 states and the

District of Columbia. The chain has been

divided into 14 divisions with more than

250,000 employees.

Sales explained that Albertsons Safeway

sends out 67 million emails and has 6.8

million unique website visitors and 3.9 mo-

bile visitors monthly. The new company’s

stores net more than $57 billion in sales

yearly, with more than 30 million consum-

er transactions per week. SM

help aid the process by:

n negotiating scale marketing buys,

n clearing brand and category approvals

with merchandising,

n coordinating a national plan, and

n project managing all of the omnichannel

touchpoints.

“Our divisions are fully empowered and

accountable in the market,” Sales said. “The

national team serves and enables the divi-

sion teams to help them compete and to

provide strategic guidance to leverage scale

and drive efficiency.”

She encouraged brands to reach out with

insights, innovations and overall interest in

partnership programs. “We are also open

to going off turf to meet with your corpo-

rate marketing teams to brainstorm and

plan for the future together,” she added.

“We are very eager to collaborate with you.”

The company’s overall goal is sales

growth, according to Sales. “With our new,

combined scale, just one extra item in the

basket equates to more than $100 million

more in sales. We want to work with you

so your initiatives and your investment are

reflected in our marketing approach.”

Platforms that teams can partner on with

the company include growing Safeway.

com e-commerce solutions. “We support

MyMixx and Just for U [digital coupon]

platforms offering personalized, relevant

digital coupon offers,” Sales said. “It’s defi-

nitely going to be more complicated than it

has in the past, but we think it’s worth it.”

Three key priorities were outlined for

Albertsons Safeway:

n combining operations to build a national

chain of local market leaders;

n differentiated value proposition for cus-

tomers; and

n driving profitable growth through in-

novation and expansion.

Sales detailed the national events that

will be held across both companies next

year. These will include Albertsons’ “Mo-

nopoly” and “Best Road Trip Ever” efforts

and Safeway’s “Savor the Summer.”

The current profile of the typical Albert-

sons Safeway customer is a high-income,

CORRECTION: On page 42 of the

Aprilissue,thearticle“TargetWelcomes

Brands That ‘Matter’” incorrectly stated

that Procter & Gamble’s Pampers brand

participated in the retailer’s “Made to

Matter” platform. This photo, taken in

a Salt Lake City Target store, suggested

that Pampers had participated.

Albertsons

Continued from Page 1

Albertsons Safeway’s Karen Sales](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-11-2048.jpg)

![from

Can Beacons Convert Shoppers In-Store?

March 2015

… Retailers need to take baby steps, according to Erik McMillan, founder and

chief executive officer of Shelfbucks, which offers an in-store beacon promotion

platform that works via retailer apps. In October 2014, the company teamed with

Menasha Packaging to embed beacons into displays. “We may do 3,000 displays for

a CPG to learn, look at the data and see how they engage,” McMillan says. “After

piloting on a few displays, then 2016 is about scaling what’s learned in 2015.”

IN THE NEWSRecent stories from the various Institute news outlets,

P2PI.org and Shopper Marketing magazine

from

Unilever Gives

Walgreens ‘Beauty

Must-Haves’

January 2015

Walgreens partnered with Unilever

for an exclusive “Beauty Must-Haves”

promotion that awarded a free tote bag

(up to 5,000) with purchase of $15 in

qualifying items. Consumers who made

the required purchase from Jan. 4-10

received a receipt code (via Catalina) to

be entered on a Unilever promotional

site, yourbeautyhaul.com. The

participating brands were Axe, Dove,

Degree, Tresemme, Suave, St. Ives and

Vaseline.

from

OwnerIQ Taps RSI

May 2015

Boston-based programmatic ad platform

OwnerIQ recently partnered with Mountain

View, California-based POS analytics firm Retail

Solutions Inc. to integrate RSi’s retail store-level

intelligence and sales data with OwnerIQ’s pool

of targeting and analytics data. The companies

say that CPG brands and retailers can maximize

the impact of their promotions by combining

RSi’s store-level UPC sales and inventory data

from more than 150,000 store locations with

OwnerIQ’s vast retail shopper data.

Also: Promotional marketing services

company News America Marketing, New York,

has teamed with OwnerIQ to introduce News

America Programmatic Advertising. The new

offering is a response-driven digital display

product that combines NAM’s geo-scoring

system with OwnerIQ’s shopper data.

from

Dailybreak and RevTrax

Combine Forces

November 2014

Dailybreak Media, a Boston-based gamification

platform, recently partnered with RevTrax, a New

York-based digital coupons platform, with the goal

of enabling CPG brands and retailers to engage

shoppers and optimize the path to purchase via

gamification and coupon promotions intended

to drive in-store traffic. In their initial campaign

together for an unnamed CPG, the two firms

achieved strong results with 47% of consumers

printing the coupon after viewing the offer, and

60% of printed coupons having been redeemed

with two more weeks of data yet to be reported.

“ [In 15 years, merchandising] will be

totally different than what we

think it will be, but I guarantee that

it will have something to do with the

smartphone talking to a sensor to have a

seamless experience in-store.”

Erik McMillan, founder and CEO, Shelfbucks](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-60-2048.jpg)

![from

CoOptions

Launches Social

Shopper Platform

April 2015

Shopper marketing agency

CoOptions, Apex, North

Carolina, has partnered with

social media tech firm Sverve,

New York, to launch the

CoOptions Social Shopper

Activation platform. The agency

says the partnership will allow

brands, retailers and agencies to

instantly activate social shopper

solutions that power and

amplify in-store promotions,

displays and traffic to both

in-store and online campaigns

while providing transparent

views of campaign progress and

real-time analytics.

from

Jewel-Osco Launches MyMixx Digital Coupons

February 2015

AB Acquisition’s Jewel-Osco this month launched the MyMixx digital coupon

program that has been available at sister chain Acme since August 2014. At

launch, MyMixx is offering approximately 200 digital coupons, powered by

Coupons.com. It also suggests coupons based on users’ purchase history, tracks

how much users have saved and lets them build a shopping list. Users can also

link their MyMixx accounts with SavingStar accounts for additional savings.

from

Walgreens Facilitates

‘People’s Choice’ Voting

December 2014

Walgreens kicked off the third year of its “People’s

Choice Awards” sponsorship by promoting online

voting for the program’s awards. When consumers

finish voting, they’re taken to a landing page operated

by Hello World, Pleasant Ridge, MI, and given the

opportunity to enter a Walgreens-sponsored sweeps

running Nov. 4 through Dec. 4 that awards a trip to

Los Angeles to attend the awards show.

from

Working Closely With The Customer

December 2014

Kellogg offered promotional packages of Pop-Tarts, Krave, Frosted Flakes, Frosted Mini-Wheats and

Froot Loops that carried codes good for $5 off Sony Pictures’ “The Amazing Spider-Man” via the

retailer’s Vudu streaming service. With three or six codes, participants could also earn “Concession

Cash” or “Movie Cash,” respectively, from TPG Rewards, New York.

from

Avocados from Mexico Is ‘Hungry for Football’

November 2014

Avocados from Mexico (AFM) is running a “Hungry for Football” campaign from Sept.

8 through Dec. 15 in partnership with Ro-Tel. The branded consumer promotion is

supported with contests for consumers and retailers, coupons, social media and in-store

display materials. AFM will use IRi data to evaluate the performance of select retailers

during the promotion period as well as the total category overview. AFM’s coupon

redemption partner, Winston-Salem, North Carolina-based Inmar, will provide data

related to individual customer redemption by retail marketing area and independent

accounts.

from

Overcoming the Barriers to

Mobile Use in Stores, Part 2

October 2014

… [He] is particularly interested in RSI Retail

Solutions, a provider of business analytics and

real-time supply chain intelligence that helps CPG

companies maintain their in-stock positions. He

says the company recently began partnering with

MaxPoint, a hyperlocal advertising company.

Theoretically, this should enable a brand to

know if there are too many boxes of Honey Nut

Cheerios clogging a store’s backroom a half-mile

from households that will respond to a targeted

mobile ad that says, “Go get your Honey Nut

Cheerios!”](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-61-2048.jpg)

![MAY 2015 SHOPPER MARKETING WHO’S WHO IN DIGITAL SHOPPER MARKETING & E-COMMERCE 63

n JohnShen,Senior

Director,Interactive

Marketing&

ConsumerPromotions

Shen leads digital and

promotions initiatives

across the organization, partnering

with John Stichweh and shopper mar-

keting teams to provide thought lead-

ership, best practices and approaches

for retail activation in the digital and

promotional space.

n JohnStichweh,

Director,Digitaland

SocialShopper

Marketing,

E-CommerceandCRM

Stichweh leads a team

that leverages enterprise resources

including data, infrastructure and plat-

forms such as ConAgra’s ReadySetEat

recipe website to deliver the aligned

objectives and measure their impact

along the way.

CONSTELLATIONBRANDS

n Karena Breslin, Vice

President of Digital

Marketing

Breslin manages

digital strategy and

execution for Constel-

lation’s portfolio of wine and spirits

brands. Her organization is responsi-

ble for social media, digital advertis-

ing, content marketing and shopper

activation, and she also leads mar-

keting technology initiatives.

n Barry Roberts,

Director, Retail

Shopper Solutions,

North America

Roberts leads the

retail shopper solu-

tions team that consists of category

management, shopper marketing and

e-commerce.

CONAGRA FOODS INC.

n Jill Kristle, Manager, Interactive

Marketing

COTY INC.

n Kristen D’Arcy, Vice President of

Global Digital

CVS HEALTH

n Kate Goodman, Senior Director,

Retail Digital

Goodman manages the development

of strategies that support omnichan-

nel customer acquisition and reten-

tion in both the online and offline

channels.

Josh Wexelbaum and Dilini Fernando share the com-

mon task of improving the digital ventures for one of

the world’s largest brewers, but they came to their man-

agement roles at MillerCoors on different paths.

Fernando is a 2003 graduate of Brown University,

where she pursued interests in science, psychology, en-

trepreneurship, business and organizational behavior

management. She was a disc jockey at a college radio

station, then used that skill at two different stations in

the years between Brown and her MillerCoors intern-

ship in 2010.

Fernando also founded and ran a musician-centric

business in Taunton, Massachusetts, as well as an inde-

pendent record label for two years before earning an

MBA at University of Chicago’s Booth School of Busi-

ness. She took a year after her internship to help four

other Booth students with a mobile payment start-up

through Booth’s New Venture Challenge program. She

rejoined MillerCoors as an associate brand manager in

2011, and assumed her present position two years later.

Fernando says her experience with digital in her en-

trepreneurial projects has inspired her work at Miller-

Coors. She now guides the MillerCoors digital incuba-

tor, a laboratory of sorts to test new tools, tactics and

technologies with the goal of increasing sales and cre-

ating scalable solutions for the organization. “Digital

was such an amazing way to reach a broad audience

on a limited budget,” she says. “I love its nimble and

dynamic nature.”

Wexelbaum took a more straightforward route to his

position as senior manager of digital marketing. Unsure

of a major at the University of Texas, he discovered a

passion for advertising in a 101 course, seizing on the

ideas of Ogilvie, Burnett and Bernbach to spark his

choice to earn an advertising degree.

He rose to associate media director in seven years at

Starcom MediaVest Group, joining MillerCoors in 2006

as media manager. Wexelbaum was a brand manager

for retail marketing for two years, then brand manager

for Miller Lite before taking on his present role in April

2014.

He says working in digital is perfect for his out-of-the-

box thinking that began as a kid. “I never really was too

big on using established solutions to solve problems,”

he says. “I wanted to create a solution on my own, to

try something different, to experiment. Operating in

the digital space is a great opportunity to continue that

process. To experiment, to try, to fail, find the things that

work that we can actually scale.”

Fernando and Wexelbaum recently took time out to

answer the following questions about their digital work

at MillerCoors:

How do shopper and digital marketing intersect at

MillerCoors?

WEXELBAUM: Digital marketing as a standalone or even

as a bolt-on practice no longer makes sense. Right now

we’re living in a world where nearly everything our shop-

per experiences from a communications perspective can

be and, I would argue, increasingly is delivered digitally. I

don’tbelieveit’saboutdigitalmarketingpersebutrather

how do we market in an age when everything is digital?

Once you understand it’s about marketing in a digital

age, to me digital’s role in shopper marketing becomes

more obvious. It’s to take us further down the purchase

model than we’ve traditionally been in a way that better

engages our consumers by providing real value to them.

How does the organization promote digital

innovation?

FERNANDO: As part of developing best practices, in

2014 we started the digital incubator, which is meant to

be essentially a pipeline of ideas that incubate the next

level of digital marketing, where we test, learn, fail and

ultimately scale. I oversee the execution and the inter-

nal and retailer education of the digital incubator tests

for the organization.

Anything in particular you are working on?

FERNANDO: In 2014 we supported about 20 different

digital incubator tests. There was a lot of exciting work

with mobile order on-premise, proximity messaging,

driving traffic and engagement and, more recently, with

beer delivery.

Photo by Brian Morrison

Manymarketersbelievethatdigitalishelpingto

narrowthegapthathastraditionallyexistedbetween

CPGbrandsandretailers.Agreeordisagree,andwhy?

WEXELBAUM: I generally agree. As CPG marketers, I

think we have to acknowledge that our capabilities in

the digital space lag those of our direct marketing coun-

terparts, but in that gap between direct marketers and

consumer package goods I do see a world of oppor-

tunity for CPG companies and retailers to partner and

drive new solutions that can influence and affect our

shoppers. We can’t directly sell our beer to anyone like

a direct marketer can. In using delivery services to spur

new occasions are ways that we can grow the category

for ourselves and our retailers while overcoming some

of the inability-to-sell-direct challenges that we face.

What does omnichannel mean to you as a marketer

and a shopper?

FERNANDO: For me it’s about creating an enjoyable re-

tail experience. I’m probably like most online shoppers,

where I feel comfortable navigating between digital and

physical. Where can I get information, where can I get in-

spiration?Ifthere’sanimpulsetobuy,howisthatenabled?

Is that in-store, online? I feel comfortable with both.

WEXELBAUM: Afriendofminewhoworksinsportsevent

marketing used to say, “Be sure to go so you know,” in

reference to event activation. I feel that same sentiment

applies to digital, and omnichannel as an aspect of digi-

tal. To me our shoppers are doing it and more so every

day, so I better be doing it myself if I ever really hope to

understand and be able to capitalize on that experience.

MILLERCOORS

Josh Wexelbaum, Senior Manager, Digital Marketing

Dilini Fernando, Digital Innovation & Marketing Manager

“Our shoppers are doing [omnichannel], so I better be doing it myself if I ever

really hope to understand and be able to capitalize on that experience.”

Josh Wexelbaum](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-63-2048.jpg)

![76 SHOPPER MARKETING MAY 2015SPECIAL REPORT

grail that folks are striving for,” he says. “Collabo-

ration in supply chain and merchandising gives

you opportunities to unlock growth.”

The major benefits include cost savings, speed

to market, fewer people involved, and less waste

in the process, says Annette Groenink, group vice

president at Menasha. When collaborating with

other companies in the supply chain, retailers and

CPGs need to be willing to share a certain amount

of intellectual property that they traditionally have

been guarded about, she says.

“People outside your company are going to

have different perspectives and views, and those

are valuable,” she says. “[The growth in collabora-

tion] represents the realization that new products

come and go so quickly. If you’re getting hung

up on whether you own 100% of the intellectu-

al property, and somebody else gets out there

quicker, you could lose a distinct advantage while

you’re sitting around worrying.”

“If the CPG and supplier have multiple people

involved and are approaching the problem from

different perspectives, you’re going to find ways

to eliminate cost and time,” adds Greg Dugan, re-

gional vice president for Menasha.

John Barnette, vice president for center store

merchandising at Food Lion, says he’d be crazy

not to work with his business partners around

supply chain. “If you’ve got open and honest re-

lationships, discipline around the work you do

and a collaborative decision process, more often

than not, the outcomes are going to be better,”

he says. Initiatives “are more fully vetted. When I

think about how broad my business is, it’s kind of

ridiculous to think about not leveraging that tal-

ent. … They’ve got their finger on the pulse of that

stuff [in their category] much closer than we do.”

CPGs and retailers cannot be complacent, says

CPGs, retailers and service

providers gain from ongoing

strategic partnerships

Sponsored by:

Why Collaborate

Around Supply Chain?

SUPPLY CHAIN OPTIMIZATION, PART 1:

By Ed Finkel

hen consumer packaged goods

companies, retailers and suppliers

collaborate vertically around supply

chain, the collaboration frequently

is short-term and tactical. But doing the heavy

lifting to create more ongoing, strategic partner-

ships has myriad benefits, according to a survey

conducted jointly by the Path to Purchase Insti-

tute, A.T. Kearney and Menasha.

The benefits are being realized in small pock-

ets today, but shopper marketers need to impress

upon their supply chain colleagues the need to

forge such vertical collaborations by pointing out

the positive impacts on the bottom line as well as

the competitive disadvantage that results if they

do not, A.T. Kearney believes.

When the concept of collaboration comes up,

supply chain and even some shopper marketing

personnel often react by saying that they’re al-

ready collaborating. Typically, however, this char-

acterization is a stretch, according to A.T. Kearney

executives. Such partnerships usually amount to

“firefighting” because of issues like deliveries com-

ing late and products reaching out-of-stock status.

When supply chain personnel complain that

they don’t have the time or capabilities to go

deeper, the best response is to suggest trying a

single campaign or initiative as a pilot, gain sup-

port from the top and move forward. Commer-

cial teams need to realize that their supply chain

organizations alone will not capture the benefits,

Kearney says, and those outcomes aren’t simply

about dollars saved or earned but also about au-

thentic deepening of relationships.

In more advanced cases, retailers and manufac-

turers have integrated their supply chain almost as

if the two companies have merged, which brings

vastly greater operational efficiencies and speed

to market, A.T. Kearney believes. Companies work

jointly when determining new products to launch,

slotting and assortment, shelf sets, shopper mar-

keting campaigns and promotional events.

Manufacturers and retailers find themselves

at different stages of supply chain collaboration

because the buyer-seller relationship creates fric-

tion, which leads to inefficiencies and waste, says

Arun Kochar, principal at A.T. Kearney. “You are

wanting to behave as one company. Don’t treat

each other as buyer and seller. That is the holy

W

Jeff Krepline, vice president of national sales,

Menasha. “The ever-changing demands of retail

are not letting anybody sit still,” he says. “If you

think you’ve got it, you need to re-ground your-

self. We’ve all heard about speed to market and

late-stage customization – all of that stuff is driving

continued need for evolution in the supply chain.”

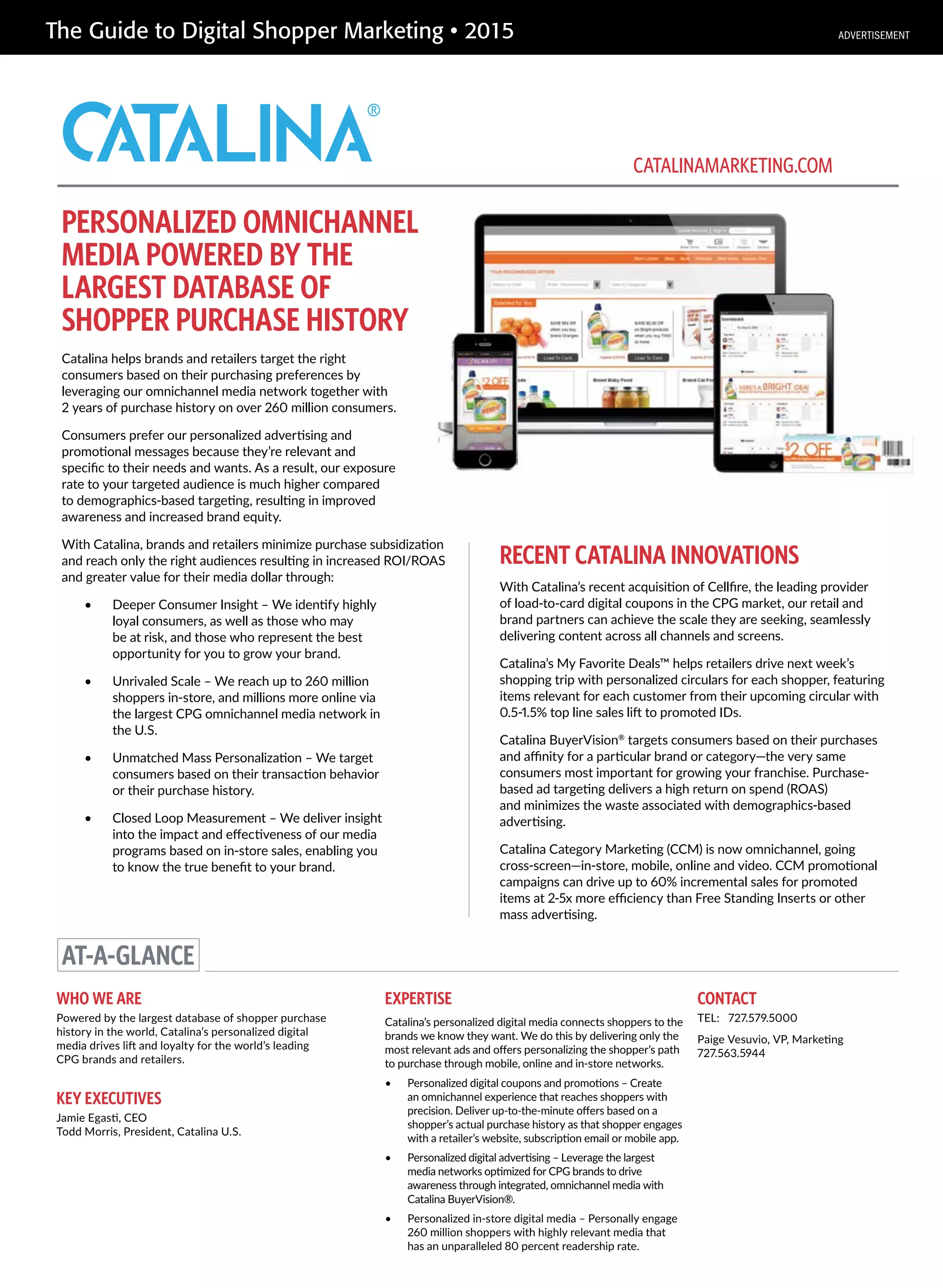

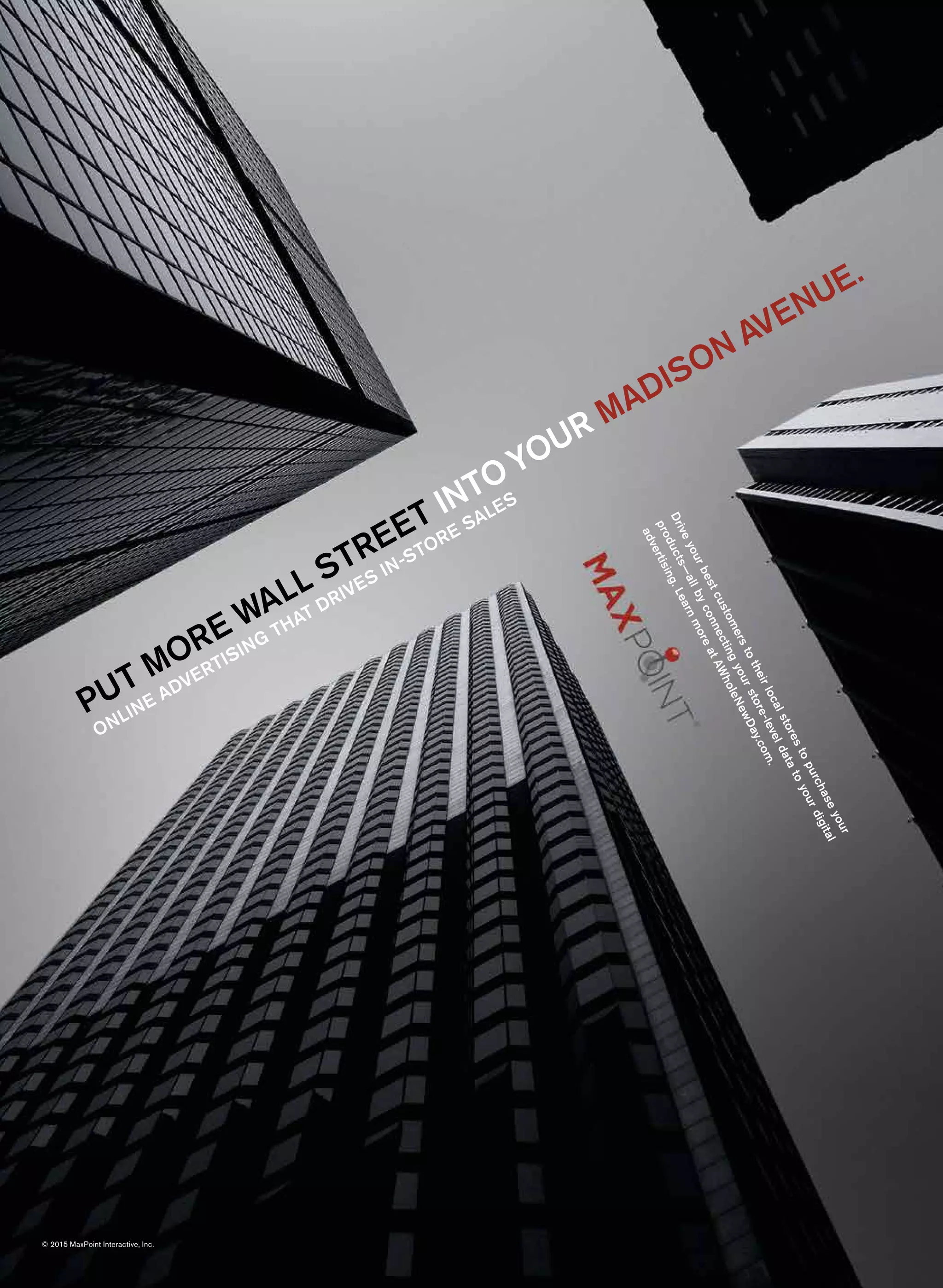

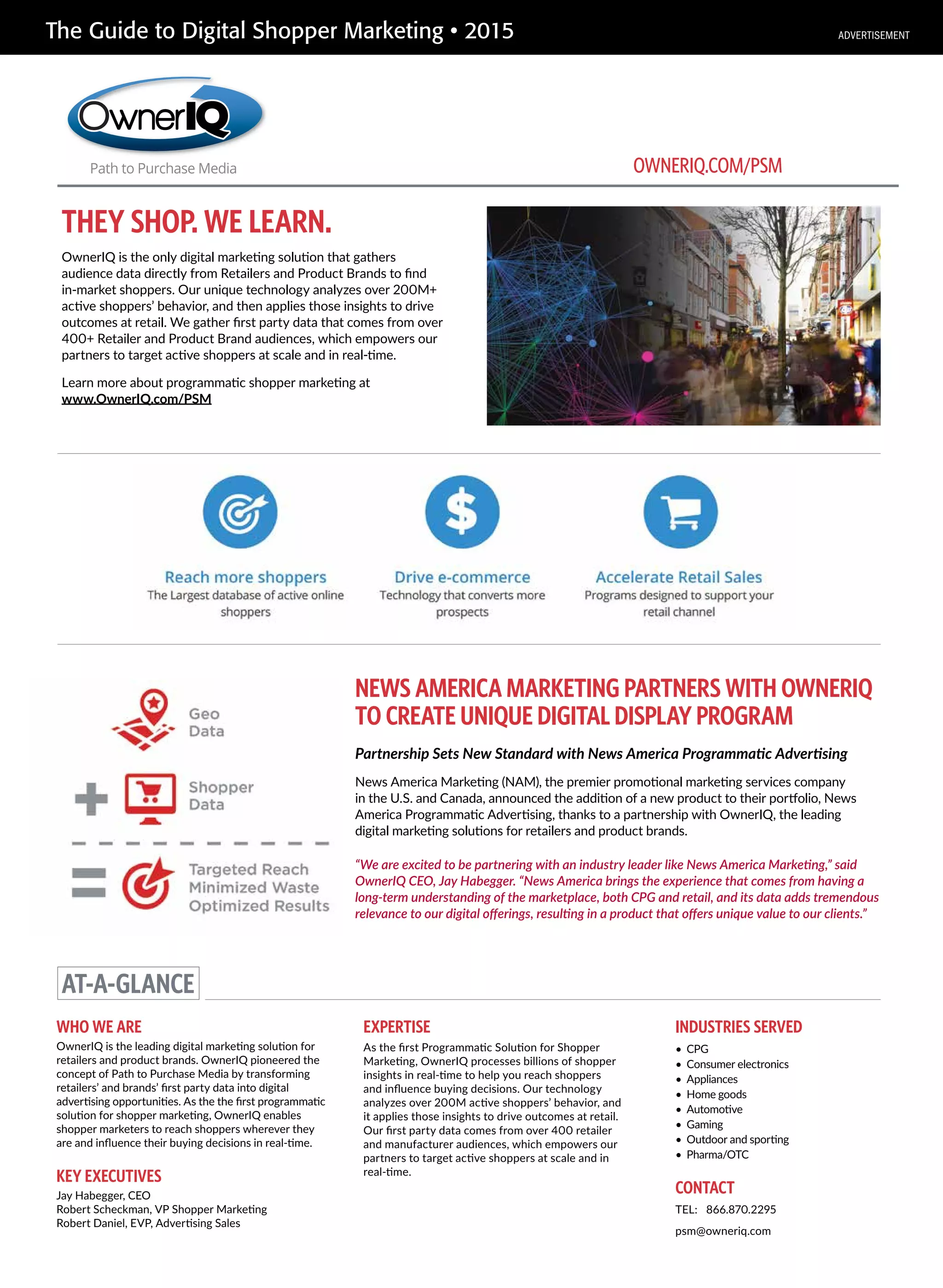

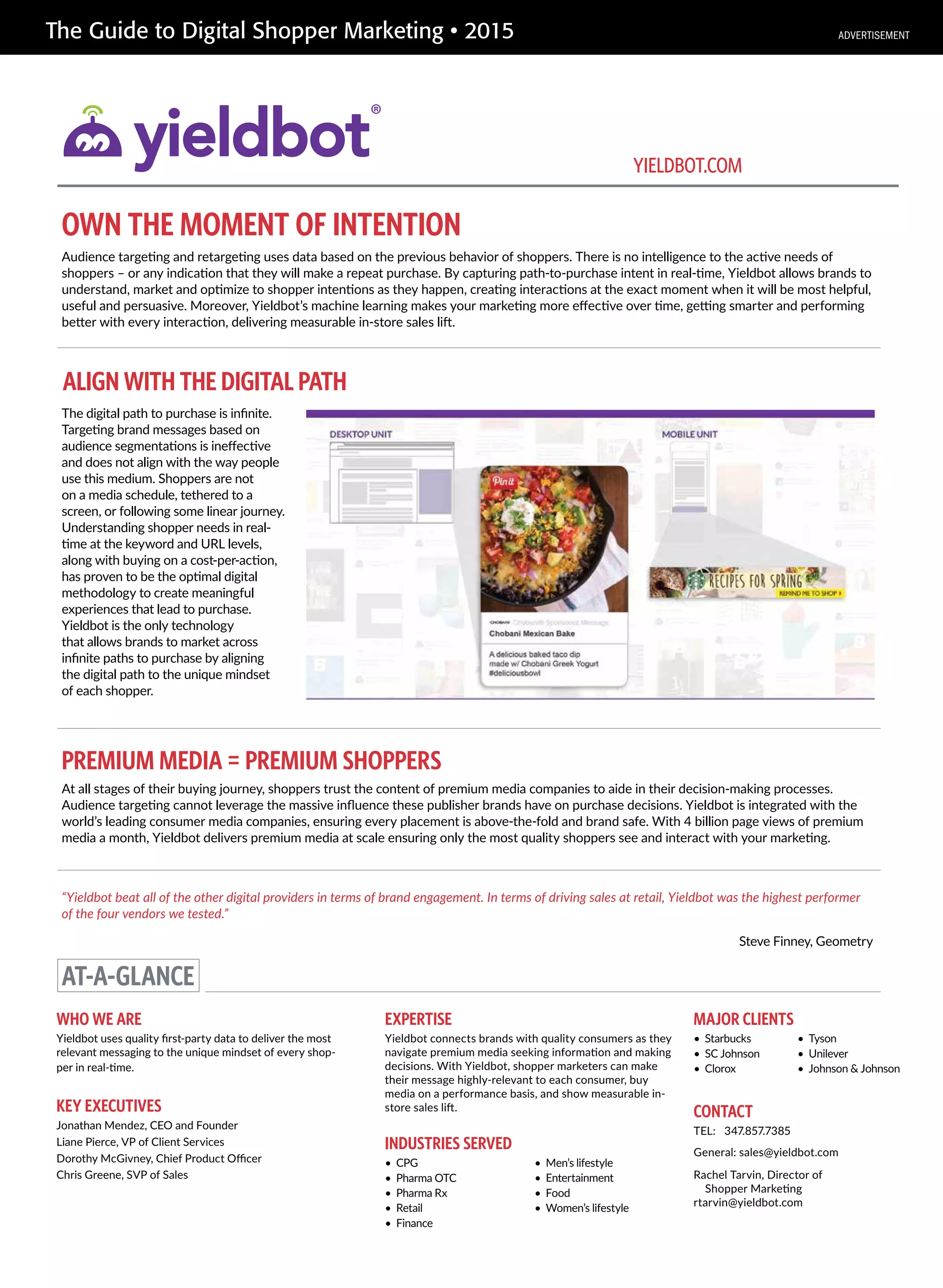

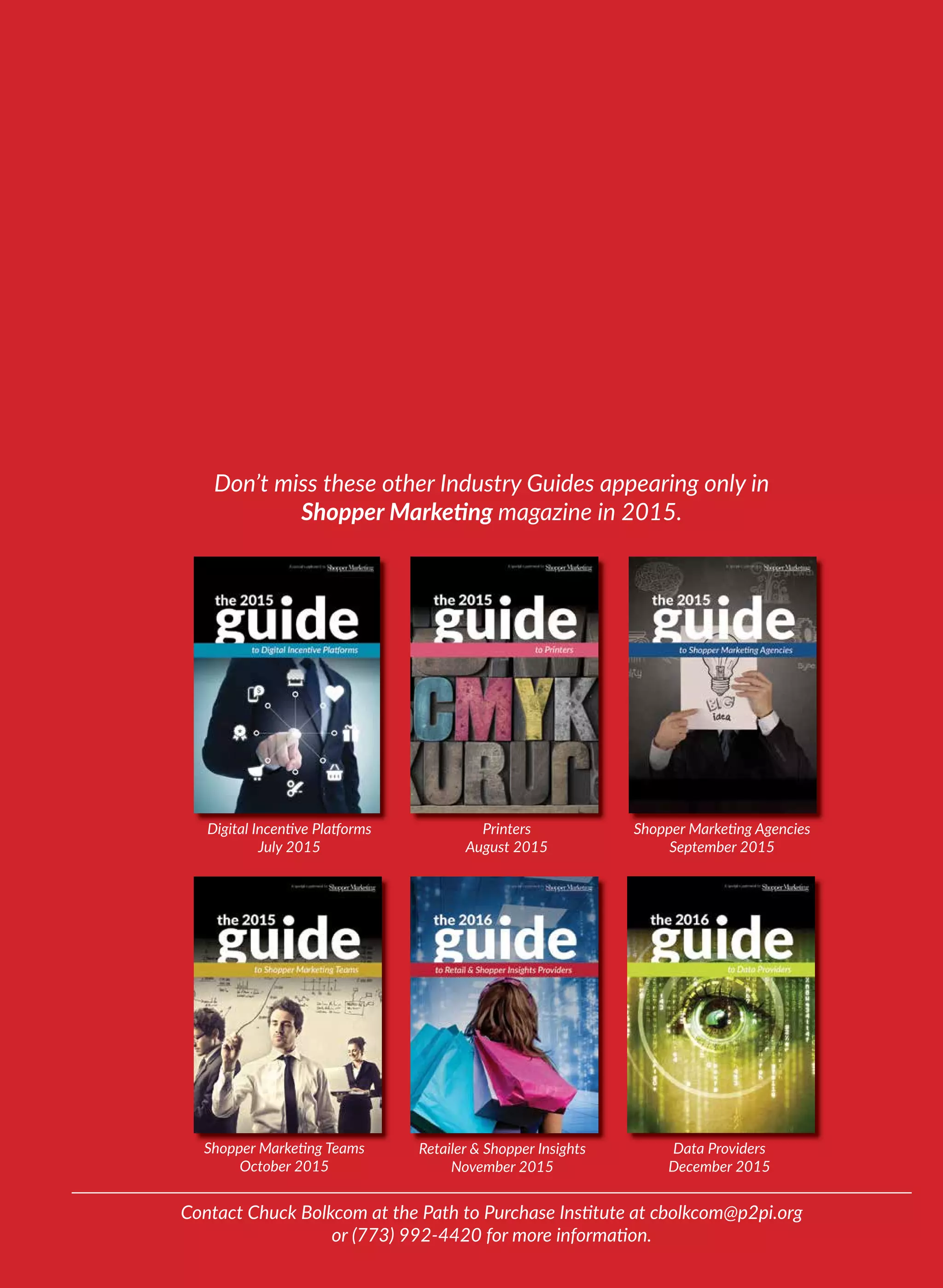

Survey Says …

The A.T. Kearney/Menasha survey, which drew 33

responses, revealed five major takeaways:

1. To date, collaboration efforts have not gone

as far as most organizations would like. Thirty-

eight percent of respondents said they currently

pursue a portfolio of mid- to long-term initia-

tives, and only 13% are still working toward that

end; but only 19% said they already have achieved

end-to-end supply chain integration with their

partners, while 50% have that in their sights in the

next three years (see chart above).

Dugan says that while “very few” CPGs and retail-

ers have reached that point, he sees it as “kind of

the wave of the future. There are a few that will let

you inside so you can make an educated decision.

The majority still hold suppliers on the outside and

give you only what they think you need to know.”

Barnette has seen an evolution in the five years

he’s been at Food Lion. While some partners

seemed more self-serving in his early years, increas-

ingly “we’re comfortable that people are bringing

to us insights that will help the overall business and

are not just self-serving,” he says. “Some folks I like

to lean into because I trust them. They’re going to

give me the real skinny on the stuff.”

Collaborations are still largely around transac-

tions and spot opportunities that will have an im-

mediate impact, says Joy Peters, partner at A.T.

Source: A.T. Kearney/Menasha 2015 Supply Chain Optimization Survey. Multiple selections permitted.

Responses might not add up to 100% due to rounding.

Which statement best reflects your current

and future collaboration vision?

Exchanging relevant

freight, other SC data

Brainstorming ideas

with and pursuing SC

cost improvement

Engaging in discrete

short-term joint

improvement project

Pursuing a portfolio

of medium to

long-term initiatives

Creating an integrated

SC with suppliers

and customers

25%

13%

19%

25%

38%

13%

19%

50%

0% 0%

Currently In 3 Years](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-76-2048.jpg)

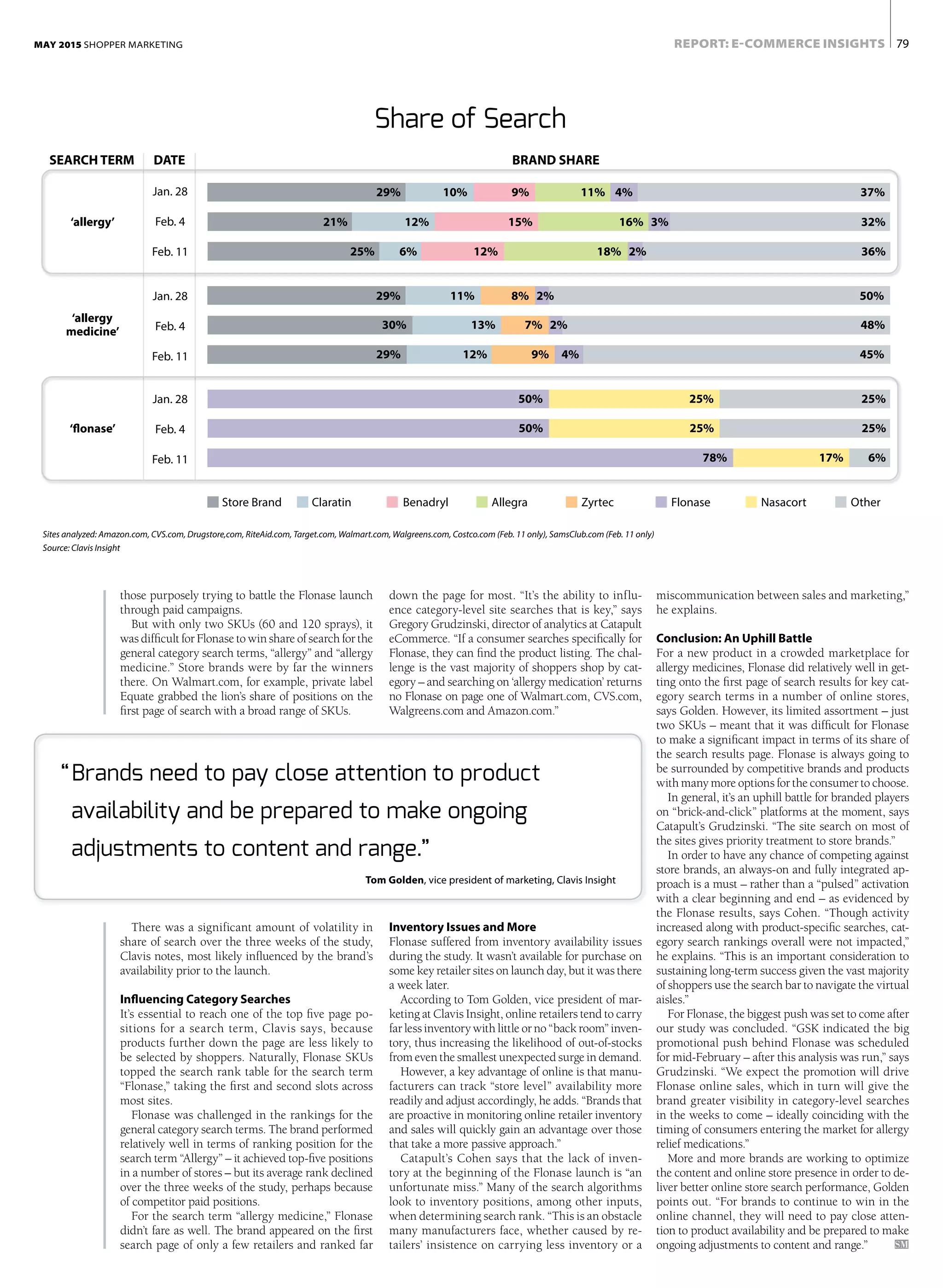

![SPECIAL REPORTMAY 2015 SHOPPER MARKETING 77

Kearney. “When we look at the 50% who want

to get there in three years, that denotes aspira-

tion,” he says. “How do we treat two companies

as one?”

Kearney has worked with a “middle-of-the-pack”

CPG food manufacturer that saw limited gains from

short-term joint projects with their retail counter-

parts. “They said, ‘This is not getting us anywhere,’”

Peters says. “We want to have reoccurring, demon-

strable improvement in our growth.”

Working with A.T. Kearney, the CPG company

chose two of its largest and most strategic retail-

ers and found “a ton of opportunities in taking out

nodes from the supply chain and bypassing distri-

bution networks to get their product to the retail-

er, avoiding double-handling and finding oppor-

tunities in planning more effectively, which means

I’m out of stock less often,” Peters says. “Now

they’re in a completely different way of working

together. There was a relationship transforma-

tion, sponsored at the very top, that changed the

way they worked together.”

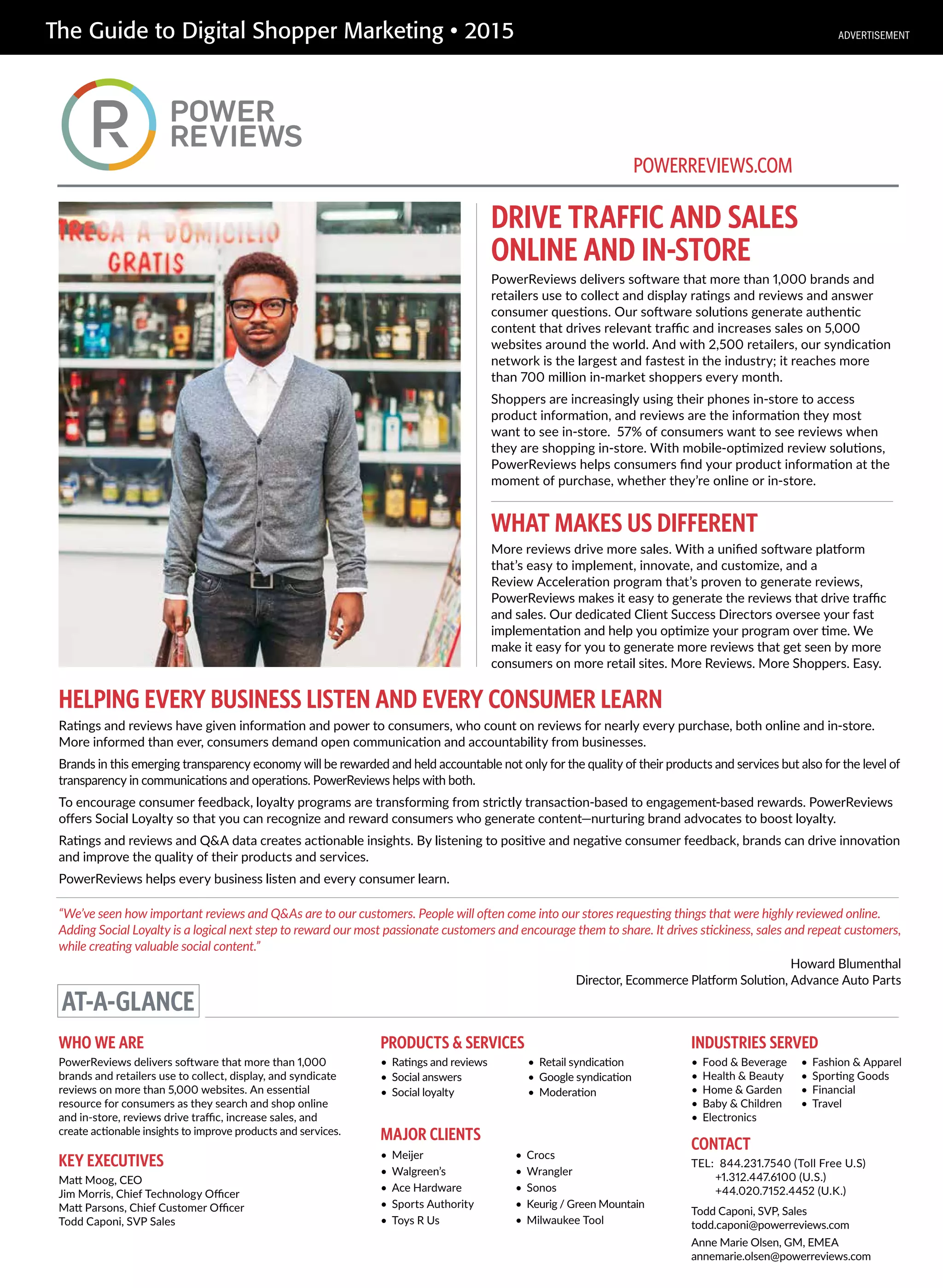

2. The majority of collaboration efforts are initi-

ated by one party rather than both. Fifty percent

of respondents said their organization had done the

initiating, while 33% said collaboration was jointly

initiated (see chart above right). Groenink sees an

opportunity for third parties to help facilitate these

efforts, although “that’s not happening very much.”

But Barnette says that from his vantage point, third

parties and suppliers were initiating the process

more often in the past, while now “this is a very ban-

ner-centric process. We’ve scheduled marketing

summits to talk about what’s next: ‘Here are some

things we’re thinking about, do you want to play?’ …

We’re doing much better solving from within.”

3. Collaborative efforts are more likely to be

sustainable if they improve the go-to-market

proposition of the parties and build trust. Forty

percent of survey respondents said improving

their go-to-market proposition helped to build a

sustainable relationship, while 33% said the same

about increased trust and information sharing (see

chart below).

Barnette sees the go-to-market proposition as

the ultimate objective and the others as founda-

tional pillars. Krepline notes that go-to-market

proposition and building trust feed off of one

another. “Speed, accuracy and customization,

they’re all going to prove that go-to-market prop-

osition,” he says. “But for that you need informa-

tion. And information builds trust.”

Dugan has found the same thing. “We’re finding

that our onsite teams have a much higher degree

of collaboration due to the fact that we’re physi-

cally working side-by-side with our customers,”

he says. “We’re with them and talk to them so

much, they’re kind of like co-workers.”

A.T. Kearney worked with a distributor and a man-

ufacturer in the wine and spirits industry that had a

With what other companies does your organization collaborate?

Collaborating with … Who initiated the effort?

15%

Consultants/

Advisors

Competitor 4%

Non-Competitive Peer 4%

31%

Customer

11%

A Third Party/

Intermediary

33%

Jointly Initiated

by Both Parties

6%

Other

Organization

50%

Your

Organization

46%

Supplier

Source: A.T. Kearney/Menasha Packaging 2015 Supply Chain Collaboration Survey. Multiple selections

permitted. Responses might not add up to 100% due to rounding.

Increased trust

and information

sharing

Improved

go-to-market

proposition

Equitable

value sharing

Long-term

contractual

agreements

Others

33%

10%

17%

40%

0%

How have the collaboration initiatives

you’re engaged in enabled sustainable

relationships between organizations?

Revenue

growth

Cost of goods

sold (COGS)

reduction

Working capital

reduction

Improvement in

speed-to-market

Others

2.8 2.72.6

3.1

0.0

Rate the importance of the benefits your

organization hopes to achieve from

B2B collaboration in the next three years?

(1: Least Important 5: Most Important)

About the Sponsor

Menasha is a packaging and merchandising

solutions company focused on optimizing

the retail supply chain. Menasha collaborates

with the world’s leading retailers and

consumer packaged goods companies to

deliver the greatest measurable value across

the entire integrated merchandising supply

chain. As market leaders within the in-store

merchandising industry, Menasha combines

an unmatched understanding of the retail

sector with a proven methodology for

developing efficient, sustainable offerings to

meet customer-specific goals.

multi-decade relationship marred by lack of trust.

“The CEOs said, ‘We have to do something about

this,’” Kochar says. Once both companies received

a top-down mandate, they spent about six months

building relationships across the chain of com-

mand, and for the last two or three years, with trust

in place, “the organizations have transitioned from

an exchange of relevant data, to starting to pursue

broader portfolios of opportunities,” he says.

4. Organizations seek a wide variety of benefits

from collaboration, although cost reduction is

desired a bit more highly more than others. On

a scale of 1 to 5, cost reduction rated an average

of 3.1, slightly ahead of revenue growth, improve-

ment in speed-to-market and working capital re-

duction (see chart below right).

5. The results mostly jibe with these desires,

although cost reduction is significantly more

frequent than the others. Revenue growth is the

next frequently achieved benefit of collaboration,

according to the survey, followed by improve-

ment in speed-to-market and, somewhat less of-

ten, working capital reduction.

Dugan finds that revenue growth and improved

speed-to-market are the most frequent goals of

those with whom he works. Groenink finds it very

positive that revenue growth rates highly in the

survey. “If revenue growth were the least frequent

achievement, that would be sad because that’s

what we’re in it for, more value for everybody,”

she says.

But Barnette says he’s surprised that wasn’t

the most important goal. “If you’re asking supply

chain and category management people, whose

primary responsibility is to negotiate for a lower

cost of goods, I get it,” he says. “But if you’re talk-

ing to a banner merchant, ultimately they’re look-

ing for top-line growth.”

Collaborations around reducing the cost of

goods are easy to justify because the benefits are

tangible and tend to be apparent within a year or

two, Kochar says. For example, the spirits com-

pany with which A.T. Kearney worked saw hard

dollar savings from the joint go-to-market.

Growth, on the other hand, “doesn’t happen

overnight, and even with an exclusive initiative,

like a product launching, there are so many other

drivers that could impact growth,” he says. “It’s

hard to isolate that the growth is because of this

particular initiative. That’s where it becomes a lit-

tle harder to justify the effort.”

Krepline says measures like working capital

reduction, revenue growth and improvement in

speed-to-market are well worth considering, but

he views them as traditional and looks to “emerg-

ing measures” of collaborative success.

“For example,” he says, “the execution rate at

retail. Are we getting the sales lift that the extra

dollars [justify]? How do we know there’s a return

on investment for these elements? … All of this is

a very broad stroke for the supply chain.” SM

NOTE: This is the first installment in a three-

part series. Next month, we will address some

of the “how-tos” of collaboration, such as

selecting partners, identifying key enablers and

establishing a benefit-estimation process. In the

third installment, we will look at ways to “scale”

the effort, decide on key requirements and

select from different operating models.](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-77-2048.jpg)

![82 SHOPPER MARKETING MAY 2015

INSTITUTE STRATEGIST

By Patrycja Malinowska

Despite widespread concerns that Walmart is cutting

back on in-store displays, collaborative merchandising

activity is alive and well at the mass merchant.

The retailer has been expanding its exclusive product

assortment through partnerships with premium brand

manufacturers, and this year gave extensive merchandis-

ing support to two high-profile launches from Henkel

Corp.

Walmart in January became the exclusive U.S. retailer

of an Ultime line of hair care products from Henkel’s

Schwarzkopf. Created in partnership with supermodel

Claudia Schiffer, the 72-item line includes care, styling

and color products priced between $6.97 and $9.97. The

collection launched in Europe in 2014.

The products are merchandised in-line, securing a

brand block identified with a black header and aisle

violators. At launch, the items also earned a dedicated

endcap display outfitted with a product video.

Co-op advertising support included 15-second re-

gional and national TV spots, print ads in magazines

including Conde Nast’s Glamour and Hearst Com-

munications’ Cosmopolitan, FSIs in Sunday newspapers,

display ads on websites including Walmart.com and

PopSugar.com, as well as 5- and 15-second video ads on

websites such as Hulu.com.

In March, Walmart exclusively launched Henkel’s

Persil ProClean, a line of premium laundry detergents

available in liquid, powder and unit-dose forms and

boasting a Pro-Power stain-fighting technology. The

Persil brand is widely available in Europe.

On store shelves, the detergent is sandwiched between

category leader Procter & Gamble’s Tide and lower-

priced sister-brand Gain. Persil, priced comparably to

Tide, is prominently spotlighted with in-line signage.

The new product also gets secondary placement on a

dedicated endcap outfitted with side panels and an in-

teractive video delivering details on the products’ various

formulations. It earned yet another shopper touchpoint

via sampling stations.

Co-op support for the detergent includes regional and

national 30-second TV spots, print ads running in Time

Inc.’s All You, and display ads on the retailer’s website.

A dedicated website for the line touts its availabil-

ity at Walmart. At launch, site visitors could enter a

sweepstakes awarding one grand-prize winner with six

vouchers for free bottles of the product and a “premium

night on the town” comprising gift cards to Nordstrom.

com, OpenTable.com and Uber.com. One runner up also

got six vouchers. Entry ran March 13 through April 12.

The Wall Street Journal characterized the Persil launch

as a way to potentially pressure P&G to lower prices on

Tide. P&G’s dominant position in the category helps

insulate it from pressure to cut prices or take other steps

that might give Walmart a bigger edge over competitors;

Editorial Index Companies named in the editorial columns of this issue are listed below.

Ace Hardware Corp. . . . . . . . . . . . . . 75

Albertsons Safeway . . . . . . . . . . . . . . . 1

Amazon.com . . . . . . . . . . . . . . . . 74, 79

AppMachine . . . . . . . . . . . . . . . . . . . 75

A.T. Kearney . . . . . . . . . . . . . . . . . . . . . 76

Bravo Sports . . . . . . . . . . . . . . . . . . . 80

Caden Consulting Group . . . . . . . . . . . 6

Catalina . . . . . . . . . . . . . . . . . . . . . . . 72

Catapult eCommerce . . . . . . . . . . . . 78

Centro . . . . . . . . . . . . . . . . . . . . . . . . . 72

Clavis Insight . . . . . . . . . . . . . . . . . . . 78

Conde Nast . . . . . . . . . . . . . . . . . . . . 82

Cone Communications . . . . . . . . . . . . . 6

Costco . . . . . . . . . . . . . . . . . . . . . . . . . 10

CVS/pharmacy . . . . . . . . . . . . . . . . . 79

DataXu . . . . . . . . . . . . . . . . . . . . . . . . 73

Drugstore.com . . . . . . . . . . . . . . . . . 79

Endurance International

Group . . . . . . . . . . . . . . . . . . . . . . . 75

ES Robbins . . . . . . . . . . . . . . . . . . . . . 80

Facebook . . . . . . . . . . . . . . . . . . . . . . . 74

Food Lion . . . . . . . . . . . . . . . . . . . . . . . 76

General Mills . . . . . . . . . . . . . . . . . 6, 66

GlaxoSmithKline . . . . . . . . . . . . . . . . 78

GSP Inc. . . . . . . . . . . . . . . . . . . . . . . . 75

Hearst Communications . . . . . . . . . 82

Henkel Corp. . . . . . . . . . . . . . . . . . . . 82

Hershey Co. . . . . . . . . . . . . . . . . . . . . 10

Hershey PrintShop . . . . . . . . . . . . . 10

InMarket . . . . . . . . . . . . . . . . . . . . . . . 74

IRI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Kantar Shopcom . . . . . . . . . . . . . . . . . . 6

LG Electronics . . . . . . . . . . . . . . . . . . . 12

Magna Global . . . . . . . . . . . . . . . . . . 72

Mars Agency, The . . . . . . . . . . . . . . . . . 4

MaxPoint . . . . . . . . . . . . . . . . . . . . . . 73

Menasha . . . . . . . . . . . . . . . . . . . . . . . 76

Nestle USA . . . . . . . . . . . . . . . . . . . . 64

MillerCoors . . . . . . . . . . . . . . . . . . . . 63

Nielsen . . . . . . . . . . . . . . . . . . . . . . . . . . 6

News America Marketing . . . . . . . . . . 6

Origin . . . . . . . . . . . . . . . . . . . . . . . . . 10

OwnerIQ . . . . . . . . . . . . . . . . . . . . . 6, 72

Path to Purchase Institute . . . . . 1, 76

PetSense . . . . . . . . . . . . . . . . . . . . . . 75

Procter & Gamble . . . . . . . . . . . . 73, 82

Pure Fishing Inc. . . . . . . . . . . . . . . . 80

RetailNext . . . . . . . . . . . . . . . . . . . . . . . 6

Retail Solutions Inc. . . . . . . . . . . 6, 73

Retail Strategy Partners . . . . . . . . . . . 4

Rite Aid . . . . . . . . . . . . . . . . . . . . . . . . 79

Sam’s Club . . . . . . . . . . . . . . . . . . . . . 10

Shopatron . . . . . . . . . . . . . . . . . . . . . 75

Solutran . . . . . . . . . . . . . . . . . . . . . . . . 74

Strine Printing Co. . . . . . . . . . . . . . . 10

Studio G . . . . . . . . . . . . . . . . . . . . . . . . . 6

Subway . . . . . . . . . . . . . . . . . . . . . . . . . 74

More info at

the story noted P&G had effectively raised prices for

some Tide varieties last year by reducing the amount of

detergent per container.

The retailer has been refocusing on lower prices and

asking suppliers to provide the lowest costs possible –

even at the expense of joint marketing programs – a

move Walmart U.S. president and chief executive officer

Greg Foran characterized as “business as usual” during

an April analyst meeting. It has raised some concern

among P-O-P vendors, and the industry is watching

Walmart closely. As one provider told the Institute, “the

pendulum swings again.”

Foran said reducing the number of displays is a way to

give store managers more assortment and merchandis-

ing authority to ensure localization and ownership, with

the overall goal of greatly improving the store experience

throughout 2015.

“We’ve had too many PDQs, or displays, not allowing

associates to merchandise the store – their store – the

way they need to for their customer,” Foran said. “We’ve

got too much inventory in the back rooms, and our

processes are not where we want them to be. And that is

causing some undue shrinkage and some out-of-stocks.”

In addition to the shopper experience and price lead-

ership, Foran listed assortment and access as Walmart’s

other two areas of focus. He said the retailer is improv-

ing its use of data to help build a customer-relevant as-

sortment, especially in terms of fresh, private label and

omnichannel.

To improve access and convenience the retailer is

expanding its grocery home shopping test and better

leveraging in-store pickup, as well as fine-tuning its store

format strategy and next-generation supply chain.

“There are opportunities for us to significantly update

and improve things like space allocations, adjacencies,

ambience, navigation and flow in both of our formats

[Supercenter and Neighborhood Market],” Foran said.

“We are working on this now as we are also on the next

generation of our supply chain, one that leverages mov-

ing pallets with each as one unit and looks at inventory

across the entire enterprise.” SM

p2pi.org

‘Business as Usual’ at Walmart?

Pressure on suppliers to lower costs doesn’t hinder collaborative activity with Henkel

Target . . . . . . . . . . . . . . . . . . . . . . . 6, 20

Time Inc. . . . . . . . . . . . . . . . . . . . . . . 82

Turnstyle Solutions . . . . . . . . . . . . . . 74

Tyson Foods . . . . . . . . . . . . . . . . . . . . 68

UltraCreative . . . . . . . . . . . . . . . . . . . . . 6

United Healthcare . . . . . . . . . . . . . . . 74

Viggle Inc. . . . . . . . . . . . . . . . . . . . . . . 74

Vizio . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Walgreens . . . . . . . . . . . . . . . . . . . . . 79

Walmart . . . . . . . . . . . . . . . . . . . . 79, 82

WPP . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Zenith Media . . . . . . . . . . . . . . . . . . . . . 6](https://image.slidesharecdn.com/ptpsm201505-150513221555-lva1-app6892/75/Shopper-Marketing-Magazine-May-2015-82-2048.jpg)