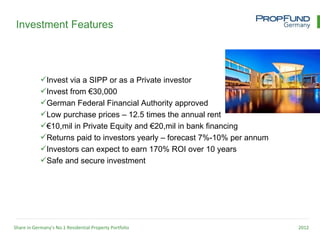

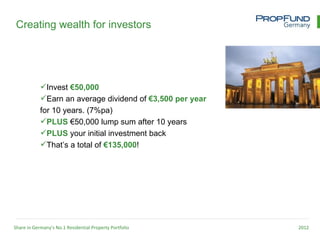

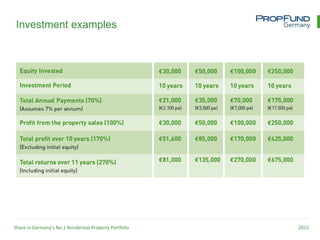

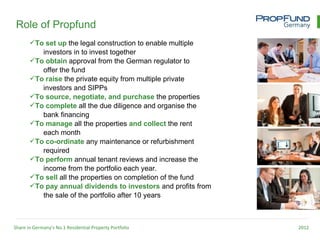

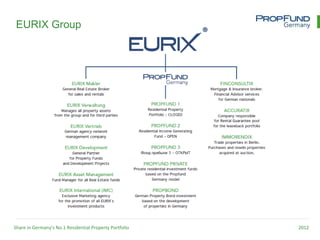

Propfund Germany allows investors to jointly purchase residential apartment buildings in Germany at lower prices than purchasing individually. By investing together, investors benefit from higher rental yields, lower costs, and greater returns. The portfolio described aims to acquire over 500 units worth over €30 million, targeting an average rental yield of 8% and forecasting returns of 7-10% annually and a 170% return over 10 years through dividends and resale proceeds. Propfund's role is to set up the fund, acquire and manage the properties, and pay returns to investors.