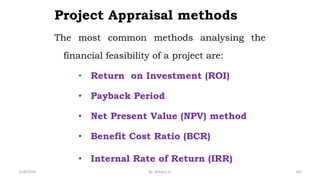

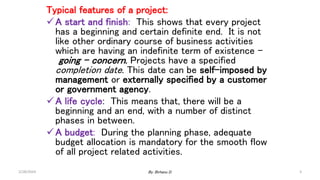

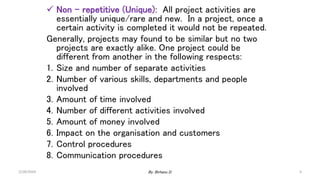

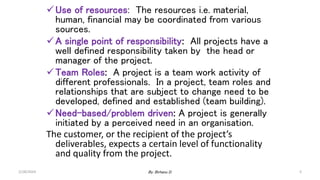

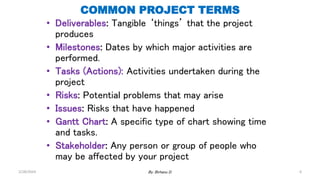

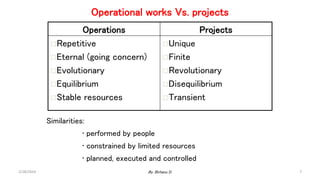

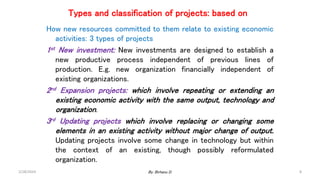

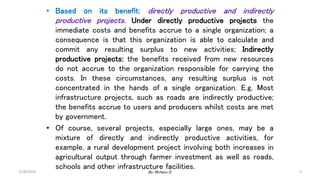

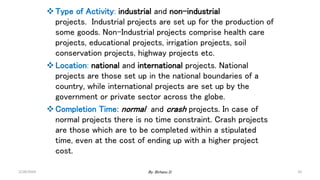

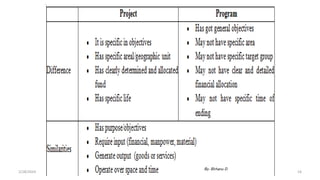

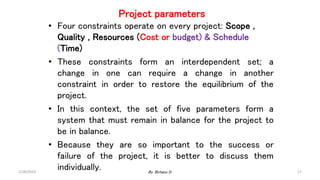

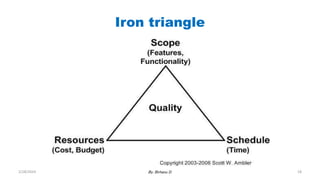

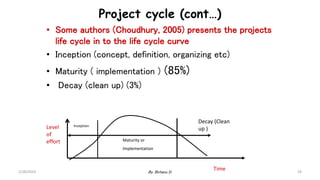

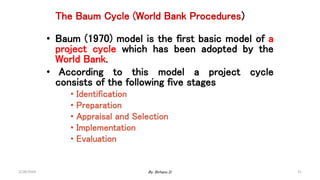

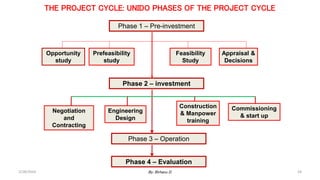

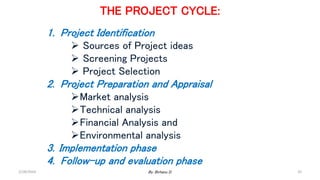

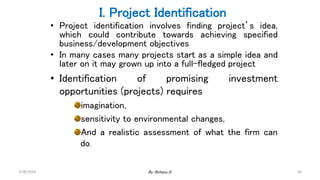

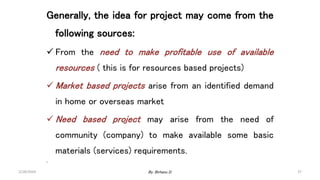

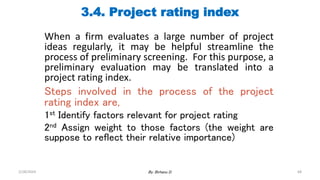

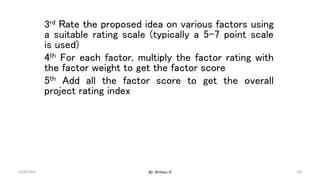

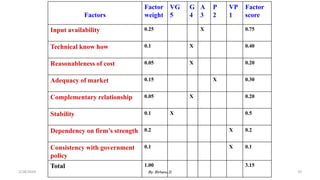

The document provides an introduction to project management, defining projects as unique, time-bound endeavors with specific objectives, budgets, and responsibilities. It outlines the typical features of projects, common project terms, various classifications, and key aspects of project management processes. Additionally, it discusses project cycles, emphasizing stages from inception to implementation and evaluation, and highlights the importance of managing project constraints effectively for successful outcomes.

![72

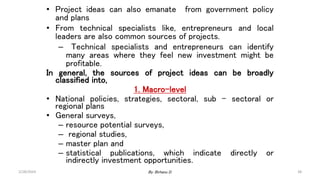

3.6. Problems in Project Identification

1. Ambiguity regarding the Development Goals (Objectives)

of the nation

2. Priority Issues in the Existing Development Goals

(Objectives)

3. Limited Data and Obstacles in Information Flow and

accessibility

4. Conflict of Interest between Local Beneficiary Groups [as

some group(s) might bear the cost while benefits accruing

to others].

2/28/2024 By: Birhanu D.](https://image.slidesharecdn.com/ch1-4-240228080848-3a8a7d79/85/Project-management-material-from-chapter-one-up-to-chapter-four-72-320.jpg)