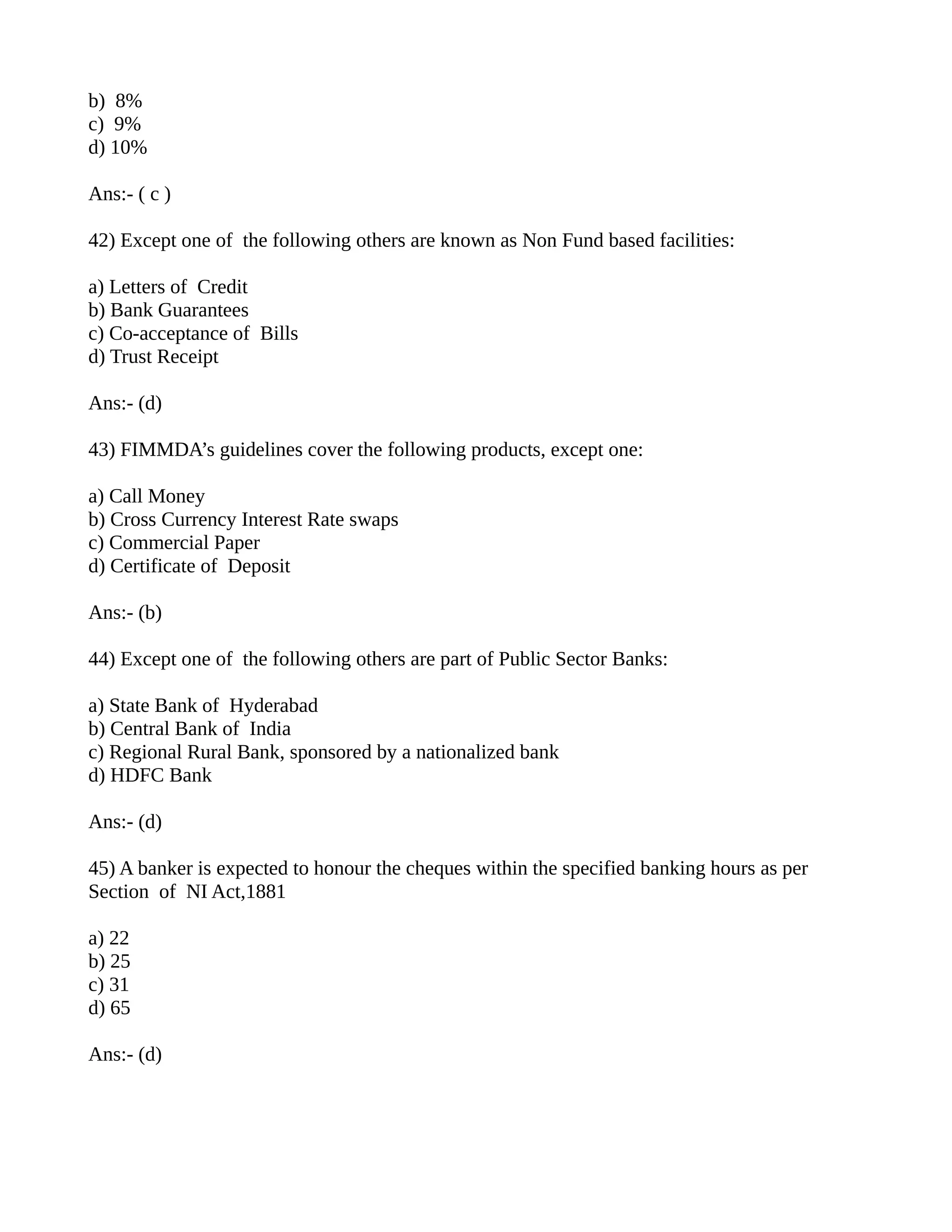

This document contains 45 multiple choice questions from a JAIIB sample paper on banking topics. The questions cover Reserve Bank of India functions, banking regulations, terms like KYC and priority sector lending, types of bank accounts and facilities, and the roles of organizations like RBI, SEBI and FIMMDA.