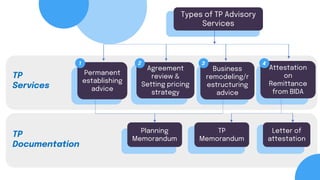

This document discusses types of transfer pricing advisory services and memorandums related to intragroup services. It outlines the following key services:

1. Providing advice on permanent establishment issues and whether a company has a PE in Bangladesh according to tax law and double tax treaties.

2. Reviewing intragroup agreements to ensure pricing is not contradictory to transfer pricing rules and proposing benchmark prices.

3. Providing advice on business remodeling and restructuring.

4. Issuing attestation letters confirming that arm's length principles were followed for intragroup transaction remittances from Bangladesh Investment Development Authority (BIDA).