The document outlines a three step process for choosing securities for an investment portfolio:

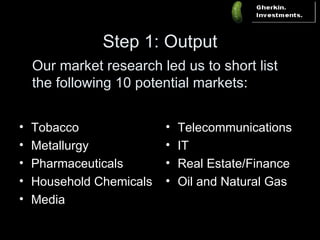

Step 1 involved qualitative and quantitative market analysis to understand attractive markets and diversification, shortlisting 10 potential markets.

Step 2 calculated average returns over 10 years for FTSE 100 companies within those markets, analyzing the top 12 earners and their prospects.

Step 3 combined market correlation, returns data, and research to select the final portfolio of Randgold, ICAP, British American Tobacco, and Reckitt Benckiser and Tullow.