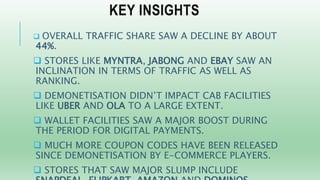

The document analyzes the impact of India's demonetization on the business metrics of Zoutons. It compares traffic, sessions, and pageviews in the two months before and after demonetization on November 8, 2016. Overall, total sessions and traffic declined by around 44% following demonetization. Certain e-commerce categories like apparel sites Myntra and Jabong saw increased traffic and rankings during this period. Digital payment wallets also experienced a boost, while ride-hailing services like Ola and Uber were less affected.