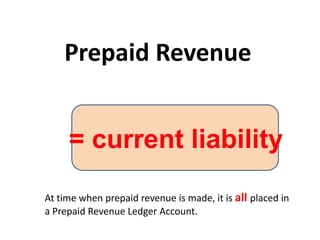

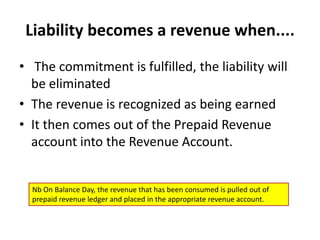

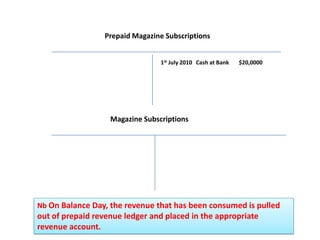

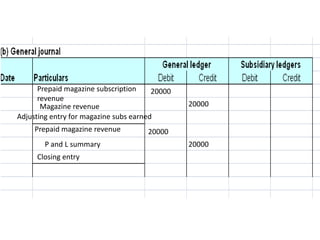

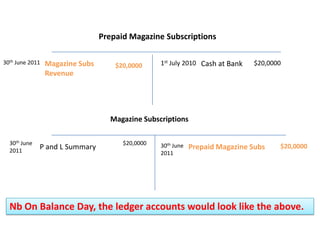

The document discusses the concept of prepaid revenue, specifically how it is recorded and classified in accounting. It explains that cash received for services not yet delivered, such as airline tickets or magazine subscriptions, should not be recognized as revenue until the service has been provided. Prepaid revenue is initially recorded as a current liability and is then moved to a revenue account when the service is fulfilled.