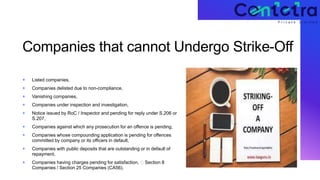

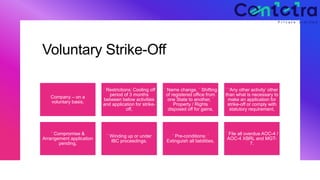

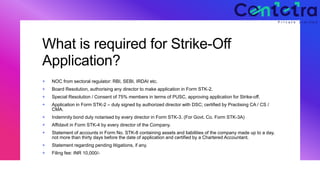

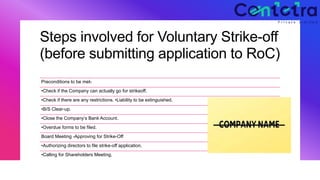

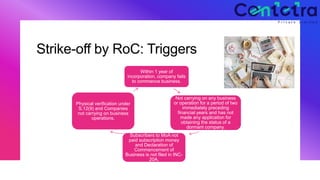

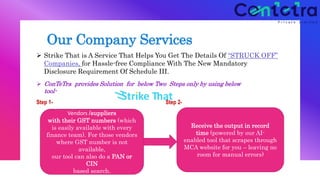

The document discusses the process and requirements for the voluntary strike-off of defunct companies, outlining conditions under which a company may be deemed inactive and the steps necessary for initiating a strike-off application. It describes several restrictions and preconditions, such as extinguishing liabilities and obtaining necessary approvals before application submission. Additionally, it highlights the role of the Registrar of Companies (ROC) and the associated legal and compliance obligations for companies seeking to be struck off the register.