Portfolio MS-MBA

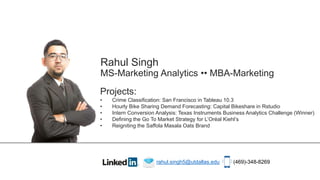

- 1. Rahul Singh MS-Marketing Analytics •• MBA-Marketing Projects: • Crime Classification: San Francisco in Tableau 10.3 • Hourly Bike Sharing Demand Forecasting: Capital Bikeshare in Rstudio • Intern Conversion Analysis: Texas Instruments Business Analytics Challenge (Winner) • Defining the Go To Market Strategy for L’Oréal Kiehl’s • Reigniting the Saffola Masala Oats Brand rahul.singh5@utdallas.edu (469)-348-8269

- 2. Exploratory Data Analysis in R Analyzing and Visualizing Data with Excel Marketing Analytics: Marketing Measurement Strategy Intro to SQL for Data Science MIT: The Analytics Edge Tableau 10 A-Z: Hands-On Tableau Training For Data Science! TECHNICAL COURSES

- 3. San Francisco Crime Classification RAHUL SINGH Data Visualization Project Tableau 10.3

- 4. Key Observations • Crime rates steadily decreases from 2003-2007 • Unusual spike in crimes in the year 2008 • Decreasing pattern returns • Reaches all time low of 66,542 Crime Incidents Per Year • Jump in crimes after 2011 • Reaches all time high of 75,606 in 2013 • Showing decrease but no more data points to understand if its decreasing or increasing

- 5. Key Observations • Each year starts with a low number of criminal incidents • Around the middle of the year in May and in October criminal incidents shoot up Crime Incidents Per Month • The incidents drop to a very low value towards the end of the year • Possible reasons can be the holiday season towards the end of the year

- 6. An overview of SF Crime Map Before we start getting deeper lets look at the Criminal map of SF. There are some colors which dominate the map. From an observers perspective one can say that crimes like Assault, Burglary, Larceny/Theft and Non-criminal look like some of the top criminal categories.

- 7. Key Observations The high density dots in the map match most of the crimes which make up the top 10 criminal categories in SF. Top 10 Crimes to look out for

- 8. Top 5 Crime Categories across SF The categories are distributed throughout the geography of SF but there are some parts of the maps which show some clusters.

- 9. The 10 Police Department Districts Since the crimes are locally reported a good way to analyze the impact of geography can be from the PD District perspective.

- 10. Key Observations • Southern, Mission and Northern are the top 3 PD Districts with the highest number of incidents reported Top 3 PD Districts and their top 5 crimes • The three districts have four our of their top 5 crimes in common- Larceny/Theft, Other Offences, Assault and Non-Criminal

- 11. Key Observations • Larceny/Theft see a bump during the end of the wee- Friday and Saturday and falls down Sunday onwards Top 5 Crime Incidents weekly trend • Non-criminal and Assault categories also see a rise on weekends • Other offenses and drug related crimes actually go down as the week ends

- 12. Hourly Crime Occurrences Majority of the Crimes occur during the evening 3pm-7pm and at Noon Crime Rates are pretty low during the early morning hours 1am-7am This trend is seen all 7 days of the week

- 13. Hourly Crime Occurrences Top 5 Crimes during the peak Crime Time 3pm- 7pm and at Noon Top 5 Crimes during the peak dormant Crime Time 1am- 7am

- 14. PD Districts Weekly Analysis Majority of the PD districts see the highest number of incidents on Friday Southern PD districts has huge number of reporting's which is a point to explore

- 15. PD Districts during Peak Hours (3pm-7pm) We can similarly check the districts where the rest of the crimes are reported more frequently During peak crime hours Central, Northern and Southern get the highest reports of Larceny/Theft

- 16. SUMMARY Crime rates overall are seeing a rise after falling down in the years 2008-09 Top 5 Crimes-Larceny, Other Offences, Assault, Drug/Narcotics and Non-Criminal Larceny dominates the crime map of SF and is one of the top crimes in most of the PD Districts including the top 3-Southern, Mission and Northern Southern PD District has the highest number of cases which is cause of concern A hourly trend was seen in the crimes: • Crime rates go up during the evening period 3pm-7pm • Crime rates are less dominant during the early hours of the morning 1am-7am

- 17. Bike Sharing Demand Forecast l Project for Business Analytics with R l

- 18. • Launched September, 2010 in Washington, D.C. • Operated by Motivate International of Brooklyn, NY – largest bike sharing network in the U.S. • Goal: to provide fun and affordable alternatives for getting around in the heavily congested area • Used to commute to work, school, run errands, attend social events, etc. • 5 jurisdictions with over 3,700 bikes Introduction Our working data includes hourly rental information over two years. • Date/Time • Season: Spring, Summer, Fall, Winter • Holiday • Working Day (not weekends) • Weather (defined categories of weather) • Temp (in C) • atemp (in C): “feels like” • Humidity • Windspeed • Registered: Count of registered users by type • Casual: Count of users by duration of use type • Count: Count of total rentals Understanding the Data

- 19. Forecasting total bicycle Demand The data informs us as to the types of users and when they are consuming this service. The independent variables such as various weather factors, holidays and time of day, shape those rider decisions. We aim to explore these relationships to predict rider behavior and make recommendations. Getting Research Ready Research Objective Categorizing the variables • We categorize the seasons as Spring, Summer, Fall, Winter and weather as Good, Normal, Bad, Very Bad and identified which factors dominate • We break apart the Date/Time Variable into hours of the day and days of the week. We further categorize the weekday as workday and holiday Weather Seasons Hours Days

- 20. Exploratory Data Analysis Hourly Demand

- 21. Bike Demand is the highest during Good and Normal weather but drops during Bad and Very Bad weather Seasonal Demand Weather Demand Bike Demand is fairly high during the Fall, Summer and Winter Season and less during Spring Exploratory Data Analysis

- 22. • Temp is positively correlated with dependent variables • Humidity is negatively correlated with dependent variables • atemp is highly correlated with temp • Windspeed has a weaker correlation as compared to temp and humidity Correlation Factors for Temperature, Windspeed and Humidity train.registered train.casual train.count train.temp train.humidity train.atemp train.windspeed train.registered 1.00 0.50 0.97 0.32 -0.27 0.31 0.09 train.casual 0.50 1.00 0.69 0.47 -0.35 0.46 0.09 train.count 0.97 0.69 1.00 0.39 -0.32 0.39 0.10 train.temp 0.32 0.47 0.39 1.00 -0.06 0.98 -0.02 train.humidity -0.27 -0.35 -0.32 -0.06 1.00 -0.04 -0.32 train.atemp 0.31 0.46 0.39 0.98 -0.04 1.00 -0.06 train.windspeed 0.09 0.09 0.10 -0.02 -0.32 -0.06 1.00 Positive Correlation Negative Correaltion Weak Correlation

- 23. Cleansing and transforming the data To adjust for the highly-positive skewed dependent variable, we took the natural log of demand and added a constant log(count + 1) To cleanse outliers: · First we attempted clustering to group observations with outliers. However, clustering just gave us new outliers. · Eventually we found that the variable containing the outliers was insignificant and we dropped it from our models. To adjust for autocorrelation: · We utilized an Auto-Regressive Distributed Lag (ARDL) Model to remove the trend and seasonality components.

- 24. We did a random 70:30 split in our data set. Hence 70% of the data was used for training our models, and the remaining 30% to evaluate them. Way Forward Train & Test Sets Evaluation metric RMSE The main error metric we used to evaluate our models was the RMSE (root mean squared error). It indicates the absolute fit of the model to the data– how close the observed data points are to the model’s predicted values. Baseline Model The best guess for predicting the demand on any given hour will be the mean of the demand of the bike in the training data set.

- 25. Evaluating the Baseline Model Best Guess-192 bikes Best Guess is the mean of the bike demand in the training data Baseline Model RMSE (root mean squared error) -180.978 We will compare the rest of the models… Linear regression, Decision Trees and Random Forests …with the Baseline Model RMSE and compare the values to gauge the model performance and find the best model for predicting the demand

- 26. Linear Regression Model Auto-regressive Distributed Lag (ARDL) Model Utilizes lags of bike demand and distributed lags of the hour of the day to remove the trend and seasonality components RMSE -125.345 RMSE 30.8% improvement over Baseline Method R2 – 0.84 Count of Bike Demand season, workingday, temp, humidity, hourofday, count1, count2, count3, hourofday1, hourofday2, hourofday3, hourofday4, hourofday5, hourofday6, hourofday7, hourofday8, hourofday9

- 27. Understanding the ARDL model Non-Stationary Trending Data Non-Stationary Random Walk Desired State: Stationary Data Sample means from different periods are relatively equal.

- 28. Decision Tree Model Using variables- Season, Day of week, Hour of day, Working day, Holiday, Weather, Temperature, Humidity and Windspeed RMSE- 107.259 RMSE 40.5% improvement over Baseline Method R2 – 0.64 We can further try the Random Forest approach to improve upon the results and prevent overfitting.

- 29. Random Forest model Top 4 Important Variables Hour of Day, Temperature, Humidity, Day of week Random Forest Model RMSE-68.869 RMSE 62% improvement over Baseline Method R2 – 0.85 Count of Bike Demand Season, Day of Week, Hour of Day, Working Day, Weather, Temperature, Holiday, Humidity and Wind Speed 1000

- 30. Understanding the Random Forest model Minimum no of trees needed-613 Plotting error as a function of the number of trees Top 4 Important Variables- Hour of Day, Temperature, Humidity, Day of week

- 31. Comparing different approaches used for Prediction Since our primary objective is to predict the count, we would want to go with the approach that gives us the lowest RMSE, which is Random Forest in this case.

- 32. Recommendations To make our promotions more targeted through Weekdays, we can segregate the bike demand in three categories: HIGH 7-9 and 17-19 hrs. Medium 10-16 hrs. Low 0-6 and 20-24 hrs. Also we see a trend where we see less demand during Spring. Find ways to increase demand • Give returning and new customers a deal • Look at creating an exclusive riders club

- 33. Appendix

- 36. THANK YOU

- 37. Specific details were removed due to Non Disclosure Agreement

- 49. ‘L’Oréal Brandstorm’ Defining the Go To Market Strategy for L’Oréal Kiehl’s

- 50. Total sales men’s cosmetics USD 5.13 Bn • Continent’s five biggest markets - France, Germany, Italy, Spain and UK • Sales of skincare products boomed -289 million euros in 2005 to more than 420 million euros in 2011 • Mature and Developed market • Slow and controlled growth The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research Global Market Characteristics • Men’s grooming is a 13.4 billion posing 4 % growth to reach 15.5 billion 2017 • Account for 47 % percent of beauty products worldwide • Average spend on cosmetics US $ 2443.07 • Deodorant is 2nd largest category with $ 8 billion sales in 2012, follows 8 % growth rate • Skincare is the largest category in this industry • Men’s grooming reached USD 3 Bn in 2012, up from US $ 2.5 Bn in 2007 • Sales expected to rise by 16% by 2017 USA World Europe Asia Pacific Total sales- USD 4.043 Bn Contribute to 23% growth by 2016 of global market Major markets- • India, China • Japan, South Korea South Korea: Market growth has been average 10.4 % since 2006 Largest market size, constitutes around 21% of Global Sales Market size growth-from $493 million in 2007 to $ 836million 2012 (Euromonitor) China- Market grown by more than 20% a year during 2012 to 2014 (RNCOS) Will overtake South Korea as the largest market in next 5 years • World: Men's grooming to reach 15.5 billion USD by 2017.(2% CAGR) Asia Pacific: To contribute 23% growth(2016) of global market • Mature Markets: Japan & South Korea • Drivers of Future Growth : China, Thailand and India Key Takeaways :

- 51. Consumer Insights Current Market Situation in India Expected market size Rs 52.7 billion 2016 Current market size Rs 38.1 billion Increase of 22% in the year 2012 Absolute Growth US $ 191mn CAGR 9% (08-13) India at a Glance Two major categories • Shaving • Toiletries (bath, shower, hair, skin, body care etc.) Major segment is Shaving category By 2015 Major Segment, Toiletries – 54% share Presently, Pre-shave category is much bigger than the post- shave category Source-Hansa Research Company Source-Euromonitor Demand • Maturing demand in top-tier cities -Mumbai, Bangalore and New Delhi & second rung areas with a highly style-conscious population like Chandigarh and Goa • Great desire in small towns for grooming increasingly, especially in the whitening and fairness segment The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 52. Fastest growing Category: Fairness creams 2nd Category: Mass creams 3rd Category: Face washes By 2016 66% of total male skincare product sales to come from the Asia Pacific region (Euromonitor) Male Skin Care • Market size Rs 800 crore • Grew at 34% as compared to 20% of women skin care • Skin creams segment grew at 41%—faster than the overall skin cream category in India, which grew at 27%. • Expected 25% CAGR due to increased demand of skin whitening creams • 50 % of men’s toiletries sale to come from deodorants and hair care products. • Growth rate of deodorants is 46% • 31% of men's grooming value growth by 2016 will come from deodorants • Nielsen study, men grooming segment growth is faster than the growth rate of the total personal care and beauty industry in India • The market for hair color for men grew nearly three times the overall category growth of 23%. • Male anti-aging cosmetics are a niche segment with interesting growth prospects in the future • Conditioners have low adoption among youth segments • Male’s grooming category is evolving in India. Expected market size (2016) :Rs.52.7 billion • Skincare plays an intrinsic role in personal grooming • Toiletries to become the major segment in 2015 • Increased demand of skin whitening creams in India • Male anti-aging has high growth prospects • Maturing demand in metropolitan cities Key Takeaways : Deodorants/Fragrance The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 53. Consumer Insights Local Market Characteristics Industry competition Threat of Potential entrants Threat of Substitutes Power of Buyers Power of Suppliers Level: Low • Most stores are self owned • Majorly products are imported directly by company Level: High • Limited premium well established brands offering differentiated products • Quality is a major factor in the premium brand segment Level: Medium • Masstige brands fighting for premium target segment • In few cases selective brands users move to lower level brands Level: Medium • A Limited number of premium brands to choose from for men cosmetics • Men are brand loyal and stick to specific brands • Can shift brands for specific needs Level: Low • High start up costs in R&D • Government regulations-High import tariff • Ban on animal testing by India India to drive growth in the men grooming market by 2016 along with other BRIC nations Retail penetration has been a major factor in growth. Rise in retail penetration from 3% in 2005 to 8% in 2012, expected 13% in 2015. Industry Analysis for premium men cosmetics in India Porter’s 5 forces model The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research India to become a major market for grooming in the coming years. The market is maturing with time and can be explored by various premium brands.

- 54. Most Preferred Consumer Insights Distribution Channel Characteristics Distribution channel 2000 2005 2013 Non-store retailing 10.0 14.0 16.1 Drugstores 13.1 12.4 12.8 Department stores 13.3 10.6 9.5 Beauty specialists 13.9 13.1 13.4 Super/Hyperma rkets 25.6 26.0 26.9 All others 24.1 23.9 21.3 Source: Barbalova 2011, Moulin 2012, Euromonitor International. Cosmetics distribution channels 2000-2013 In Premium Segment 6% sales comes from Online model Internet is an important tool to make men learn about the products Growth in Brick and Mortar Retail-5% and in online selling- 31% since 2012 Premium Segment Mass Segment *includes online sales also DistributorProducer Wholesaler Retailer Customer Customer Producer • Premium brands tend to keep strict control over distribution networks • Online selling has been growing with a healthy rate • Supermarkets were dominant sales channel for with US $8 Billon worth sales worldwide. Company owned store Customer 3rd party Ex. Shoppers Stop Producer The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research Key Takeaways • Growing importance of Multi channel distribution- Results in increased Brand Loyalty, larger profits and sustainable growth • Premium Brands also provide direct shipping, home delivery to customers to increase penetration of markets

- 55. Consumer Insights Evolution of Man and Market 1985 25 % of men’s goods were bought by the men themselves 1998 52 % men were shopping for themselves 2004 69% of men involved in shopping for own selves 2012 85% prefer to buy their own products Evolution in Emerging markets: Need to reach a certain level of income before adoption of grooming products begin. Start Household products like detergents and soaps Extension Packaged foods such as instant noodles Move up Personal care products Deceleration occurs slowly in grooming industry than other consumer items Hence it has longer periods of fast growth Men in Mature markets for Grooming Products:. Concept of metro sexuality adopted very early by men Results in enhanced rate of maturity of the market Ex. In the market of JAPAN: • The per capita sale of men cosmetics is one of the highest • Grooming regime is no longer the preserve of the gay male • Proof that high disposable income is not the only reason for growth www.spireresearch.com Major Challenges: • Converting male users of women’s skin products to use the products developed for them is a challenging task • Brands cannot approach the men’s market as they approach the women’s one Key Takeaways • Men have started to purchase their own products • Male grooming has a longer period of fast growth • Grooming no longer associated with gay or metro sexuality • Converting male users of female skin products is a huge challenge • Only 11% of men use skincare products daily The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 56. Consumer Insights Factors Affecting Purchase Men are: • Brand conscious • Do adequate research before purchase • Take pride in being boys and masculinity • Brand loyal when it comes to skin care and shaving products Reasons for sharp rising demand among India men: • Rising beauty consciousness • Changing demographics and lifestyles • Deeper consumer pockets (increased spending) o Indian men spend approximately $100 more than women in personal care products (ASSOCHAM report) • Rising media exposure • Greater product choice, more brands in market The Indian Youth: • Young generation influenced by changing standards of male beauty • 75% of India’s youth spend on fashion and beauty products and tech products • Spending is Rs 1000-5000 every month on buying cosmetics • Huge growth in consumption pattern of cosmetics between 2010 and 2013 • Increasing awareness of fashion trends amongst teenagers • Good skin and hair is matter of style and depicts social status, flaunt value , results in competitive advantage in job market • Dull skin and hair makes youth less confident and attracts negative attention • 58% of men say personal care products boost self-esteem • 79% say they feel more attractive when they’re well groomed • 71% think good skin is important to attract opposite sex What do they think? A CHANGING ATTITUDE Great looking skin is the latest men's accessory which affirms masculinity and social new car. Mintel’s Report Key Takeaways Characteristics of Men: • High Brand Loyalty • Pride in Masculinity • Relate personal care products with self esteem • Indian Men spends more than women for personal care • Youth of India spends a substantial amount on grooming products The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 57. Consumer Insights Mass Market Selective MarketHair care- • Hair Gel • Shampoo • Conditioners Shaving- • Razors • Shaving cream • After shave Others • Difference in product portfolio of both the markets for men’s grooming • Selective market caters more towards aging and younger looking skin, specific products for different needs Body & skin care- • Fairness cream • Face wash • Moisturizer • Cleanser • Body wash • Soap bars Anti ageing- • Youth Activating • Anti wrinkle • Age Defense Shaving- • Pre Shave • Post Shave Body & skin care • Sun care • Cleanser • Lip balm • Eye cream • Dark spots • Body Cream • Hand & Foot Cream • Multifunctional products Fragrance Product Category 1998 2012 Skincare 16.4% 23.0% Haircare 20.8% 17.3% Fragrances 12.9% 10.4% Toileteries 31.2% 30.6% Others 5.2% 6.4% Global Beauty Retail Sales by Product Category Major Shift towards Skincare Growing Aging Population worldwide Non Organic Beauty Products Increasing awareness and demand of Organic and Natural Products Organic Beauty Products Premium Segment Companies Masstige Market Companies are shifting towards upper Masstige segment The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research What’s Out there for him? Current Trends

- 58. Consumer Insights Consumer Survey Objective: Study the consumption pattern of male consumers towards male cosmetic products. No. of Respondents : 128 Age: 24-45 Gender : Male (conducted through Rotary India) Survey Research Hypothesis Correlation Analysis Conclusion Research and Conclusions 54.3 % are those who are using a skin care product since last 2 to 3 years 75.4 % feel that physical appearance is important for them in today’s world 50.9 % using the skin care product for facial care Majority 69.71% spend 0-1000 on cosmetic products per month 41.1 % were those who purchase form specialized cosmetic store Conclusion after Correlation Analysis • The result indicates that the Delhi’s male cosmetic consumption behavior was strongly influenced by cultural and personal factors. • Growing importance of looks in work and life • Spending on cosmetics is increasing and the most preferred distribution channel is specialized stores The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 59. Various Phases 18-25 26-35 35+ • Lack of choice when it comes to cosmetic products • Spends more money on grooming and personal care products than women counterparts • The aspirations and requirements of this segment is rapidly evolving • Young male segment has been assigned the 2nd highest brand influence of all • Higher purchasing power • Segment contributes most to the increasing trend of males using skincare products • Want to make an impression at their workplace • Have little experience with luxury skincare brands and also limited knowledge of skincare products • Highly susceptible to the marketing efforts of cosmetic brands • Males in this segment are slightly more influenced by brands • Do not want to trade down to cheaper and unisex brands • Ability to access the effectiveness of brands they have tried before in the past • Difference in attitudes than female counter parts Consumer Insights Classifying the Indian Male Consumer Defining a Premium Male Customer Needs High Quality, allergy free products Knowledgeable about products Frequent Traveler(Mostly 2-3 times a year) Socio Economic Classification A+, Seekers, Aspirers Mostly Working Professionals Equate looks with Social Status Specific needs when it comes to skin care Susceptible to marketing efforts of brands The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research Willing to pay premium price for Male Specific Cosmetics Products KuicK Research

- 60. Starts using aging products of premium brands Customer loyalty steeps in Switches brand only if a new need arises Starts Diverting: He starts using a couple of premium products Rise in purchasing power Gets married :Female Enters his life and changes the purchasing pattern Requires products for specific needs Ready to try different brands Faces the world( job/education) Gains knowledge about premium segment Consumer Insights Consumer Life Story of an Indian Male 16 18 Products: Shaving Products Hair Gel Face wash (Any Brand) Unisex Shampoo Uses majorly Mass segment products or Unisex Products 21 Products: Conditioner Face Wash Skin Cream Deodorants Enters College Becomes more careful about his looks 23 Products: Shower Gel Body Wash Men’s Shampoo Moisturizer Products: Male Specific Products 26 Products: Starts using Premium products for men like anti wrinkle, dark spots 35 Products: Anti Aging Eye coolant Youth activating 45 Sticks to a particular brand: Loyal customer He has moved away from the mass products Products: Male Specific Products as and when need arises 60 At various Ages The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 61. Consumer Insights Defining main trends for this customer Importance of Packaging • Color of packaging is crucial for the success in the market (preferred colors-blue, white and silver) • Products need to be rebranded to look and feel as tailor made for men • Sachet marketing is the trend in men grooming market to promote products Demand of Multifunctional Products • 3 in one products like shower hair wash and shaving combination helps in persuading men • Need for offerings that target multiple problems such as dry and sensitive skin, hyperpigmentation and acne. • Multifunctional products which though high priced cut the need for buying several products The Fast pace of Men • Men who are always on the go cannot afford to invest a lot of time in taking care of their skin • An ASSOCHAM study shows most men are looking for separate sets of bathing and essential care products that include bath and shower gels, face wash, and deodorants. • “ A man wants to be able to get his shopping done quickly and doesn’t want to have to walk through dozens of meters of perfume and makeup counters to do so “ Need to increase Awareness • Having a men specific place in the store helps male purchases • Media helps a lot in buying and motivating men to change their perceptions example David Beckham • In India magazines make men more open to purchasing items that are less familiar • Brands are relying on online campaigns and social media to reach out to their target market Key Takeaways • Men have specific needs and want to get done with shopping quickly • They prefer products which are multifunctional and have decent packaging The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 62. Consumer Insights Major players in market To provide consumers with products which fit their needs, ones that are allergy and fragrance free, never tested on animals, are easy(3 step process use), and are backed by years of R&D to prove that they are of exceptional quality • To bring the best to everyone that uses it…Fresh , Clean & Pure Parent Company: Estee’ Lauder Major Player in India. Record growth of 65% P T P T To promote a responsible and healthy way of life, through the very best traditional, organic, natural and effective beauty and well being products from the Provence region of France. • Shea butter specialist, refreshing, earthy and musky P T Believes in refinement, discretion, sophistication & attention to detail to gain credibility in the eye of the consumer. • Believes in Omotenashi : Understanding the customers needs correctly • High quality at low price , Affordable: Value for money P T As an one stop solution, to redness, irritation, flare- ups, tightness etc. • As a pioneer in the Men’s grooming business with simple ideas • One that makes men comfortable by helping them take good care of their skin, every day No specific stores in India. Products are sold online One that believes in beauty with an unmistakably French Accent • Provides quality service that one can trust combined with personalize advice, masculine look, dermatologically approved P Discontinued Men’s Care India from 2012 Only available Online Men who have just started working in service industry Want premium grooming products at the price of mass products Men who want multifunctional products Want products that are of high quality and are fragrance free Men want who natural products derived from organic elements Men who want simple products that become part of their daily lives Want less number of products for different day to day problems POSITIONINGP TARGETT Limited number of players in Indian market are selling products of premium range for Men The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 63. Consumer Insights Competitive Analysis Basis L’Occitane Clinique Kiehl’s Presence No. of Posts on FB last month 46 45 26 Total Likes 2784747 3020118 784079 Growth Rate(likes) 1.39% 1.2% 1.6% No. of Tweets Last month 50 63 153 Replies Last Month 7 122 27 Total Followers 2156 149463 47249 Growth Rate(Followers) 7.96% 2.6% 2.75% Digital Strategy Category L'Occitane Clinique Kiehl’s Shaving Post/Pre/After shave + Razor &Brush Post/Pre/After Shave Pre Shave Bath and Shower Conditioner, Shampoo, Soap, Body Care Hand Cream, Foot Cream, Body Lotion Face Care Moisturizer, Face Wash Dark Spots, Scrubbing lotion Moisturizer, Lip balm, wrinkle lift Sun Care Instant Tan SPF 50 cream Eye Care Cooling Eye Gel De Puffer Fragrance Yes Yes No Products Natural Ingredients Scientific Expertise General Targeted Product Positioning Pricing Basic Shaving cream Rs.1250 – Kiehl’s 150 ml Rs.1490 – L’Occitane 150 ml Rs. 2001 - Clinique 125 ml Store Experience Clinique: More centric towards women. Few male salespersons and lesser shelf space for male products. L’Occitane: A connect with the nature, pleasant ambience. They bring their French culture in the store by putting French music and the French interiors Kiehl’s: The store has a quirky look and has more of a unisexual look. It does not look like a any other competitor, its more trendy and cool ( Mr. Bones, Bikes etc.).Separate rack for Men’s products(helps attract male customers) The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research Key Takeaways • Kiehl’s is low priced (when compared to the rest 2) • Clinique has the best online presence • Kiehl’ store experience for men is better • Differences Product portfolio

- 64. Consumer Insights Channel L’Occitane Clinique Kiehl’s Self Owned stores Specialty stores Online Department Stores Pharmacies Distribution Strategy Market Share Category Global Asia Pacific Premium Men’s Bath and Shower 0.4 4.4 Premium Men’s Deodorants 0.7 1.2 Premium Men’s Skin Care 7.0 2.5 Men’s Shaving 0.1 0.6 Post Shave 1.5 6.4 Pre Shave - 0.5 Category Global Asia Pacific Premium Men’s Skin Care 0.3 0.4 Men’s Shaving - 0.1 Post Shave 0.6 0.8 Pre Shave 0.1 0.4 *Only categories having market share above or equal to 0.1 have been mentioned Category Global Premium Men’s Skin Care 0.5 • Featured stories • SMM • Word of Mouth • “No Advertising” policy • Advertising • Social Media • Direct selling (mail) • Coupon codes • Video advertising • SMM • Coupon codes Promotion Strategy L’Occitane Khiel’s Clinique The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research Key Takeaways • Distribution network of Kiehl’s and Loccitane is stronger due to more control on distribution • Market share of Kiehl’s is not significant • Promotion and marketing of the brands other than Kiehl’s are diversified

- 65. Consumer Insights SWOT Analysis • Apothecary culture • Retro packaging tailored for men • Intensive Sampling • No fragrance, natural products • Diversified product portfolio tailored to men • Kiehl's rich history of adventure and science • Quirky store experience • Consultations, personalized advice Strengths Weakness • Small part in store dedicated to men • Low brand awareness among men • Digital presence not tailored to men • Recent price cuts • Conversion rate of male customers to male specific products is low (7 out of 20 males) Threats • Import oriented (subject to various tariffs, currency fluctuations) • Low market penetration of men grooming products • Increased presence of Masstige men cosmetic products • Bath and mostly hair care usage of unisex products by a majority of men Opportunities • Demand for innovative and multifunctional products catering to specific needs • E commerce with local players • Increasing digital activities catering to men (Fb, twitter, YouTube etc.) • Expanding in market of anti-ageing and whitening products (increasing consumption rate) Opportunities for Kiehl’s • Tap young customers (18-22 years) • Increase male specific content on Facebook and other social media platforms-Pinterest and YouTube (Increase awareness among men) • Involvement of Indian celebrities in its cause campaigns in India (association of celebrities will help convince men and change perception) • Expanding the e commerce business model for Kiehl’s men ( men are spending more time online) • Expand product portfolio (include products which are multifunctional and cater to specific needs) • Aging population in Asian region (need for categories like hair-fall treatment, hair implantation, skin treatments in near future) • Improving distribution of products in places where brand is absent (Mostly tier 2 cities) The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 66. Consumer Insights Kiehl’s New Mobile App Helps in engaging male customers Makes a connect with the customers even when they are offline Link Loyalty Card with Mobile App Increased Customer Engagement Encouraging repurchase Send mobile notification to place order with a single click It’s been 3 months time to buy a new shaving foam. Order with a single click Convenience of ordering safely Take order directly from Mobile App with Cash on Delivery option Products for Men • Shaving • Skincare • Eye Care • Anti Aging Details of Product and range Giving them an offline experience and an opportunity to find new products Activities: Mobile App The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 67. Consumer Insights “Smile with Khiel’s” Photo wall Create a RFID enabled Loyalty card Helps manage profiles and purchasing history information of registered customers RFID tagged sample product Touch screen with RFID reader • Enables customers to find info about any product • Faster service for customers • Greater information about how customers sample products. When a customer steps in Checks IN Scans Product of choice • Reads Details • Reads Reviews • Sees recommendation • Option of sharing views on FB • Places an order Simultaneously, Salesman knows about his • Personal Details • Past purchase history • His preference Bill is processed Key Takeaways • Improving in store experience • Obtain useful data about consumers • Involvement of couples in purchase decisions • Building stronger relations with couple shoppers Photographs clicked of couples who visit to store with their Khiel’s purchase Based on the number of purchases “Shopper Couple of the Month” is selected Event Frequency- Monthly Photograph is displayed on the Khiel’s photo wall Winner announced on FB page and he gets a gift pack RFID tagging The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research

- 68. Consumer Insights Kiehl’s Men FB page and YouTube Channel Channel • Contains details about Men’s Products- in Kiehl's quirky way • Daily posts related to areas like- Sports, Gadgets, Heath, Fitness Movies, etc. • Online App for getting tips and suggestions • Videos and tutorial on YouTube channel • Men spend more time on YouTube than women • Use FB mostly to gather information, broadcast their views and opinions Key takeaway: • Increased posts by men, product recommendations by men, feedback and suggestions on page • Create awareness and visibility among men Cause Marketing Campaign Lift-UP a Child’s Career Product: Facial Fuel Heavy Lifting Idea: Men will adopt a child through Kiehl's and help lift up their career (financially) Activity: In-Store promotion of the campaign globally and special donation boxes in store The Male Consumer Premium Male Consumer Competitive Analysis The Brand Kiehl’s In-Store Activities The Market Research 1. Male users of Facial Fuel will be shown a special promotional video of children who want to study further but cannot due to income constraints 2. Kiehl’s will accept donations from customers and transfer the whole amount to support these kids 3. Customers who donate will be shared regular updates about the performance of kids and their achievements both is store and by e-mail S T E P

- 69. THANK YOU

- 70. Marico Over the Wall Reigniting the Saffola Masala Oats Brand

- 71. Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead 20-35 years old working professionals Aspirational and expressive Time poor generation Constantly connected Peer influenced Misconception: To be slim is to be fit Tendency to dine out 2+ times a week Key snacking hours: 1600-1900 & 0000- 0200 hours Key snacking locations: Street food stalls 62 % Delhi Metro travelers observe Advertisements TARGET CUSTOMER KEY INSIGHTS CATCH THEM ON THE RUN Advertising in train and on major metro stations Generate trials through “THE SNACKY BAG” Tie up with food stall vendors outside commercial offices spaces Concerned about Health SAFFOLA’S Micro website to provide lifestyle and diet plans based on body types Targeted YOUTUBE Ads FACEBOOK Sponsored posts and activation campaigns on SMO’s official page Tie-ups with Zomato verified reviewers and bloggers Featuring SMO in Zomato collections Like Quick bites, Pocket friendly, Street food and Great breakfasts Consumer Story Consumer Story Detailed Executive Summary of 500 words Attached in the above link, this slide is a summarized version of it.

- 72. Redefining Target Segment Key Insight All the brands are focusing on benefits for the heart and are targeting age group of 30 + Target Market: Working professionals 35 + and housewives Positioning: Deliciously nutritious mornings & Make a smart start to a Healthy Heart Target Market: Working professionals 35 + and family as a whole Positioning: Health Advantage : Control Blood Pressure, Reduce Cholesterol & Weight Target Market: Middle Aged men ( 33 + ) Positioning: Reduce Cholesterol, Healthy, Tasty OPPORTUNITY ?? Connected to the content & technology 85% Rely on peer approvals for buying decisions Healthy conscious Always on the move Gen C Age : 20-30 Years First Jobbers Key Takeaway Saffola can target a totally untapped market who is health conscious wants to stay fit. IT Employees / BPO/ KPO Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead DIFFERENTIATING FACTOR Consumer Story Consumer Story

- 73. Health Wrongly believe that to be slim is being fit, Slim is in Fashion Eating behaviors like skipping meals, eating out, and snacking are common Unaware about the importance of a balanced and complete diet Diets remain deficient with energy, protein, iron, vitamin, and fiber Blood pressure becoming common among youngsters Every 3rd person in an Indian city is a youth, population 464 Million by 2021 Influenced by cosmopolitan trends, international food, media and cuisine Increasingly time-poor, seeks convenience in preparing meals More than 50% flocking to On-the-Go meals during office hours Lifestyle More than 75% online population <35 years 69% FB users in age groups 20-30 years 80 % with smartphone watch YouTube 44 % aren’t opposed to Ads when relevant Online Trend 2H 05M Avg time spend on Social Media Key Takeaway • Increasing demand for On-the-Go, healthy meals • Need to educate youth about ways to stay fit • Smartphones paly an integral role in the lives of Youth • Ideal target group as product fits the needs of consumers Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead Consumer Story Consumer Story * Reports: National Restaurant Association of India (NRAI) and Technopak

- 74. • Established itself as a 4 pm snack • Usually not considered as wholesome • Targets frivolous food moments of consumers • Market share shrinking, newer healthier options in market Why Oat Noodles? • Wants to position the variant as a morning option • Plans on riding on the growing popularity of oats • Directly compete with major oat brands in India • Aims to give consumers serious food moments* Market Insights Healthy variants wheat-flour and multigrain Maggi noodles failed in past Instant noodles no matter what they claim leads to various health issue Priced at Rs25/packet, makes it the costliest noodle in store Does not compete with breakfast oats because of Maggi brand Image In Store Research • Displayed with other Maggi products • Gets more visibility to drive sales • Drives impulse purchase • Putting in Oats category reduces consumer footfall • TV ads influencing purchase decisions • Price, deterrent for repeat purchase • Not being consumed as breakfast • Health element unclear to new consumers Key Takeaway • Too early to predict fate of Maggi Oats Noodles • Not a competitor to Saffola Masala Oats presently • Highest priced Maggi ever, might result in loos of sales • Perceived as unhealthy snacking option because of Maggi brand image • Does not influence Oat users to shift to Maggi in any way Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead * CERS report states Maggi Oats as unhealthy, with just 40% oats in it Consumer Story Consumer Story

- 75. Getting Ready for work 7:00-7:45 AM Saffola Oats @Rs.15 The Healthier way to do things on the RUN 7:45-9:00 AM Facebook Targeted AdsYouTube Advertisement Consumer sees the advertisement before the music he plays Types of Targeting: Interest Based Remarketing Content based Consumer has glimpse on this ad when he checks Facebook Types of Targeting: Interest Based & Demographics Key lines of Delhi Metro: Yellow Line (Jahangirpuri to Huda City Centre) Blue Line (Dwarka to Noida City Centre) Costing: Advertising cost for inside station – INR 25,000 -1,10,000 Number of passengers : 12.59 lakhs/day Inside train branding prices: Per boggie per month : INR 75,000 Consumer sees this advertisement while travelling and tries to associate with himself Stations : Kashmere Gate , Rajiv Chowk Key Takeaway The connect would be their because Gen C is health conscious and Oats have never been targeted towards them Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead Going to Office- Transport Consumer Story Consumer Story

- 76. Tea Break at 4.30 Team Saffola Arrives Distribute Snacky Surprise boxes Contains Trial Packs and Taster Kits Generate Conversation with consumers * SMO: Saffola Masala Oats What’s in? TCS India • Biggest IT company in the country (2nd world wide) • Offices in major Indian cities including metros • Highest number of employees, 2 times Infosys • 81% employees are fresher/trainees • Activation gives huge potential to communicate with TG of SMO Why TCS For Connect • Leaves lasting impression in customer’s mind • Free samples create strong emotional connect • Increases chances of recall and repurchase For SMO Potential • Capture the On-the-go meals market for professionals • Pitch in to increase job performance of the company • Monitor response from activation campaign for positive reactions • Further tie ups with office cafeteria, office canteen owners Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead 9:00 AM- 6:00 PM Working in Office Consumer: • Impressed by taste • Probable Snacking option • Convenient to cook and consume SMO Consumer Story Consumer Story

- 77. Mobile Application Website Portal Flavored Oats My Diet Plan Myth Breakers Oats Recipes Benefits of Oats Download App Sign Up MYTH BREAKERS Myth 1: People need to starve when they are dieting No, In dieting people need to have healthy food. Dieting would make people heavier. Myth 2: Oats can be had only in breakfast Oats is an all-day food. It helps give you sufficient nutrition to carry out your day Myth 3: Saffola Oats has ‘Ajinomoto’ in it Saffola Masala Oats does not use ‘Ajinomoto’ as an ingredient ……… … .. Consumer Engagement Initiative: Diet Plan based on body type The Chilli Pepper The Pear The Apple Body type: Narrow Body type: Heavier Bottom Body type: Fat belly Calorie Requirement: 2000 ( 800 carbs,700 fat,500 protein) Calorie Requirement: 1500 ( 750 carbs,375 fat,375 protein) Calorie Requirement: 1500(600 carbs,525 fat,375 protein) Diet Plan: Olive oil, nuts, lean protein, Carbs: Fruits, Veggies Exercise: Heavy Weight Training Along with moderate intensity cardio Diet Plan: Complex Carbs: Whole grain cereals, Oats, beans & lentils Exercise: Aerobic Activities,30 minutes rigorous cardio along with strength training workouts for upper body Diet Plan: Complex Carbs: Whole grain cereals, Oats, Monosaturated Fats: Nuts avocado, Olive Oil Exercise: 40 Minutes cardio session to build body muscle Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead MYTH BREAKERS Key Insight Myths about harmful ingredients can be broken if clubbed with other popular myths to gain credibility Key Insight • Special website for Saffola Oats to Reinforce the positioning to Gen C • Facebook & YouTube ads linked to the Saffola Oats Website to promote this feature Consumer Story Consumer Story

- 78. Getting Featured Sponsored SMO cover pictures across categories: • Quick bites • Street Food • Pocket Friendly • Great Breakfasts Blogging It Articles on “Zomato: Official Blog ”about: Experiments with SMO, Healthy Eating Influencing them Tie ups with “Zomato Verified Reviewers” across major cities in India * SMO: Saffola Masala Oats Exec Summary His Insight Maggi Oats Our TG Website Zomato & POS Vendors Way Ahead Key Insight: Target Foodies across 21 cities in India and create positive brand perception to influence their choices when they make a purchase In Store Sampling Creative Retail Store Display Key Insight • In Store Sampling increases product trails and impulse purchase • For easily substitutable and similar products, it leads to decrease in sales of competitors • It is an effective way to boost product awareness and encourage sales • Creative Retail Display improve visibility of product in cluttered Oats Section Consumer Story Consumer Story

- 79. Key Insight To convert the Campaign into numbers, Saffola needs to provide it at vendors near the office areas, so that people try it and get habitual Select a corporate Hub. Example : DLF Cyber City Talk to local vendors and persuade them to make & sell Saffola oats. Give 2 cartons for trials Corporates start trying it because they miss meals. Oats become a snack Other Vendor start demanding the product Pilot Sales Representative of Marico would be going to the vendors Vendors approach Marico’s distributors or sales representatives *Based on primary research in DLF cyber city and Udyog Vihar Costing for Marico* Selecting 200 vendors in Cyber City & Udyog Vihar Giving 2 cartons per vendor as a promotion PSR’s cost 24*15*200= 72000 No. of trials by consumers 24*200= 4800 Cost per consumer trial Rs.15 Cost is just for promotional campaign and its scalable. The cost per consumer will reduce drastically once new vendors start asking for the product Costing for Vendor No. of Packets Price Per packet/plate Discount( as per Maggi) Final price Price of procurement 1 Saffola Carton 12 15 10% 162 Selling Price of 1 Saffola Carton 12 25 - 300 Profit Margin 85% Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead SMO Vendor Consumer Story Consumer Story

- 80. Story 2020 Exec Summary His Insight Maggi Oats Our TG Website Zomato Deal Vendors Way Ahead 2010 Saffola Oats launched – Targeted at regular users of oats in Indian market 2011 Catering to Indian Consumer’s palate Savory flavored oats- Saffola Masala Oats launched. Targeted at individuals looking for weight loss. 2014 Change the Target customer & Positioning Reasons: • 65% of Indian Population less 35 years • By 2020, average age in India will be 29 • Untapped Market Catch them on the run: Distribution network for on the run working professional to be strengthened by local vendor vendor tie ups Positioning Change: • Towards fitness over weight management • Round the clock healthy snack SMO successfully positioned as an easy to prepare, healthy snacking option 2016 2020 Target market & POS : • College goers : college canteens, vendor stalls • First jobbers and working professionals : office cafeteria, street food stalls With a strong distribution network through vendor tie ups, Saffola will expand its target customer base to 15-35 years old, including college goers and first jobbers. Thus, “Catch them young!” Saffola Masala Oats available as: Healthy- Fast food snack * SMO: Saffola Masala Oats Consumer Story Consumer Story

- 81. THANK YOU

Editor's Notes

- Task Sec A, Sec A+ Heading cause activity End with global Proof read

- The male grooming industry is widely regarded to be recession-proof. Spending patterns vary sharply from region to region.

- Instant Tan Deo Fragrance

- images

- Missing is no. of stores + website look + packaging look

- Task Sec A, Sec A+ Heading cause activity End with global Proof read

- Report by National Restaurant Association of India (NRAI) and Technopak Research reports ‘State of the Urban Youth, India 2012: Employment, Livelihoods, Skills,’ a report published by IRIS Knowledge Foundation in collaboration with UN-HABITAT. Research reports from Ashocham, Global Web Index, IAMAI, Nielson 2012

- ** Notes: "In the food category, there are serious food moments and frivolous food moments.” Consumers serious food moments which usually happen at breakfast, lunch or dinner.