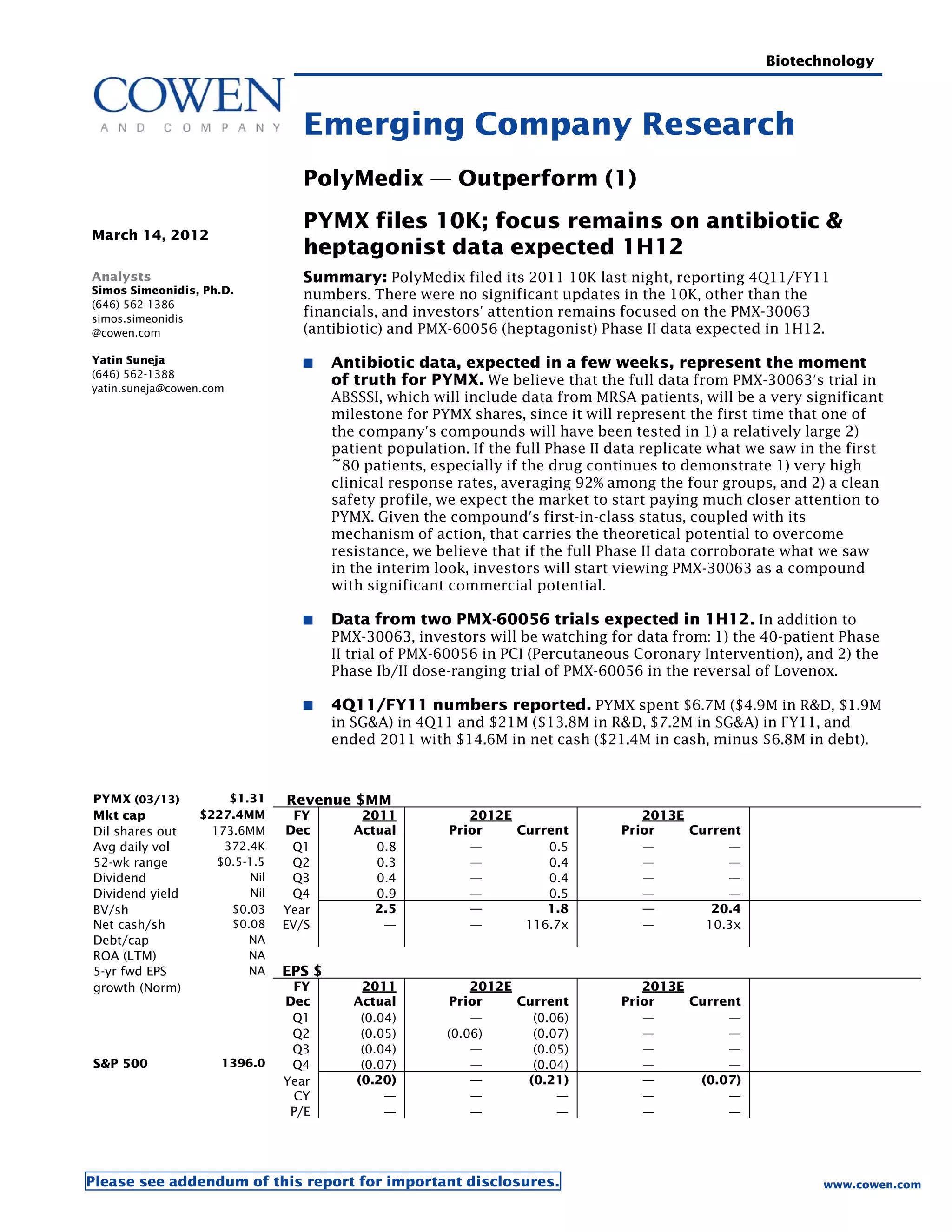

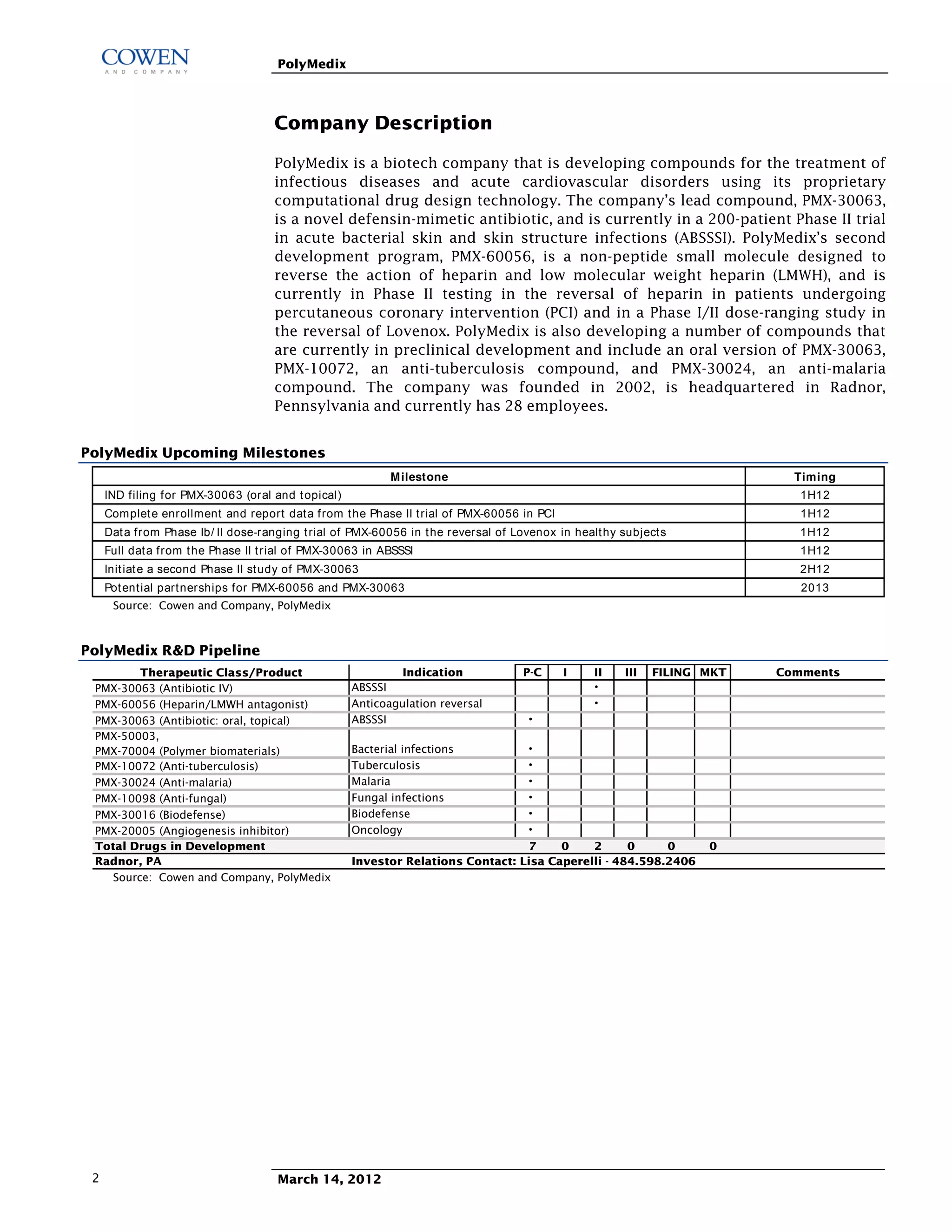

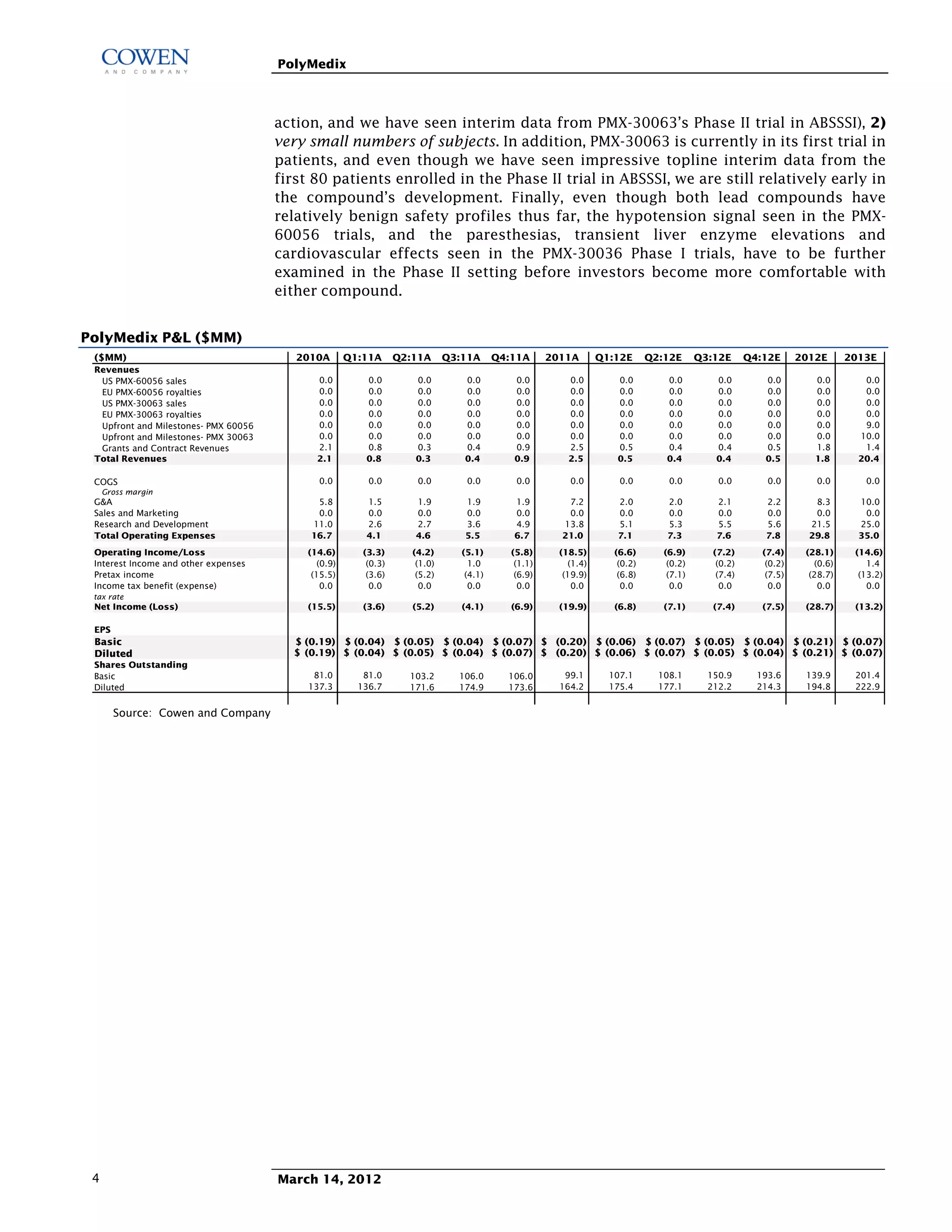

Polymedix is a biotechnology company focused on developing antibiotics and cardiovascular treatments, with its lead compounds PMX-30063 and PMX-60056 currently undergoing Phase II trials. The firm reported 2011 financials showing a net cash of $14.6 million and investments focused on R&D for antibiotic resistance solutions. Upcoming data from these trials is expected to significantly influence the company's market perception and potential commercial success.