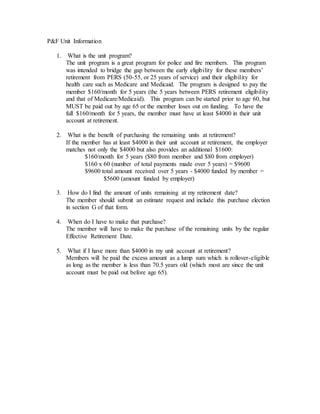

Police and Fire Unit Info

- 1. P&F Unit Information 1. What is the unit program? The unit program is a great program for police and fire members. This program was intended to bridge the gap between the early eligibility for these members’ retirement from PERS (50-55, or 25 years of service) and their eligibility for health care such as Medicare and Medicaid. The program is designed to pay the member $160/month for 5 years (the 5 years between PERS retirement eligibility and that of Medicare/Medicaid). This program can be started prior to age 60, but MUST be paid out by age 65 or the member loses out on funding. To have the full $160/month for 5 years, the member must have at least $4000 in their unit account at retirement. 2. What is the benefit of purchasing the remaining units at retirement? If the member has at least $4000 in their unit account at retirement, the employer matches not only the $4000 but also provides an additional $1600: $160/month for 5 years ($80 from member and $80 from employer) $160 x 60 (number of total payments made over 5 years) = $9600 $9600 total amount received over 5 years - $4000 funded by member = $5600 (amount funded by employer) 3. How do I find the amount of units remaining at my retirement date? The member should submit an estimate request and include this purchase election in section G of that form. 4. When do I have to make that purchase? The member will have to make the purchase of the remaining units by the regular Effective Retirement Date. 5. What if I have more than $4000 in my unit account at retirement? Members will be paid the excess amount as a lump sum which is rollover-eligible as long as the member is less than 70.5 years old (which most are since the unit account must be paid out before age 65).