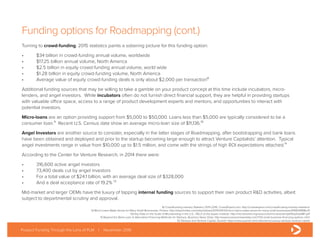

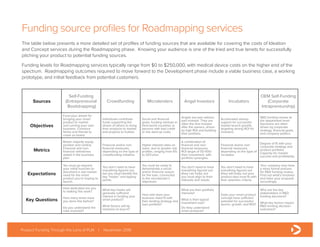

The document discusses product lifecycle management (PLM) and how it relates to acquiring funding for new product development. PLM provides a framework for mapping out activities and requirements throughout a product's lifecycle. This helps identify funding needs at different stages and potential sources of funding. Most new product launches and startups fail due to running out of cash at critical times. PLM can help avoid this by planning funding needs in advance. Early-stage funding sources include bootstrapping, crowdfunding, microloans and angel investors. Venture capital becomes more important later in development when larger funds are required. Understanding the appropriate funding options for each stage of development is key to a product's success.