This document provides an analysis of plastics production, demand, waste management and recycling data for Europe. Some key points:

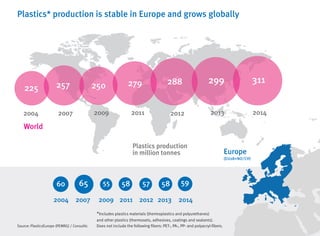

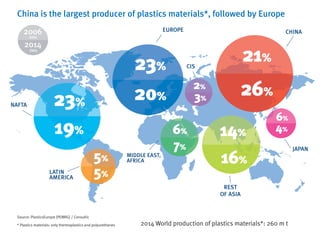

- Plastics production in Europe is stable while global production is growing, with China being the largest producer.

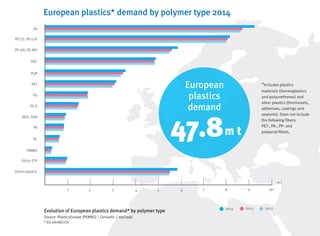

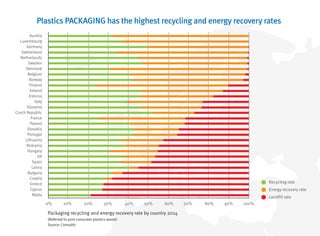

- Packaging, building/construction and automotive are the top markets for plastics in Europe.

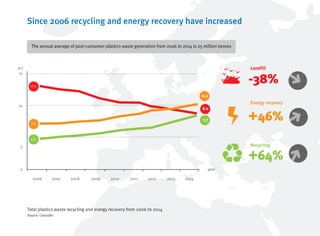

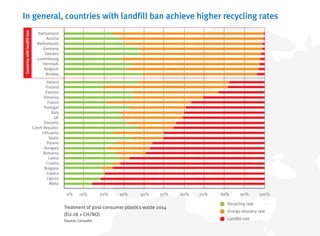

- Recycling and energy recovery of plastics waste in Europe has increased in recent years but 30% still goes to landfill.

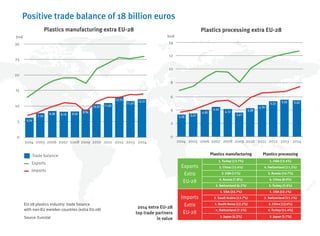

- Further increasing recycling and limiting landfilling can provide economic and environmental benefits for Europe.