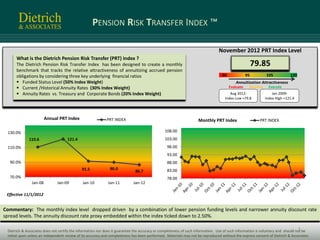

The Dietrich Pension Risk Transfer Index tracks the relative attractiveness of annuitizing accrued pension obligations by considering three key financial ratios: the funded status level, current and historical annuity rates, and annuity rates versus treasury and corporate bonds. In November 2012, the index level was 79.85, indicating annuitization should be monitored. The monthly index level dropped due to lower pension funding levels and narrower annuity discount rate spreads.