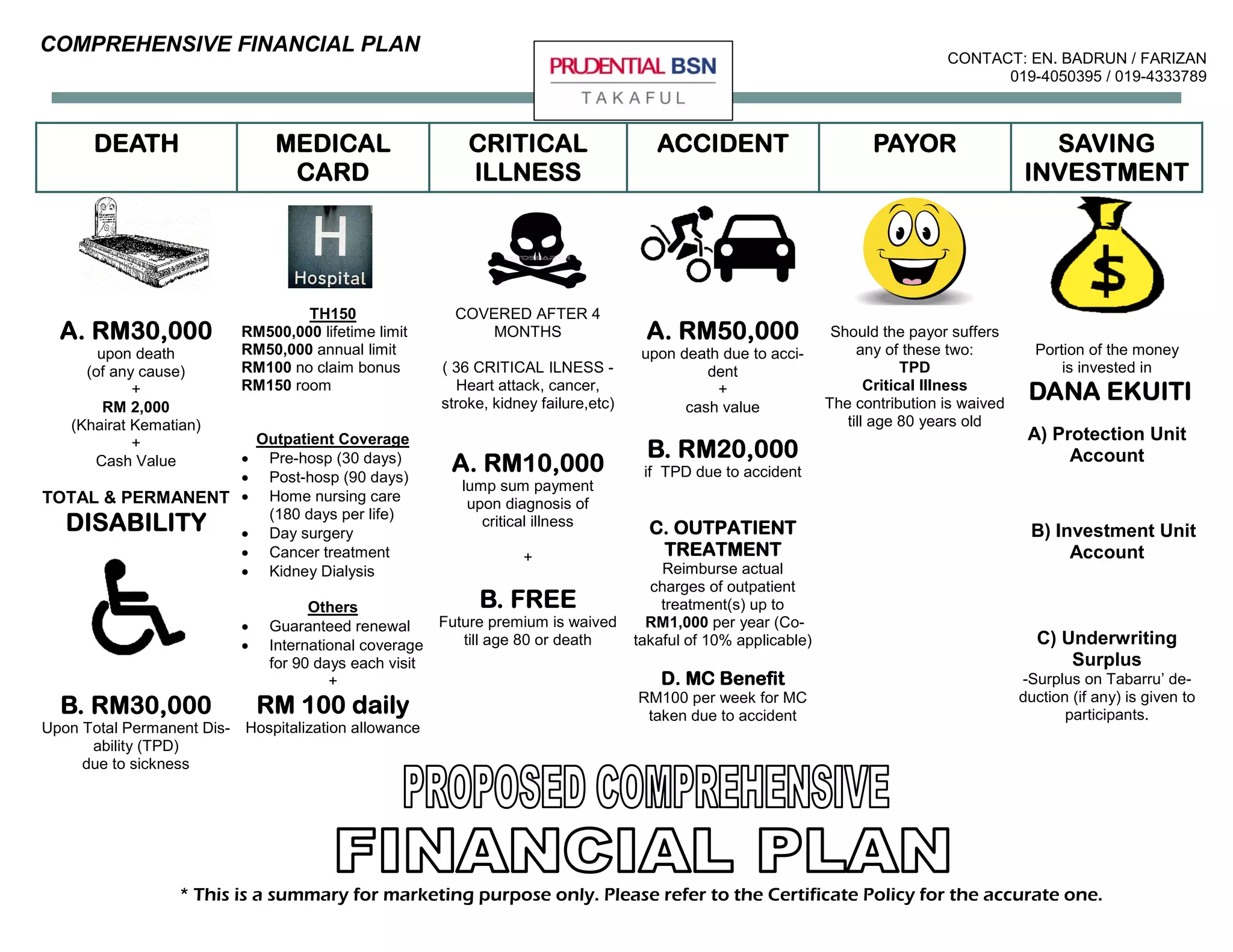

This document provides a summary of a comprehensive financial plan that offers various types of insurance coverage:

1. Death coverage up to RM30,000 as well as RM2,000 for khairat kematian. Medical card coverage up to RM500,000 lifetime limit. Critical illness coverage that covers 36 illnesses after 4 months.

2. Total permanent disability coverage of RM30,000 for sickness and RM50,000 for accidents. Critical illness benefits include lump sums of RM10,000 and waiver of future premiums until age 80.

3. Accident coverage includes RM50,000 for death, RM20,000 for TPD, and RM100 weekly hospitalization allowance. Outpatient treatment