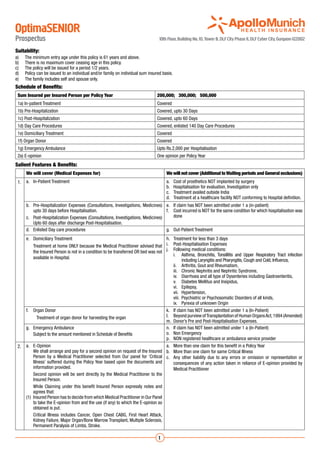

This document provides the prospectus for the OptimaSENIOR health insurance plan. It outlines the plan's suitability, schedule of benefits, salient features and benefits, exclusions, and waiting periods. Key details include:

- The plan covers medical expenses for inpatient treatment, pre-hospitalization, post-hospitalization care, day care procedures, and more.

- It has benefits like e-opinion and ambulance coverage up to specified limits.

- Several medical conditions and treatments have waiting periods of up to 36 months.

- Exclusions include cosmetic treatments, substance abuse, experimental treatments, and pre-existing conditions (among others).

- The basic sum insured ranges from Rs. 200,000