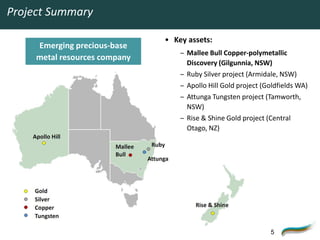

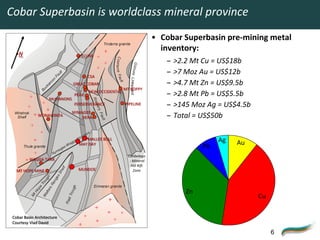

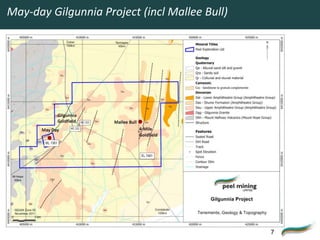

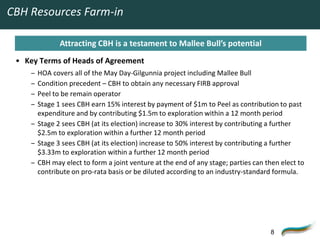

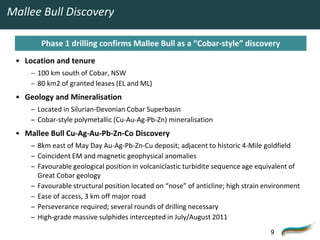

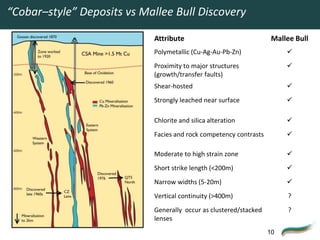

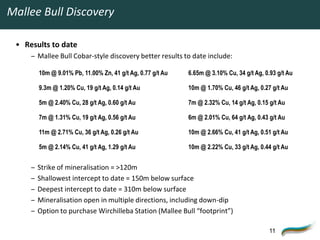

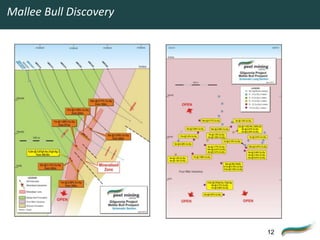

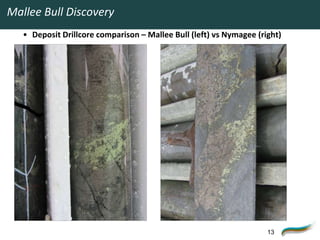

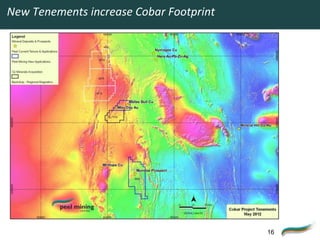

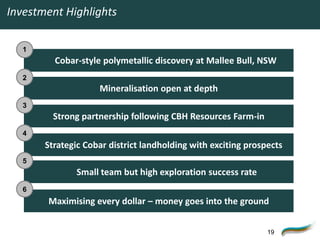

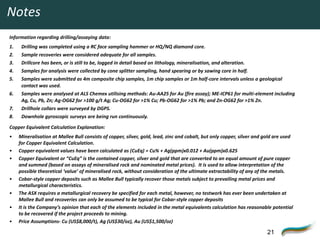

The document discusses the Mallee Bull copper-polymetallic discovery by Peel Mining Limited in New South Wales, Australia. It notes that the Cobar Superbasin region is a world-class mineral province that has historically produced over $50 billion worth of metals. Peel Mining's Mallee Bull discovery adds further evidence of the significant mineral endowment of the region.