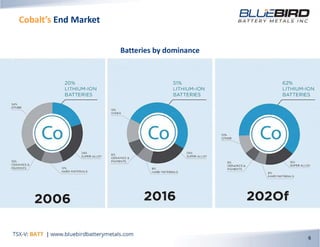

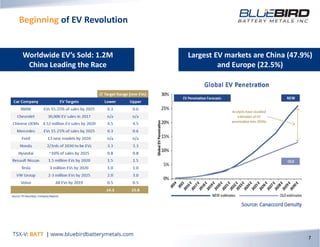

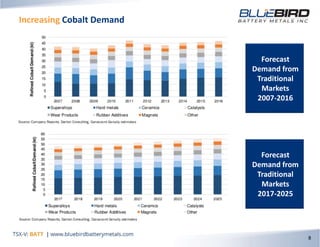

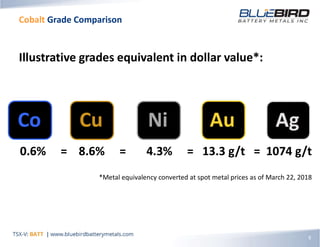

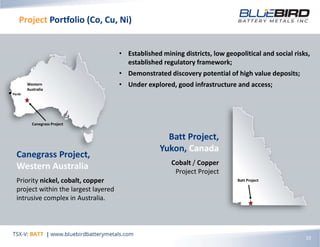

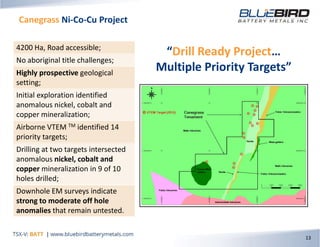

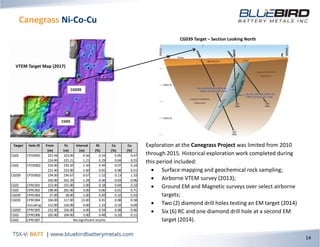

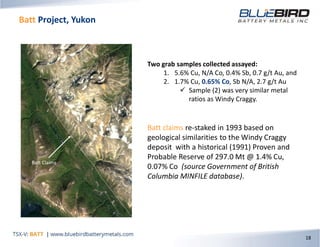

Bluebird Battery Metals Inc. focuses on the exploration and development of battery metals, particularly nickel, cobalt, and copper, in regions with low geopolitical risks. The management team has extensive experience in the mining and investment sectors, and they emphasize the growing demand for high-purity battery metals driven by the electric vehicle market. Their projects are drill-ready with promising exploration results in Australia and Yukon, Canada, indicating significant mineralization potential.