PAYABLES METHODOLOGY | MERU ACCOUNTING

Accounts payable and its management is a critical business process that allows an entity to effectively manage its payable obligations. Accounts payable is the amount owed by an entity to its vendors/suppliers for goods and services received. To elaborate, once an entity orders goods and receives them before paying for them, it should record a liability in its books of accounts based on the invoice amount. Accounts payable refers to this short-term liability owed to suppliers, vendors, and others. Once the vendor is paid for the unpaid purchases, the corresponding amount is deducted from the accounts payable balance. What is the significance of Accounts Payable and its management? Accounts payable and their management are critical to the smooth operation of any business entity. It is critical for any company because: It is primarily responsible for timely payment of the entity's bills. This is critical in order to maintain strong credit and long-term relationships with vendors. Only by paying invoices on time will vendors ensure an uninterrupted flow of supplies and services, which will aid in the systematic flow of business. A good accounts payable process ensures that there are no overdue charges, penalties, or late fees. The well-organized accounts payable process ensures that all invoices are tracked and paid on time. This will help you avoid missing payments and paying twice. It also enables businesses to better manage their cash flows (i.e. making payments only when due, using the credit facility provided by the vendor, etc.) Following a strict accounts payable process can help to reduce fraud and theft to a greater extent. Accounts payable balances must be recorded accurately for a company's financial statements to be complete and accurate. These payables must be handled efficiently and correctly. Process of Accounts Payable Every business will have an accounts payable department, and the structure will vary depending on the size of the company. The accounts payable section is organised based on the expected number of vendors and service providers, the volume of payments that will be processed over time, and the type of reports that will be required by management. A small entity, for example, with fewer purchase transactions, would require a basic accounts payable process.

Recommended

Recommended

More Related Content

More from Meru Accounting Private Limited

More from Meru Accounting Private Limited (20)

PAYABLES METHODOLOGY | MERU ACCOUNTING

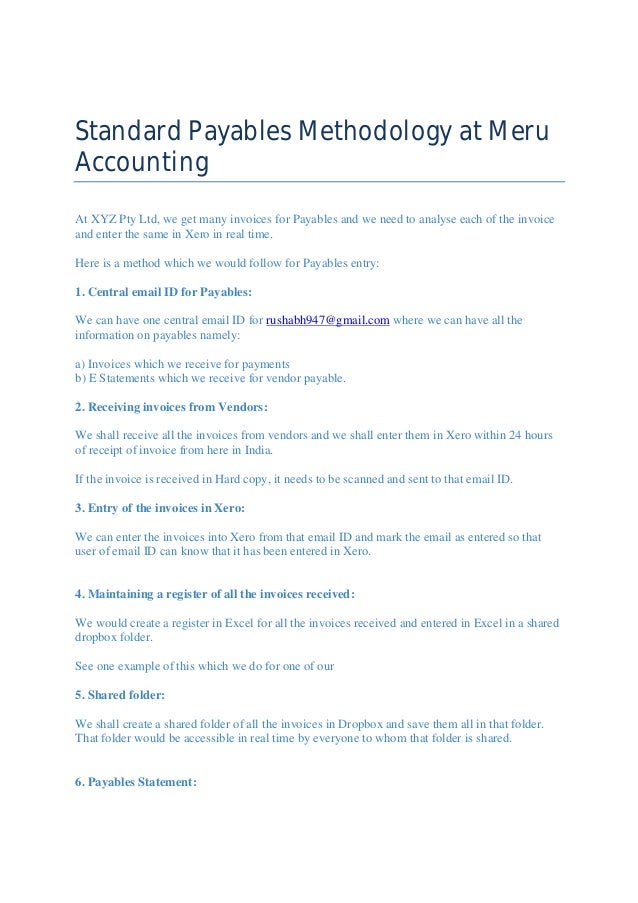

- 1. Standard Payables Methodology at Meru Accounting At XYZ Pty Ltd, we get many invoices for Payables and we need to analyse each of the invoice and enter the same in Xero in real time. Here is a method which we would follow for Payables entry: 1. Central email ID for Payables: We can have one central email ID for rushabh947@gmail.com where we can have all the information on payables namely: a) Invoices which we receive for payments b) E Statements which we receive for vendor payable. 2. Receiving invoices from Vendors: We shall receive all the invoices from vendors and we shall enter them in Xero within 24 hours of receipt of invoice from here in India. If the invoice is received in Hard copy, it needs to be scanned and sent to that email ID. 3. Entry of the invoices in Xero: We can enter the invoices into Xero from that email ID and mark the email as entered so that user of email ID can know that it has been entered in Xero. 4. Maintaining a register of all the invoices received: We would create a register in Excel for all the invoices received and entered in Excel in a shared dropbox folder. See one example of this which we do for one of our 5. Shared folder: We shall create a shared folder of all the invoices in Dropbox and save them all in that folder. That folder would be accessible in real time by everyone to whom that folder is shared. 6. Payables Statement:

- 2. We would generate a payable statement twice a week on Tuesdays and Fridays and send the same to ALL the concerned for review and their comments. The person approving the invoices can mark them as approved and send it for making cheques. 7. Vendor reconciliation: We shall prepare vendor reconciliation as and when we receive statements so that we can get update on missing invoice. 8. Location in invoices: Please ensure a location is used when it is stated on the invoice i.e. Healesville or Reservoir. If unknown please then leave blank. 9. Due dates of Invoice: Please put the correct due date in Xero. Most of the invoices you uploaded have the invoice and due date as the same day. If the date is unknown then please put in the due date as invoice date + 14 days.