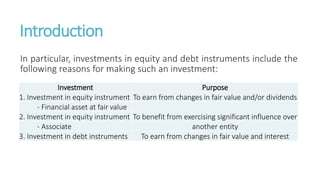

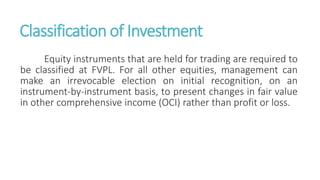

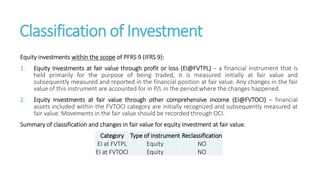

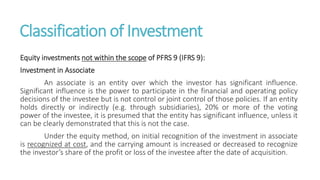

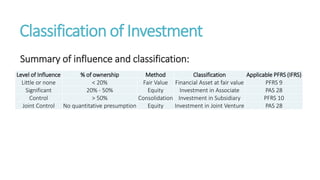

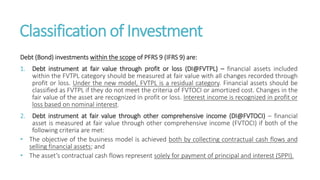

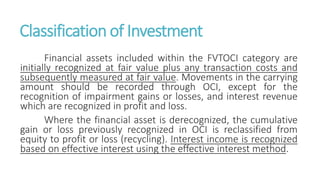

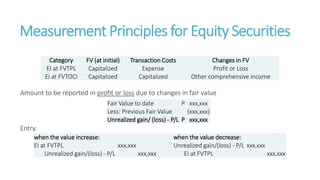

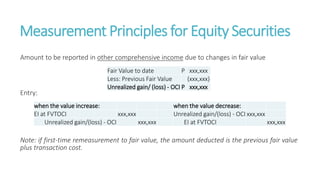

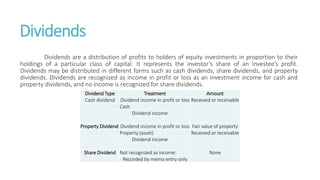

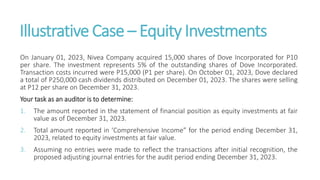

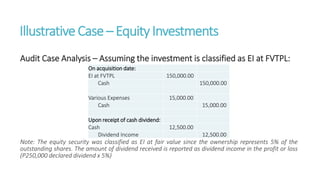

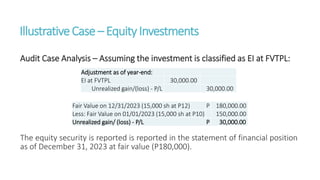

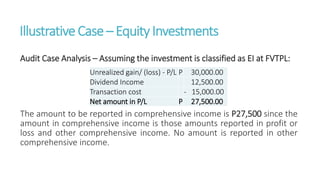

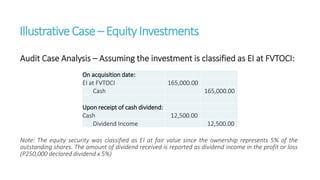

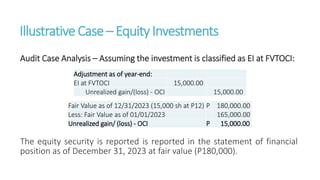

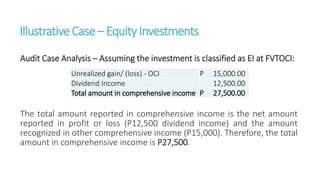

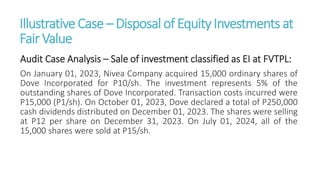

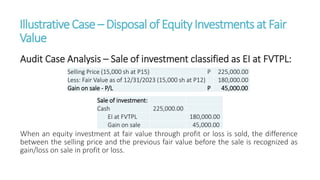

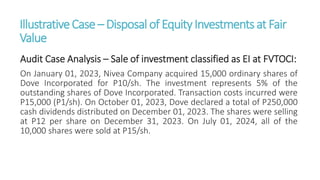

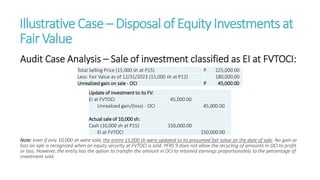

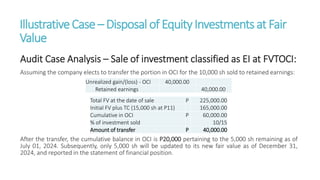

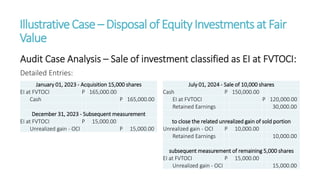

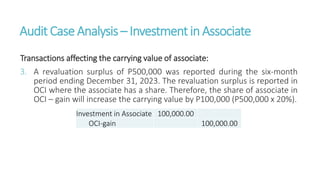

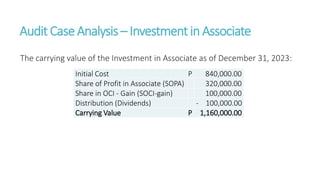

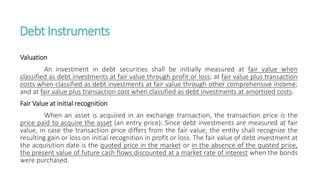

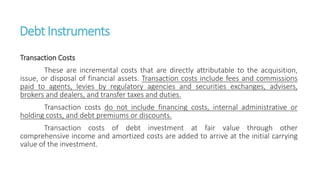

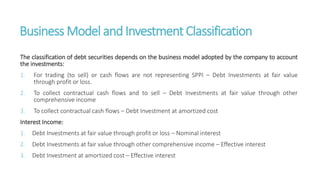

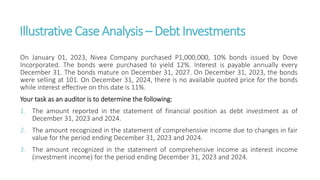

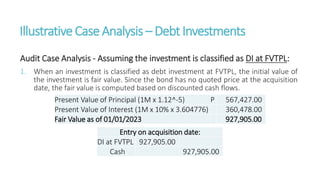

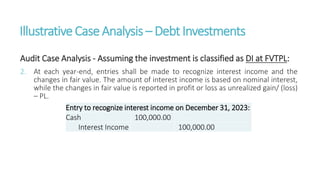

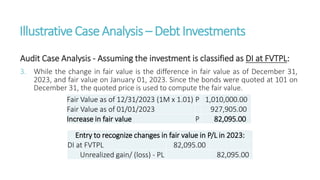

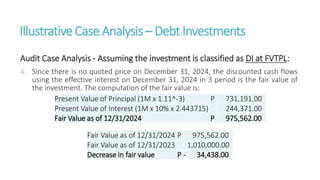

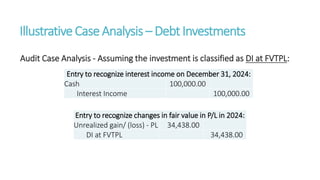

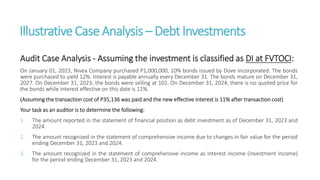

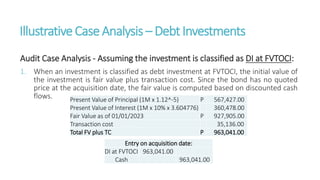

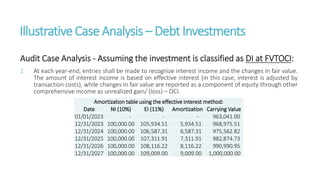

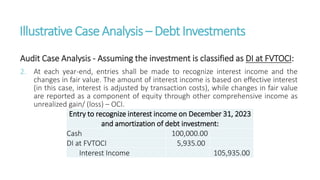

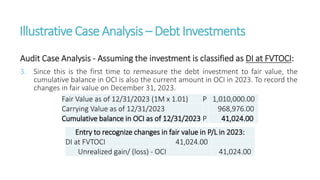

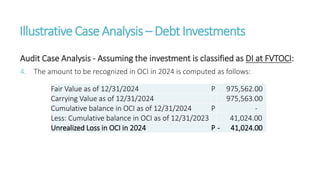

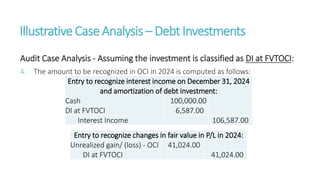

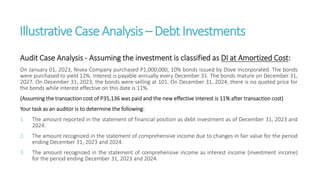

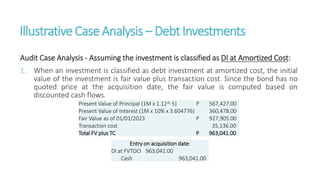

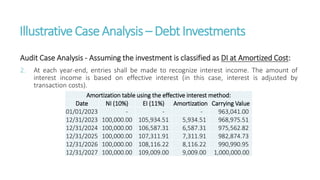

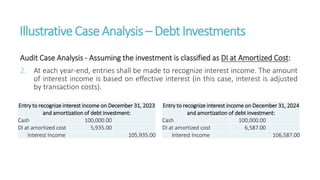

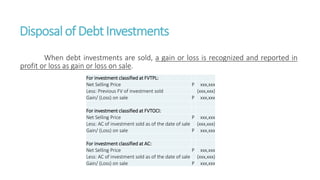

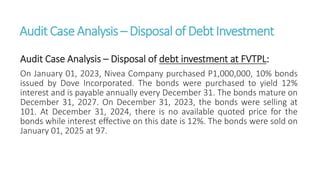

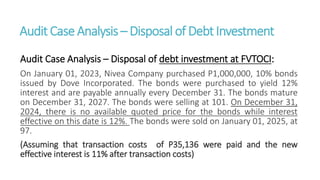

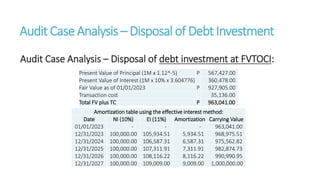

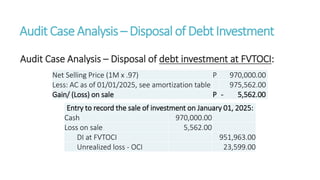

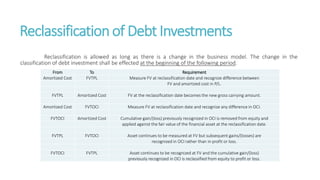

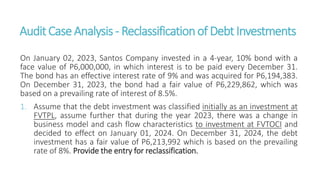

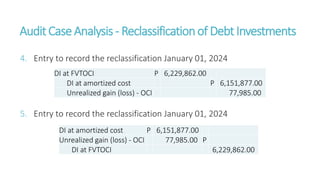

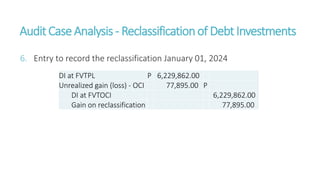

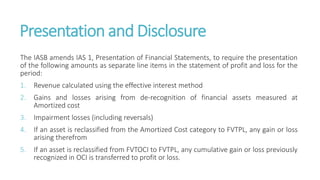

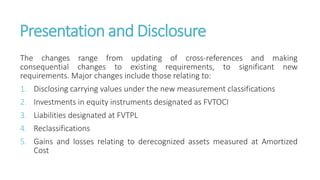

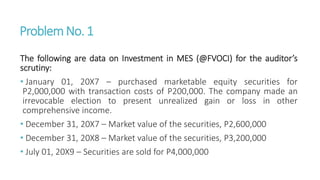

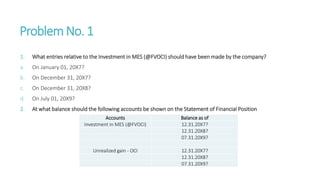

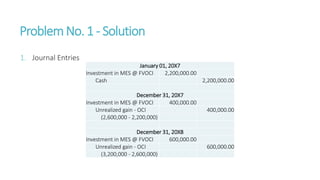

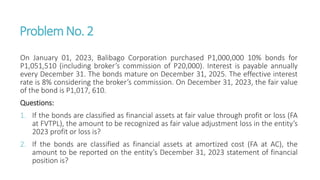

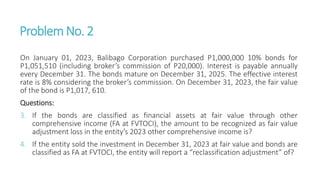

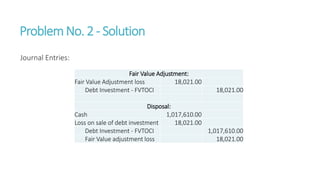

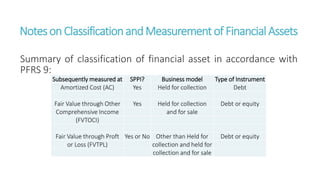

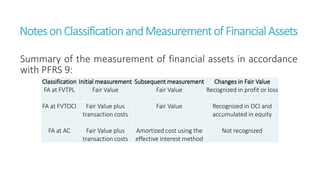

1. The document discusses the audit of investments, including the classification, valuation, and risks associated with different types of investments. Equity investments can be classified at fair value through profit or loss or other comprehensive income, while debt investments can be classified at fair value, amortized cost, or fair value through other comprehensive income.

2. Inherent risks of investments include improper valuation, incorrect recording of value changes, impairment issues, and incorrect accounting treatments. Control risks relate to authorization, segregation of duties, reconciliation, and valuation/classification policies.

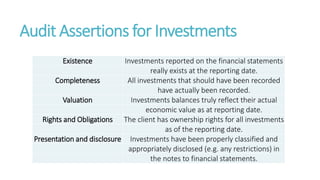

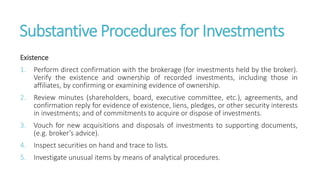

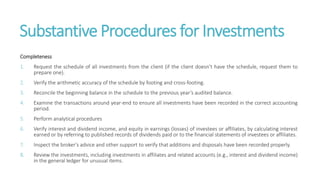

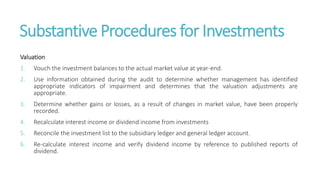

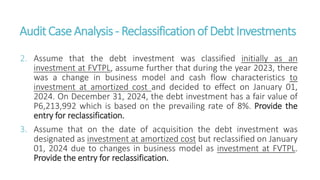

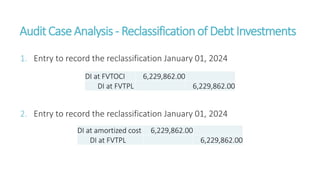

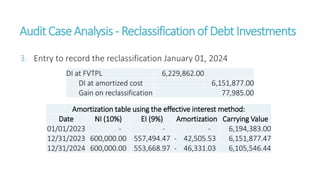

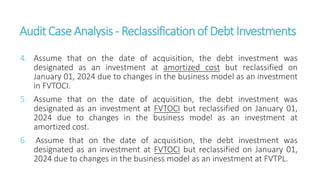

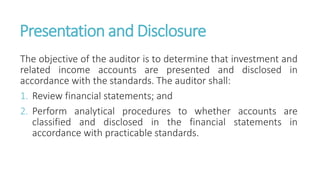

3. Audit procedures address existence, completeness, valuation, rights and obligations, and presentation/disclosure, including confirmation, examination of ownership evidence, analytical procedures,