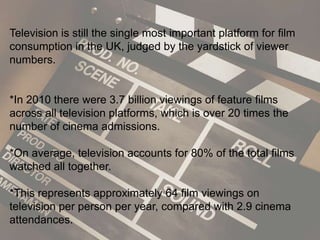

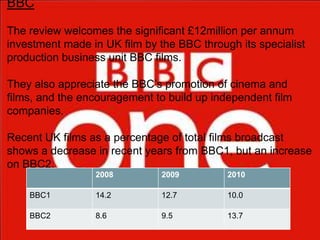

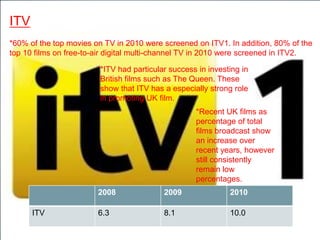

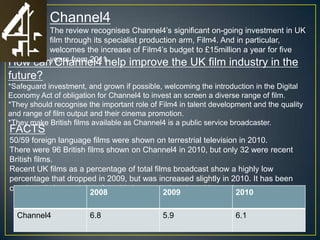

The document discusses the film industry in the UK and aims to improve support for British filmmakers. It summarizes the current state of the industry, including that television is the primary way films are viewed but broadcasters vary in their support of British films. The document recommends that major broadcasters like BBC, ITV, Channel 4, and Sky increase their commitment to screening and investing in British films. This would help nurture creative talent and build careers in the industry, benefiting both filmmakers and UK audiences.