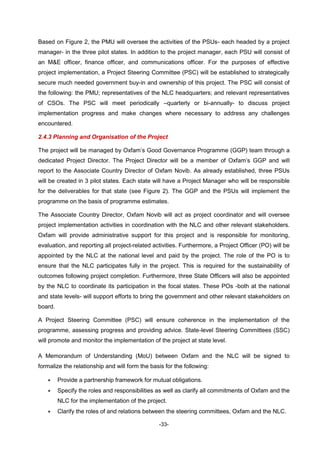

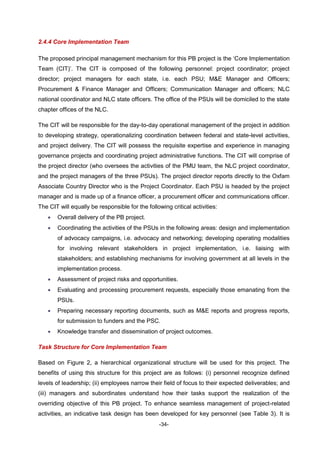

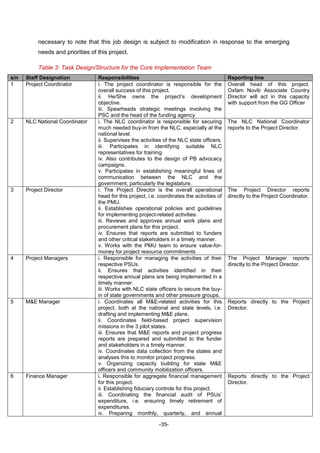

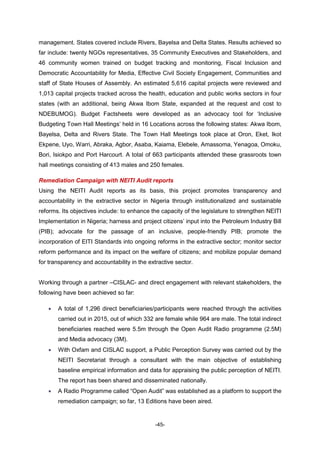

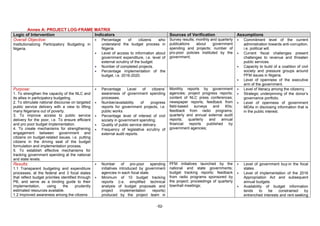

This document proposes a 5-year project to institutionalize participatory budgeting in Nigeria led by Oxfam in partnership with the Nigerian Labour Congress. It notes that despite Nigeria earning over $150 billion annually from oil revenues in the past 16 years, poverty has increased and budgeting is opaque with little public participation. The project aims to build capacity of civil society including the NLC on participatory budgeting, mobilize citizens, and implement a participatory budgeting cycle. It is hoped this will make budgeting more transparent, accountable, and oriented toward the needs of the poor. Key activities include training, public hearings, and enabling the media to cover budgets. Challenges include government resistance to sharing power and limited civic

![-17-

strongly propagated by the West, often did little to serve the interests of those that lacked the

effective purchasing power, namely, the poor.13

These solutions of the West (i.e., private sector ‘solutions’ to public sector ‘problems’),

emphasised strategic planning, performance measurement, accountability, results,

purchaser/provider split, contracting out and ‘doing more with less.14

These managerial tools

drawn from the corporate sector were transferred, sometime without much thought to the public

sector. This juxtaposition seemed to have been fraught with one major flaw; the public became

connected now to the State as “consumers with the ability to choose and complain [although]

not the ability to proactively shape services.”15

Result has been that the interests of the

powerless, the hard-core poor, the ethnic minority, the aged etc. got side-lined and the existing

democratic institutions, the electoral democracy, that got hijacked by the rich and the lobbyists

created no space for the marginalised. These emerging challenges started, for the first time, to

prompt many to see the limitations of electoral governance and to recognize the importance of

linking public administration, social equity, and ethics with citizen participation.16

There are now two billion people on earth who continue to remain poor and most alarmingly, the

numbers are increasing. An Oxfam report further noted that 62 people own more than half the

world. What is equally telling is that during the 1990s, many developing countries experienced

significant economic reversals or stagnation which has impacted negatively on the MDGs. The

Oxfam report An Economy for the 1%, shows that the wealth of the poorest half of the world’s

population has fallen by a trillion dollars since 2010, a drop of 38 percent. This has occurred

despite the global population increasing by around 400 million people during that period.

Meanwhile, the wealth of the richest 62 has increased by more than half a trillion dollars to

$1.76tn.

Many attribute this falling performance to weak governance institutions, entrenched corruption

and a post-colonial legacy of elitist public administration and indeed, under-developed human

capital (de Alcantara, 1998). It is, therefore, not so surprising that when the same market-

managerialist solutions of the West were applied to the developing countries that contained

serious systemic problems, the outcome was that many of these initiatives either failed to

produce any tangible results or yielded only marginal benefits. Furthermore, prompted by the

Bretton Woods institutions, many developing governments withdrew or decreased government

13

See, Strengthening Public Administration for the Millennium Development Goals: A Partnership Building Approach.

UN Committee of Experts. E/C.16/2004/5

14

Hood, c (1991) A Public Management for All Seasons? Public Administration, Vol. 69, Spring, pp. 3-19.

15

Corrigan, P. and Joyce, P. (1997) Five arguments for deliberative democracy, Political Studies, 48(5), pp. 947-969

de Alcantara, C.H. (1998) Uses

16

Esquith, S. (1997) John Rawls and the recent history of public administration. Journal of Management History, Vol.

3, No. 4, pp 328-341.](https://image.slidesharecdn.com/5270f3b2-7532-49f0-b282-320df40865b3-161029114413/85/Oxfam-NLC-Proposal-Final-Document-18-320.jpg)