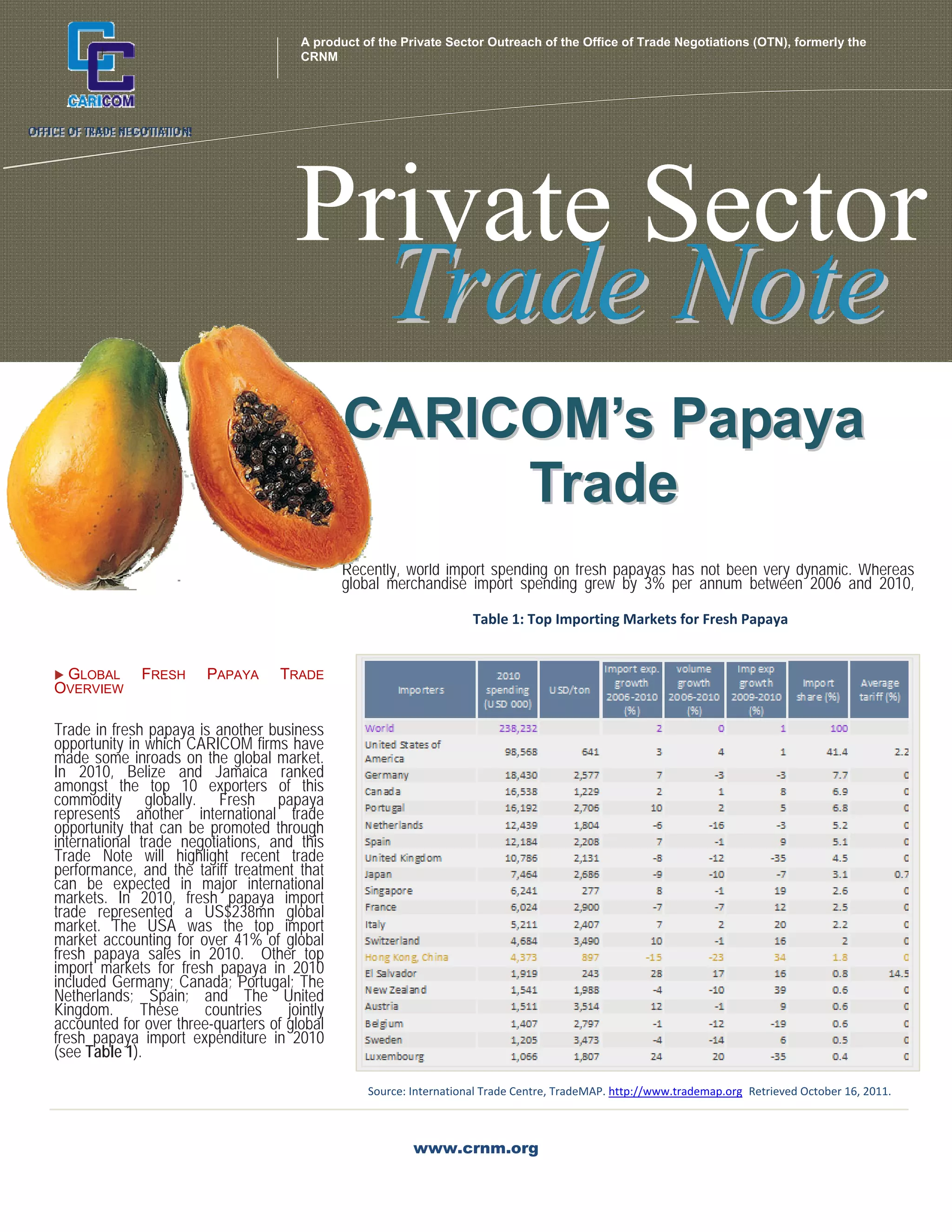

This document discusses trade in fresh papaya, an area where some CARICOM countries have had export success. It finds that while global fresh papaya import growth has been slow in recent years, some countries like Portugal have shown more dynamic growth. For CARICOM, Belize is the top exporter, accounting for 85% of regional exports in 2010, though its exports have contracted in recent years. Prices of CARICOM exports are generally higher than global averages, indicating potential inefficiencies. The largest import markets of the US and Canada offer opportunities, but CARICOM countries will need to improve competitiveness.