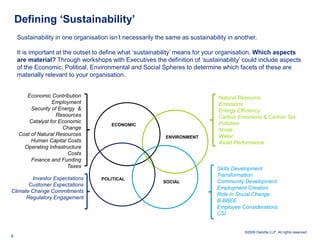

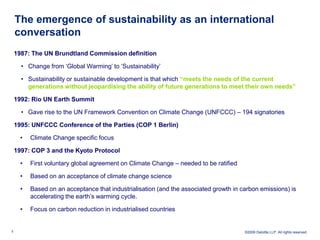

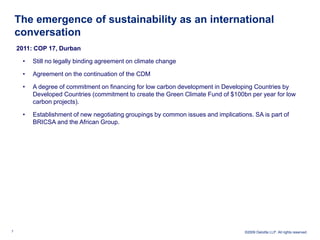

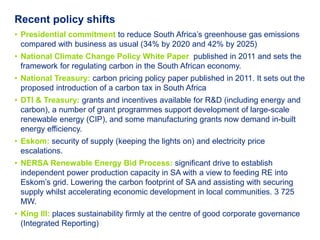

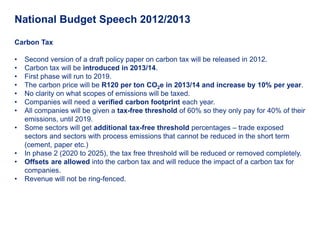

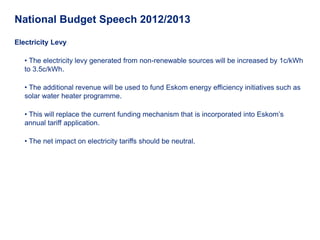

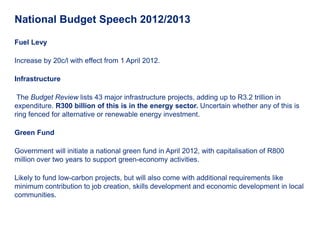

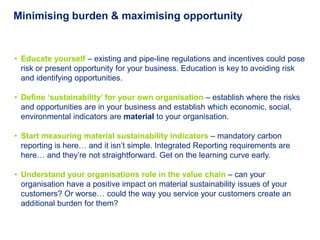

The document discusses the implications of sustainability and climate change for South African businesses, emphasizing the need for organizations to define sustainability in their context and monitor relevant indicators. It outlines the emergence of sustainability as an international agenda, key policy shifts in South Africa, and the introduction of the carbon tax as part of the national budget for 2012/2013. The presentation highlights the importance of engaging in policy-making, understanding supply chain dynamics, and integrating sustainability into corporate strategy to mitigate risks and leverage opportunities.