More Related Content

PPTX

Kim Larsen on State of Open RAN 2025 v5.pptx PDF

How to build high performance 5G networks with vRAN and O-RAN PDF

X-Haul: towards an integrated 5G transport network architecture PPT

Huawei telecom i+d 2010v4 PDF

PDF

Evolving to an open C-RAN Architecture for 5G PDF

PPTX

O_RAN.pptxklllkioouuuuyyyvvvvvvccccgtyyybb Similar to ORAN and NextGen xHaul TCO Analysis.pptx

PPTX

Cloud RAN for Mobile Networks_Final PDF

Seesion2_Arnab Das_Capgemini Engineering Open RAN India.pdf PPTX

PPTX

Mavenir: RAN Evolution for 5G PDF

Getting to the Edge – Exploring 4G/5G Cloud-RAN Deployable Solutions PDF

Beginners: TCO of a Mobile Network PDF

Aleyggfffhhfoggcccccccccccccjlvvcxddi.pdf PDF

A fresh approach to remote IoT Connectivity by Podsystem PDF

A fresh approach to remote IoT connectivity | by Podsystem PPTX

Global Telecom Equipment market update 19_9.pptx PDF

PLNOG 22 - Aleksandra Chećko, Robert Cieloch - 5G: wydatek czy oszczędność? PDF

Reducing RAN infrastructure resources by leveraging 5G RAN Transport Technolo... PDF

3GPP Standards for the Internet-of-Things PDF

5G: Why Wait? - 5G Observatory 2016 PDF

5G: Why Wait? - 5G Observatory 2016 PDF

IoT connectivity and solutions PDF

5G Network Managament for Inteligent Transport Systems PDF

PDF

LTE-M & NB-IoT Roadmap at LPWAN Conference 2018 PDF

Role and REvolution of Radio Acsses Networks Recently uploaded

PPT

HDTV and DTV Standards: The United States Opts for a Digital HDTV Standard PDF

कम्प्यूटर.pdf for all computer examination PPTX

Spacecraft Guidance Quick Research Guide by Arthur Morgan PPTX

Corporate AI Training to AI Enable a Company Workforce PDF

Digital Marketing Trends in 2026: AI, Data, Content & Future Growth PDF

Artificial Intelligence(AI) full Book.pdf PPTX

AI Bot Traffic Surge: Retail Fraud Threat for Age-Restricted Websites PDF

Industrial RFID Landscape for 2025 - Readers, Tags, Antennas, Printers, etc PDF

A Brief Introduction About Christopher Elwell Woburn PPTX

Why 2026 Could Be a Turning Point for Decentralized Exchanges.pptx PPT

Carole BirdCarole BirdCarole BirdCarole Bird.ppt PDF

The map to conquer linear algebra for IT engineer PDF

Navigating the Spectrum of Advanced AI – Agentic, Autonomous, and Autopoietic... PDF

250 Prompts - ChatGPT acting as your Assistant PDF

IAI-Unit1-notes useful............................. PPTX

AN Introduction to UNIX File System—An Approach PDF

Ai In Courts Ai in courts AI in court AI in court PDF

How Application Performance Monitoring Tools Are Used in Performance Testing PDF

Benefits of Using the IAC 500 Sensor for Ambient Conditions PDF

Huawei Datacom – How To Pass H12-892 On Your First Try ORAN and NextGen xHaul TCO Analysis.pptx

- 1.

O-RAN and NextGenxHaul

TCO Analysis

Dimas Noriega, Ricky Perry, Hendry Tong

Converged Access and Device Technology

Updated 9-13-19

Based on TCO worksheet ver. 2.61

© 2019 AT&T Intellectual Property. AT&T, Globe logo, and DIRECTV are registered trademarks and service marks of

AT&T Intellectual Property and/or AT&T affiliated companies. All other marks are the property of their respective owners.

- 2.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

2

Executive Summary

Target architecture

Disaggregated, Containerized RAN SW running

on

Centralized,

O-RAN compliant,

Non-proprietary, and

Pooled hardware

Pivot year Disaggregate LTE + 5G Disaggregate 5G only

2021 $220M $205M

2022 $193M $176M

2023 $113M $90M

Recommendations:

Issue RFP for FHG/CAS in 2019, targeting for 2021 deployment

•FHG PIZ in 4Q 2019 in NYC – already funded and in motion

•RFP FHG/CAS 4Q2019, Recommendation 1Q2020

•2020 TechDev, Validation, Certification, and FFA 4Q

•RoE Phase 1Q2021, L-PHY phase 1Q2022 (aim to accelerate L-PHY to 2021)

Issue RFI/RFP for whitebox O-DU/O-BBU in late 2019-early 2020,

targeting for 2020-2021 trial/PIZ and 2021-2022 deployment

•Drive ecosystem to develop O-RAN compliant O-DU/O-BBU product

•Start with incumbent vendors’ disaggregated HW and SW

•Trial O-RAN– start with O-CU & O-DU (Sub6) in 2020, then O-DU/O-BBU (sub6, mmW)

in 2021

Conduct a more thorough modeling for the whole NYC and LA

markets

Conclusions:

Lower TCO w/ Centralized O-RAN : 7 year cost saving $159M~$220M

for 4 markets

• Nationwide estimate: ~$350- $500M including extra cost on RAN SW, TechDev,

eCOMP.

Benefit mostly from BBU pooling (CAPEX) & Transport (OPEX) for OOR

markets

• Higher the site density, greater the saving

Sooner we pivot, higher is saving

Present Target

Based on 4 market (NYC, LV, ATL, SF)

- 3.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

3

RAN: (BBU / vBBU)

• BBU pooling in Urban/Dense Urban areas only

• DSS works when regardless if LTE is disaggregated or not;

• Only 5G BBU are subject to upgrade/replacement, after 5 years

placed in services

• Legacy LTE BBU write-off applied in case of LTE SW disaggregated

• E/// 5216, Nokia ABIA/ASIA.

• Newer BBU (E/// 6630, Nokia ABIL/ASIK) is re-deployable.

Transport

Capital Data Views:

• SIAD Types, cost, and logic are normalized across IR and

OOR averages.

• Data are rolled up into a market level view

• Output is based on RAN configuration and BBU capacity

modeled.

Network Cloud:

• Assume multi-tenancy/linear scalability supported in 2021

Key Assumptions and Parameters

2028 target ATL NYC LV SF

Smallcell sites per Macro site (Core) 4 7 5 7

Smallcell site per Macto site (non core) 3 3 3 3

vDU-vCU on WB BBU - E/// LTE SW cost mark up on BAU SWBO 50%

vDU-vCU on WB BBU - E/// 5G SW cost mark up on BAU SWBO 50%

vDU-vCU on WB BBU - Nokia LTE SW cost mark up on BAU SWBO 50%

vDU-vCU on WB BBU - Nokia 5G SW cost mark up on BAU SWBO 50%

Deployment start (Year) 2021

LTE disaggregated year 2029

5G50% take up rate 2024

Smallcell perMarco site mid-point year 2024

Macro -mmW % mid-point year 2024

densification 50% rate (smallcell mmW % mid-point year) 2024

% of Marco site deploying mmW (Core) - by 2028 30%

% of Marco site deploying mmW (non Core) - by 2028 10%

% of cRAN smallcell deployed mmW (Core) - by 2028 70%

% of cRAN smallcell deploye mmW (non Core) - by 2028 20%

- 4.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $13.2 M -$13.2 M -$10.7 M -$10.7 M

SF $32.9 M -$21.7 M -$15.7 M -$4.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $104.3 M -$83.6 M $220.0 M

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $13.2 M $46.7 M -$10.7 M $49.2 M

SF $32.9 M $66.3 M -$15.7 M $83.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $252.2 M -$83.6 M $368.0 M

4

Transport Savings Assumptions:

• OOR markets (e.g.: NYC, LV) have significant

saving opportunities w/ O-RAN arch.

• IR markets based on telco service MRC

o “Grey Dollar (Budget Savings)” Telco service

MRC

o “Green Dollar (Cost of Business)” Deployment

cost and LRIC (i.e. Depreciation, Tax,

Maintenance)

• Mobility realizes budget savings for IR by

moving to O-RAN

— ATL and SF realized $107M in budget savings

• IR Budget savings does not contribute to NPV

and IRR calculations.

Additional Savings view – With Gray $$$ included

7 year NPV Saving: O-RAN w/ both 5G and LTE Disaggregated

With out Mobility IR Gray $$$ Included

7 year NPV Saving: O-RAN w/ both 5G and LTE Disaggregated

With Mobility IR Gray $$$ Included

Compared to Present Mode of Operation

Note: results assumes 2x cost multiplier for HUB cost on C&I and

Materials for macro site compared to current HUB cost for cRAN site.

ATL-SF

Cost of Business

ATL-SF

Budget Savings

- 5.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

5

• RAN performance & reliability improvement due to

centralized scheduler , optimized mobility/layer

management, UL CoMP/Multi TRP, Intersite CA etc

• Potential saving for 1: many macro-cRAN mmW site

deployment (~$4M saving for 4 markets studied

assuming 2021 pivot)

• Inter site FR1-FR2 CA/DC is easier to implement

• Synergy with Edge Core, MEC

• RU-BBU remapping (carrier growth driven) made

easier

• Synergy in wireless/wireline transport convergence

and potential cost saving for wireline business

• Potential maintenance saving with more advanced

troubleshooting capability using FHG/CAS

The “Intangibles”…

Operation complexity in

• managing disaggregated BBU - lessons learned

from vEPC operation and D1D2 transition in

• RAN SW feature management in disaggregated CU

and DU

• Using ECOMP instead of vendor OSS

• Cost for geo-redundancy

Risk in:

• Incumbent vendors’ support for CPRI eCPRI

conversion on FHG

• Incumbent vendor’s support for disaggregated LTE

SW and DSS SW using non disaggregated LTE SW

• Readiness of O-RAN compliant Whitebox BBU

• CO/HUB’s reliability: 5-9 desired but may be difficult

to achieve?

Benefit Cost & Risk

- 6.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

6

What critical network capabilities are needed to realize the cost

saving?

1. Whitebox O-RAN compliant BBU (“O-BBU”)

• O-RAN support of AT&T ‘s WB concept

2. Incumbent vendors support RAN SW virtualization on WB O-BBU

• In case of LTE not disaggregated : support DSS with classical LTE and virtual 5G BBU

3. O-RAN compliant FHG/CAS product capable of converting CPRI to eCPRI

• RAN Supplier to provide Low-PHY software module

• Incumbent vendors’ continuous support for FHG/CAS

4. Tools to manage packetized transport network

• we already have such architecture and skillset

5. Efficient way to manage cRAN HUB planning and build-out

• organizationally we may need a dedicated team for this purpose;

• Lesson learned for Edge core build

Critical Enablers

- 7.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

7

FHG/CAS

How Do We Get There From Here?

2019

Explore & Drive

2020

Design and Trial

2021

Develop & Deploy

2022

Deploy & Optimize

2023

Expand & Scale

2H 1H 2H 1H 2H 1H 2H 1H 2H

O-DU/BBU

+ RAN SW

TechDev &

Internal

tools

Refine O-DU POR

Drive O-RAN WG6

roadmap

Initiate RAN roadmap

plan with

incumbents

Refine FH_G

POR

Issue RFP

Issue RFI/RPF

Refine RAN

roadmap

Define requirements

0-DU PIZ (Rel. 1)

(Sub-3, single server

pooling)

PIZ (RoE)

O-DU/CU FFA + limited

deployment

RoE FFA

LoPhy FFA

RoE

Deployment

LoPhy

Deployment

Scale Up

Funding /Planning for

FHG/CAS

Development for

FHG/CAS

Deployment for

FHG/CAS

Development for

O-DU/BBU

Deployment for

O-DU/BBU

Funding /Planning

for

O-DU/BBU

Continual support...................

PIZ

(LoPhy)

O-DU PIZ (Rel. 2)

(mmWave)

Optimize

Potentially: begin w/ Incumbent vendors’ O-BBU+disagg. SW, then transition to true mixed vendor

O-BBU + SW

O-CU PIZ

- 8.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

8

Scenario 1: dRAN/cRAN + mmW

RU

Round 2 - Scenarios Compared (2 & 3, 3-a as New)

Scenario 2: dRAN/cRAN + mmW AU Scenario 3 / 3-a: Class I O-

RAN pooling w/

incumbent BBU HW +

mmW AU / mmW RU

Circuit Switch (TDM) based Transport

FH Interface:

• LTE/5G Sub-6: CPRI;

• 5G mmWave: native eCPRI

mmW RU used

Scenario 4: O-RAN + mmW RU

xHaul: Packetized Transport Network

DU + CU containerized @ O-RAN class 2b poolin

FH Interface:

• FH_GW convert/aggregate CPRI to eCPRI for

• 5G mmWave: eCPRI native

xHaul: Packetized Transport Network

Incumbent vendors’ BBU @ class I pooling

3: mmW AU (integrated RU/DU) used

3-a: mmW RU used

Circuit Switch (TDM) based Transport

FH Interface:

• LTE/5G Sub-6: CPRI;

• 5G mmWave: native eCPRI

mmW AU (integrated RU/DU) used

New New

- 9.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

Appendix

…..

- 10.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

10

TCO Fiberwise Value (Preliminary)

TCO Cost: 7 year NPV starting year 2021

Cluster

O-BBU &

Pooling (LTE

disaggregated)

Transport Other total

ATL $13.2 M -$13.2 M -$10.7 M -$10.7 M

SF $32.9 M -$21.7 M -$15.7 M -$4.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $104.3 M -$83.6 M $220.0 M

Fiberwise (IR)

-$47 M to -$35M

$12M Saved

Non-Fiberwise Assumptions:

Dark Fiber estimate per site is $47.0K per site (F1 + F2)

• (Shared) F1 Feeder portion estimate $22K per site

o Splice work, Cable reinforcement, etc…

• (Mobility) F2 Drop to site estimate $25K per site

o F2 drop has to be built

Mobility Optics

• Gray optics

o CRAN Radio / BBU Gray optics ($84 10G ea, $459 25G ea)

o FHG 100G uplinks Gray optics ($1500 100G ea)

Fiberwise Assumptions:

Dark Fiber estimate per site is $25.3K per site (F1 + F2)

• F1 Feeder portion estimate $5.3K (FW UC reduction 85%)

o SFCM placement in FAP, No additional Spice work, No cable

reinforcement

• F2 Drop to site estimate $25K per site

o F2 drop has to be built

Mobility Optics

• DWDM Color optics

o CRAN Radio / BBU DWDM (ST) optics (Incr RRU $616 10G,

$241 25G ea)

o FHG 100G uplinks DWDM optics ($2K 100G ea)

o Passive Mux (assume per wave channel $375 ($12/32 waves)

Not Fiberwise (IR)

26%

Net Avg Per Pico

Site FW Savings: ~$13K

Net Avg Per Macro

Site FW Savings: ~$16K

Note: Mobility Fiber 2018 estimates are based on the affiliate

license program. Estimates provided by Historical CFAS Project

Data (Cecil Lara)

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU &

Pooling (LTE

disaggregated)

Transport Other total

ATL $13.2 M -$18.5 M -$10.7 M -$15.9 M

SF $32.9 M -$28.7 M -$15.7 M -$11.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $92.0 M -$83.6 M $207.7 M

- 11.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

11

Fiberwise Historical Data

CFAS Projects

(2019)

Fiber

Jobs Mobility (F2) Shared (F1)

$100 and $1K 3 $.0 M $.0 M

$1K and $5K 29 $.1 M $.0 M

$5K and $10K 106 $.4 M $.4 M

$10K and $25K 420 $3.4 M $3.6 M

$25K and $50K 272 $5.2 M $4.2 M

$50K and $75K 104 $3.8 M $2.5 M

$75K and $100K 33 $1.5 M $1.3 M

$100K and $500K 38 $2.5 M $3.1 M

> $1M 2 $1.0 M $1.9 M

Grand Total 1007 $17.9 M $17.0 M

76%Total Spend

$13.0 M

CFAS Projects (2019)

(F1)

Unit cost

(F2)

Unit Cost

Total

Unit Cost

$100 and $1K $0.3K $0.3K $0.6K

$1K and $5K $1.3K $2.1K $3.4K

$5K and $10K $3.8K $4.2K $8.1K

$10K and $25K $8.5K $8.1K $16.6K

$25K and $50K $15.5K $19.3K $34.8K

$50K and $75K $23.8K $36.3K $60.1K

$75K and $100K $38.4K $46.5K $84.8K

$100K and $500K $81.1K $65.7K $146.7K

> $1M $965.5K $483.0K $1,448.4K

Average Unit Cost $16.9K $17.8K $34.7K

Unit Cost

$60 K

Mobility

Note: Mobility Fiber 2018 estimates are based on the affiliate

license program. Estimates provided by Historical CFAS Project

Data (Cecil Lara)

PMO (IR)

Fiberwise (IR)

• Dedicated fibers (6 per Pico)

• No shared fiber asset

• Longer Time to market

• Builds on DaFi solution (F2 Fiber savings)

• F1 Fiber Savings (Splice, cable jobs)

• 85% less cost per unit

• Impacts 70% of the Mobility triggered

spend

Assumed

Averaged

Fiber Cost

$47 K

- 12.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

12

Overall:

• OOR markets (e.g.: NYC, LV) have significant saving

opportunities w/ O-RAN arch.

• Greater saving if LTE is also disaggregated ($20M more)

• Similar outcome is expected for other markets

RAN (BBU related):

• All markets have saving opportunities w/ O-RAN

architecture

• Higher the site density, greater the saving (NYC the

greatest)

Transport: (FHG, CAS)

• OOR has significant saving while IR markets have higher

cost

Others: (C&I, Services, NC, Utilities, maintenance, site Acq. Etc)

• Higher spending required to enable O-RAN vBBU, as expected

• Operational /Life cycle impact are not included

Results Summary (4 markets view)

7 year NPV Saving: O-RAN w/ both 5G and LTE virtualized

7 year NPV Saving: O-RAN w/ only 5G virtualized

Compared to Present Mode of Operation

Note: results assumes 2x cost multiplier for HUB cost on C&I and

Materials for macro site compared to current HUB cost for cRAN site.

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $13.2 M -$13.2 M -$10.7 M -$10.7 M

SF $32.9 M -$21.7 M -$15.7 M -$4.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $104.3 M -$83.6 M $220.0 M

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling

(LTE not

Disaggregated)

Transport Other total

ATL $18.3 M -$17.1 M -$11.6 M -$10.4 M

SF $40.4 M -$29.4 M -$16.6 M -$5.6 M

LV $21.1 M $44.0 M -$12.1 M $53.0 M

NYC $139.1 M $78.0 M -$49.2 M $167.9 M

Sum $218.8 M $75.5 M -$89.5 M $204.9 M

- 13.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

13

SW cost ~ $440M not accounted, default scenario: 2660 sites/39 hubs

TCO savings, 4 market scenario ($440 M SW charge not included) TCO savings extrapolation @ 16384 sites: expected savings > $350M

Network wide extrapolation @ 16384 cell sites, 240 Hubs

RAN (BBU related):

• All markets have saving opportunities w/ O-RAN architecture

• Higher the site density, greater the saving (NYC the greatest)

Transport: (FHG, CAS)

• OOR has significant saving while IR markets have higher cost

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling (LTE

Disaggregated)

Transport Other total

ATL $13.2 M -$13.2 M -$10.7 M -$10.7 M

SF $32.9 M -$21.7 M -$15.7 M -$4.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $104.3 M -$83.6 M $220.0 M

- 14.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

14

Cost saving reduces if OBBU Pivot is later:

(4 markets combined)

If start in 2021: $220M saving

If start in 2022: $193M saving $27M missed

If start in 2023: $113M saving $80M missed

$107M missed

(OOR market only: NYC, LV)

If start in 2021: $235M saving

If start in 2022: $208M saving $27M missed

If start in 2023: $144M saving $64M missed

$91M missed

Timing Sensitivity: Sooner we pull the trigger, higher is saving

Sooner we pivot, Greater the saving: 2021 ideal, 2022 latest.

TCO Cost: 7 year NPV starting year 2021

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $13.2 M -$13.2 M -$10.7 M -$10.7 M

SF $32.9 M -$21.7 M -$15.7 M -$4.5 M

LV $19.6 M $40.9 M -$11.1 M $49.4 M

NYC $133.6 M $98.3 M -$46.1 M $185.8 M

Sum $199.3 M $104.3 M -$83.6 M $220.0 M

TCO Cost: 7 year NPV starting year 2022

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $13.5 M -$14.2 M -$10.5 M -$11.1 M

SF $34.4 M -$23.8 M -$15.4 M -$4.8 M

LV $19.7 M $37.0 M -$10.7 M $46.0 M

NYC $136.0 M $70.4 M -$44.1 M $162.3 M

Sum $203.7 M $69.4 M -$80.6 M $192.5 M

TCO Cost: 7 year NPV starting year 2023

cluster

O-BBU & Pooling

(LTE

Disaggregated)

Transport Other total

ATL $14.1 M -$14.9 M -$16.2 M -$17.0 M

SF $35.2 M -$25.6 M -$23.8 M -$14.2 M

LV $19.9 M $34.0 M -$17.2 M $36.8 M

NYC $135.9 M $46.9 M -$75.7 M $107.1 M

Sum $205.1 M $40.4 M -$132.9 M $112.6 M

- 15.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

15

RAN SW Cost:

vendor support for O-RAN SW and

integration w/ O-BBU platform

(assuming 40~50% incremental cost on annual

SWBO)

TechDev & EMS Cost

• Internal IT cost to support O-BBU,

FHG/CAS platform

• Expect O-BBU/FHG/CAS are ECOMP/O-RAN

compliant, to minimize OSS cost and avoid

using supplier’s EMS

National Level Cost: shared among ALL markets per vendor

LTE not disaggregated/aggregated

o-BBU

FHG/CAS

$310 M / $400 M

o-BBU

$34.6 M

$12.4 M

- 16.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

16

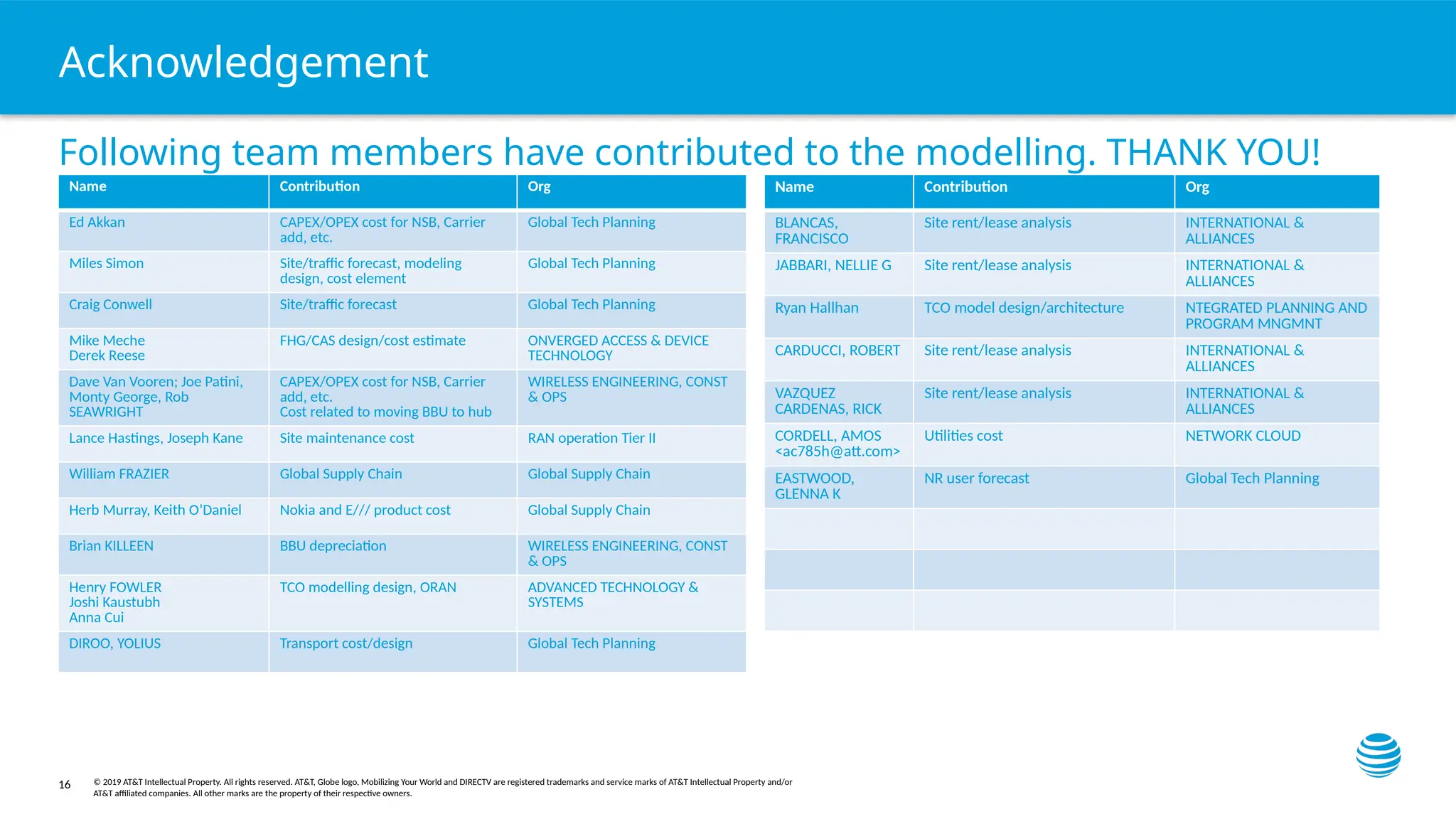

Following team members have contributed to the modelling. THANK YOU!

Acknowledgement

Name Contribution Org

Ed Akkan CAPEX/OPEX cost for NSB, Carrier

add, etc.

Global Tech Planning

Miles Simon Site/traffic forecast, modeling

design, cost element

Global Tech Planning

Craig Conwell Site/traffic forecast Global Tech Planning

Mike Meche

Derek Reese

FHG/CAS design/cost estimate ONVERGED ACCESS & DEVICE

TECHNOLOGY

Dave Van Vooren; Joe Patini,

Monty George, Rob

SEAWRIGHT

CAPEX/OPEX cost for NSB, Carrier

add, etc.

Cost related to moving BBU to hub

WIRELESS ENGINEERING, CONST

& OPS

Lance Hastings, Joseph Kane Site maintenance cost RAN operation Tier II

William FRAZIER Global Supply Chain Global Supply Chain

Herb Murray, Keith O’Daniel Nokia and E/// product cost Global Supply Chain

Brian KILLEEN BBU depreciation WIRELESS ENGINEERING, CONST

& OPS

Henry FOWLER

Joshi Kaustubh

Anna Cui

TCO modelling design, ORAN ADVANCED TECHNOLOGY &

SYSTEMS

DIROO, YOLIUS Transport cost/design Global Tech Planning

Name Contribution Org

BLANCAS,

FRANCISCO

Site rent/lease analysis INTERNATIONAL &

ALLIANCES

JABBARI, NELLIE G Site rent/lease analysis INTERNATIONAL &

ALLIANCES

Ryan Hallhan TCO model design/architecture NTEGRATED PLANNING AND

PROGRAM MNGMNT

CARDUCCI, ROBERT Site rent/lease analysis INTERNATIONAL &

ALLIANCES

VAZQUEZ

CARDENAS, RICK

Site rent/lease analysis INTERNATIONAL &

ALLIANCES

CORDELL, AMOS

<ac785h@att.com>

Utilities cost NETWORK CLOUD

EASTWOOD,

GLENNA K

NR user forecast Global Tech Planning

- 17.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

17

Objective: compare TCO on Present & Target Architecture

• Compare and Contrast BAU (Present) and O-RAN (target) mode

of operation

• Understand the difference of

• In-region vs Out-of-Region

• LTE-disaggregated and LTE-Not-disaggregated

WHY?

Potentially lower Cost in long term

due to:

• BBU Pooling gain

• Avoid costly BBU replacement

• Transport cost reduction w/

FHG/CAS

Introduce Open RAN competition and

reduce dependency on incumbent

vendors

Target architecture is:

Disaggregated, Containerized RAN SW running

on Centralized, O-RAN compliant,

non-proprietary and pooled Hardware

- 18.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

18

7 year NPV based

4 Markets: In-region: ATL, SF; Out-of-Region: NYC, LV

Urban and Dense urban sites (meet Fronthaul latency restriction)

LTE touched: LTE need to be collocated with 5G sub6 BBU to support Dynamic

Spectrum Sharing

Scope of Work

ATL NYC LV SF

CAPEX: material, radio, C&I, Site Acq.,

BBU/BBU upgrade, Services, Transport,

Network Cloud, RAN SW, TechDec

OPEX: Lease/Rent, Utilities, Transport,

Maintenance, RAN SW, BBU upgrade;

anything removed from site

319 cell sites, 7 hubs

46 average sites per hub

1536 cell sites, 12 hubs

128 average sites per hub

389 cell sites, 8 hubs

48 average sites per hub

420 cell sites, 7 hubs

53 average cells per hub

- 19.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

19

Scenarios

1 2 3A (LNV) 3B (LV) 4A (LNV) 4B (LV)

Macro Site dRAN, BBU at cell site w/ backhual same as 1 Whitebox (WB) DU at HUB Whitebox (WB) DU at HUB

Smallcell BBU at cRAN HUB w/ fronthaul same as 1 Whitebox (WB) DU at HUB Whitebox (WB) DU at HUB

Sub6 FH CPRI CPRI converted to eCPRI w/ FHG converted to eCPRI w/ FHG

mmW FH eCPRI eCPRI eCPRI eCPRI

virtual LTE NO NO NO YES, vCU at NC (MTSO) NO YES. vCU in vBBU at HUB

virtual 5G NO YES YES YES, vCU at NC (MTSO) YES YES. vCU in vBBU at HUB

Main focus is the Comparison of the scenario 1 and 4A&4B

- 20.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

20

O-RAN v0-DU platform supports Load balancing Optimization, load sharing

Traffic per TRP: a R.V. with generalized

gamma distribution, μ<< peak value

vo-DU a flow switching pooling capable

Node

oDU node abstracted model

• The traffic profiles for Macro, Micro,

DAS and indoor layers have distinct σ

(standard deviation) and μ (mean

value)

• oDU N TRPs access K DSP tiles

• Research ongoing to address flow

relocation / “failover”

CAS family

LLS_DU accelerator 1

vCU + UP Anchor + Crypto

LLS_DU accelerator L

gNB 1

gNB N

Packet

FH, TSN

64 x 100 Gbps Ethernet Switch

Packet

backhaul

DSP array 1, 1600

Mhz

DSP array K, 1600

Mhz

DSP ...

CM+Ethernet Switch

Load

Balancer

Load

Balancer

GPP1 GPP

NPU

CM+Ethernet Switch

UP

anchor

&

Crypt

o

UP

anchor

&

Crypt

o

DSP array 1, 1600

Mhz

DSP array K, 1600

Mhz

DSP ...

CM+Ethernet Switch

Load

Balancer

Load

Balancer

gNB 96

gNB

• AKRAINO SW stream

• POD baseline

• Dual TOR flow switching optimized

• (M+1) GPP/GPU servers, NvRAM

SSD memory

• K Acceleration blades “DSP array label”

may comprise DSPs, FPGAs, ASICs

INDOOR

DSP

array

PHY MAC/RLC CU_CP CU_UP

Layer PRB_LOAD

Scheduler

Load

RRC_CU PPS

Reference 100% 100% 256 16384

MACRO 40% 50% 64 2560

CRAN 15% 20% 16 768

DAS 30% 40% 48 1280

INDOOR 10% 15% 16 768

How?

Needs updating

- 21.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

21

vo-DU, o-RAN

compliant DU,

Akraino Stream

Vo-DU a pooling capable Node: a heterogeneous HPC/high reliability /real

time node

S/W

H/W Cloud stack (containers/VMs), OS, cloud m-plane

O-CU O-DU O-RU

Centralized CU/DU

(C-RAN)

CU/DU split Distributed

CU/DU

(D-RAN)

Blackbox

BBU

Multitude of deployment

models: CloudRAN,

CU-DU split,

dRAN on whitebox or DC

All RAN modules

Acceleration abstraction layer

Flexible

Orch.

Inventory,

Discovery,

Registration

Policy,

Metrics

Support 10,000s

of distributed

cloud sites

Multitude of silicon

accelerators

Common LCM

mechanisms

across VNF &

PNFs

Cloudification

Orchestration

- 22.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

22

TCO Polygon Area - Example

New York City

Core

Non-Core

Core

Non-Core

Atlanta

• Polygons were computed based on a Matlab program

• Core polygons sites closer together (Dense Urban)

• Non-Core polygons sites are more spread out (Urban)

• IR Existing Hubs in ATL are Telco COs, MTSOs

• OOR Existing Hubs In NYC are Macro Sites and MTSOs

• OOR Telco COs are explored as Candidates Hubs

2,693 10,323

Polygon

Core

Macros

per hub

Hubs Core Pico

to Macro

Non-Core

Macro

per hub

Non-Core

Hubs

Non-Core

Pico to

Macro

Total

Macros

Total

Picos

Atlanta 60 1 4 48 6 2 348 816

San Fran 132 1 7 96 3 3 420 1788

New York 256 2 7 128 10 3 1536 6656

Las Vegas 95 1 5 42 7 2 389 1063

(4) Markets Polygon Assumptions

Model Assumptions still under review with FNP

Existing Hubs

Telco COs

Possible

New Hubs

- 23.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

FHG and CAS: RoE/Low PHY

LTE

NR NR

LTE

NR NR

Tower HUB

RoE (Radio over Ethernet)

• CPRI over ethernet using 1914.3 standard

• Tunneling Mode

• Line Code Aware

• Structure Aware

Low Phy in FHG

• Convert CPIR to eCPRI

• Functional 7.2x split from O-RAN Standard

Tower HUB

ROE

TSN

Ethernet

5G BBU

CPRI

eCPRI

5G BBU

5G BBU

5G BBU

5G BBU

4G BBU

ROE

TSN

FHG WB

FHG WB

CAS WB

LPHY

TSN

Ethernet

TSN

FHG WB

FHG WB

CAS WB

TSN

5G BBU

5G BBU

vDU

CPRI

eCPRI

eCPRI

CPRI

eCPRI

- 24.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

24

AT&T CAS Solution with RoE

CAS Cellsite (ROE)

CAS Aggregation

CAS Distribution (ROE/L-PHY)

Macro/Micro Cellsite

CRAN HUB/CO

mmW

LTE

LTE

mmW

LTE

LTE

mmW

LTE

LTE

Macro1 Macro2 Macro3

mmW

LTE

LTE

mmW

LTE

LTE

mmW

LTE

LTE

Macro4 Macro5 Macro6

mmW

LTE

LTE

mmW

LTE

LTE

mmW

LTE

LTE

Macro7 Macro8 Macro9

BBU

BBU

BBU

BBU

BBU

BBU BBU

BBU

BBU

BBU

BBU

BBU

Ethernet

Dark Fiber

SIAD/MSN

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS(RoE/LPHY)

CAS CAS CAS CAS CAS CAS CAS CAS CAS

CAS CAS CAS CAS CAS CAS CAS CAS CAS

vDU

vDU

vDU

vDU

vDU

Pending update from Mike M.

- 25.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

25

FHG Transport Architecture

- 26.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

26

FHG/CAS Timeline

- 27.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

27

Transport Assumptions

Capital Data Views:

• SIAD Types, cost, and logic are normalized across IR and

OOR averages.

• Data are rolled up into a market level view

• CapEx (one time cost) and Opex (reoccurring monthly

cost) are considered

• Output is based on RAN configuration and BBU capacity

modeled.

High Level Assumptions:

Cost:

• Existing HW (i.e. SIADs, DaFi..) -

Based on collaboration with FNP

• New HW (i.e. FHG/CAS, vDU..) –

Based on equivalent solutions

and Vendor quotes

Deployment:

• Existing HW based on current

PMO deployment strategies.

• New HW based Target

Architecture (i.e. aggregation

Hierarchy, solution density,

technology strategy)

Hardware:

In region:

• Ethernet Backhaul based on

deployment cost and Long

Range Incremental Cost (LRIC)

“Real Green $$”

• Fiber based on AT&T Fiber

License estimates and calculated

LRIC

Out of Region:

• Ethernet Backhaul based on 3rd

party telco averaged pricing data

from NAM

• Fiber based on 3rd

party

averaged pricing data from NAM

Transport Cost:

Base Line

• PMO - dRAN for Macro and cRAN

for Pico

• Macro SIAD upgrade triggered

by mmW

• Macro Transport is 1Gbps

Target Architecture

• FMO – Macro and Pico are cRAN

(Fronthaul)

• xHaul fronthaul solution

comparison include Fronthaul

Gateway (FHG), DWDM, Fiber,

virtualized and Non Virtualized

BBU/DU

Solution Comparison

• Maximum OpEx savings with least amount of Capital

spend

• Leverage fiber wise strategies (IR) for least amount of

OSP Impact

• Leverage resource sharing (i.e. Backhaul, HW etc.) to

optimize cost

Analysis Strategy:

- 28.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

28

Transport OOR OpEx Savings Example

SIAD

SIAD

SIAD

MTSO

CO

MSN

CO

CO

Ethernet

BBU

BBU

BBU

RRU

RRU

RRU

1Gbps

Hub

SIAD

BBU

BBU

BBU

MTSO

MSN

CO

CO

Ethernet

RRU

RRU

RRU

FH Fiber

2Gbps

Hub

SIAD

MTSO

MSN

CO

CO

Ethernet

RRU

RRU

RRU

1Gbps

vDU

POD

dRAN

3x 1G BH = $9K per month

12 Mth * $9K = $108K per year

cRAN BBU Hub

3x fiber FH = $250 per month

12 Mth * $250 = $3K per year

1x 2G BH = $5K per month

12 Mth * $5K = $60K per year

FH $3K + BH $60K = $63K per year

O-RAN vDU Hub

3x fiber FH = $250 per month

12 Mth * $250 = $3K per year

1x 1G BH = $3K per month

12 Mth * $3K = $36K per year

FH $3K + BH $36K = $39K per year

Distributed Ran (dRAN)

• Point to Point architecture

• Back Haul to each site

• BBU and SIAD at each site

Centralized RAN (cRAN)

• Point to Point architecture

• Shared Back Haul at Hub

• Shared SIAD at Hub

• $45K per year OpEx savings

• 42% OpEx reduction

Open RAN (O-RAN)

• Point to Point architecture

• Shared Back Haul at Hub

• Shared BBU and SIAD at Hub

• $72K per year OpEx savings

• 64% OpEx reduction

Backhaul

Backhaul

Fronthaul

FH Fiber

FH Fiber

1Gbps

1Gbps

FH Fiber

FH Fiber

FH Fiber

Backhaul

Fronthaul

Share SIAD and

Backhaul

Share DU, SIAD

and Backhaul

- 29.

Presentation title here—editon Slide Master

© 2019 AT&T Intellectual Property. All rights reserved. AT&T, Globe logo, Mobilizing Your World and DIRECTV are registered trademarks and service marks of AT&T Intellectual Property and/or

AT&T affiliated companies. All other marks are the property of their respective owners.

29

Gray vs Green $$: Explained

$100 LRIC

AT&T Mobility

Pays: MRC

AT&T Telco

Transport

(Service)

Transport Up

speed (Service)

AT&T Bank

Suppliers,

Labor, Tax,

Maint…

$1K Capex

$23K Capex

Cost of

Business

Gray Dollars

Inter Org Transfer

$2K MRC

AT&T Mobility

Pays: MRC

OOR Telco

Transport

(Service)

Transport Up

speed (Service)

AT&T Bank

Green Dollars

$10K MRC

Capex $0

(included in MRC)

In Region (IR) Out of Region (OOR)

Upgrade Upgrade

Budget

Budget

Expense Expense

Revenue less

(Cost of Business)

OOR Telco

LRIC – Long Term Incremental Cost

MRC – Monthly Reoccurring Cost

Editor's Notes

- #8 Target architecture : Disaggregated, Containerized RAN SW running on Centralized, O-RAN compliant, Non-proprietary, and Pooled hardware