In today’s fast-paced financial environment, accuracy, speed, and transparency are critical. This presentation explores how Oracle Account Reconciliation Cloud Service (ARCS) with Transaction Matching transforms traditional reconciliation processes into streamlined, automated, and audit-ready workflows.

Presented by April Sharee, Senior EPM Consultant at Datavail, this session walks through how ARCS Transaction Matching validates ERP data against FCCS, reduces manual effort, and improves close control.

Key Topics Covered:

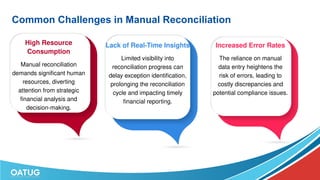

Why ARCS for Data Validation: Automate high-volume reconciliations, reduce manual errors, and improve close timeliness.

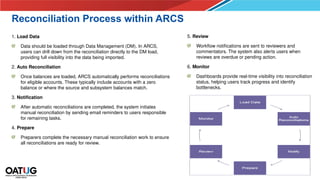

“Day in the Life” Workflow: From data load to auto-reconciliation, notifications, preparation, review, and dashboard monitoring.

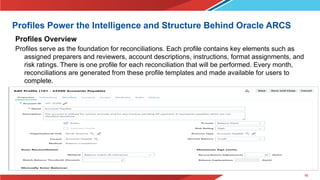

Profiles for Control: Standardize reconciliation formats, risk ratings, and ownership to scale monthly reconciliations efficiently.

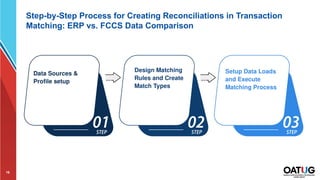

Designing Matching Logic: Build match types and rules for common scenarios like cash, AP, and AR reconciliations.

ERP ↔ FCCS Validation: Ensure data consistency with drill-through capabilities and exception handling.

Governance & Visibility: Use dashboards, alerts, and workflows to track bottlenecks and ensure compliance.

Benefits of Oracle ARCS Transaction Matching:

Real-time visibility into reconciliation status

Automated exception detection

Reduced audit preparation time

Improved financial close accuracy and speed

Whether you're a finance leader, controller, or EPM professional, this presentation will help you understand how to modernize your reconciliation process using Oracle Cloud EPM tools.

About Datavail: Datavail is a trusted Oracle partner with deep expertise in EPM Cloud implementations. Their consultants bring years of experience in architecting and optimizing ARCS, FCCS, and Narrative Reporting solutions tailored to enterprise needs.

Watch this session to learn how to:

Eliminate manual reconciliation bottlenecks

Improve audit readiness

Enable faster, smarter financial closes

📎 Watch the full presentation here: https://www.datavail.com/resources/oracle-arcs-transaction-matching-for-data-validation/