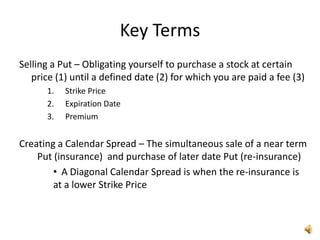

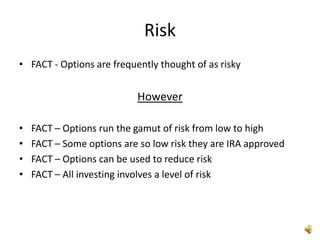

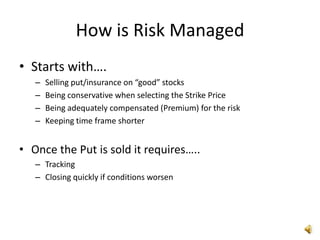

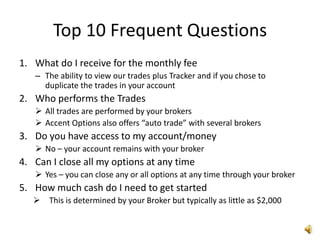

This document provides information about two programs for generating monthly income through options trading: the Shadow Program and the Mirror Program. The Shadow Program allows viewing trades at month end for free, while the Mirror Program provides same-day trade notifications, a daily tracker, and costs $100 per month. The document discusses the background and goals of Clair and Heidi Wheeler, who have been investing for over 30 years and actively trading options for several years. It outlines four types of option trades and defines key terms. Finally, it reviews the programs, answers frequent questions, and provides additional resources for learning about options trading.