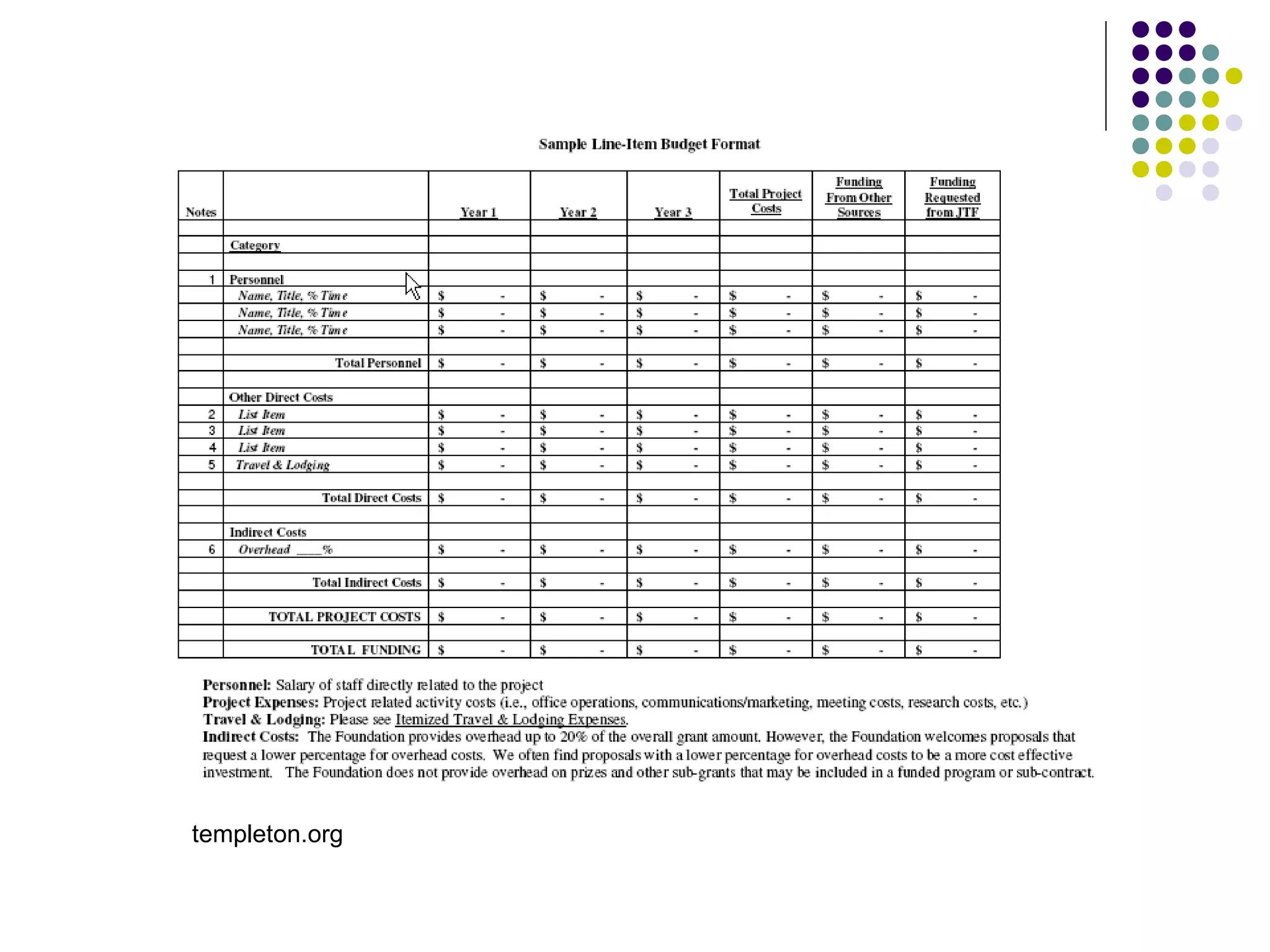

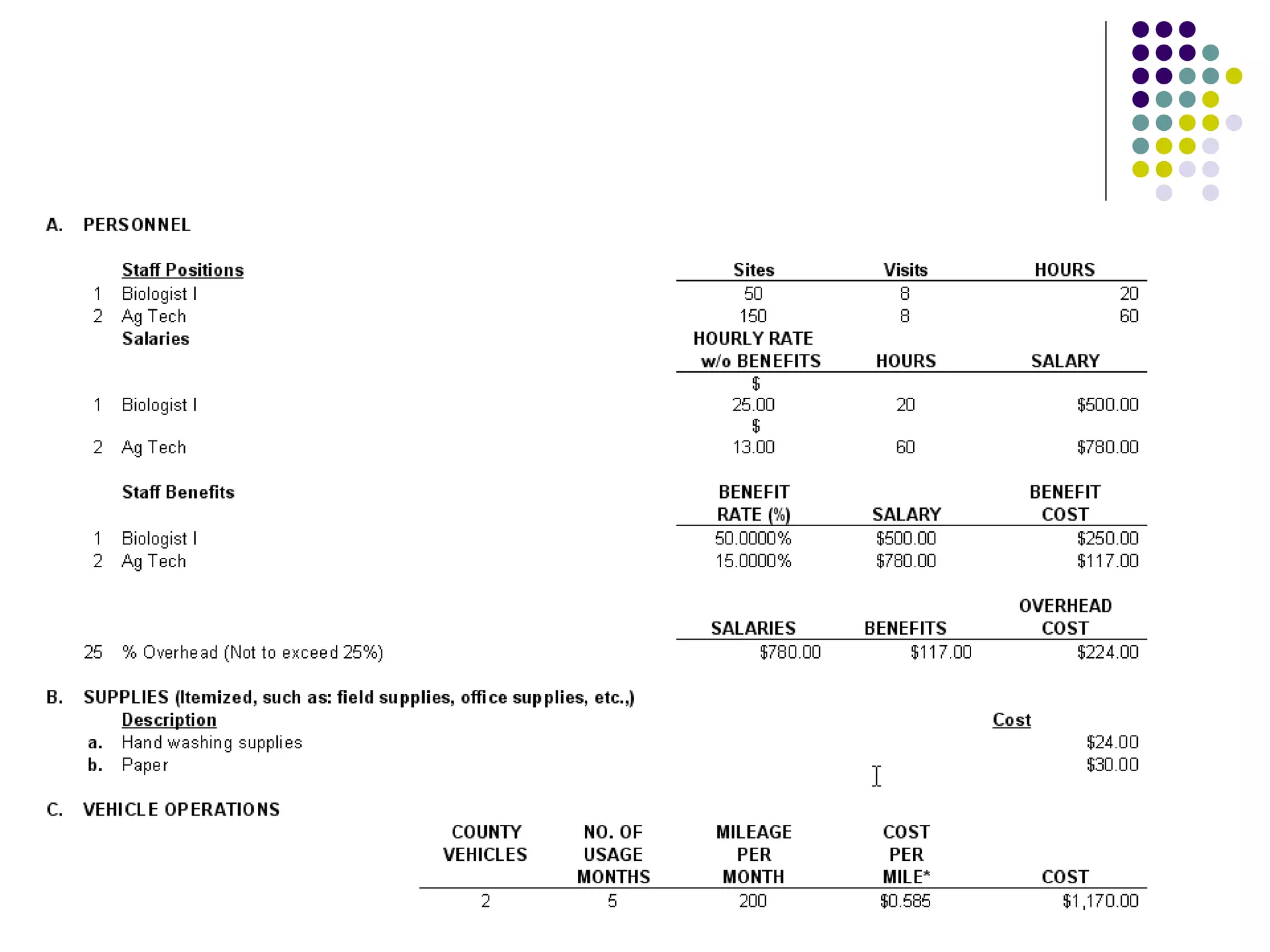

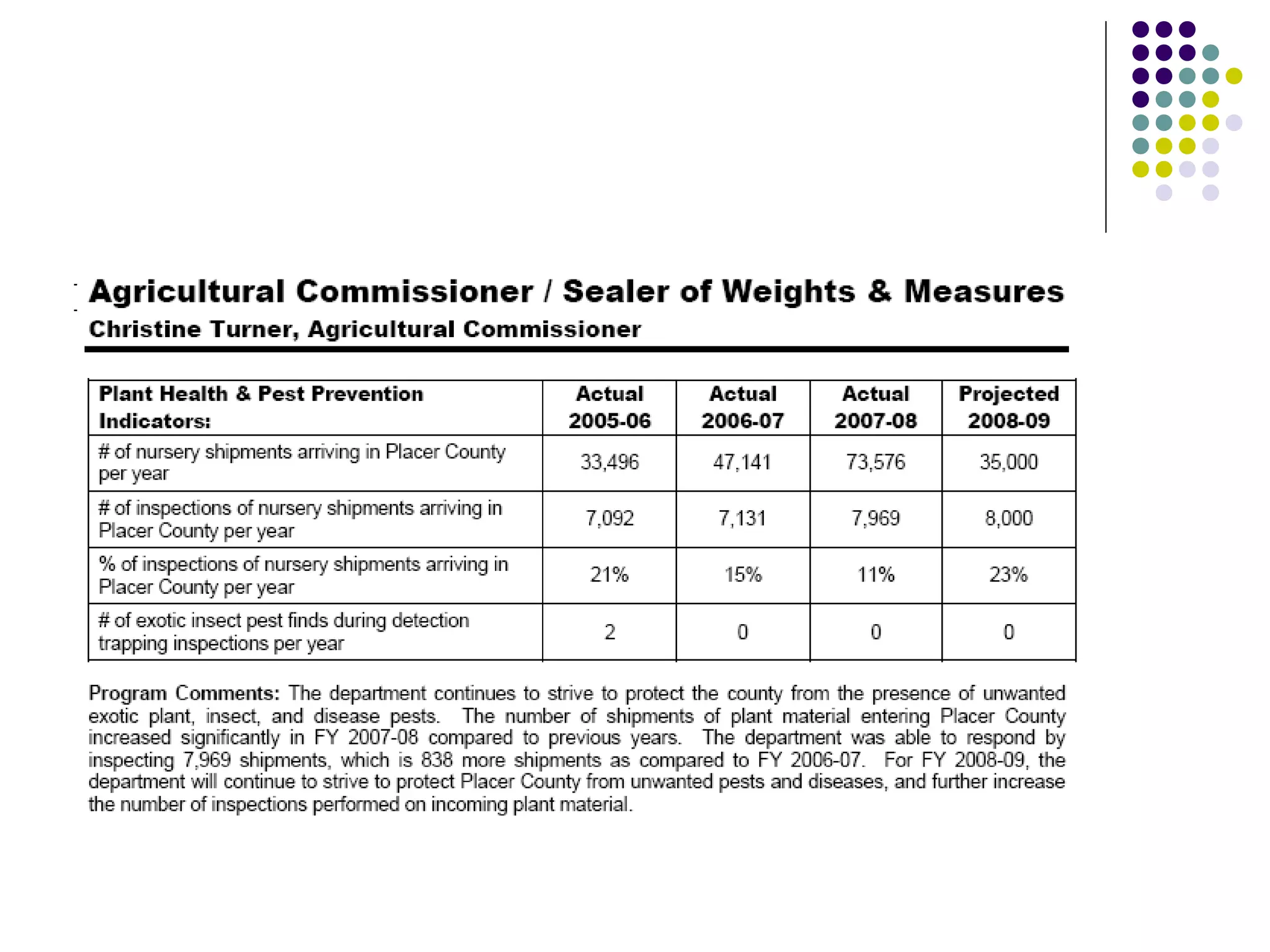

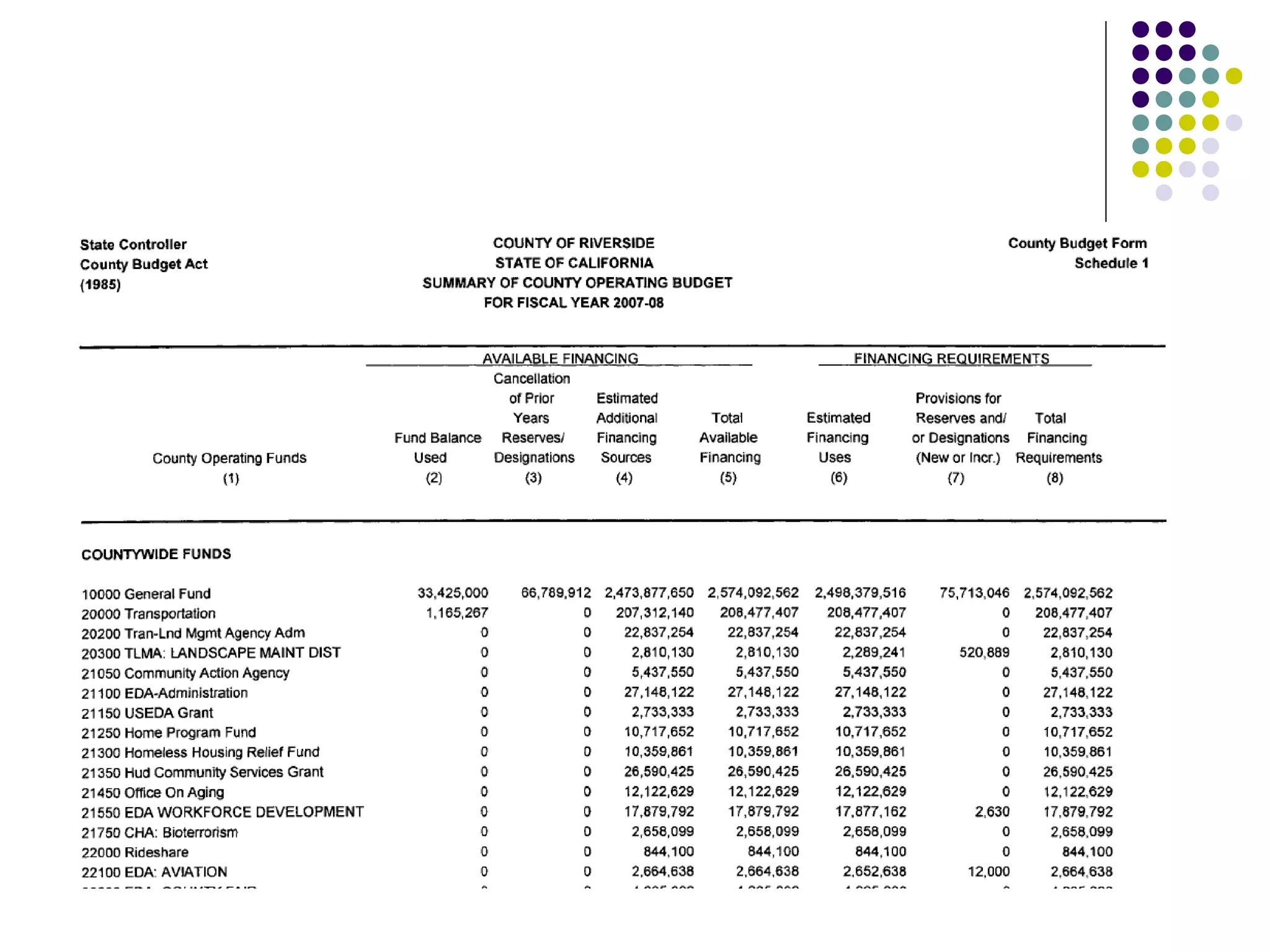

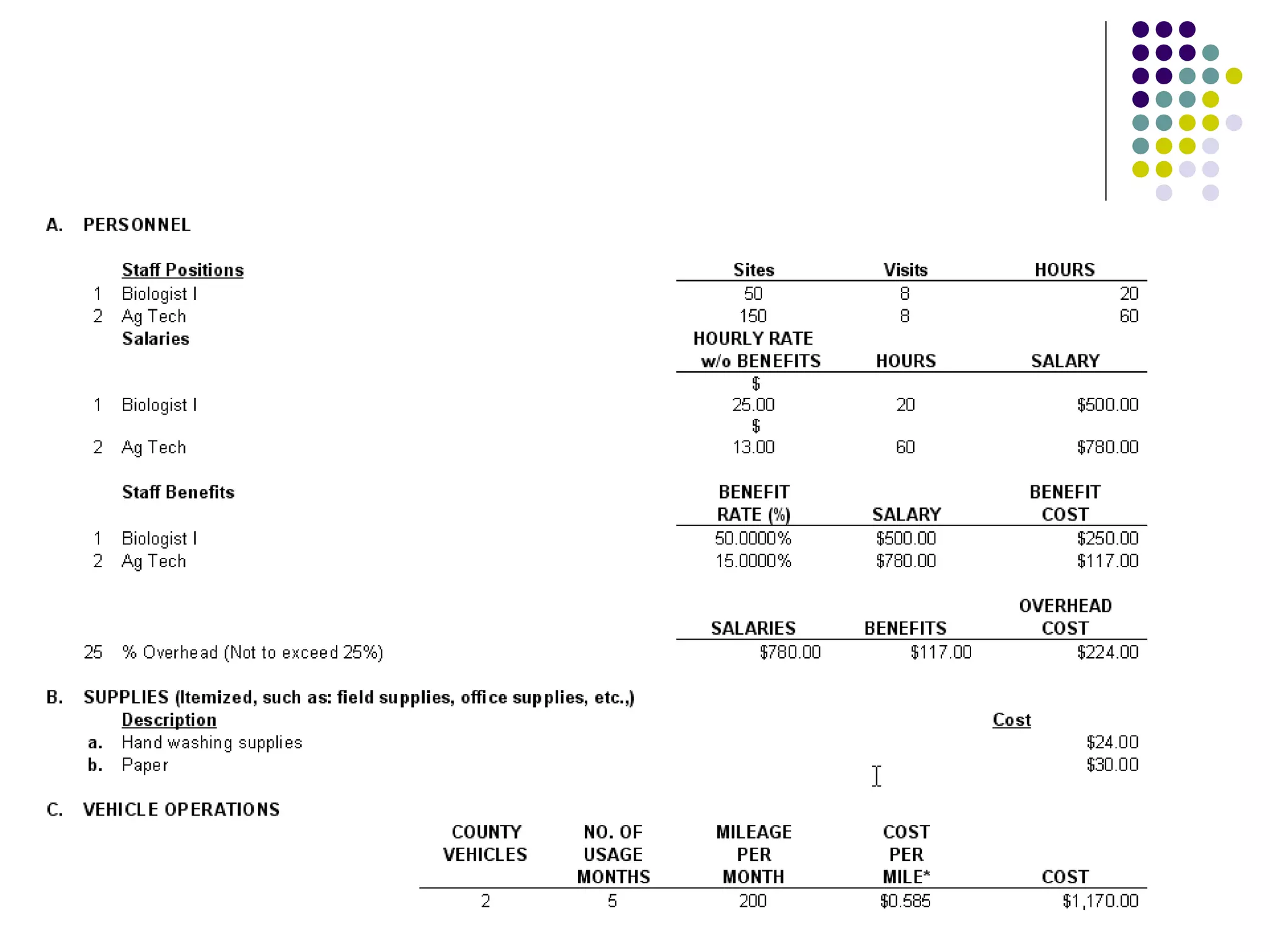

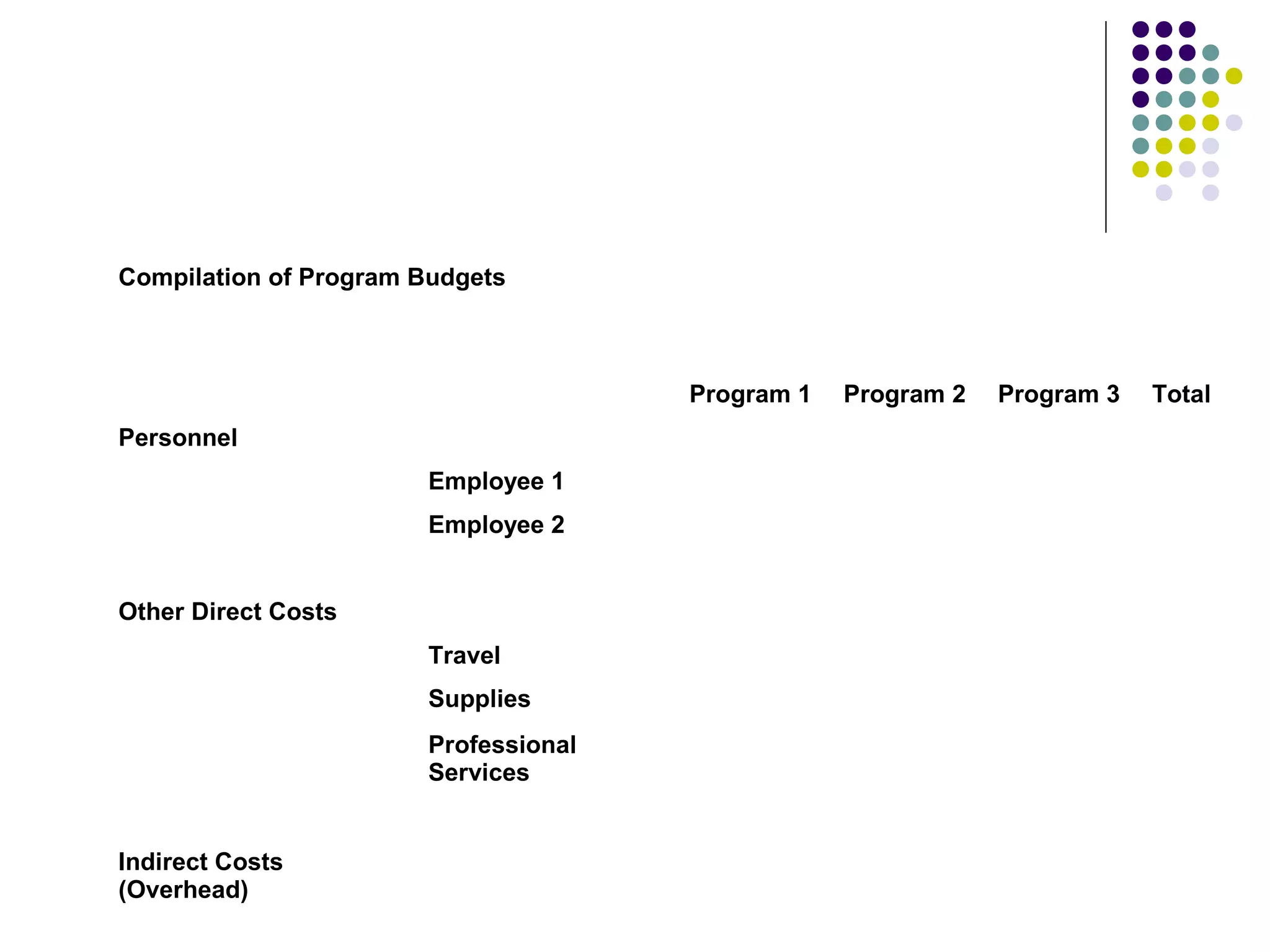

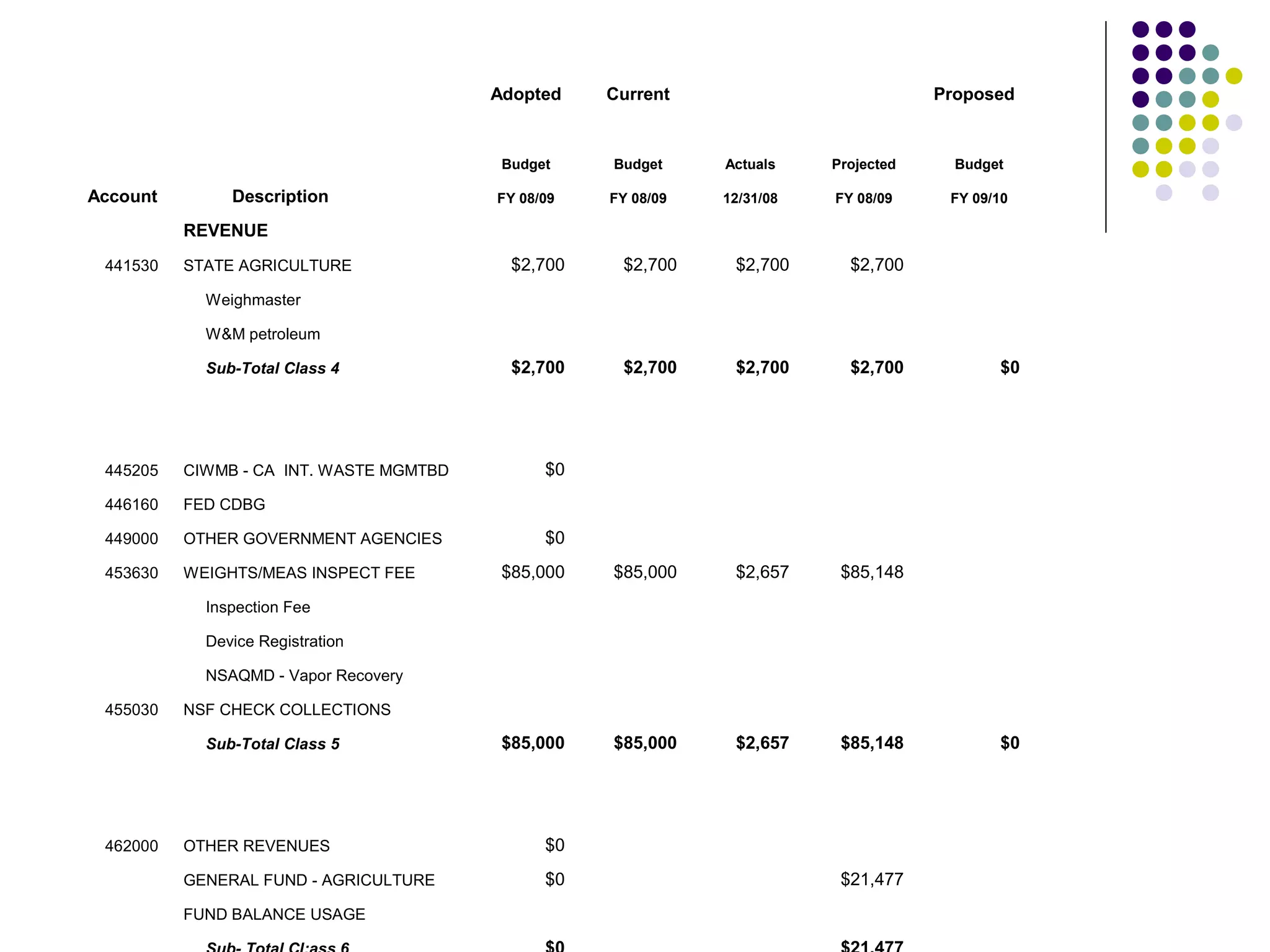

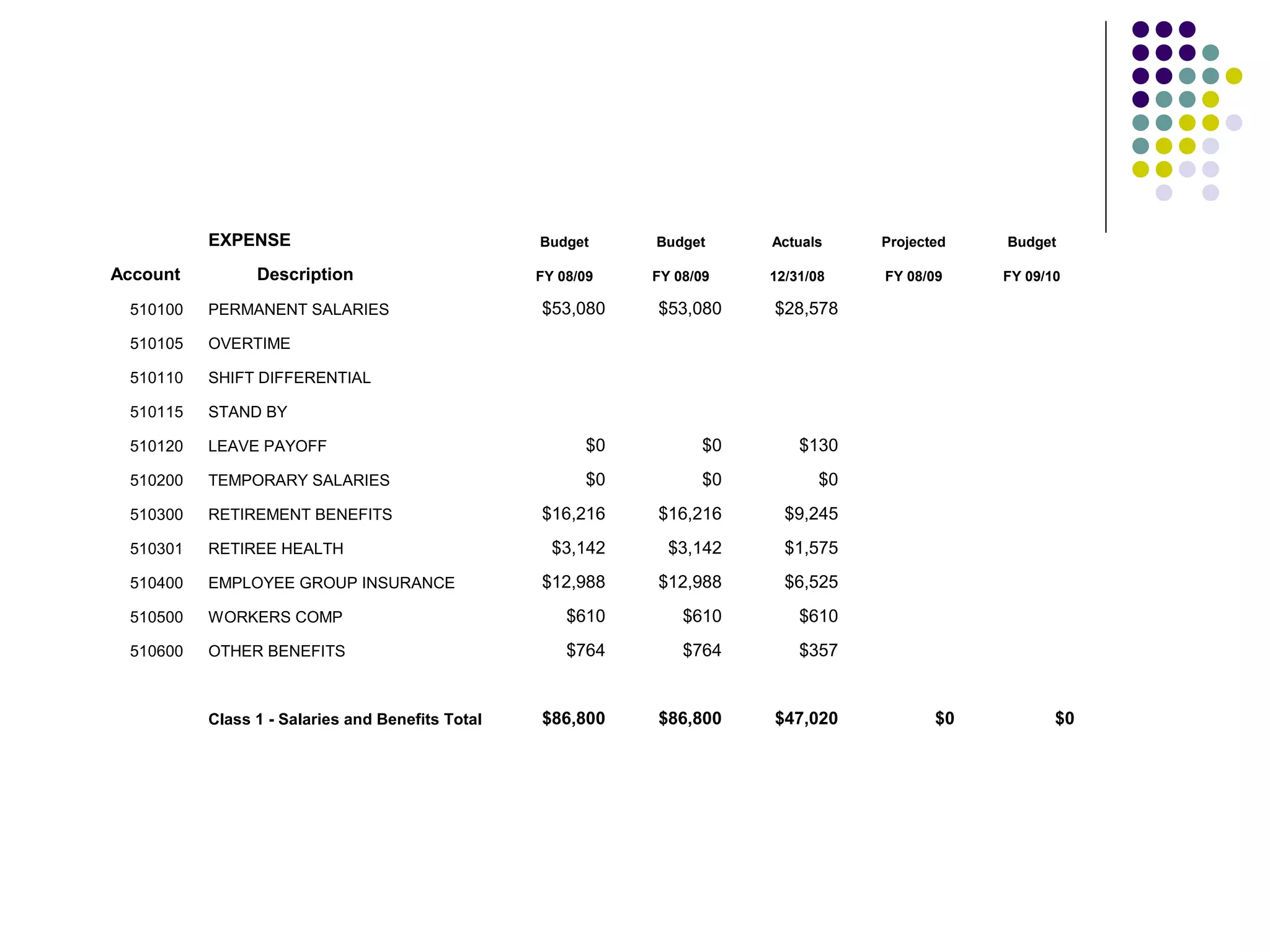

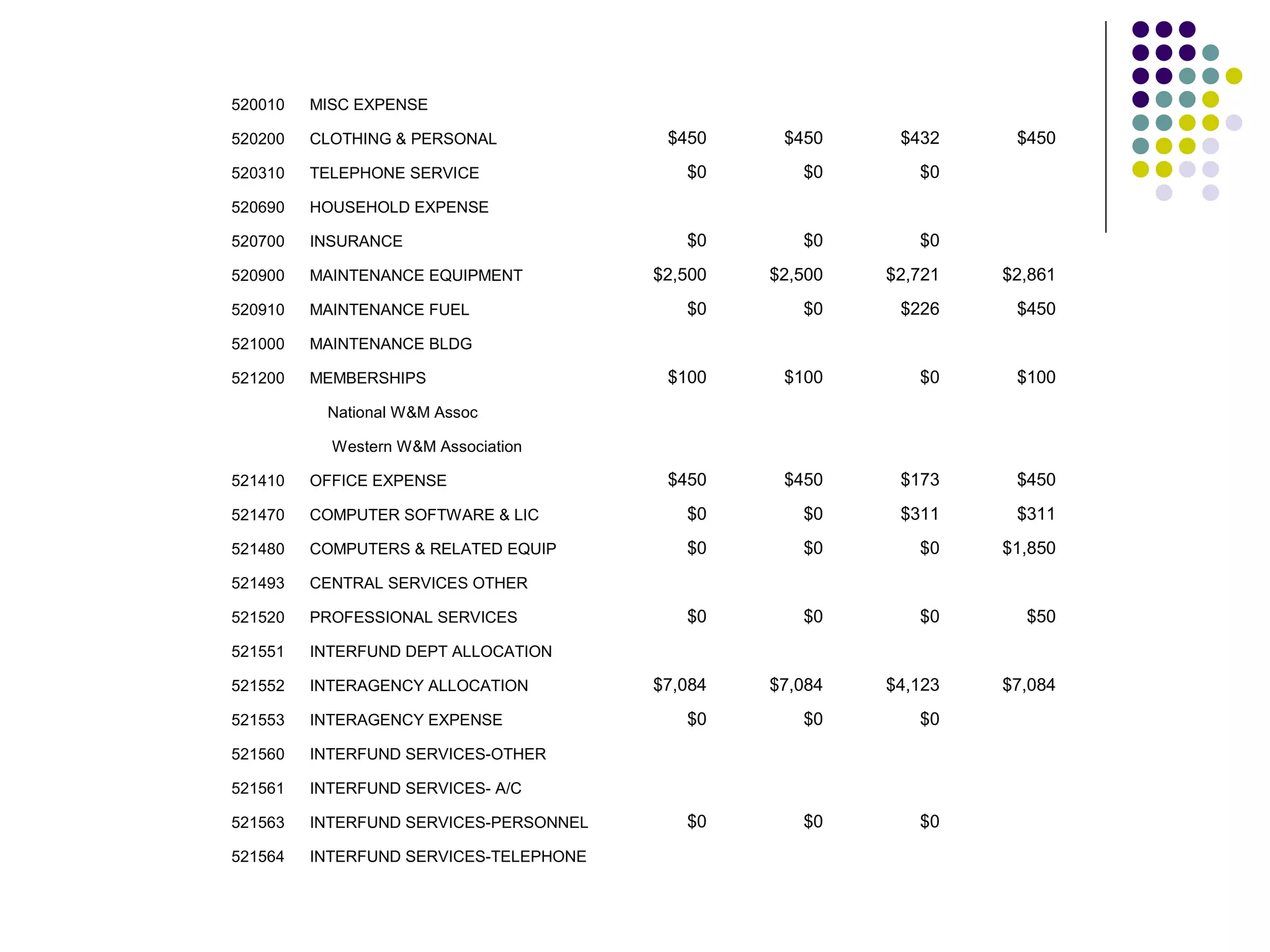

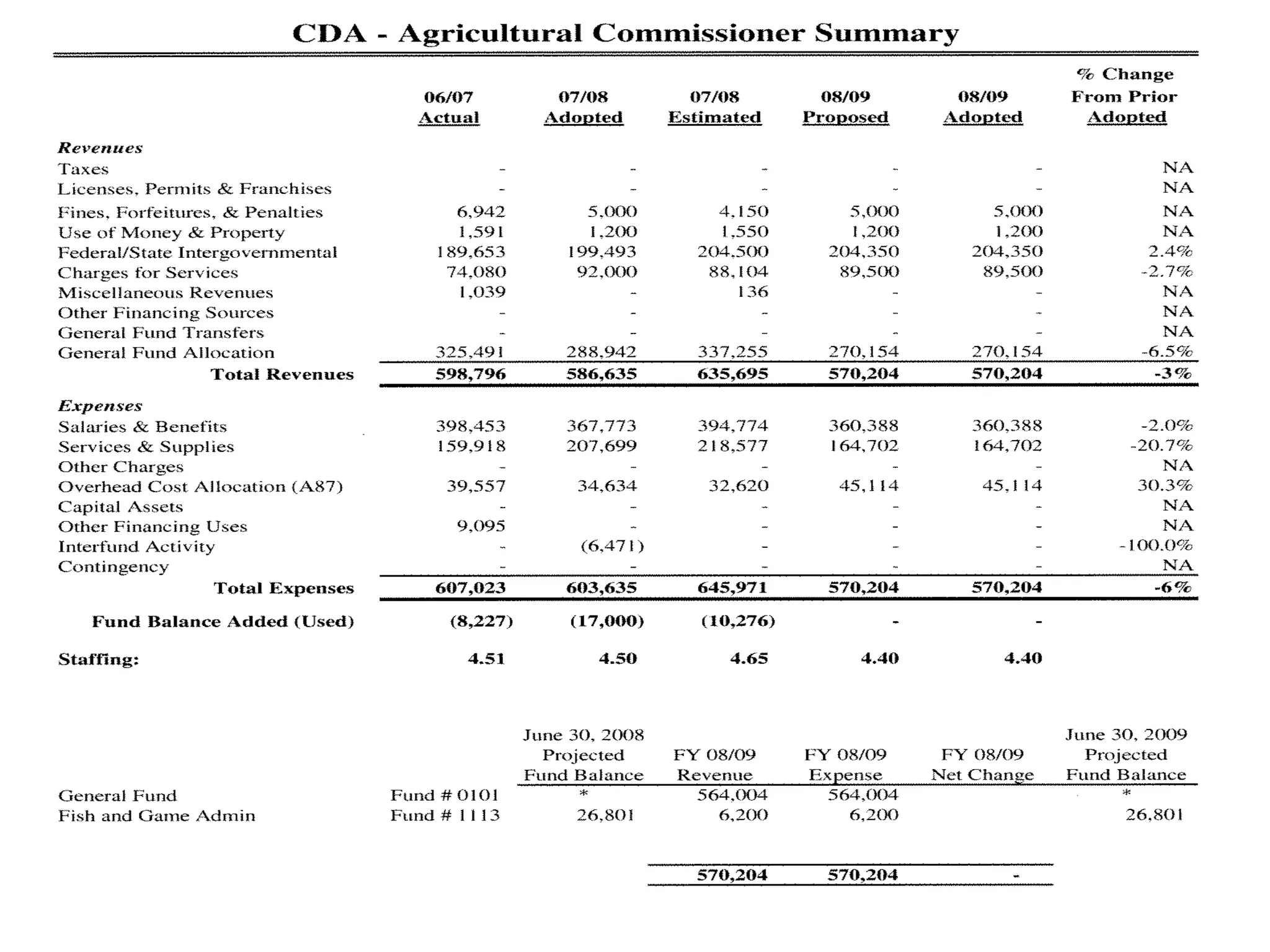

The document provides information about operational budgeting for the CASAP Annual Conference held on January 17-18, 2009. It defines different types of operating budgets including line-item, program, performance, and zero-base budgets. It then gives examples of the Nevada County Agricultural Commissioner's 2008-09 budget, including estimated revenues from government agencies and fees, and planned expenses for personnel salaries and benefits, equipment, supplies, and other operating costs.