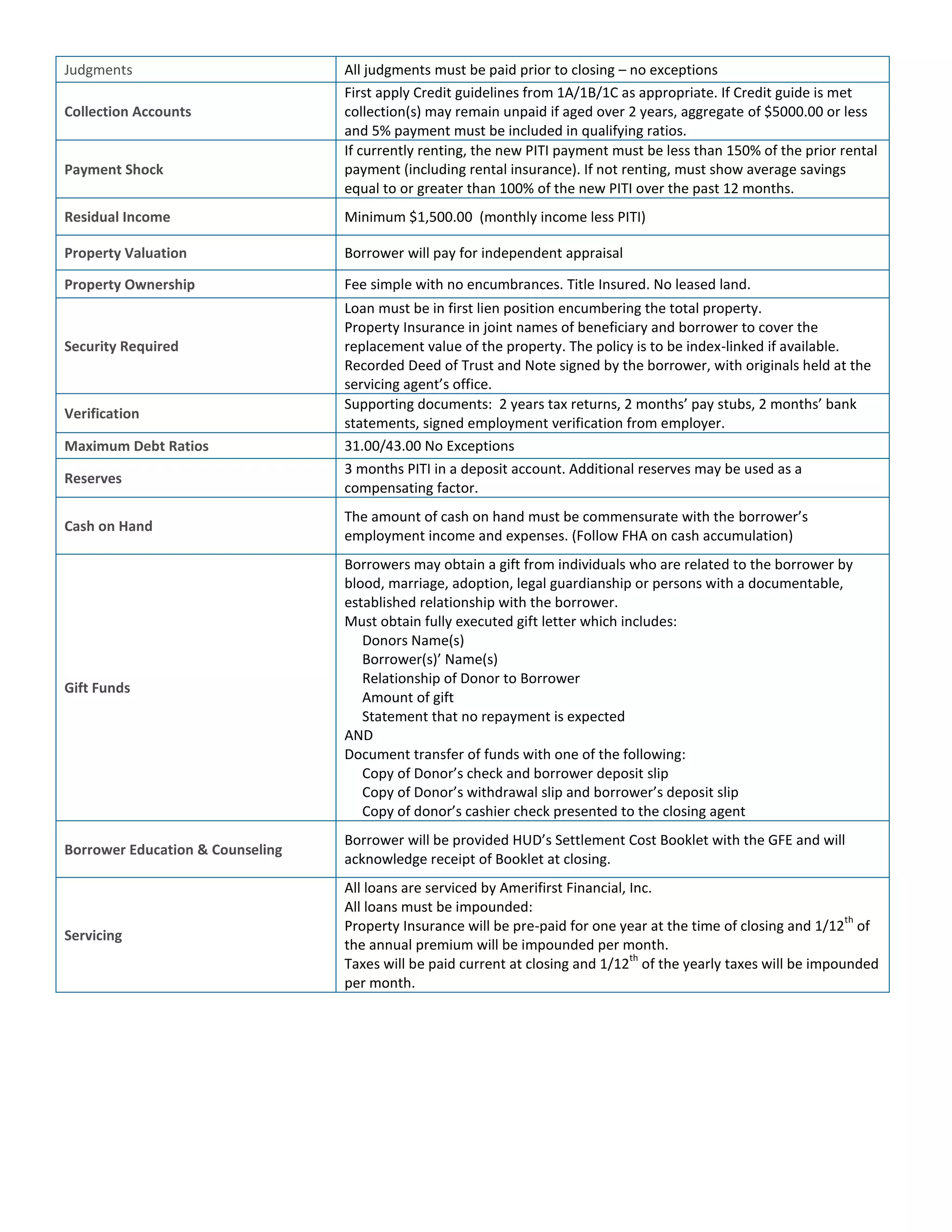

The document details a foreclosure program in Arizona targeting owner-occupied single-family residential properties, requiring borrowers to meet specific credit and income qualifications, including a minimum FICO score of 620. The loan terms include a 30-year amortization with a balloon payment due in 10 years, fixed interest rate of 12%, and maximum loan amount of $175,000. Borrowers must provide extensive documentation including tax returns and bank statements, and comply with strict debt ratio limits.