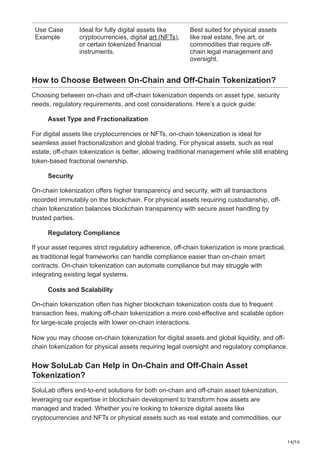

The document discusses asset tokenization, which transforms how valuable assets are traded by representing them as digital tokens on a blockchain. It outlines the differences between on-chain and off-chain tokenization methods, highlighting the advantages and applications of each, including increased liquidity, transparency, and accessibility. The market for asset tokenization is projected to reach up to $16 trillion by 2030, impacting various sectors such as real estate, art, and equities.