The budget document provides sales projections and financial indicators for 2016. Key points include:

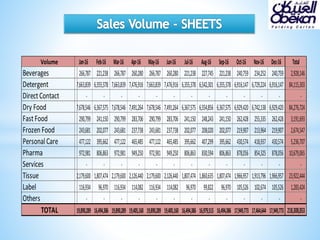

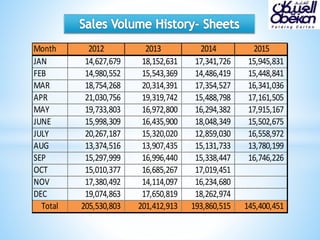

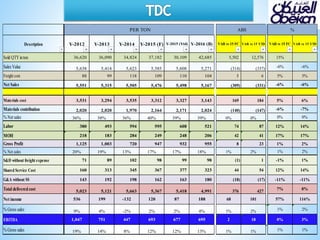

- Projected 2016 sales volume is 42,685 units, a 15% increase over 2015.

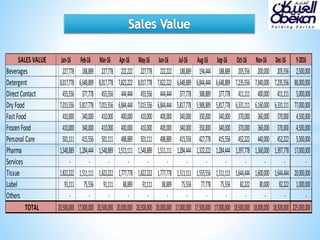

- Sales value is projected to increase 8% to SAR 225 million.

- Gross margin and net income are projected to increase to 26.6% and SAR 8 million respectively.