The document provides an overview of credit cards, including:

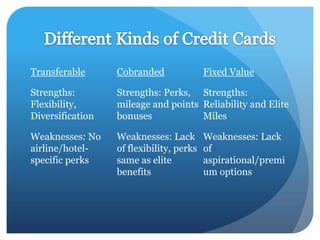

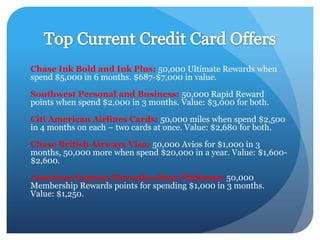

- Different types of credit card programs like transferable points and co-branded cards

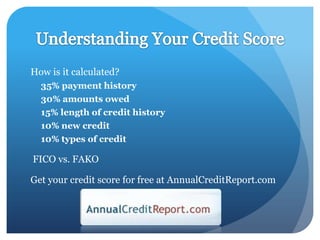

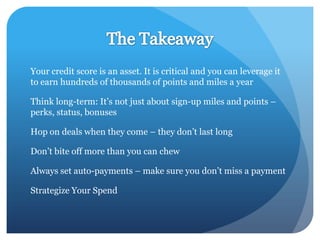

- Factors that determine your credit score and the differences between FICO and other scores

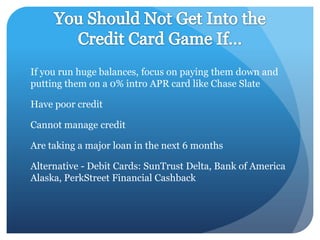

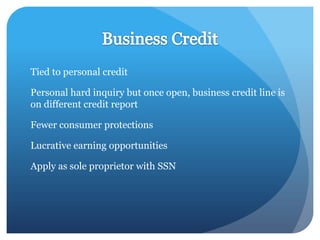

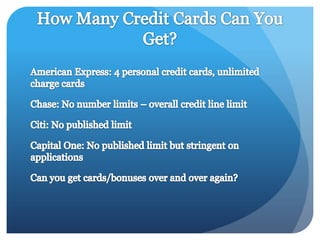

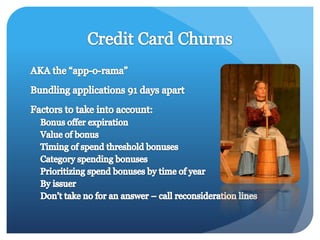

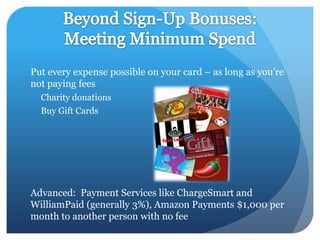

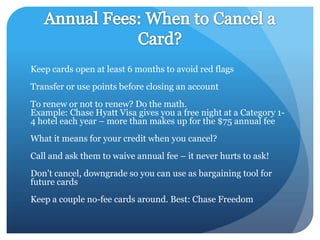

- Tips for using credit cards, such as earning sign-up bonuses and creating credit card spend

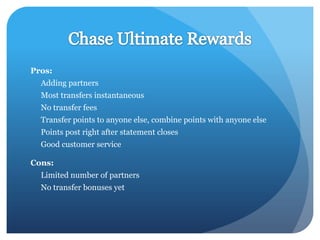

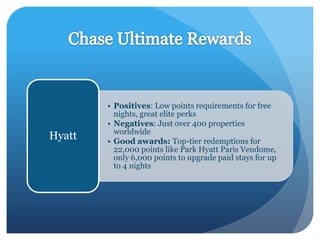

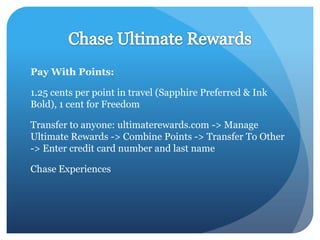

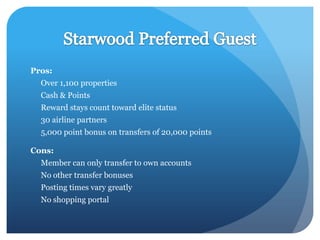

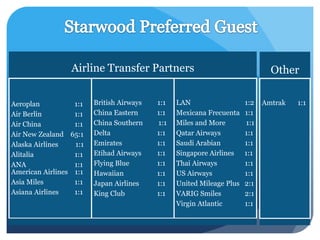

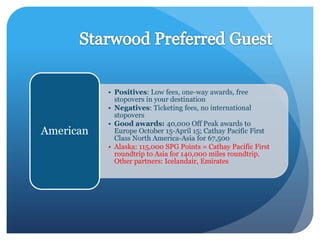

- Popular transferable points programs from American Express, Chase, and Starwood and their strengths and weaknesses