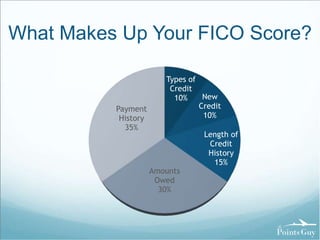

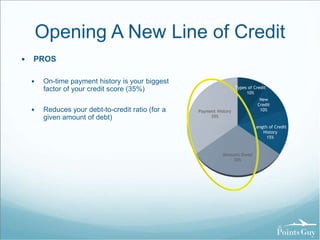

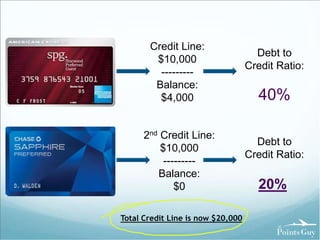

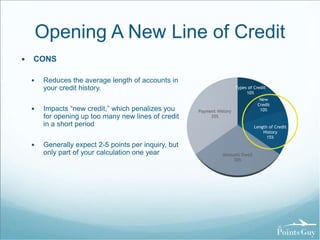

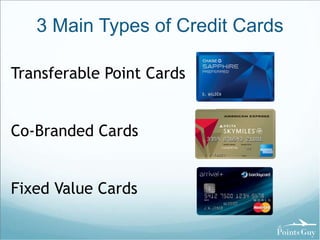

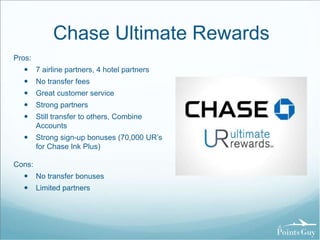

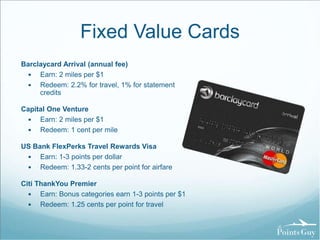

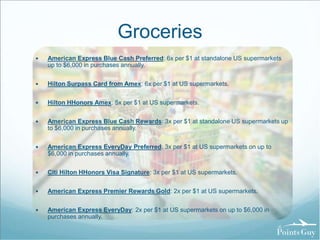

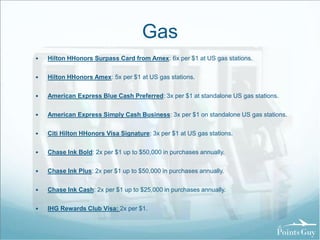

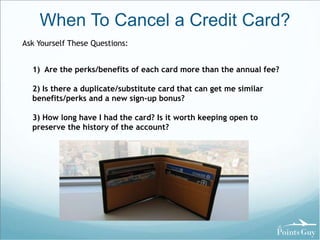

This document summarizes a presentation on maximizing credit cards. It discusses opening new lines of credit and how that impacts credit scores. Specifically, it helps reduce debt-to-credit ratios but also reduces average account length. The document also reviews different types of credit cards including transferable point cards like American Express Membership Rewards and Chase Ultimate Rewards, co-branded airline and hotel cards, and fixed-value cards. Additionally, it provides tips on earning elite status and perks through credit card spending and bonuses.