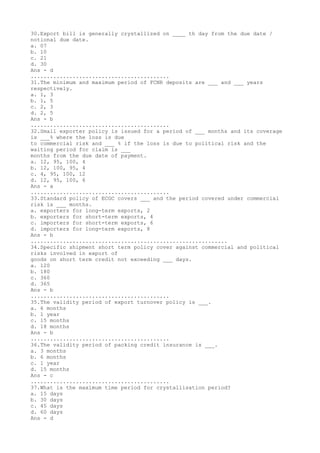

1. The document contains 45 multiple choice questions related to export-import policies, procedures and timelines in India.

2. Key timelines covered include normal transaction period (NTP) and normal delivery date (NDD) for foreign currency export bills, crystallization periods for import and export bills, validity periods for export credit insurance policies and ECGC cover.

3. The questions also address topics like maximum periods for packing credit, post-shipment credit, buyers' credit and suppliers' credit, time limits for realization of export proceeds, and reporting requirements for importers who do not submit documents on time.