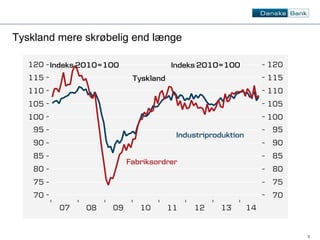

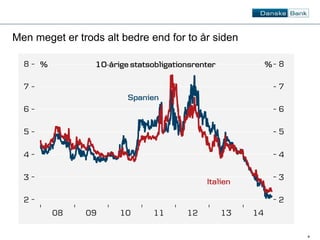

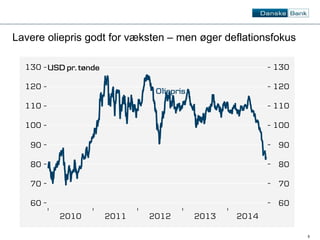

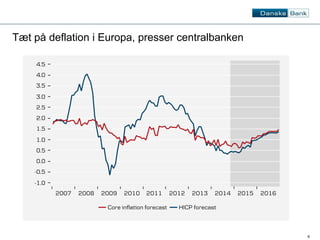

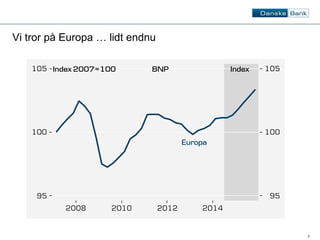

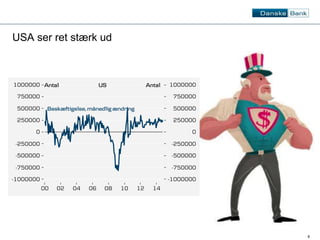

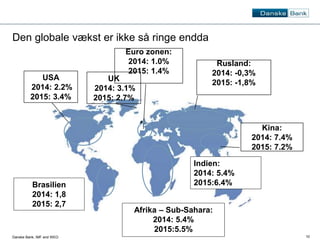

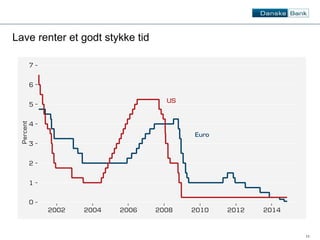

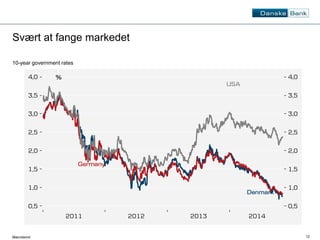

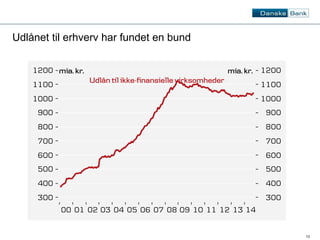

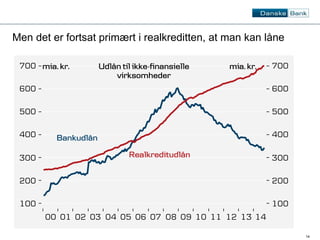

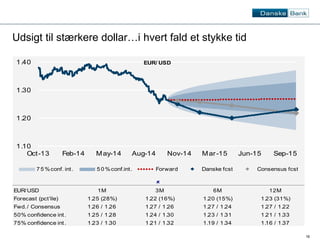

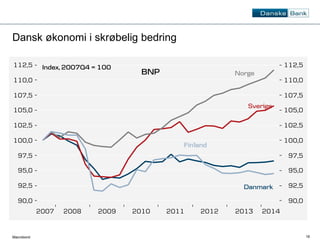

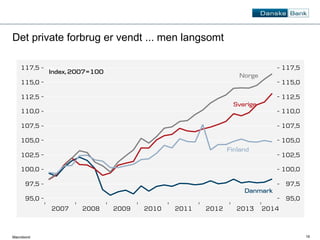

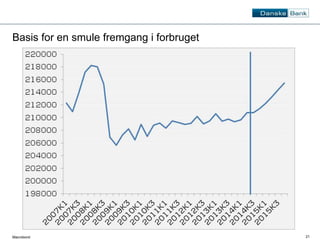

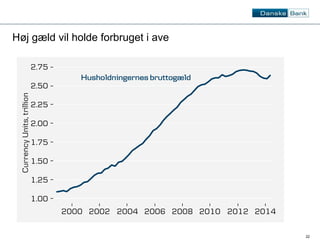

The document discusses the fragile economic progress in Europe and globally, highlighting issues such as low oil prices, deflation concerns, and varying growth rates across countries. It notes that while the US economy appears strong, challenges exist in regions like Russia and China, with predictions of slow growth in Denmark. The report underscores the importance of the housing market and private consumption as foundations for economic recovery.