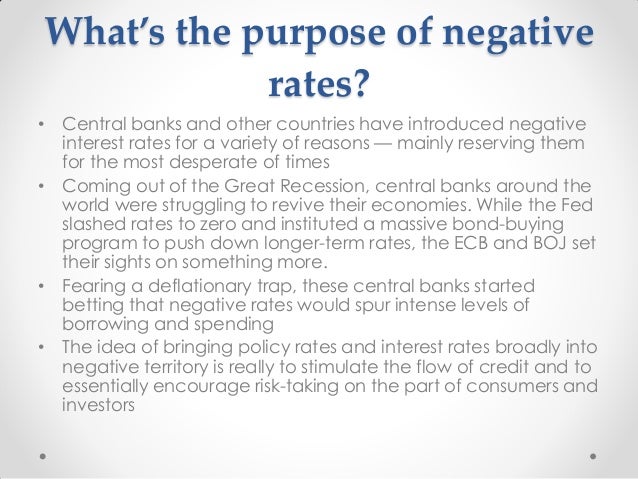

Negative interest rates occur when interest rates fall below zero. Central banks in Europe and Japan have implemented negative rates to stimulate their economies by encouraging borrowing and risk-taking. However, negative rates also narrow bank profit margins and could cause people to withdraw cash rather than accept negative returns on savings accounts. While intended to boost lending, negative rates may not achieve the desired economic outcomes and have unintended consequences for savers.