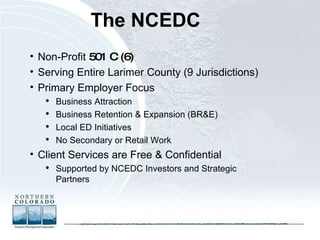

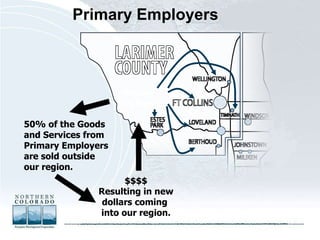

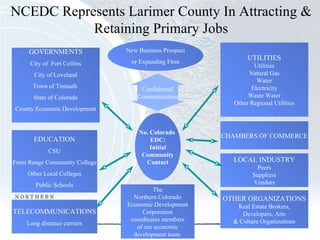

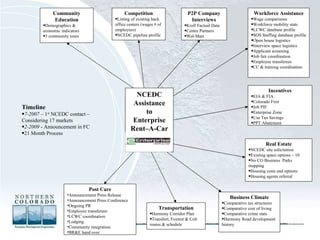

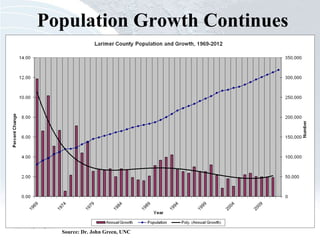

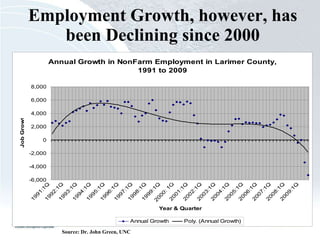

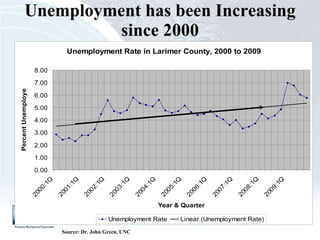

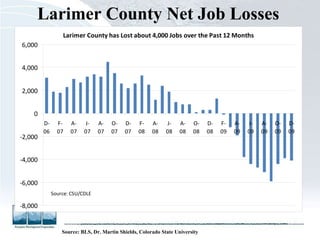

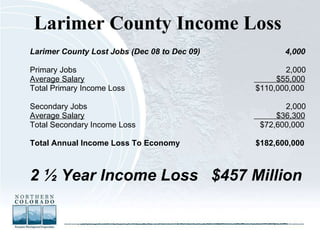

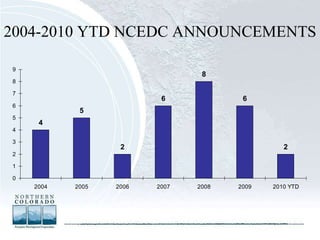

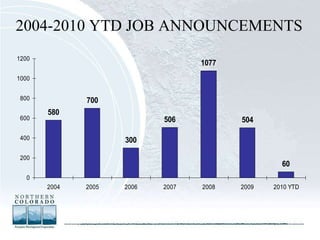

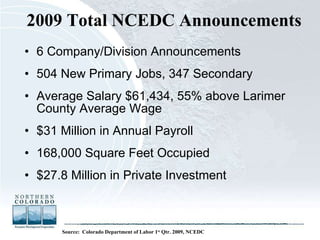

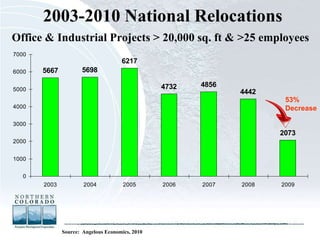

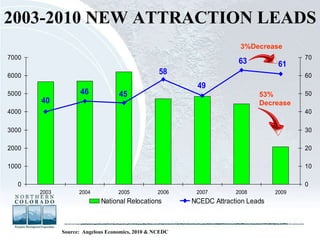

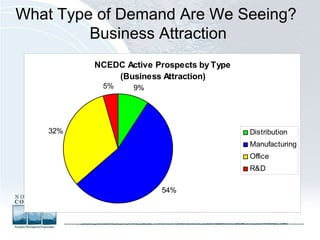

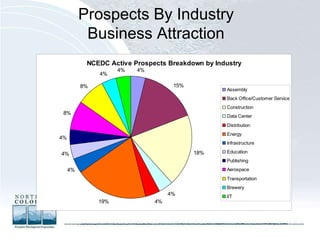

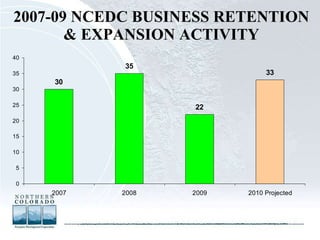

The document summarizes the role and activities of the Northern Colorado Economic Development Corporation (NCEDC) in attracting and retaining primary employers and jobs in Larimer County, Colorado. The NCEDC works with various partners across sectors to provide business attraction, retention and expansion services to companies. It also discusses trends in the local job market and examples of companies the NCEDC has assisted in relocating or expanding operations in Larimer County.