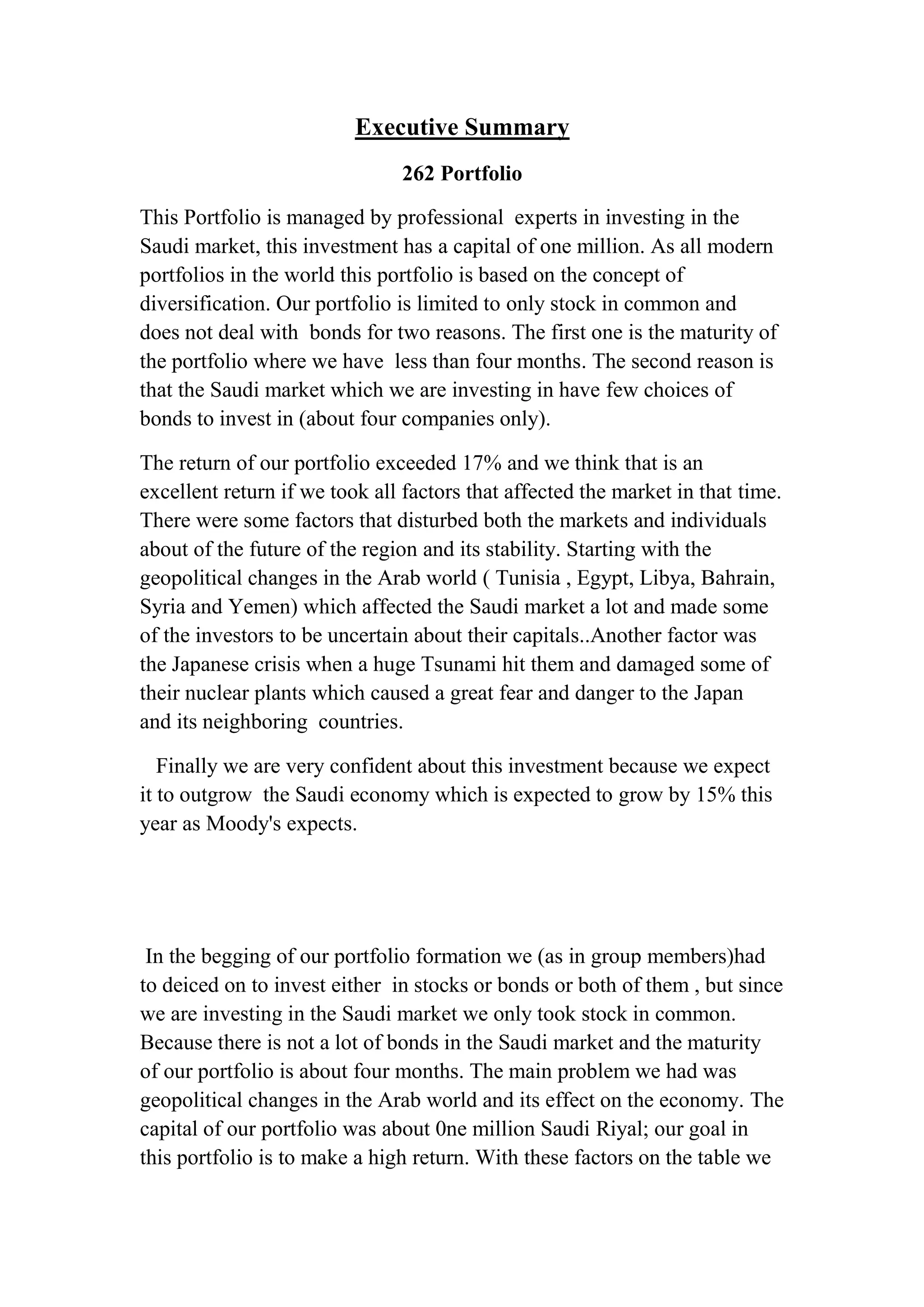

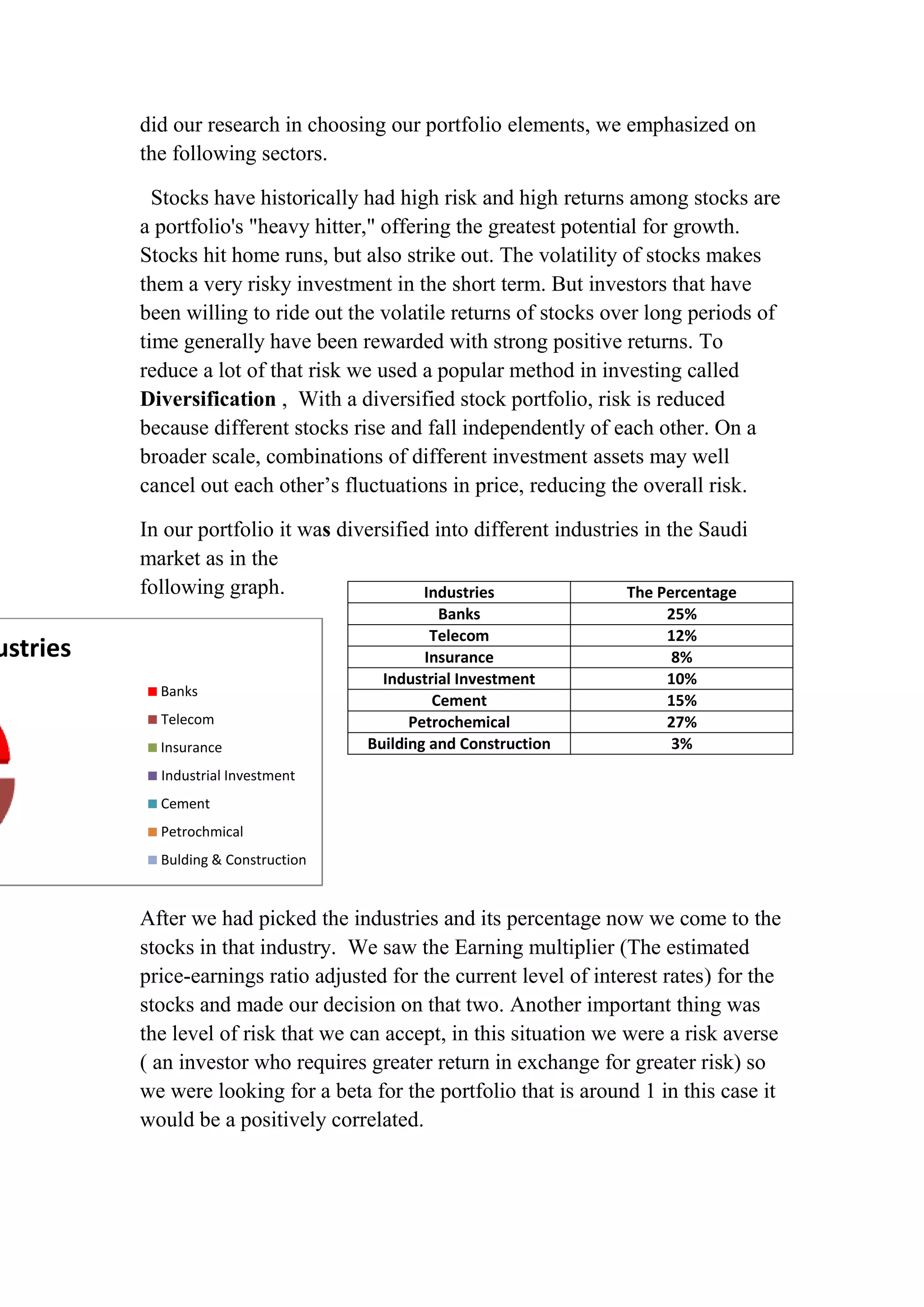

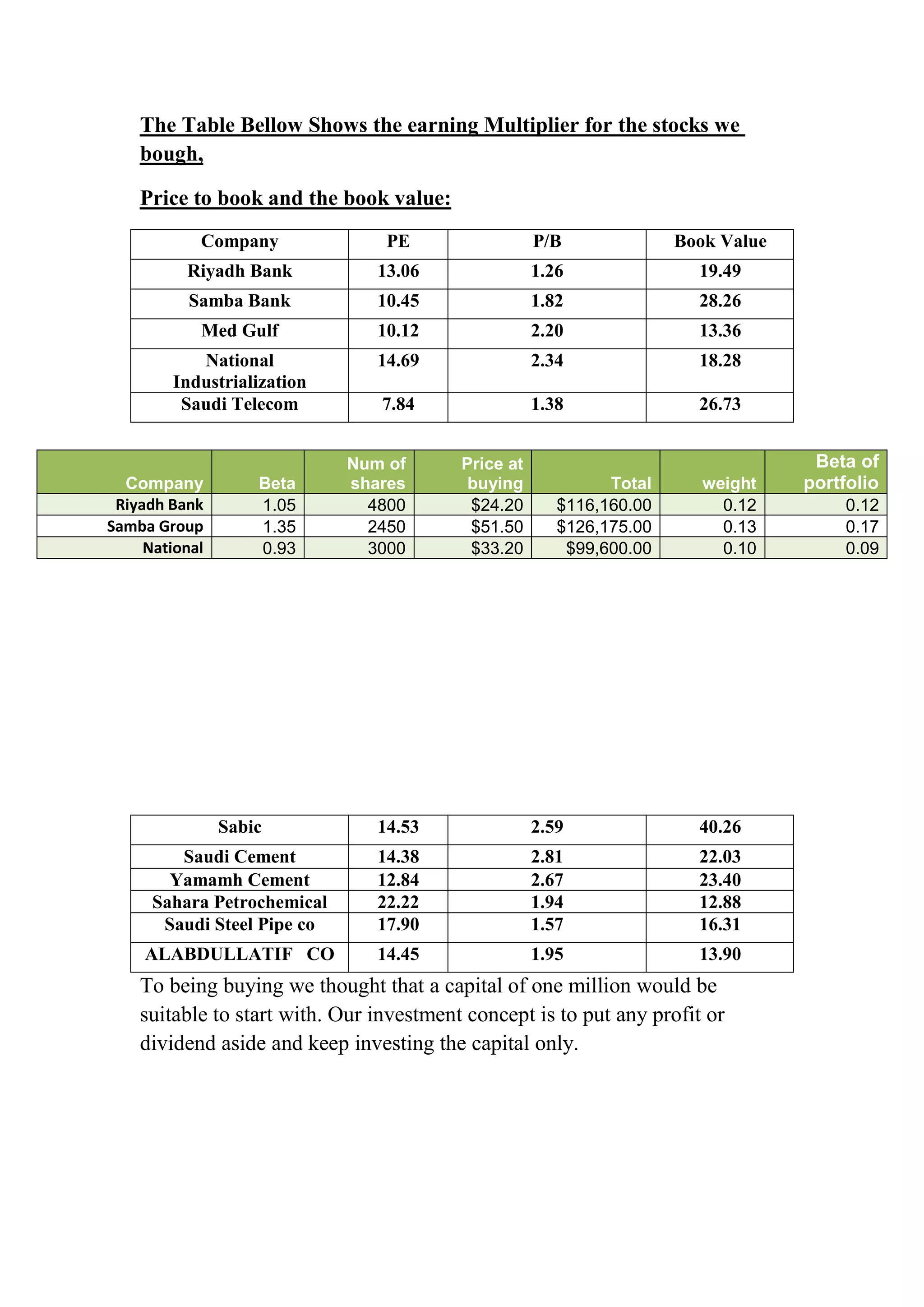

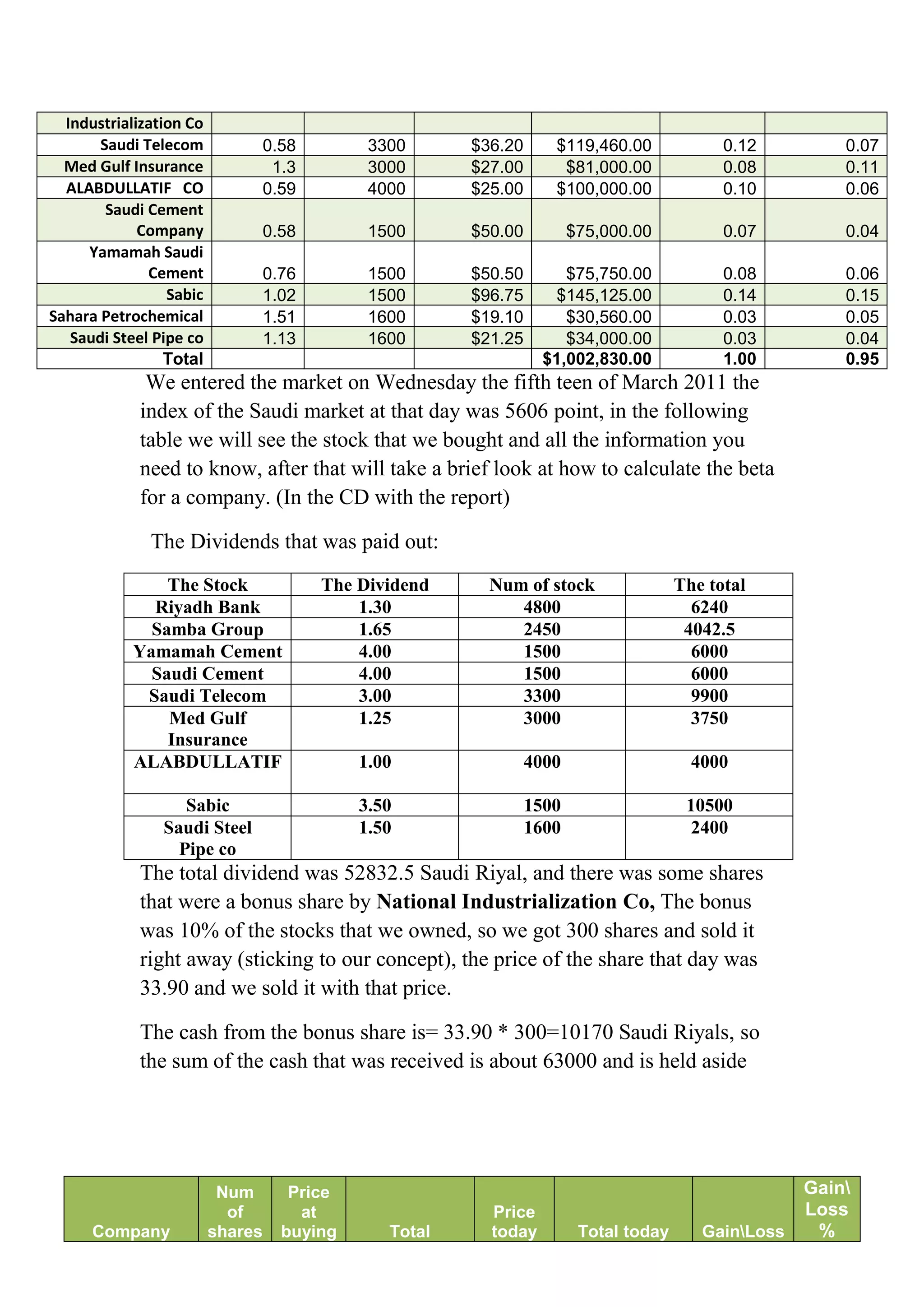

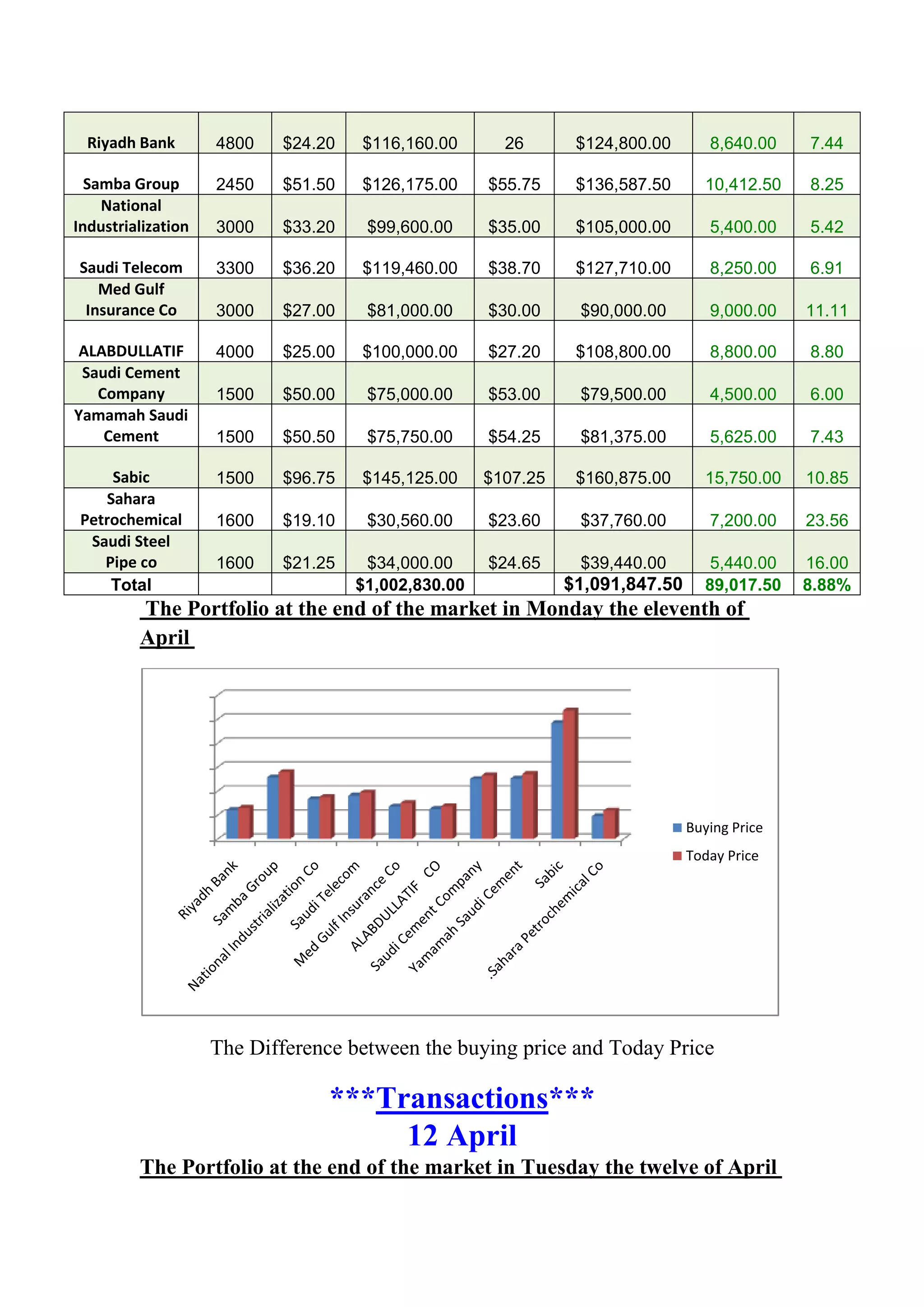

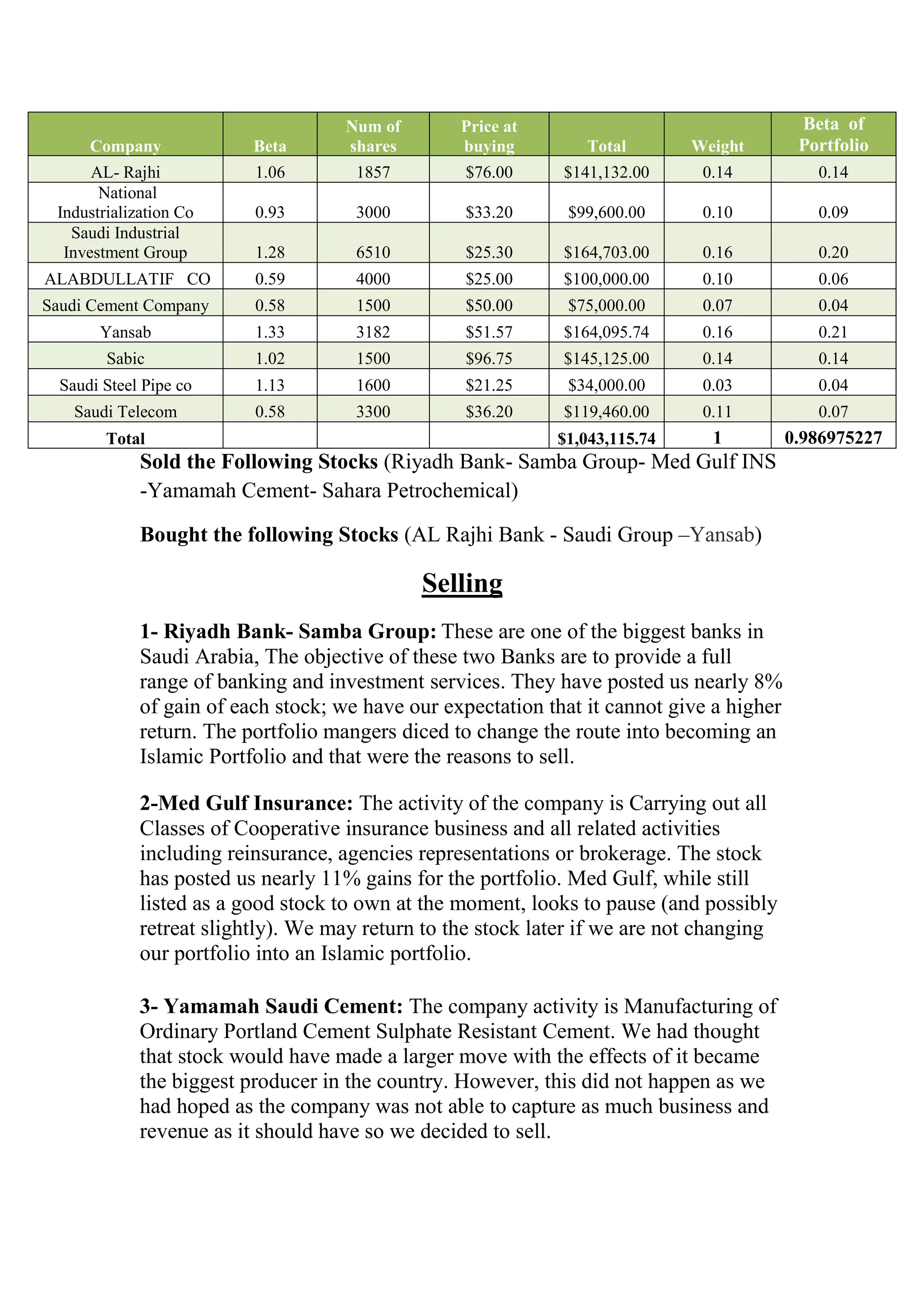

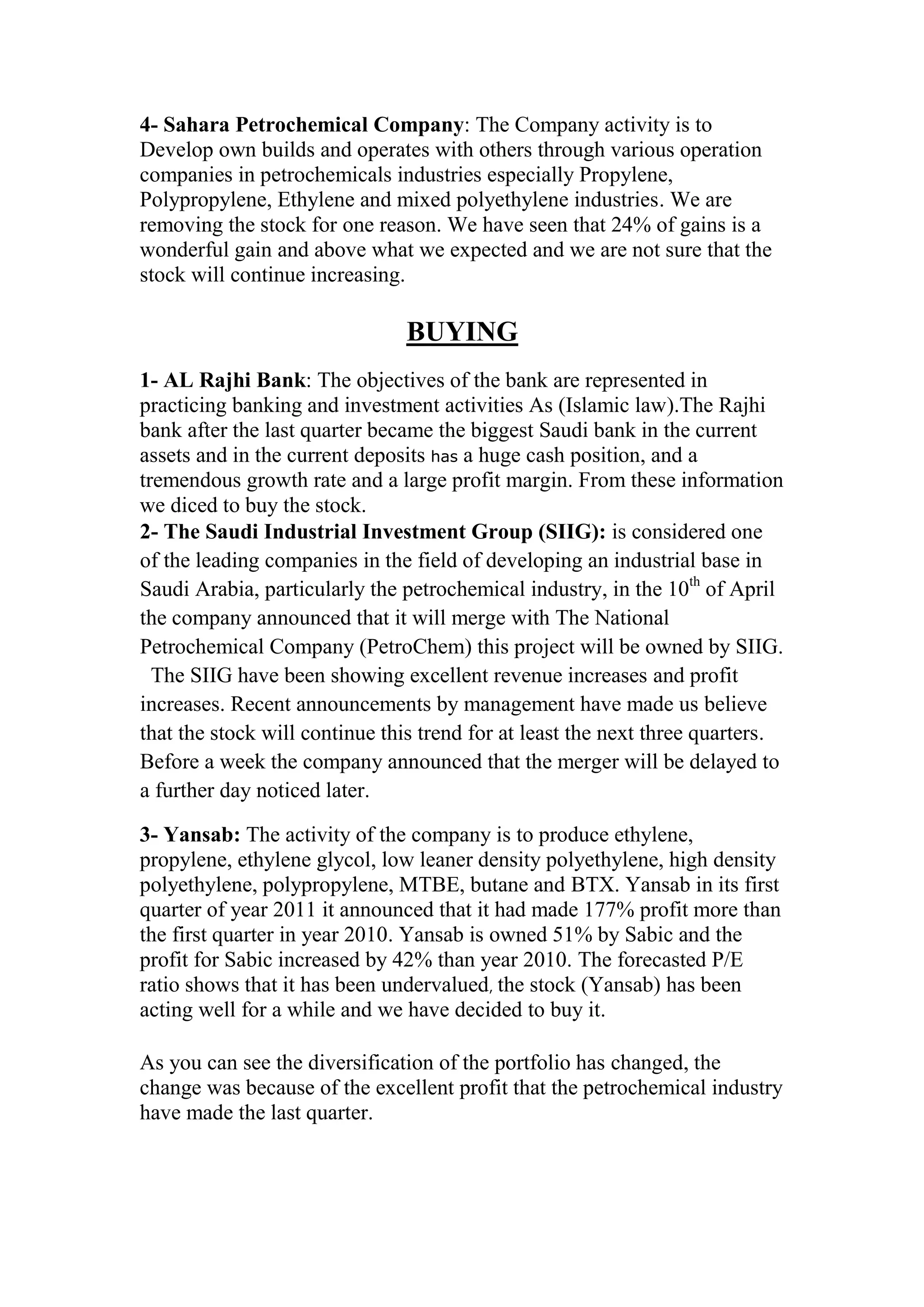

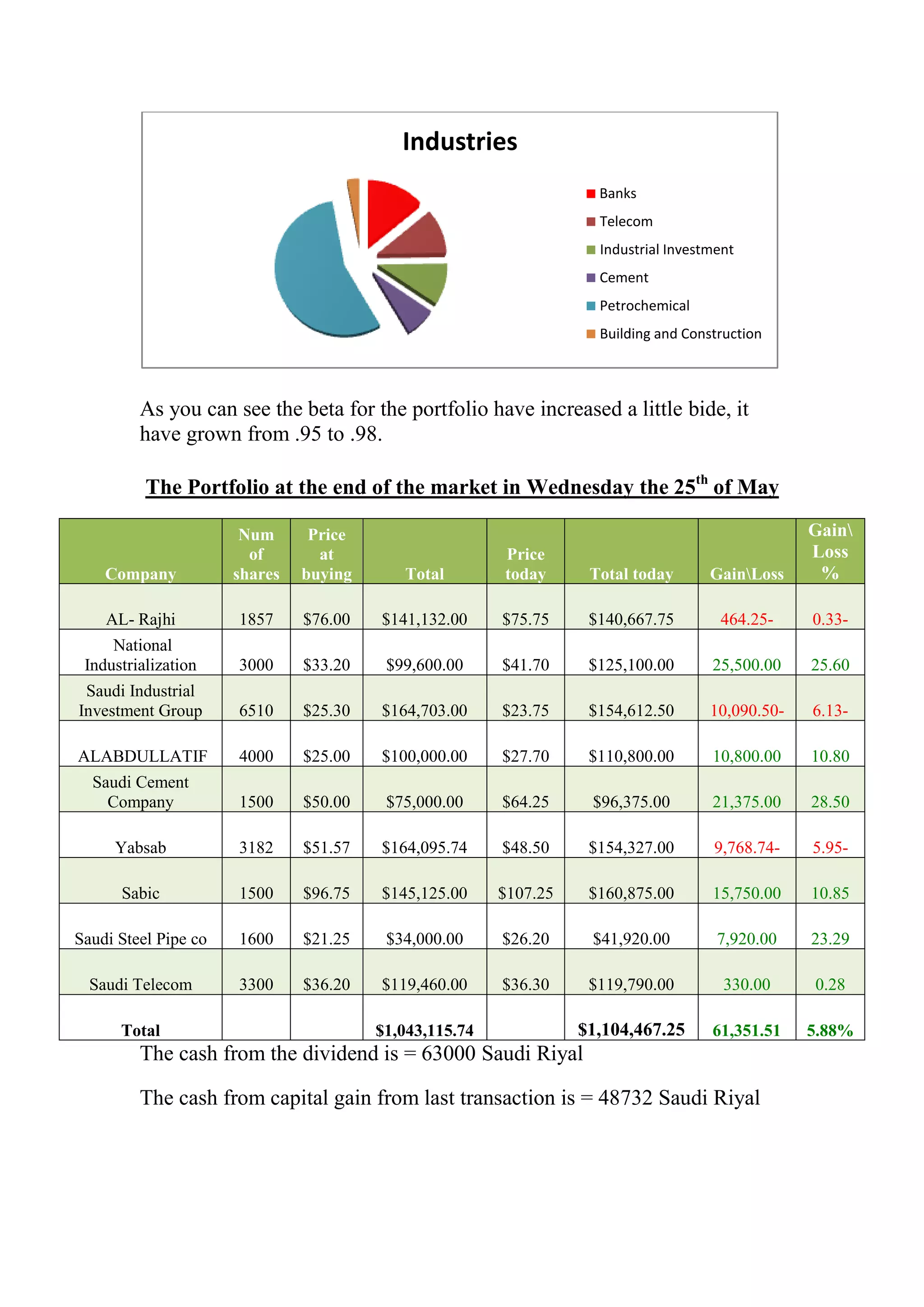

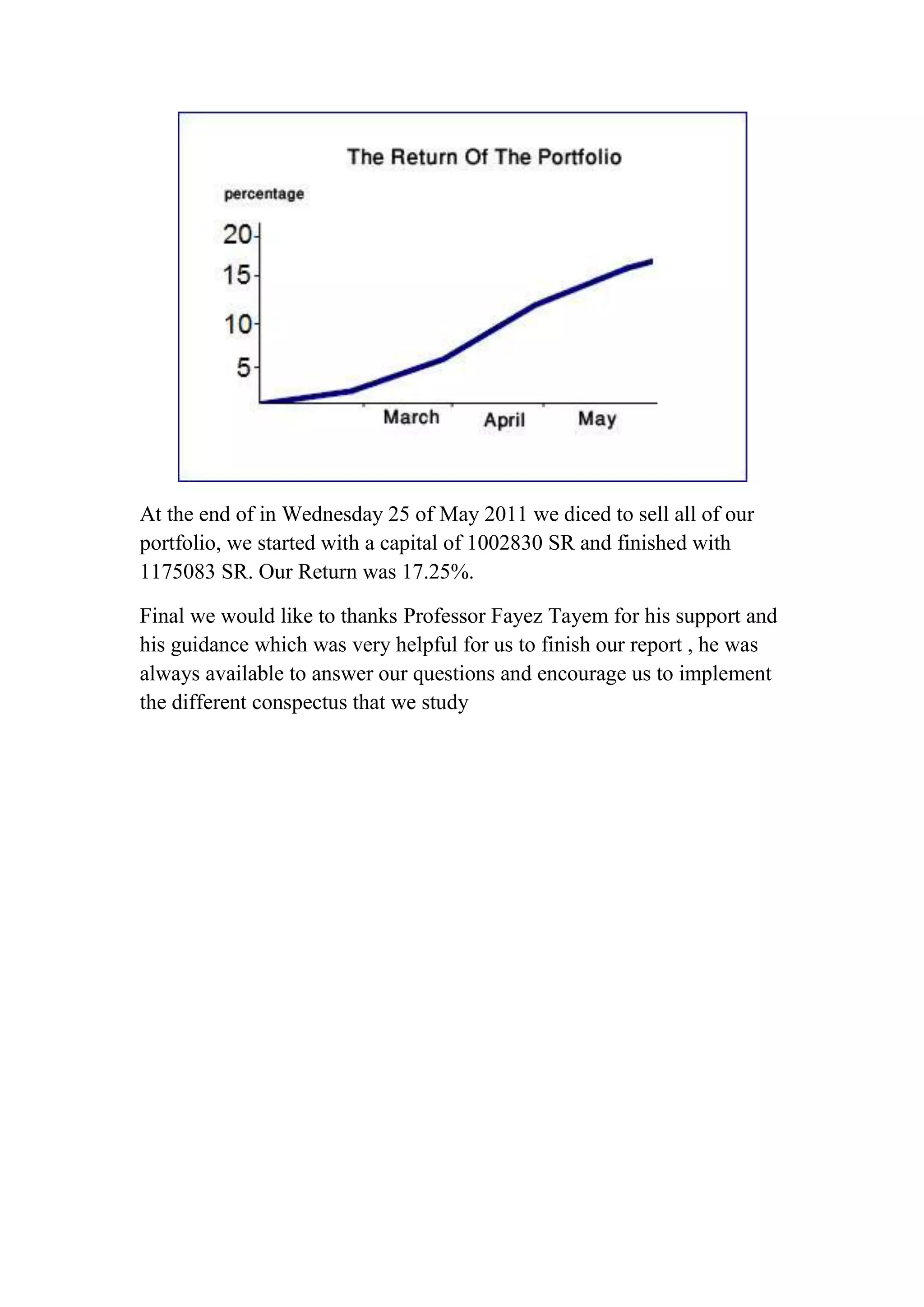

This portfolio is managed by professionals investing in the Saudi market with capital of $1 million. It is diversified across various industries like banks, telecom, insurance, etc. Geopolitical changes in the Arab world and natural disasters affected market performance. The portfolio exceeded a 17% return. Key factors considered in stock selection were earnings multipliers, risk levels, and diversification. Dividends received totaled $53,832.50. As of April 11, the portfolio value grew to $1,091,847.50, an 8.88% gain. Some original stocks were then sold and replaced to shift the portfolio to comply with Islamic principles.