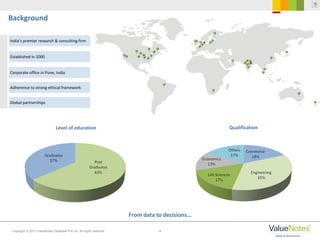

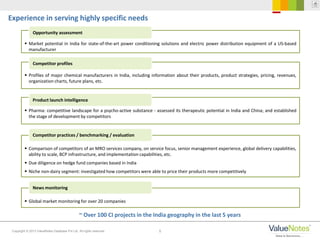

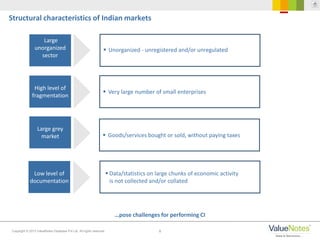

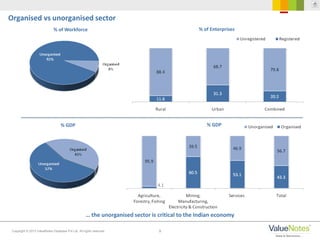

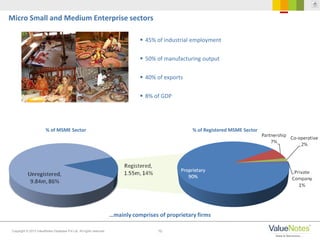

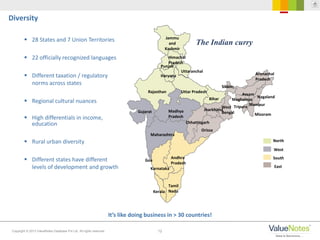

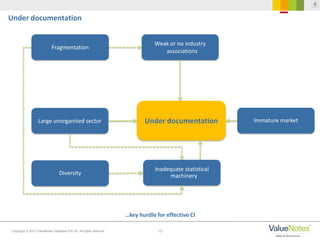

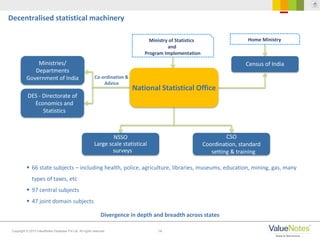

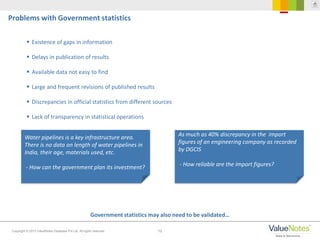

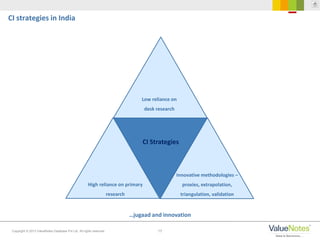

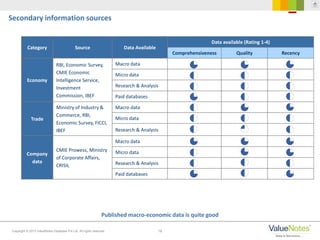

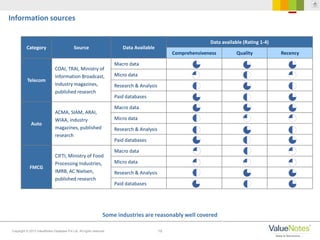

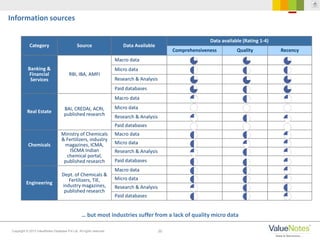

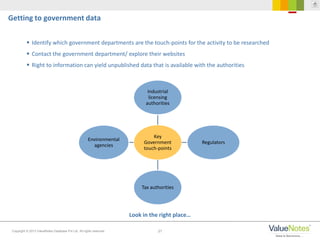

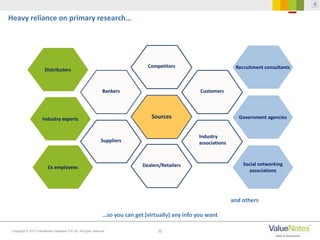

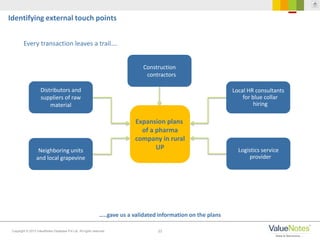

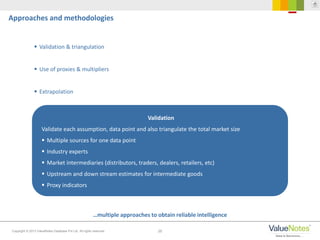

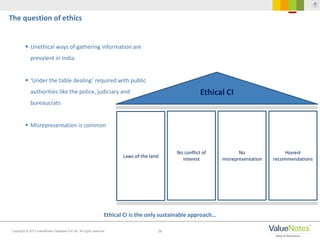

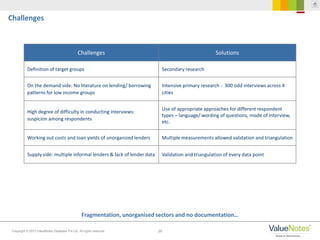

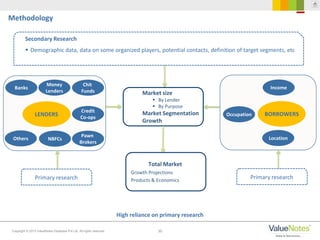

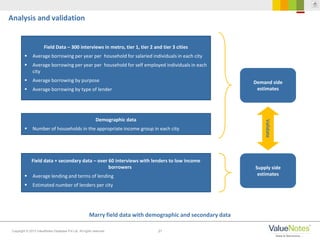

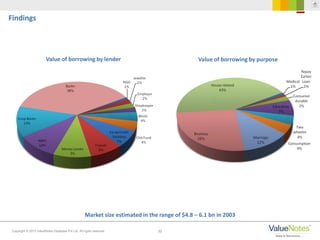

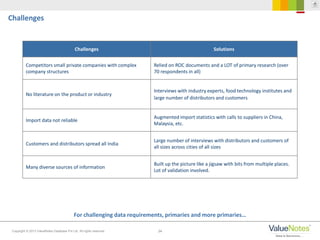

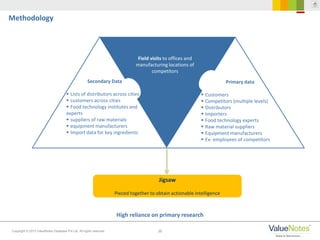

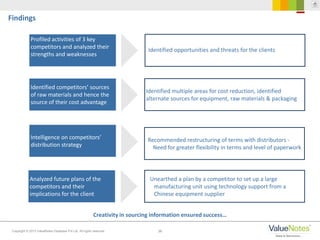

ValueNotes is a premier research and consulting firm in India, specializing in competitive intelligence (CI) to navigate India's complex market landscape. The document discusses the structural characteristics of Indian markets, including the prevalence of unorganized sectors, grey markets, and challenges in government data. It highlights various CI strategies and methodologies employed in India, emphasizing a heavy reliance on primary research and ethical considerations in information gathering.