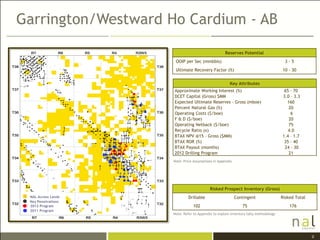

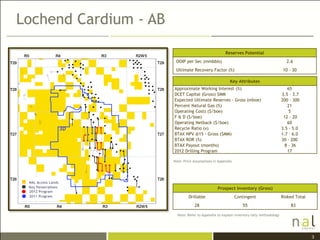

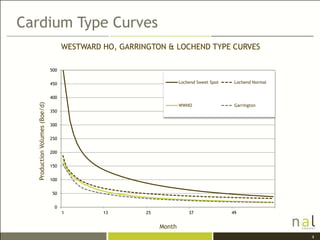

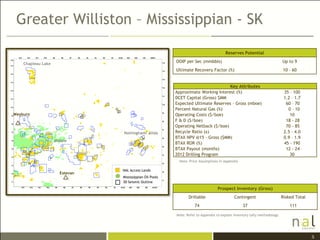

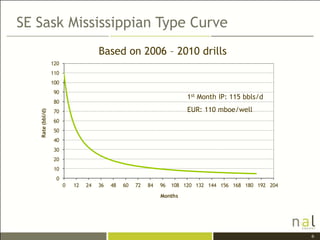

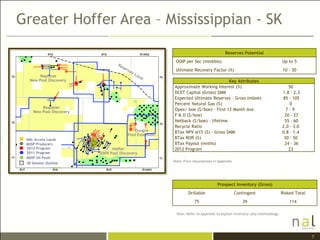

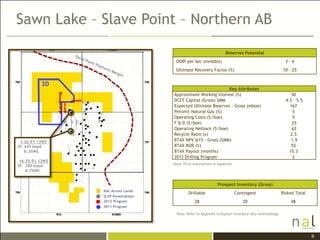

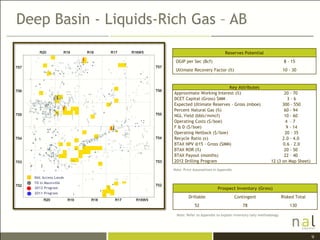

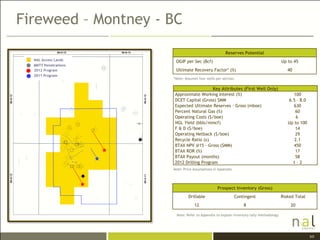

This document summarizes operational maps and reserves potential for several of the company's asset areas. Key details include estimated oil and gas in place, recovery factors, reserves potential, drilling costs, economics and prospect inventories for locations in Alberta, Saskatchewan and British Columbia. Operating metrics like recoverable reserves, production rates, costs and returns are provided for each area.