Naibg atlanta-3 q2011

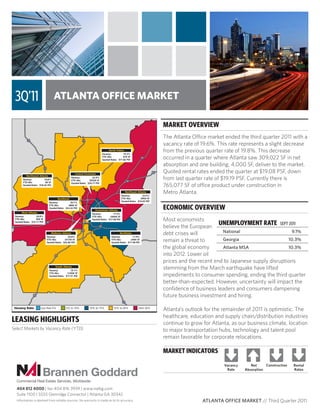

- 1. ATLANTA OFFICE MARKET MARKET OVERVIEW The Atlanta Office market ended the third quarter 2011 with a vacancy rate of 19.6%. This rate represents a slight decrease from the previous quarter rate of 19.8%. This decrease occurred in a quarter where Atlanta saw 309,022 SF in net absorption and one building, 4,000 SF, deliver to the market. Quoted rental rates ended the quarter at $19.08 PSF, down from last quarter rate of $19.19 PSF. Currently there is 765,077 SF of office product under construction in Metro Atlanta. ECONOMIC OVERVIEW Most economists believe the European debt crises will remain a threat to the global economy into 2012. Lower oil prices and the recent end to Japanese supply disruptions stemming from the March earthquake have lifted impediments to consumer spending, ending the third quarter better-than-expected. However, uncertainty will impact the confidence of business leaders and consumers dampening future business investment and hiring. Atlanta’s outlook for the remainder of 2011 is optimistic. The healthcare, education and supply chain/distribution industries continue to grow for Atlanta, as our business climate, location to major transportation hubs, technology and talent pool remain favorable for corporate relocations. Commercial Real Estate Services, Worldwide. Brannen Goddard 404 812 4000 | fax 404 816 3939 | www.naibg.com Suite 1100 | 5555 Glenridge Connector | Atlanta GA 30342 Information is deemed from reliable sources. No warranty is made as to its accuracy. ATLANTA OFFICE MARKET // Third Quarter 2011 Leasing Highlights in Select CoStar Markets Color Coded by Vacancy Rate Vacancy Rate: Less than 5% 5% to 10% 10% to 15% 15% to 20% Over 20% North Fulton Vacancy: 19.3% YTD Abs: 67K SF Quoted Rates: $17.82 PSF Northlake Vacancy: 11.9% YTD Abs: (49)K SF Quoted Rates: $17.48 PSF West Atlanta Vacancy: 26.8% YTD Abs: 65K SF Quoted Rates: $15.17 PSF South Atlanta Vacancy: 19.1% YTD Abs: (129)K SF Quoted Rates: $17.51 PSF Northwest Atlanta Vacancy: 19.8% YTD Abs: 9K SF Quoted Rates: $18.42 PSF Northeast Atlanta Vacancy: 22.5% YTD Abs: (95)K SF Quoted Rates: $16.63 PSF Downtown Atlanta Vacancy: 17.5% YTD Abs: (356)K SF Quoted Rates: $17.66 PSF Central Perimeter Vacancy: 22.9% YTD Abs: (353)K SF Quoted Rates: $20.17 PSF Buckhead Vacancy: 20.1% YTD Abs: 685K SF Quoted Rates: $23.32 PSF Midtown Atlanta Vacancy: 20.8% YTD Abs: (417)K SF Quoted Rates: $22.83 PSF LEASING HIGHLIGHTS Select Markets by Vacancy Rate (YTD) UNEMPLOYMENT RATE SEPT 2011 National 9.1% Georgia 10.3% Atlanta MSA 10.3% 3Q’11 MARKET INDICATORS Construction Rental Rates Net Absorption Vacancy Rate

- 2. VACANCY The overall vacancy rate at the end of the third quarter 2011 is 19.6%, down from the previous quarter when it was 19.8%. The current rate represents over 41.2 million square feet of vacant office space throughout the Metro Atlanta Office market, a 1% increase from this time last year. The current amount of vacant sublease space is 2.1 million square feet, down slightly from last quarter. NET ABSORPTION At the close of the quarter, an overall net absorption of 309,022 SF was reported, an increase over the previous quarter. The recorded net absorption for the current quarter by class follows: Class A: 116,750 SF, Class B: 144,780 SF and Class C: 47,492 SF. Leasing activity was over 2.9 million square for the quar- ter, up from the previous quarter. YTD NET ABSORPTIONS BY BUILDING TYPE » CLASS A 1,037,416 SF » CLASS B (1,408,548) SF » CLASS C (104,301) SF » YTD (475,433) SF CONSTRUCTION ACTIVITY At the close of the quarter, the Atlanta Office market had a single building, 4,000 SF, in new construction deliveries. This compares to 40,162 SF in deliveries last quarter and 21,000 SF this time last year. Currently there is 765,077 SF of new office projects under construction (11 buildings), an increase from the 451,318 SF that was underway this time last year. The largest projects currently underway are Cox Headquarters, Buildings 1 & 2, totaling 600,000 SF located in the Central Perimeter submarket. QUOTED RENTAL RATES The current overall quoted Atlanta Office rental rate of $19.08 PSF represented a $0.11 PSF decrease in rental rates from the end of the previous quarter, when rents were $19.19 PSF. The Class A rental rates are reported at $21.50 PSF with the highest rate reported in the Buckhead submarket at $24.55 PSF with Midtown closely following at $24.18 PSF. Class B sector ended the quarter with quoted rental rates of $16.29 PSF, which is $0.11 PSF lower than last quarter and $0.45 PSF lower than this time last year. 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Class A Class B Class C Total VACANCY RATES BY CLASS Direct Sublet 5% 95% ATLANTA OFFICE MARKET THIRD QUARTER 2011

- 3. MARKET HIGHLIGHTS Vacancy Rate Average Vacancy Quoted Rates 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 2008 3q 2008 4q 2009 1q 2009 2q 2009 3q 2009 4q 2010 1q 2010 2q 2010 3q 2010 4q 2011 1q 2011 2q 2011 3q $18.00 $18.50 $19.00 $19.50 $20.00 $20.50 $21.00 $21.50 OVERALL VACANCY & QUOTED RATES ©2011 NAI Brannen/Goddard, LLC. Data compiled from CoStar Group, Inc. Significant Third Quarter 2011 Lease Transactions (New & Renewal) Building Submarket Square Feet Tenant Name Windward Plaza - Bldg 300 North Fulton 203,245 GE Consumer Finance Atlanta Financial Center - South Upper Buckhead 135,075 SunTrust Robinson Humphrey 2635 Century Center Chamblee 119,178 FBI Companile Plaza Midtown 72,232 SunTrust Bank 4501 Northpoint Parkway North Fulton 59,501 Total Systems Services Significant Third Quarter 2011 Construction Deliveries Building Submarket Square Feet Class 4536 Nelson Brogdon Blvd - Bldg B Northeast Atlanta 4,000 B Significant Third Quarter 2011 Properties Under Construction Building Submarket Square Feet Delivery Cox Headquarters Bldg 1 Central Perimeter 300,000 2Q 2012 Cox Headquarters Bldg 2 Central Perimeter 300,000 4Q 2012 Parkway Professional Northeast Atlanta 67,500 4Q 2011 7316 Spout Springs Road Northeast Atlanta 20,000 3Q 2011 1887 Powder Springs Road Northwest Atlanta 16,650 3Q 2012 All Construction Activity (Markets Ranked by Under Construction Square Footage) Under Construction Inventory Market # Bldgs Total RBA Preleased SF Preleased % Available SF Central Perimeter 3 616,000 611,840 99.3% 4,160 Northeast Atlanta 3 94,634 35,965 38.0% 58,669 Northwest Atlanta 2 25,150 14,700 58.4% 10,450 South Atlanta 1 14,293 14,293 100% 0 Northlake 1 10,000 100 1.0% 9,900 North Fulton 1 5,000 0 0.0% 5,000 Midtown Atlanta 0 0 0 0.0% 0 West Atlanta 0 0 0 0.0% 0 Downtown Atlanta 0 0 0 0.0% 0 Buckhead 0 0 0 0.0% 0 Totals 11 765,077 676,898 88.5% 88,179 FUTURE DELIVERIES - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2011 4Q 2012 1Q 2012 2Q 2012 3Q 2012 4Q Net Absorption Deliveries (1,500) (1,000) (500) 0 500 1,000 1,500 2,000 2,500 2009 1q 2009 2q 2009 3q 2009 4q 2010 1q 2010 2q 2010 3q 2010 4q 2011 1q 2011 2q 2011 3q ABSORPTION & DELIVERIES

- 4. Commercial Real Estate Services, Worldwide. Brannen Goddard 5555 Glenridge Connector, Suite 1100 Atlanta GA 30342 www.naibg.com ©2011 NAI Brannen/Goddard, LLC Market Existing Inventory Vacancy YTD Net Absorption YTD Deliveries Under Const SF Quoted Rates# Bldgs Total RBA Direct SF Sublease SF Total SF Vac% Buckhead 117 19,763,394 3,779,640 183,231 3,962,871 20.1% 685,587 0 0 $23.32 Central Perimeter 266 29,490,494 6,478,652 287,806 6,766,458 22.9% (353,524) 0 316,000 $20.17 Downtown Atlanta 157 26,152,374 4,225,499 343,024 4,568,523 17.5% (356,019) 0 0 $17.66 Midtown Atlanta 136 22,216,380 4,373,146 253,529 4,626,675 20.8% (417,459) 0 0 $22.83 North Fulton 337 24,435,587 4,299,612 423,016 4,722,628 19.3% 67,394 0 0 $17.82 Northeast Atlanta 460 21,404,091 4,588,724 218,838 4,807,562 22.5% (94,778) 40,162 87,500 $16.63 Northlake 397 19,545,028 2,230,948 104,275 2,335,223 11.9% 48,602 0 0 $17.48 Northwest Atlanta 465 32,873,212 6,192,130 300,961 6,493,091 19.8% 8,996 0 16,650 $18.42 South Atlanta 281 11,409,561 2,105,416 78,025 2,183,441 19.1% (129,234) 19,015 0 $17.51 West Atlanta 57 2,986,956 801,535 0 801,535 26.8% 65,002 0 0 $15.17 TOTALS 2,673 210,277,077 39,075,302 2,192,705 41,268,007 19.6% (475,433) 59,177 420,150 $19.08 Market Existing Inventory Vacancy YTD Net Absorption YTD Deliveries Under Const SF Quoted Rates# Bldgs Total RBA Direct SF Sublease SF Total SF Vac% Buckhead 51 14,739,004 2,941,483 159,303 3,100,786 21.0% 690,290 0 0 $24.55 Central Perimeter 77 20,176,282 3,784,686 159,178 3,943,864 19.5% (49,991) 0 300,000 $21.89 Downtown Atlanta 26 13,720,911 2,640,966 341,714 2,982,680 21.7% 111,702 0 0 $19.09 Midtown Atlanta 33 14,326,101 3,087,443 221,157 3,308,600 23.1% 126,353 0 0 $24.18 North Fulton 99 14,118,568 2,358,353 344,950 2,703,303 19.1% (29,365) 0 0 $19.78 Northeast Atlanta 61 6,338,845 1,424,105 124,685 1,548,790 24.4% (73) 0 67,500 $19.84 Northlake 21 2,651,153 373,350 18,338 391,688 14.8% 42,057 0 0 $19.87 Northwest Atlanta 77 15,695,460 2,614,231 188,068 2,802,299 17.9% 127,614 0 0 $20.89 South Atlanta 20 1,393,033 417,901 32,963 450,864 32.4% 18,829 0 0 $20.21 West Atlanta 1 71,500 0 0 0 0.0% 0 0 0 $0.00 TOTALS 466 103,230,857 19,642,518 1,590,356 21,232,874 20.6% 1,037,416 0 367,500 $21.50 Market Existing Inventory Vacancy YTD Net Absorption YTD Deliveries Under Const SF Quoted Rates# Bldgs Total RBA Direct SF Sublease SF Total SF Vac% Buckhead 43 4,466,292 779,068 23,928 802,996 18.0% 30,925 0 0 $18.30 Central Perimeter 135 8,073,163 2,327,190 128,628 2,455,818 30.4% (309,316) 0 16,000 $18.09 Downtown Atlanta 74 9,319,414 1,102,509 1,310 1,103,819 11.8% (409,745) 0 0 $14.88 Midtown Atlanta 81 7,214,988 1,232,711 20,948 1,253,659 17.4% (545,267) 0 0 $18.05 North Fulton 215 9,672,251 1,864,337 71,533 1,935,870 20.0% 125,381 0 0 $15.00 Northeast Atlanta 350 13,557,793 3,018,370 90,558 3,108,928 22.9% (66,420) 40,162 20,000 $14.63 Northlake 280 13,773,177 1,547,919 85,937 1,633,856 11.9% 18,884 0 0 $17.45 Northwest Atlanta 328 15,095,121 3,381,504 112,893 3,494,397 23.1% (132,045) 0 16,650 $15.90 South Atlanta 198 8,125,275 1,324,720 45,062 1,369,782 16.9% (159,109) 19,015 0 $17.12 West Atlanta 36 1,328,621 135,739 0 135,739 10.2% 38,164 0 0 $18.81 TOTALS 1,740 90,626,095 16,714,067 580,797 17,294,864 19.1% (1,408,548) 59,177 52,650 $16.29 Market Existing Inventory Vacancy YTD Net Absorption YTD Deliveries Under Const SF Quoted Rates# Bldgs Total RBA Direct SF Sublease SF Total SF Vac% Buckhead 23 558,098 59,089 0 59,089 10.6% (35,628) 0 0 $18.18 Central Perimeter 54 1,241,049 366,776 0 366,776 29.6% 5,783 0 0 $13.60 Downtown Atlanta 57 3,112,049 482,024 0 482,024 15.5% (57,976) 0 0 $13.69 Midtown Atlanta 22 675,291 52,992 11,424 64,416 9.5% 1,455 0 0 $11.55 North Fulton 23 644,768 76,922 6,533 83,455 12.9% (28,622) 0 0 $14.06 Northeast Atlanta 49 1,507,453 146,249 3,595 149,844 9.9% (28,285) 0 0 $13.11 Northlake 96 3,120,698 309,679 0 309,679 9.9% (12,339) 0 0 $14.29 Northwest Atlanta 60 2,082,631 196,395 0 196,395 9.4% 13,427 0 0 $15.40 South Atlanta 63 1,891,253 362,795 0 362,795 19.2% 11,046 0 0 $14.10 West Atlanta 20 1,586,835 665,796 0 665,796 42.0% 26,838 0 0 $11.25 TOTALS 467 16,420,125 2,718,717 21,552 2,740,269 16.7% (104,301) 0 0 $13.85 TOTAL ATLANTA OFFICE MARKET STATISTICS CLASS “A” STATISTICS CLASS “B” STATISTICS CLASS “C” STATISTICS Source: CoStar Group, Inc. THIRD QUARTER 2011