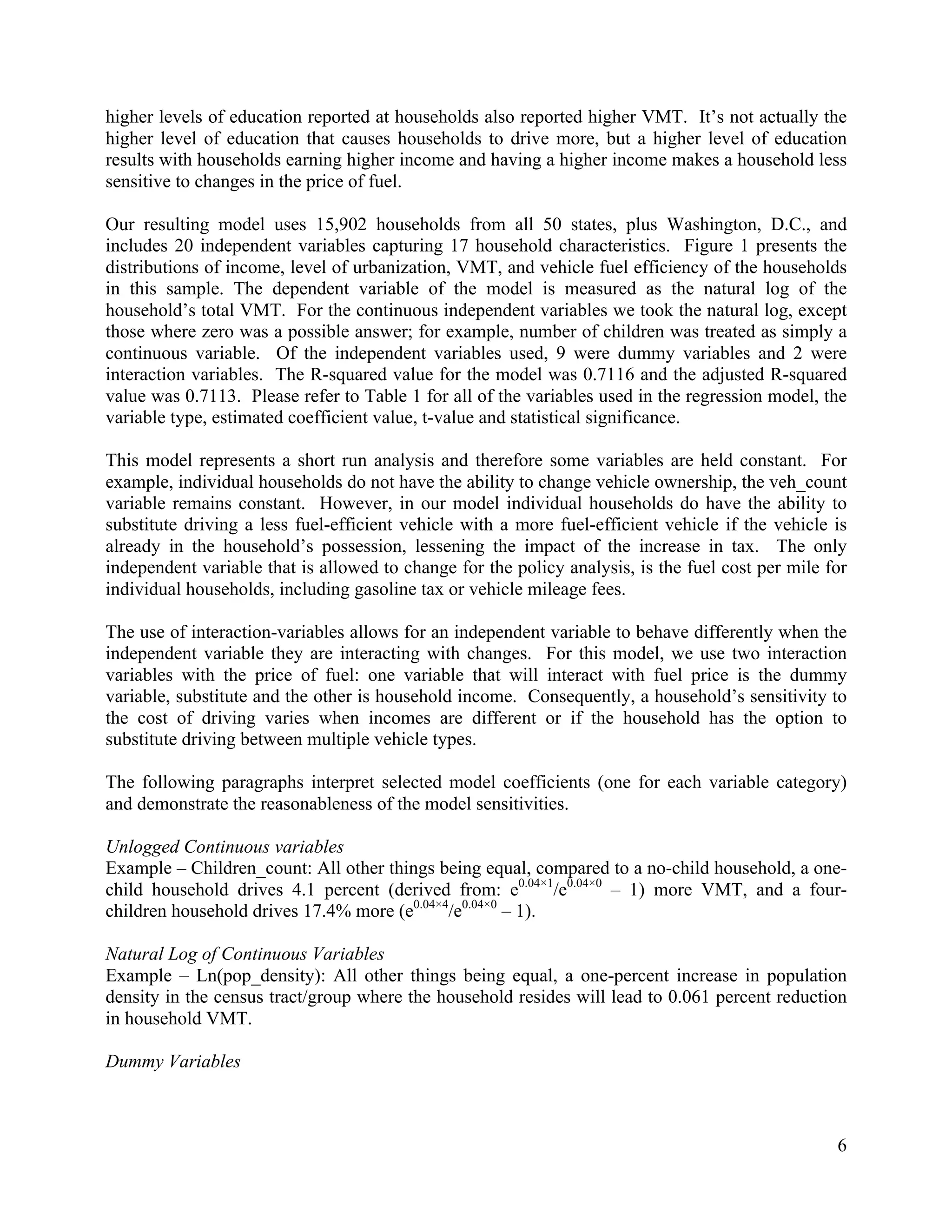

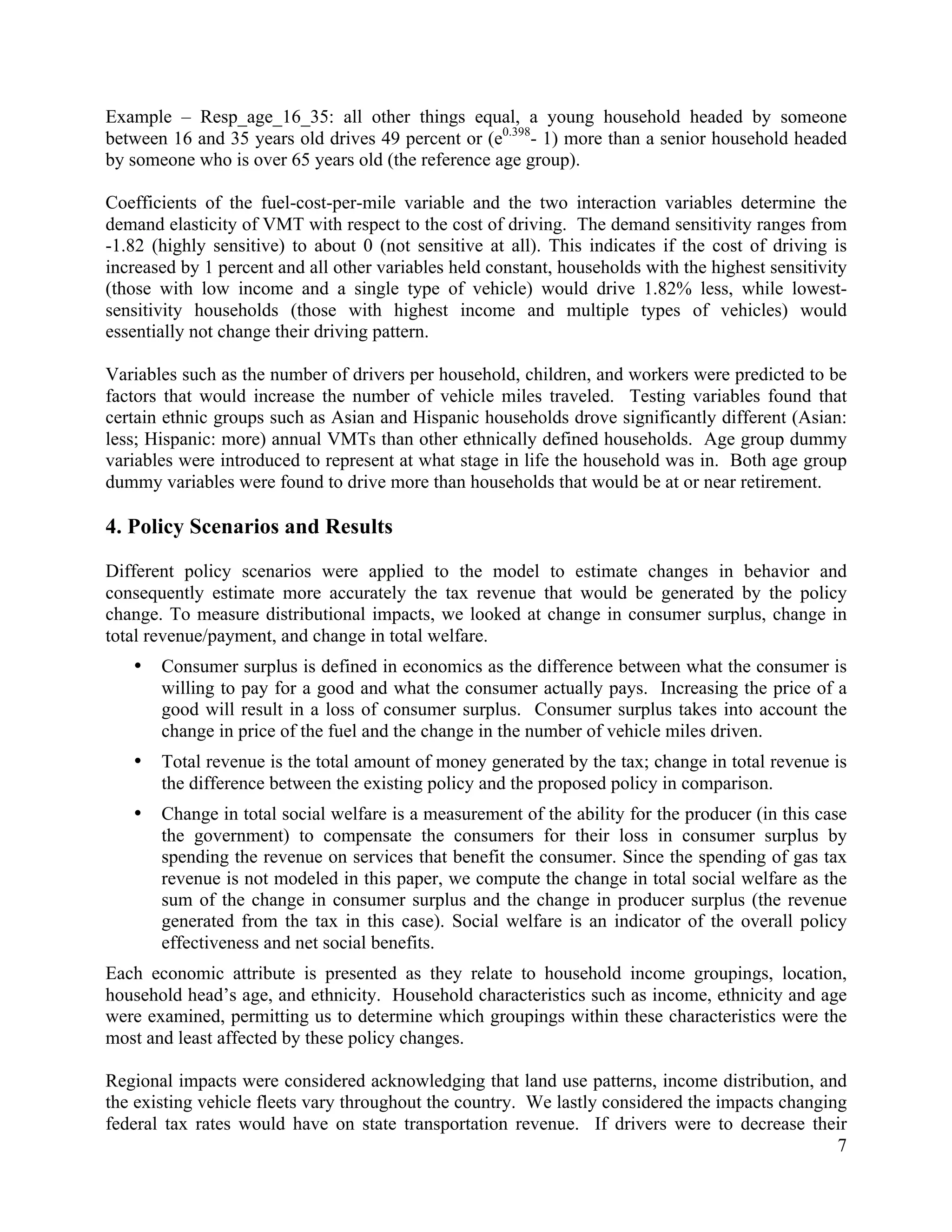

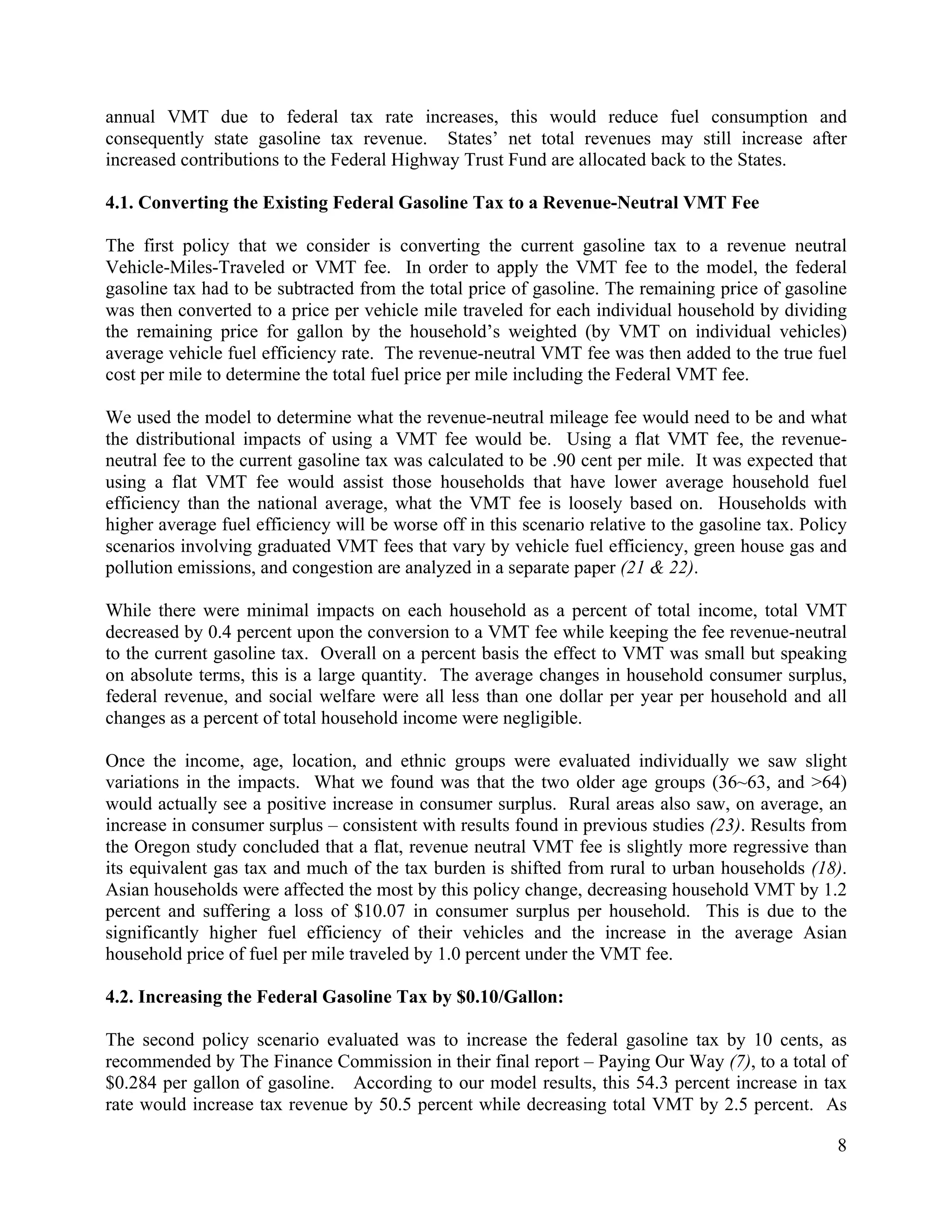

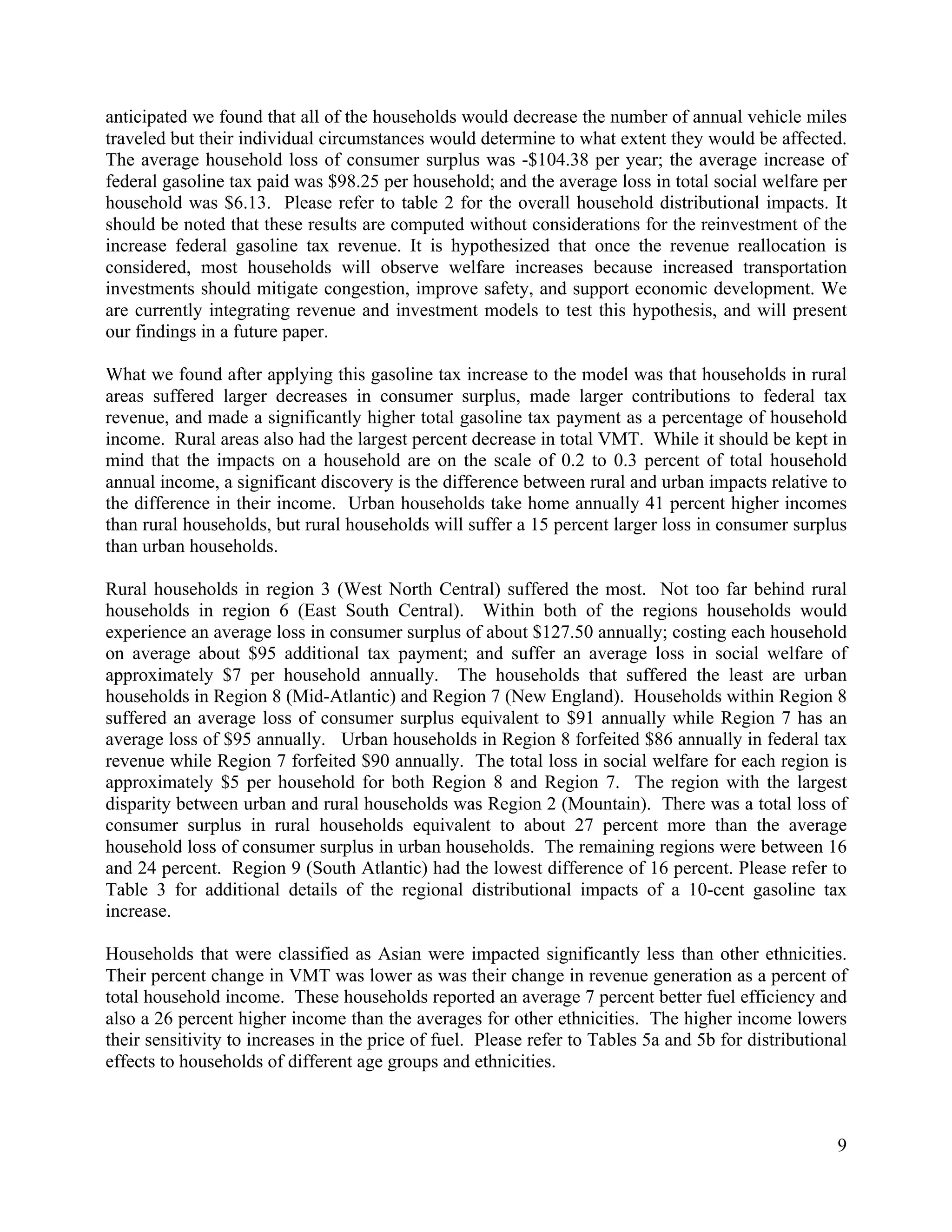

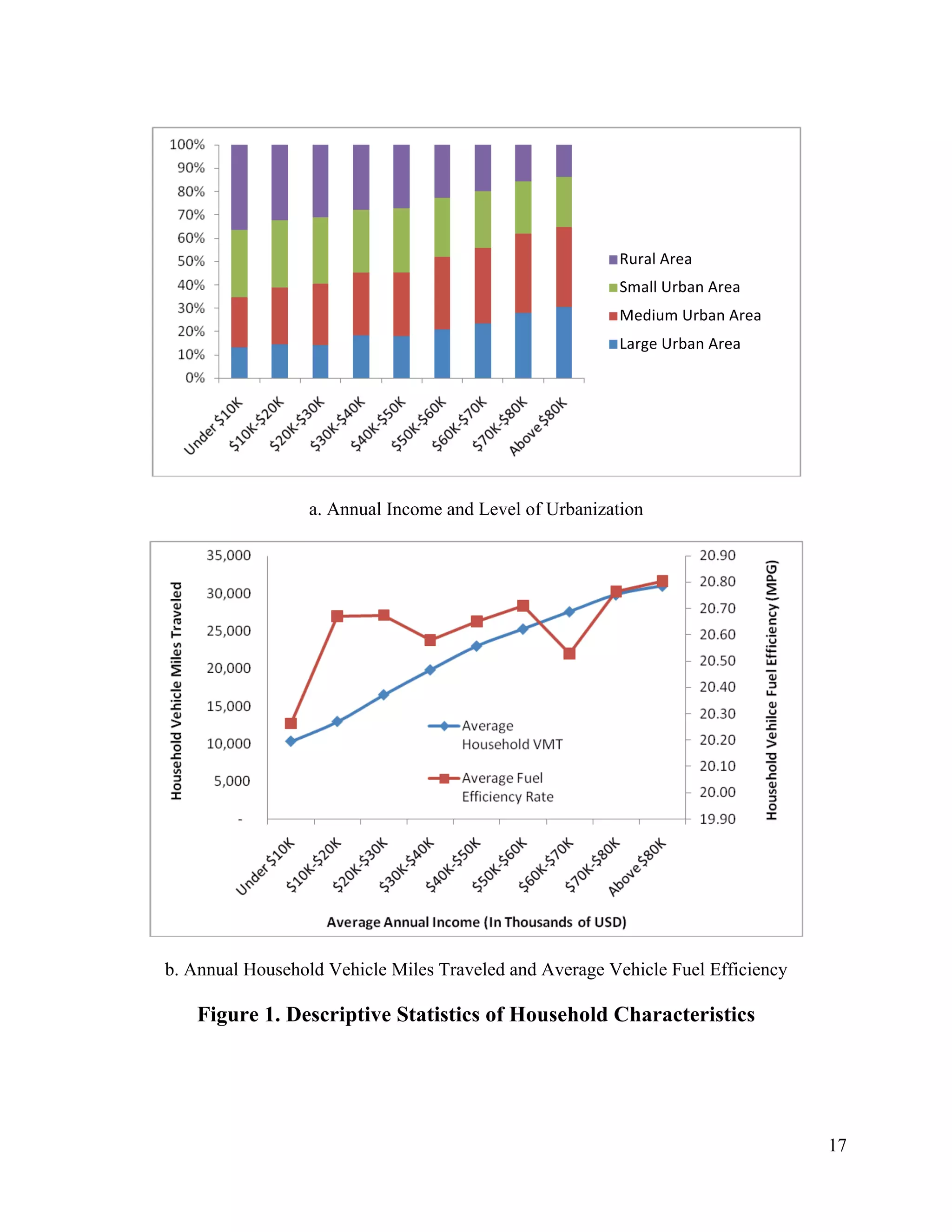

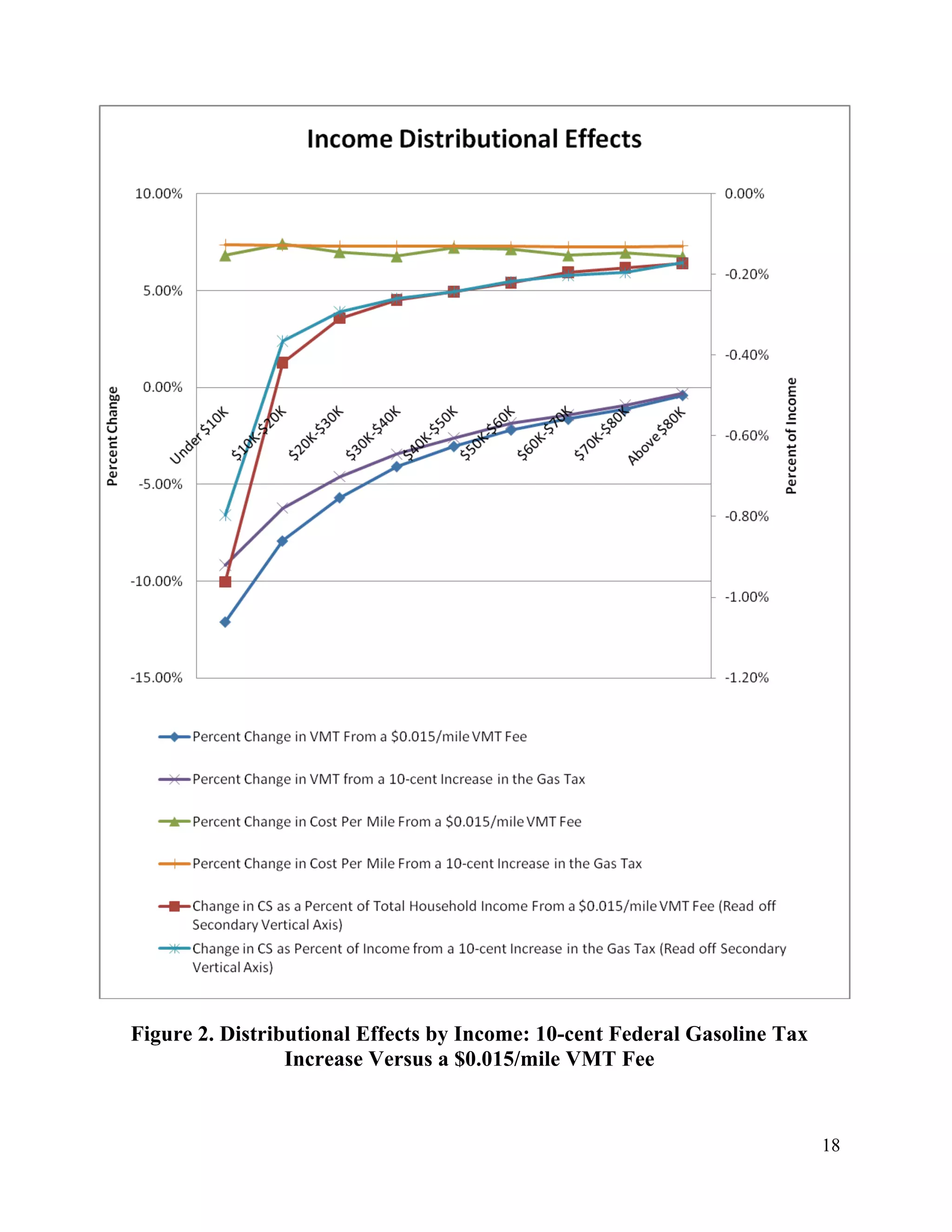

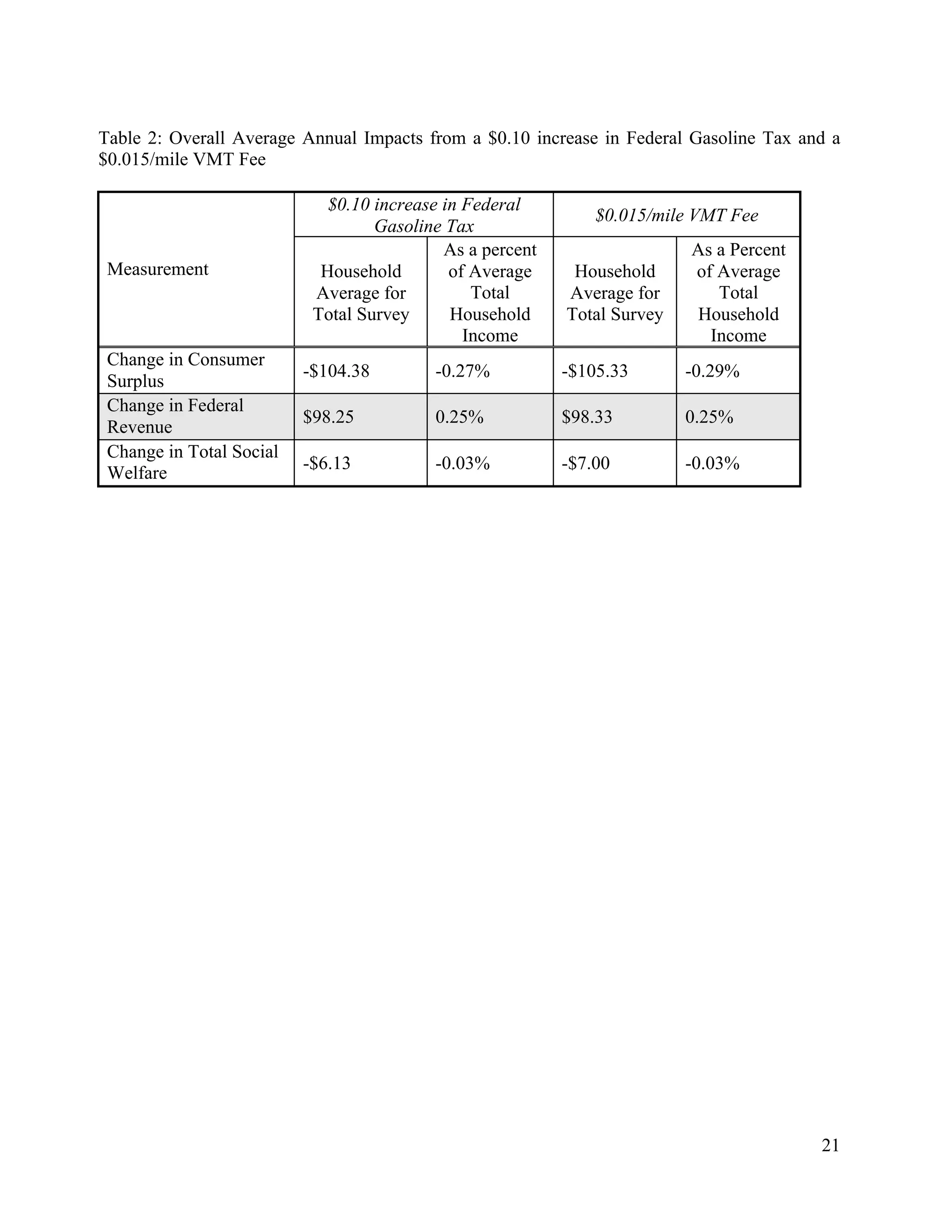

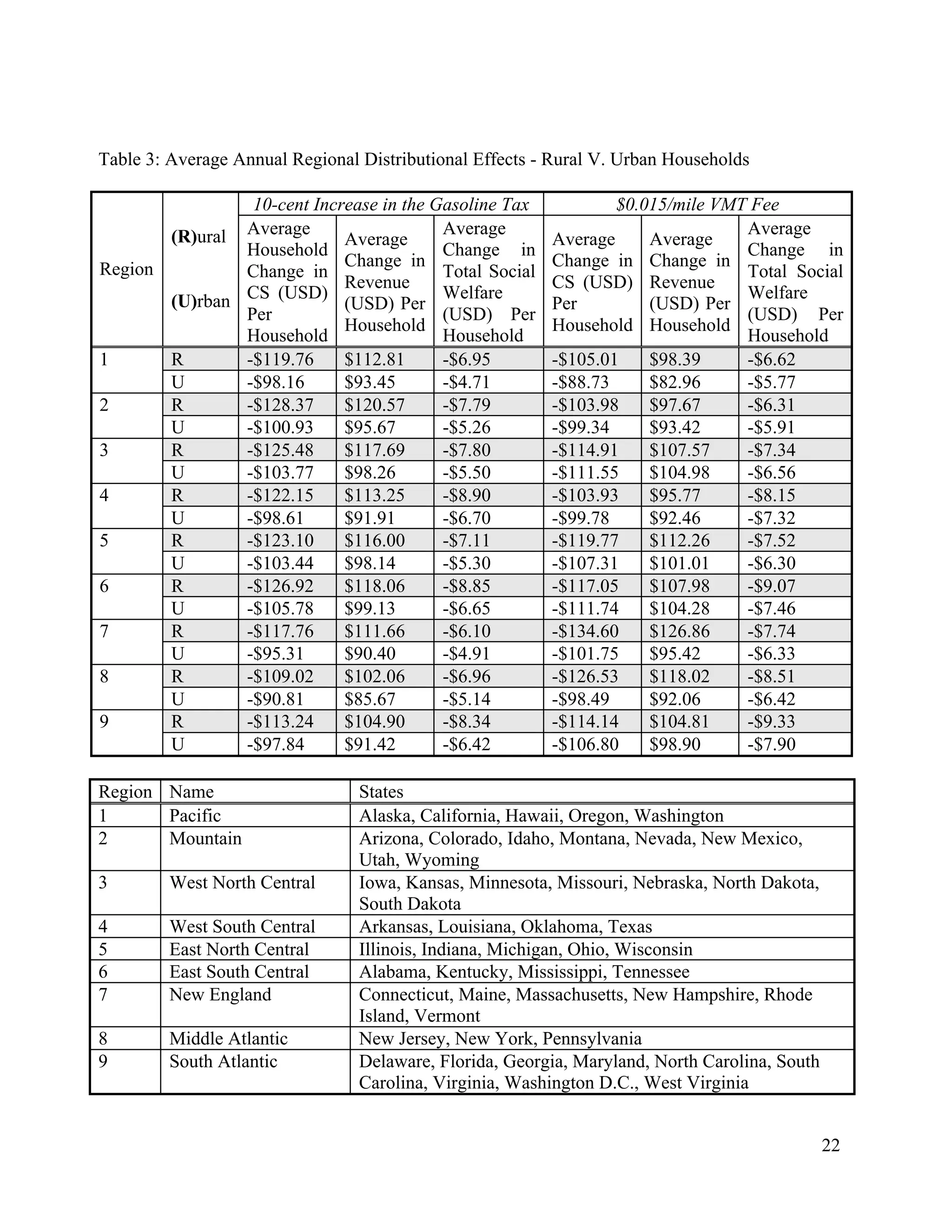

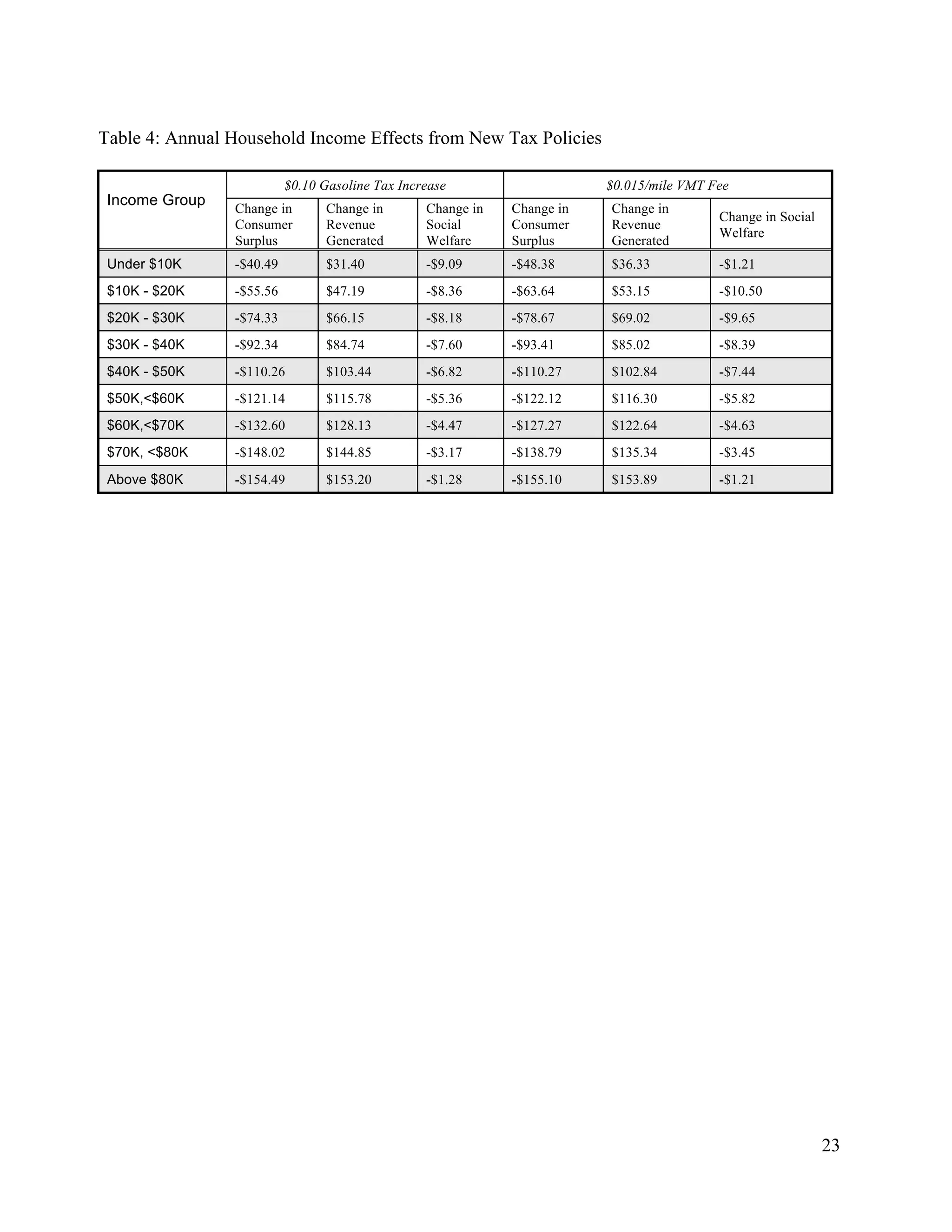

This paper analyzes the distributional effects of increasing the federal gasoline tax and implementing a vehicle mileage fee in the United States. It uses a regression model and 2001 National Household Travel Survey data to predict how households' vehicle miles traveled may change in response to policy changes, considering factors like income, location, and vehicle fuel efficiency. The paper finds that a gasoline tax increase or mileage fee could impact some groups more than others. It concludes that the effects on different populations should be carefully considered to promote both effective revenue generation and fair impacts across groups.